Exxaro Tiles IPO Details- Dates, Price & Overview3 min read

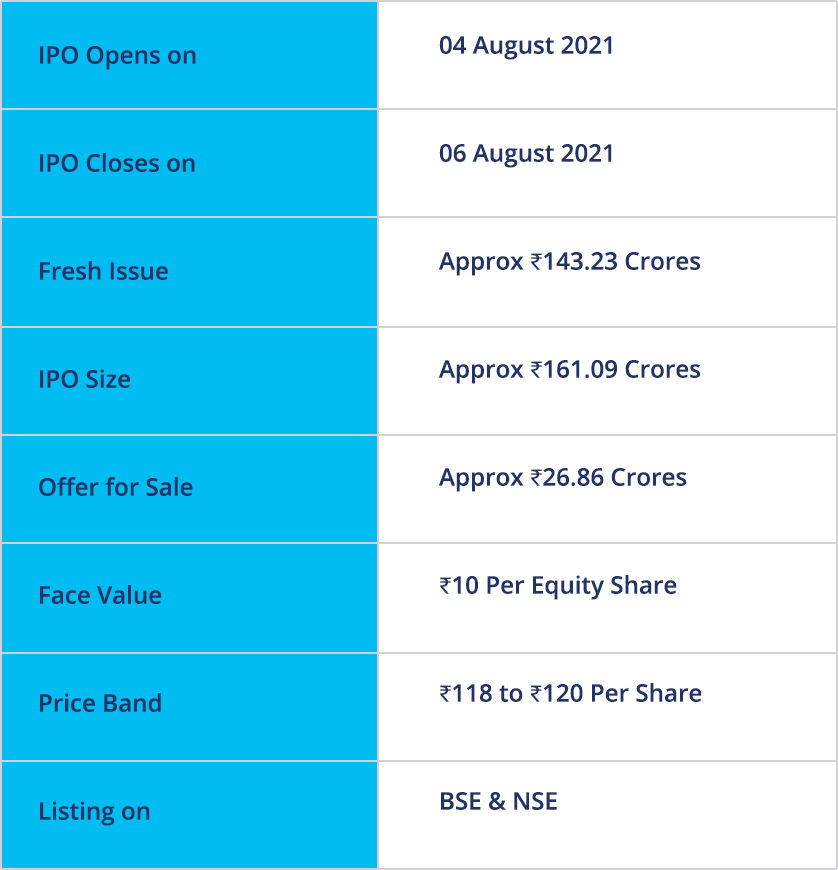

The Gujarat-based Exxaro Tiles’ Rs.161 crores IPO will hit the market on 04 August 2021 and close on 06 August 2021. The company will be raising the amount of Rs.161 crores via IPO which comprises fresh issue of 11,186,000 equity shares and offer for sale up to 2,238,000 equity shares of existing shareholders.

The price bank of each share is around Rs.118-Rs.120 and the face value of each share will be Rs.10. A bidder for this particular public issue will have to apply in lots and one lot of this IPO will comprise 125 shares of the company. Tentative date for share allotment to the bidders is 11th August.

The shares of the company will be listed at both NSE and BSE and the expected date of Exxaro Tiles IPO listing is 17th August 2021.

Link Intime India Private Limited is the registrar for this particular IPO.

Know the company:

The Gujarat-based company, Exxaro Tiles is engaged in the manufacturing and marketing of vitrified tiles which are majorly used for flooring solutions. Its business operations are broadly divided into two product categories; Double charge vitrified tiles and Glazed vitrified tiles.

The company has a pan India presence in 24 states and union territories and internationally supplies products to over 12 countries.

The company has more than 1000 different styles of tiles manufacturing. They supply their products to residential and commercial infra projects and have two manufacturing plants in Padra and Talod.

IPO details:

Objective of the offer:

With going public, the company intends to make prepayment /repayment of certain secured borrowings availed by the company. There is also a plan to fund the working capital requirements of the Company and will also use the funds for general corporate purposes.

In addition, the Company expects to receive the benefits of listing of Equity Shares on the Stock Exchanges including enhancing its visibility and its brand image among its existing and potential customers and creating a public market for its Equity Shares in India.

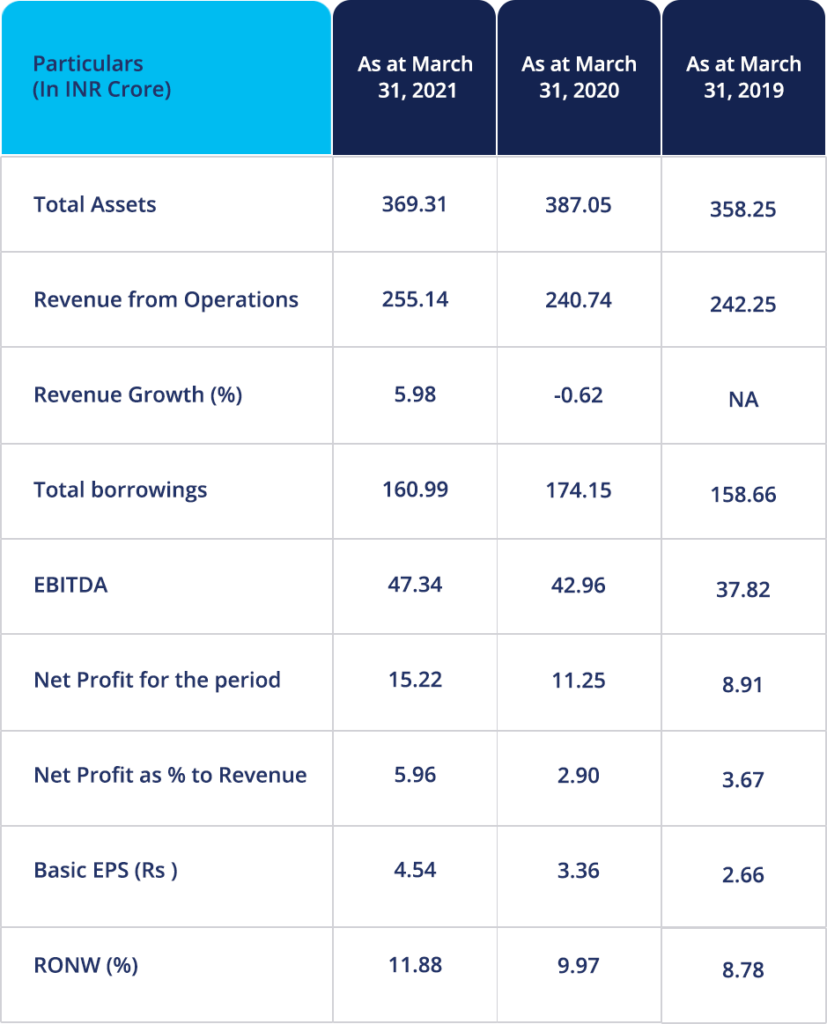

Important financial data:

Strengths of the company:

- The company has a state-of-the-art, automated manufacturing facilities with strong focus on design and quality.

- It has a widespread sales and dealers network.

- The company possesses a wide product portfolio comprising 1000+ designs

- It has a experienced management and dedicated employee base.

Risks involved:

- There is volatility in the supply and pricing of the raw materials and stores, spares may have an adverse effect on the company’s business, financial condition and results of operations.

- The company has an inability to expand or manage the distribution network for business or the loss of any significant dealer may adversely affect its business and results of operations.

- The company’s inability to meet the working capital requirements may have an adverse effect on its results of operations.

- Inability to meet the obligations under its debt financing arrangements could adversely affect the business, result of operations and cash flow.

- The shortage or non-availability of power, fuel and water facilities may adversely affect its vitrified tiles manufacturing process and have an adverse impact on its results of operations and financial condition.

- Any adverse change in regulatory requirements governing the products and products of its customers may adversely affect the business operations and financial condition.

Sources – RHP, BLRM

This content is purely for informational purpose and in no way an advice or recommendation. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.