ETFs or Exchange Traded Funds mimic the returns of indices like Nifty 50 or Sensex and hold stocks/bonds in the same proportion as that of the underlying index. They work on the philosophy of passive investing in which the fund manager makes changes to the fund composition only when there are any changes in the underlying index.

That way, ETFs may help an investor to earn returns that closely correspond to a given index. But, at the same time, since ETFs are market-linked instruments, the returns aren’t guaranteed and there can be a likelihood of minor variation in the fund returns as compared to that of index returns.

While investing in ETFs, you may either do a lumpsum investment or an SIP. However, choosing an SIP route is convenient and offers you several benefits. Additionally, SIP is a great way to stay committed to your long term goals and ensure that you invest at regular intervals.

The commitment feature works in three ways. Firstly, SIP breaks down the bulk of investment into smaller amounts, which doesn’t seem to be a burden on your pocket. Secondly, you get into a habit of setting aside some amount from your income every month, which in turn gets invested in the ETF. Lastly, SIP automates your whole investment process and takes away manual intervention and you don’t need to worry about forgetting to invest in your goals.

From a wealth accumulation aspect, SIP in ETFs brings about efficiency in the investment process. SIP utilizes the power of compounding when you invest for the long term, which means that you will not only receive interest on your original investment but also on any interest, dividends, and capital gains that accumulate.

With SIP, you are able to enjoy rupee cost averaging. In this, your regularly invested SIPs are used to buy more number of ETF units at lower prices during market downturns. Conversely, when markets rally, a relatively lower number of units would be purchased from your SIPs. This way, your investment cost comes down. Coupled with the overall low-cost structure of ETFs, SIP may help you to earn higher returns.

On the whole, ETFs offer the benefit of passive management, diversification, and liquidity to investors as it actively trades on the exchange throughout market hours like a stock, and you can buy/sell ETF units during market hours to meet your financial requirements.

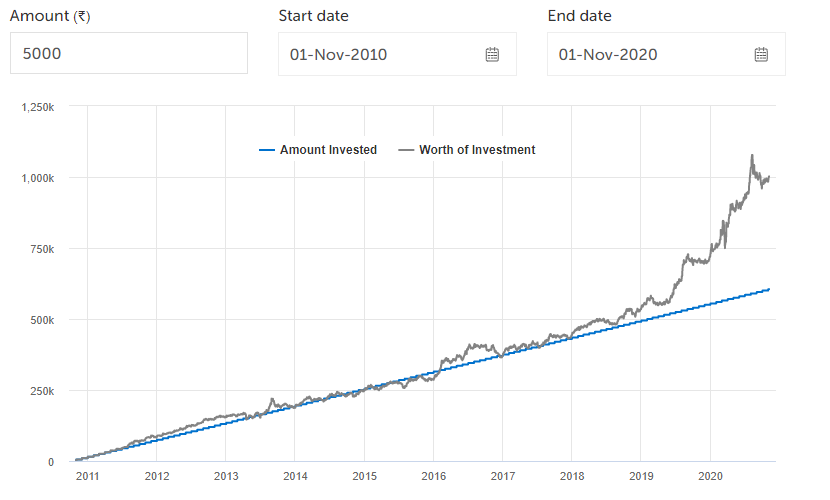

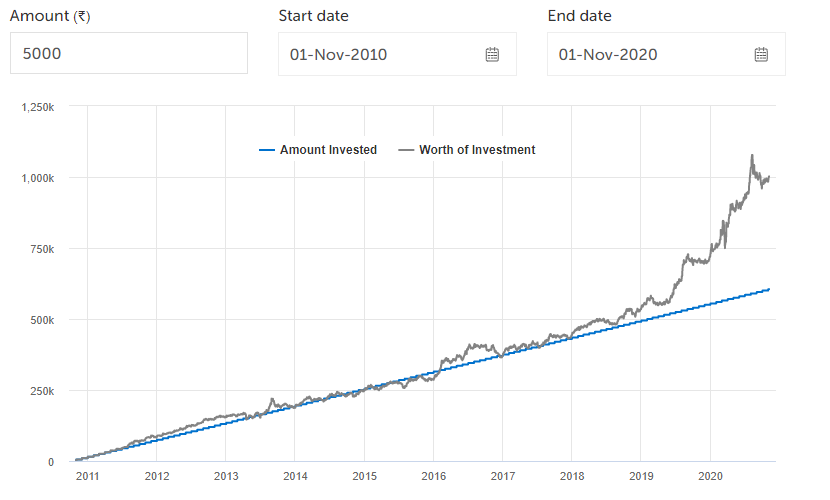

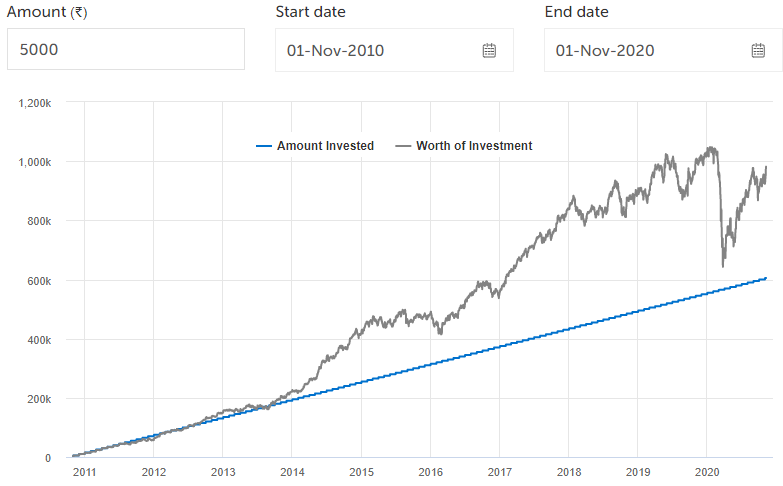

Here’s an illustration that shows returns that you would earn when you go by the SIP route in ETFs.

#Source: Value Research

The above graph shows an SIP of Rs 5000 invested in Nippon India ETF Gold BeES for a period of 10 years ( overall investment of Rs 6,05,000) would help you to accumulate a corpus of Rs 10,16,637.

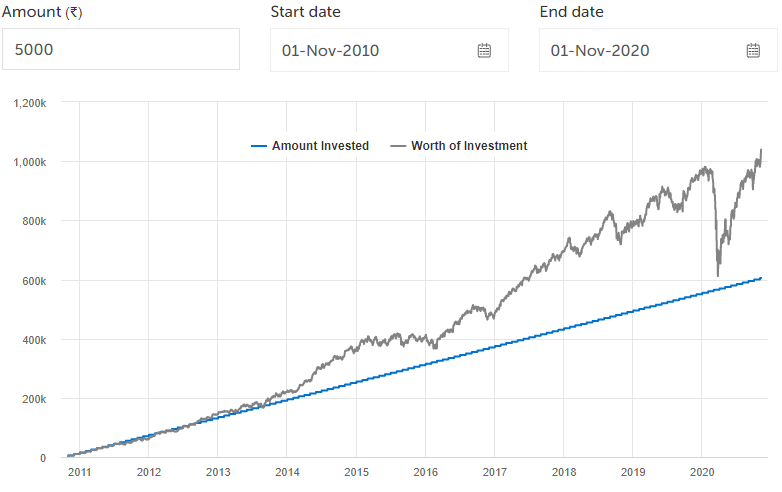

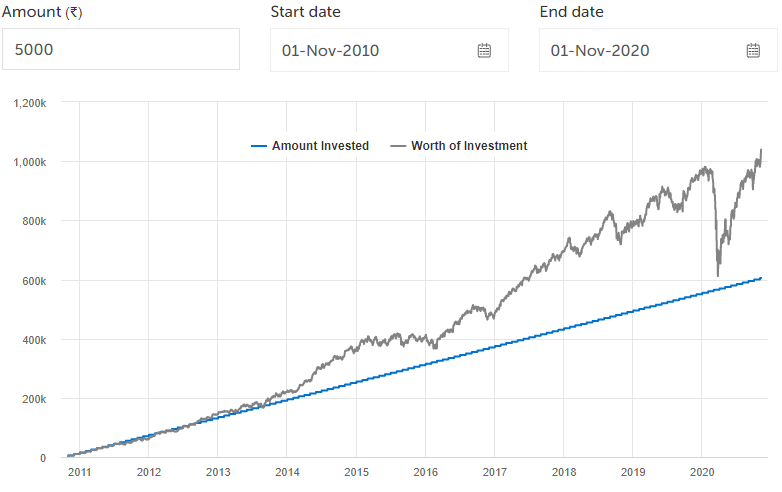

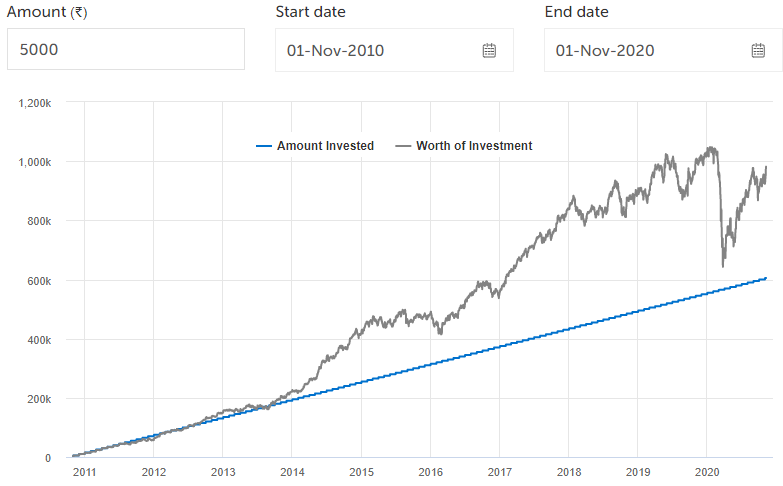

#Source: ValueResearch

Likewise, an SIP of Rs 5000 invested in Nippon India ETF Nifty BeES for a period of 10 years ( overall investment of Rs 6,05,000) would help you to accumulate a corpus of Rs 10,39,104.

#Source: ValueResearch

Had you invested the same amount of SIPs for the same 10-year period in a large-cap fund say Nippon India Large Cap Fund, you would have got a relatively lower corpus of Rs 9,81,432, which is a difference of Rs 57,672.

Conclusion

Investing in ETFs is a smart and convenient way to accumulate wealth for your long term goals at a relatively low cost. And when you do it via the Paytm Money app, you not only do it the simpler way but the app also allows you to automate your SIPs via the ‘Auto Pay’ feature. This way you will never miss your monthly investment. Don’t wait any further. Start investing in ETF via SIPs to get better returns.