Franklin AMC closes 6 credit oriented debt schemes3 min read

Contents

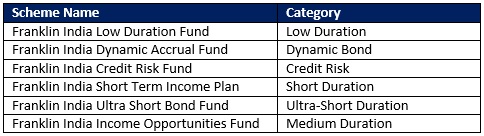

Franklin Templeton India AMC has decided to wind up 6 of their managed credit (high credit risk) schemes effective April 23, 2020, in order to protect value for investors and to provide them with an orderly and fair exit. The schemes being wound up are:

What led to this situation?

The COVID-19 pandemic has caused sharp fall in equity and debt markets, not just in India but also globally. Given that many countries are in some form of lockdown it is expected that economic growth will be adversely affected in the near term. This unprecedented situation has led to a general risk aversion in the market.

In India, this has led to a severe illiquidity in certain pockets of the debt market, especially the credit segment (lower credit rated, lower credit quality). Illiquidity means that the fund house finds it difficult to sell these securities in the market when needed. It may also be understood that there is low demand for such securities. The above mentioned schemes have material direct exposure to such securities. This has made it extremely difficult for the AMC to manage the unprecedented level of redemptions they have faced post the outbreak, compelling them to take this decision.

What does it mean for investors in these schemes?

Winding up the schemes implies that units of the funds will no longer be available for purchases and redemptions (be it through lumpsum, SIP, SWP or STP), post cut-off time on April 23, 2020. The funds will continue to publish their net asset values (NAVs) daily, and investors will not be charged any investment management fee on these funds, going forward. Accruals in the funds will continue in the same way as of now, and any money received will be distributed among the remaining investors proportionately.

Franklin AMC has taken this decision with a view to preserve maximum value for all investors. As the market situation stabilises, it is expected that the AMC would sell the portfolios in an orderly fashion and return investor money.

Can I transact on Paytm Money?

Following the AMC’s decision, Paytm Money has stopped fresh purchases, existing SIPs and any redemptions from the said schemes.

What happens to other funds of the same AMC?

All other funds managed by Franklin Templeton Mutual Fund in India – equity, debt and hybrid – are unaffected by this decision. The action taken by Franklin Templeton India AMC is limited to the six specific credit risk fixed income schemes due to the illiquidity of their portfolios.

What about debt mutual funds of other AMCs?

Association of Mutual Funds in India (AMFI) has stated that assets under management (AUM) of these six schemes constitute less than 1.4% of the Indian Mutual Fund Industry’s aggregate AUM as on March 31, 2020. Furthermore, it has stated that most mutual fund schemes have invested in superior credit quality securities and hence remain fairly liquid even during the current challenging times. Mutual funds can also borrow up to 20% of their assets to meet their redemption needs. Many mutual funds have informed AMFI that they don’t have any outstanding borrowings. RBI has also been taking steps to ensure that the debt markets function smoothly.

Our view

We continue to hold the view that investors should look at debt mutual funds for capital preservation and steady growth. You can take a quick look at our approach to debt funds – prioritizing safety over returns. This has helped us ensure that over the last 18 months, none of the debt funds in ‘Investment Packs‘ have been adversely impacted. So make sure that the debt funds you hold maintain a high credit quality portfolio.