When you are in need of an investment option that’s convenient and well-diversified, both Mutual Funds (MFs) and Exchange-Traded Funds (ETFs) fit the bill. These have many things in common. For instance, both of them offer you an access to a variety of securities like stocks, bonds and gold. Also, they have a common regulator i.e. SEBI.

However, before going for either, you should know the key differences between MFs and ETFs that would influence your end returns and the manner in which you are going to earn it.

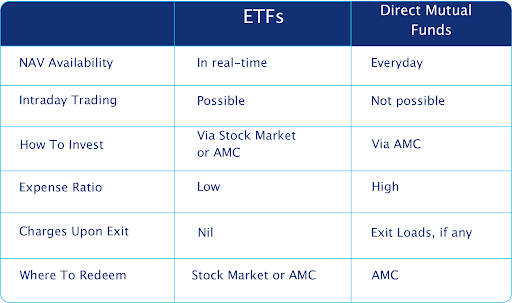

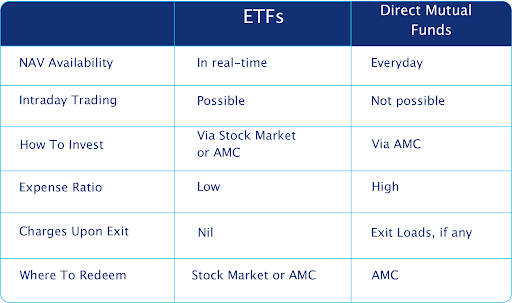

1. NAV Availability

ETFs are marketable options and listed on NSE/BSE. These funds trade on stock exchanges during the open market hours and you are able to view their prices in real-time like regular stocks and take buying/selling decisions at the right price as per the latest markets news and updates.

However, in case of mutual funds, you get to buy/sell the units at fund’s Net Asset Value (NAV), computed at the end of the day’s trading session. Also, whether you will get units at the same day’s NAV or the next day’s NAV, depends on the time at which the AMC receives your buy/sell request. This time is called cutoff time and differs across scheme categories – equity, debt, and liquid funds.

2. Intraday Trading

Intraday Trading happens in stock markets wherein you can buy/sell stocks on the same day to make profits out of the day’s stock price fluctuations. Similarly, ETFs offer you the convenience of intraday trading that makes them more liquid than mutual funds.

When you want to redeem your investments from mutual funds, the AMC takes 1-2 days to complete the entire process. But, ETFs can be sold right away over an exchange, that provides you instant liquidity. This happens because of Authorized Participants (APs), special market-makers, who are appointed by the AMCs to offer ETF liquidity on NSE/BSE. So, when you are in need of cash and you place a sell order in the stock exchange for the given ETF, these are out there on the exchange to buy your ETF units in large blocks, that helps you to exit the market easily on the same day.

3. Expense Ratio

If the expense ratio of direct mutual funds is around 1%, ETFs will be available at a relatively lower expense ratio of 0.02%-0.97%. There are several reasons that make ETFs cheaper than mutual funds.

In ETFs, the fund manager tracks a particular index like Nifty/Sensex and maintains a similar stock composition in the same weightage as that of the index. Thus, ETFs change their stock composition only when there are changes in the underlying index. This event might happen once in six months as compared to the frequent stock trading that would occur in case of an actively-managed fund. It keeps the trading costs of ETFs lower that in turn reduces its expense ratio.

Also, whenever there is stock buying/selling in mutual funds due to entry/exit of new/old investors, such trading costs add up to the fund’s expense ratio. On the other hand, when an ETF investor redeems his/her investment via stock market, the said trading cost is charged to his/her account and doesn’t fall on the remaining investors in the particular ETF.

Besides, as ETFs try to imitate the underlying index instead of aiming to beat it, they can manage with a relatively smaller fund management team as compared to bigger teams that actively-managed mutual funds have. This also brings down the expense ratio of ETFs which makes them an ideal investment option to diversify your portfolio.

4. How To Invest And Redeem

As a Mutual Fund investor, you may place investment or redemption request only with the AMC. In this, you don’t get the option to access the secondary markets to buy/sell your fund units. As opposed to this, in ETFs, you have the option to invest/redeem via the AMC and/or the stock market as per your requirement.

5. Charges Upon Exit

Direct Mutual funds have certain conditions that restrain an investor from redeeming his investments. These can be in the form of lock-in period/minimum holding period and charging you exit loads when you want to exit the fund. Exit load is a fee that the AMC would charge if you want to exit the fund before the minimum holding period. This is done to restrict speculation and short-term, in-out movements of the investors.

But ETFs don’t have such restrictions. In this, you get the freedom and flexibility to choose your investment horizon. Whether you want to stay invested for long term or just for one day, you have the autonomy to decide your course of action. ETFs don’t levy exit loads or penalties when you want to leave the fund. You are free to move in and out as per the market conditions.

Conclusion

Be it ETFs or Mutual Funds, both give you the opportunity to create wealth for your financial goals. However, the low-cost advantage of ETF might suit an investor who aims to earn returns in line of the underlying index. Conversely, those who want to beat the markets may pick mutual funds. But before choosing either, be clear about your investment goals. Also, if you want to invest in ETFs or Mutual Funds conveniently, download the Paytm Money App, get your KYC done instantly and become investment-ready within minutes.