Explore Investment Ideas for any specific need4 min read

Contents

What are Investment Ideas?

The mutual fund universe in India is vast and has multiple levels at which an investor has to make choices before arriving at a single fund to invest in. Imagine having to choose one or even a few funds out of the 11,000+ schemes, spread over 40+ AMCs, 30+ sub-categories. Adding to these, each scheme has multiple options like Dividend or Growth, Direct or Regular etc. and they can be open ended or close ended. Even, if you have managed to shortlist a few funds, how will you make sure that they are the right ones for your specific investment need?

Don’t worry! Paytm Money makes this process simpler for you with Investment Ideas. Simply put, investment ideas are a collection of top mutual funds from most popular categories that help you fulfill your specific investment objectives be it wealth creation, capital preservation or tax saving etc. Each idea can be chosen based on your investment horizon and risk taking ability. Thus, it simplifies your investment decision process.

How to pick an Investment Idea?

There is an Investment Idea for any specific need that you may have. All you need to know is your:

i. Investment Objective

ii. Investment Horizon

iii. Risk taking ability

Let’s take an example: If you are a medium risk taker looking for wealth creation over a 3-5 year period, then you can explore ‘Invest in Large Companies’ idea. This idea features top large cap funds which offer steady returns over a time period of 3-5 years.

Investment Ideas in detail

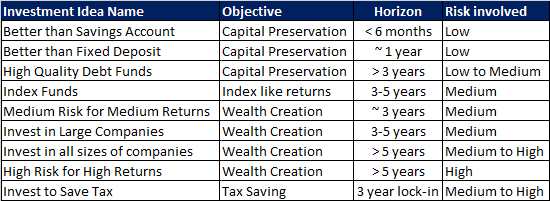

There are 9 Investment Ideas on Paytm Money which can serve multiple investment needs that you may have. Use the table below as a ready reckoner for all your specific investment needs.

Let’s understand the suitability of different Investment Ideas in detail below.

1. Better than Savings Account – Investors looking for capital preservation for a very short period of time (<6 months) should opt for funds under this idea. These funds can also be used for parking your surplus cash pending utilization instead of keeping them in savings bank account, as they have the capability to earn higher returns than a savings bank account.

2. Better than Fixed Deposit – The funds in this idea are suitable for low-risk taking investors who have an investment horizon of about 1 year. These funds can potentially generate higher returns compared to bank FDs.

3. High Quality Debt Funds – This idea consists of mutual funds that are suitable for low to medium risk taking investor for a period of at least 3 years. These funds invest in high quality bonds of Banks, PSUs and Corporates thereby minimizing the credit risk for an investor. Speaking of return expectations, these funds can potentially earn higher post tax returns than a 3 -5 year FD.

4. Index Funds – These funds track composition of popular benchmarks such as Nifty 50, Sensex etc. and are free from any fund manager bias. If you are a first time investor looking to earn equity market like returns with minimal expenses over a period of 3-5 years, then this idea is for you.

5. Medium Risk for Medium Returns – This idea is suitable for medium risk taking investors who are looking for wealth creation by investing in a mix of equity (stocks) and debt (bonds) which provide stability to the portfolio. These funds can generate equity-like returns over a period of around 3 years.

6. Invest in Large Companies – This idea features mutual funds that are ideal for stable wealth creation over the long term as they invest in large sized companies with a proven track record over years. These are suitable for medium risk taking investor looking at an investment period of more than 3 years.

7. Invest in all sizes of companies – It has a collection of funds which invest across companies of all sizes – small, mid and large. This is for medium to high risk taking investors who are looking for wealth creation over a period of over 5 years.

8. High Risk for High Returns – Top mid and small cap funds constitute this idea. These funds offer high growth potential over the long term but are volatile in the short term. So, this idea is only for high risk taking investors who are looking to earn potentially higher returns over a period of more than 5 years.

9. Invest to save tax – As the name suggests, this idea contains mutual funds which can help you save up to INR 46,800 in taxes every year. These provide equity-like returns and have a lock-in period of 3 years, which is lowest among the various tax-saving instruments available under Section 80C.

Conclusion

Investment ideas are put together by the Paytm Money Advisory team after rigorous and in-depth research. Each idea features the best funds based on relevant risk adjusted quantitative and qualitative parameters. These ideas are periodically reviewed and updated. Also, we introduce new investment ideas depending on ongoing market scenario. Once you have narrowed down on a particular Idea, invest in 2 to 3 funds in that Idea so that your investments are diversified.

So, whatever be your investment objective, horizon and risk taking ability, there is an Investment Idea just for you! Fulfil your specific investment needs with Investment ideas. Check it out today in the Invest section on the Paytm Money App and pick the funds that best suit you.