The Rise and Rise of ETFs in India6 min read

Exchange-Traded Funds (ETFs) are innovative investment options that combine the features of stocks and mutual funds. Like stocks, they are listed on NSE/BSE and can be traded through Demat accounts during open market hours. Similarly, like mutual funds, these schemes offer you access to a diversified portfolio that spans across the strategic sectors of the economy.

Fundamentally, ETFs track benchmark indices like NSE/BSE and aim to keep their returns in line with the market returns. Over the year, in India, ETFs have gathered wider investor acceptance owing to the unique benefits that these offer over actively-managed mutual funds. To break it down, the convenience of any time trading the ETF units in the stock exchange as per one’s requirements, real-time and transparent pricing and low-cost structure due to passive management of ETFs are the prominent features because of which it gets recommended by stock market gurus like Warren Buffet.

History Of ETFs And Its Key Growth Drivers

Benchmark Mutual Fund were the pioneers to introduce ETFs in India. In 2001, India witnessed its first ETF – the Nifty Benchmark Exchange-Traded Scheme (Nifty BeES) launched by the Benchmark Mutual Fund. It got listed on the NSE and tracked the Nifty 50 Index. Nifty BeES was a revolutionary avenue at that time in the sense that with a single effort investors could gain exposure to the whole index and maintain a diversified portfolio without any active fund manager.

Then came the first debt ETF in 2004 by the name Liquid BeES- a fixed income ETF launched by Benchmark Mutual Fund that addressed the investment needs of conservative investors and gave them access to the money market. Soon after that, in 2007, the AMC introduced the first gold ETF called Gold BeEs.

The popularity of Gold ETFs surged extensively between 2008 and 2013. The global credit crisis of 2008 made individuals look for safer havens and gold being a safe asset, a lot of money moved into gold ETFs. In fact, for the period 2009-14, more than half of the total ETF assets were parked in gold funds.

However, the first major boost for ETFs was noticed soon after the ETFs were recognized as an eligible asset class for the pension funds in the budget of 2013. Additionally, the securities transaction taxes were lowered to offer ETFs a level-playing field with mutual funds.

In 2014, the government’s efforts to divest its share in public sector enterprises via the ETF route also led to the spread of awareness about ETFs and gave way to the launch of the CPSE ETF (Central Public Sector Enterprise Exchange Traded Fund). With this, the government was able to raise Rs 3000 crores of disinvestment proceeds.

Additionally, NSE reported in 2019 that “Increasing awareness about ETFs, large-cap active funds struggling to outperform large-cap indices based ETFs and low fund management fees of ETFs are few other key factors which have helped the growth of ETF in India”.

The recent ETF to join the pack is the Bharat Bond ETF April 2030 and BHARAT Bond ETF April 2023 which were launched in December 2019 and Bharat Bond ETF April 2025 and Bharat Bond ETF April 2031 which were introduced in July 2020 respectively. Also, HDFC Banking ETF, ICICI Prudential Alpha Low Vol 30 ETF, and ICICI Prudential IT ETF were launched in August 2020, UTI Bank Exchange Traded Fund in September 2020, SBI ETF IT and SBI ETF Private Bank in October 2020 and Axis Banking ETF and NIPPON INDIA ETF NIFTY CPSE BOND PLUS SDL – 2024 in November 2020 respectively.

From a mere 78 ETFs (gold and others) in March 2019, there has been progress to 99 ETFs (11 Gold ETFs and 88 Other ETFs (that track various debt and equity indices)) with total assets under management being Rs 2.47 lakh crores as of November 2020.

Growth of ETFs In India

Over the period spanning October 2019-20, the share of ETFs in the overall mutual fund industry has increased from 6% to 7%. Also, the T-30 city dwellers were the frontrunners in investing in ETF (85%) as compared to B-30 dwellers (15%). The majority of the ETF growth in T-30 & B-30 was driven directly as compared to distributors.

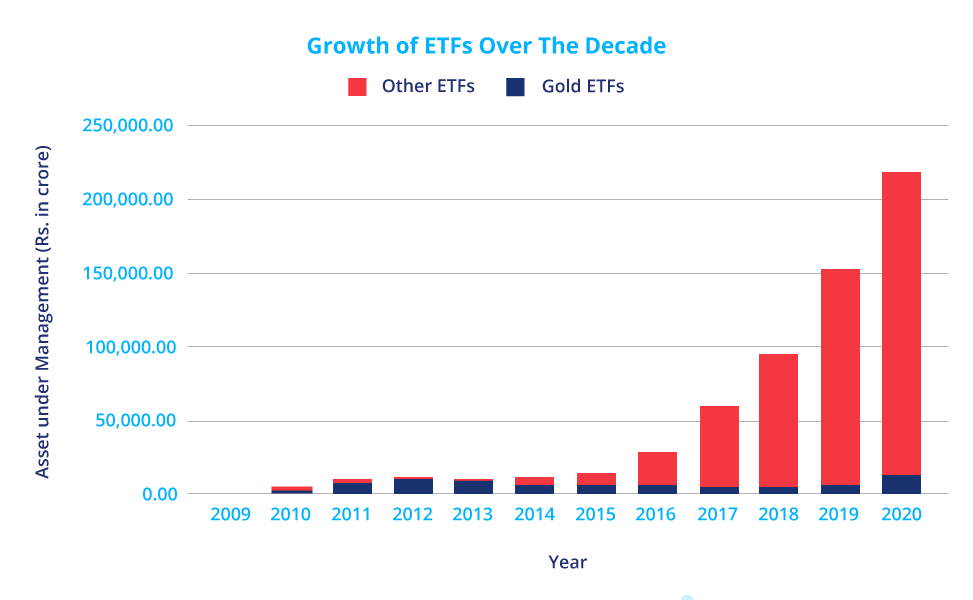

When you examine the bigger picture, you would notice that the ETF landscape has got bigger and vivid from 2014 to the present as compared to the period before (2019-13). Asset under management for the ETF grew from Rs 15.13 thousand crores in September 2015 to Rs 218.82 thousand crores in September 2020- which is 14.45x ( or 1345.77%) in a timeframe of mere 5 years, a CAGR of 70%. (Source: AMFI data)

Much of this growth can be attributed to equity and debt ETFs as against Gold ETFs. The share of gold ETFs in the total ETF composition remained high from 2009 (51%) to 2013 (88%), while the other ETFs (equity & debt) were still gaining momentum (Source: AMFI data). The high levels of uncertainty plugged by the global credit crisis of 2008 made people pool most of their assets into gold ETFs as a safe haven.

From 2014 onwards, the share of other ETFs (equity & debt) picked up steam and went from 39% (2014) of total ETF AUM to as high as 93% in 2020. (Source: AMFI data)

#Source: AMFI data, numbers as of September month of every year

Possible Impediments In Growth of ETFs

The liquidity of ETFs in India tends to be on the lower end and the show is primarily driven by institutional investors mainly the Employee Provident Fund Organisation (EPFO) while the retail investors tend to hold the shorter end of the stick.

As of October 2020, unlike equity-oriented schemes where retail investors held a lion’s share of 88% of the total industry assets, in the case of ETFs, institutional investors happened to be the major contributors holding 91% of the industry assets. If you look at the breakup of the portfolio of a retail investor, it is still dominated by equity-oriented schemes (68%), followed by debt-oriented (25%), liquid/money market (6%), and ETFs (1%).

As compared to this, in the US, the ETF flows are driven by both retail as well as institutional flows.

Besides, the expense ratio of ETFs can be as low as 0.05% which means no commission angle for the distributors vis-a-vis other mutual funds, which in turn offers them lower incentive to promote the ETF as a suitable investment product in spite of its unique advantages. Having said that, high net worth individuals and family offices have started increasingly eyeing ETFs and other passive investments as a great way to maximize wealth.

Way Forward

The underperformance of over 90% of active mutual funds in the large-cap category as per SPIVA report 2018 has perked up investors’ interests in passive funds.

Then, the extensive efforts of SEBI and AMCs towards spreading ETF education and awareness are growing a community of DIY investors who would be looking for wealth creation opportunities in ETFs. Besides, the government’s efforts to position ETF like Bharat-22 as a tax-efficient avenue along with a core part of their divestment activities to raise capital would be the key tailwind for the growth of ETFs in the future. Nippon India ETF Gold BeES and Bharat Bond ETF, among others, are some of the largest ETFs in India.

If you are looking for low-cost passive investment options over the long term & face paucity of time to track markets closely, then ETFs are good avenues to create wealth for achieving your financial goals.