Freak Trade in Nifty 16450 Call Option4 min read

On Friday, 20th August 2021, options traders experienced unusual price movement in the NIFTY contract.

Nifty 16450 CE August expiry spiked to Rs. 803.05 from Rs. 100.

This mainly happened because of a liquidity issue. This spike may have impacted a lot a of traders.

How Do Freak Trades Happen?

Some of the reasons for this kind of trades are –

- Fat Finger Trades

- Algos placing continuous orders because of errors in the system

- Possibility of stop-loss market orders triggering at a certain point

- Due to an imbalance in demand and supply price spike

What Is A Fat Finger Trade?

Here’s an easy example – A trader wants to buy 600 quantities of Nifty 16450 CE but types in 6000 quantities by mistake. This is a typical fat finger trade.

To avoid fat finger trades, the exchange has a quantity freeze rule, which regulates the flow of orders within a specified quantity to avoid such errors. W.e.f. August 2, 2021 exchange has defined single order freeze quantity for Nifty, Banknifty, Finnifty as 2800, 1200, and 2800 respectively. Any order size above this limit is automatically canceled by NSE to safeguard the trader and protect market activity.

There may be multiple reasons for the 20th August 2021, Nifty 16450 CE spike, but one of the reasons is the discontinuation of Trade Execution Range (TER).

What Is Trade Execution Range (TER)?

Trade Execution Range (TER) is the price range set by the exchange as a risk management measure to ensure that no order gets executed beyond a certain price range.

For example, if NIFTY 16450 CE is trading at Rs. 100 and the TER is 40% then the lower price range will be defined as Rs. 60 and the upper price range as Rs. 140. No order will get executed beyond this limit.

If the price hits the upper or lower limit, there will be a trading halt for a couple of seconds or minutes to cool off the price, before announcing a new TER to start the trading. This was a good mechanism to avoid freak trades, but this rule was a hurdle to market price discovery when underlyings make a huge price movement.

On 16th August 2021, NSE removed the Trade Execution Range (TER) mechanism for all contracts traded in the Equity Derivative Segment.

How Can We Protect Ourselves From Freak Trades?

Use Higher Limit Order than Market order:

When you buy or sell any stocks or derivatives contract, use Limit Order and place a higher limit price than the LTP or Touchline.

Example: If you want to buy Nifty 16450 CE which has Last Traded Price (LTP) at Rs. 99,

- Place Limit order at Rs. 99 (same as LTP)

- Check Best Seller in case of immediate buying.

There may be Best Sellers at Rs. 100 and Best Buyer at Rs. 99 in Market Depth. Place the Limit order at Rs. 100 so your order gets filled at 100 or better average price. Sometimes prices may move fast, so people buy at Market price. Instead of market price, place the order at 3 – 4% higher than best sellers. If Best Seller is at Rs. 100, place buy with Limit Order at Rs. 103. Your order will be executed at the best price. (If bestseller is at Rs. 100, the order gets executed at Rs.100 even if you place a Limit order of Rs. 103). Sometimes there may be huge differences between Best Buyer and Best Seller. Avoid those kinds of stocks or derivative contracts.

Use Stop Loss Limit (SL-L) than Stop Loss Market (SL-M) Order

When you place Stop Loss orders use the SL-L order type, where you have to give Trigger Price and Limit Price. Once your order gets triggered your order will be converted as a limit order.

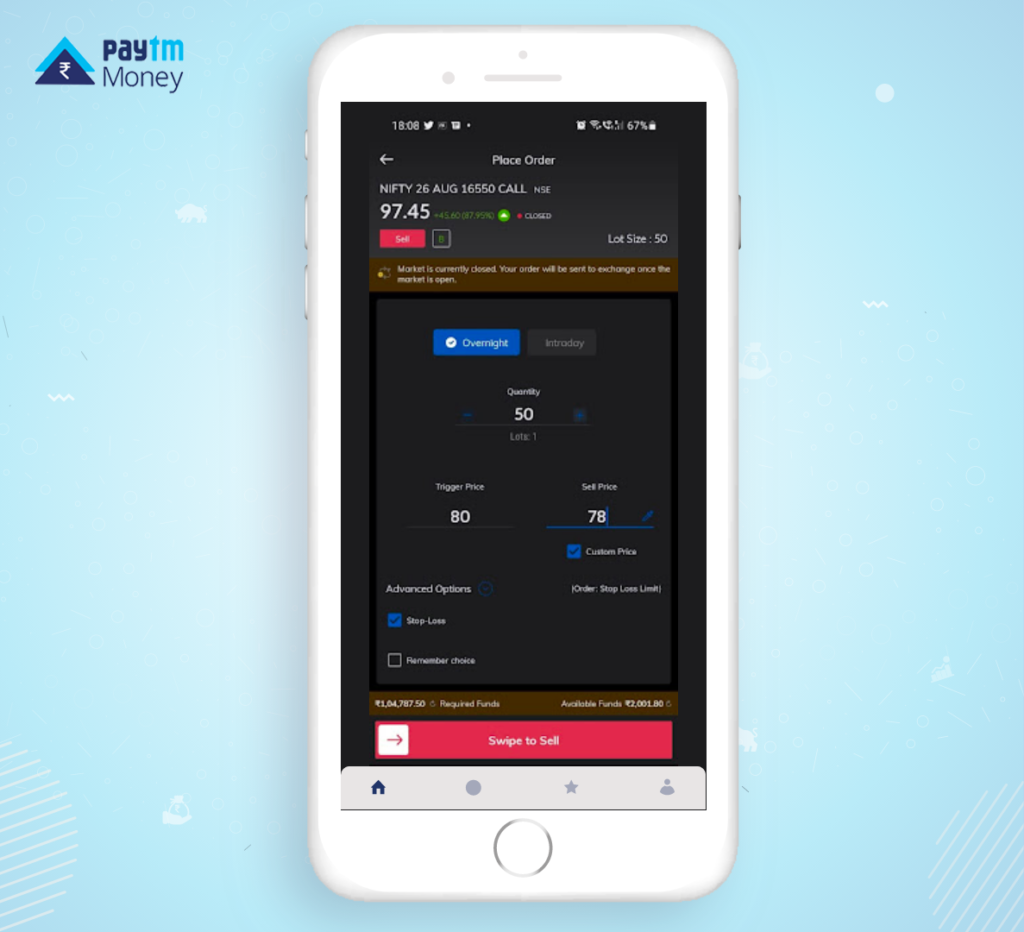

For example: You bought Nifty 16550 CE at Rs. 100 with Stop Loss may be at Rs. 80. In this scenario, you have to define Rs. 80 as Trigger Price and Limit Price may be Rs. 78. In this scenario, once the price reaches Rs. 80 your order gets triggered and sent to exchange as a Limit Order as Rs. 78.

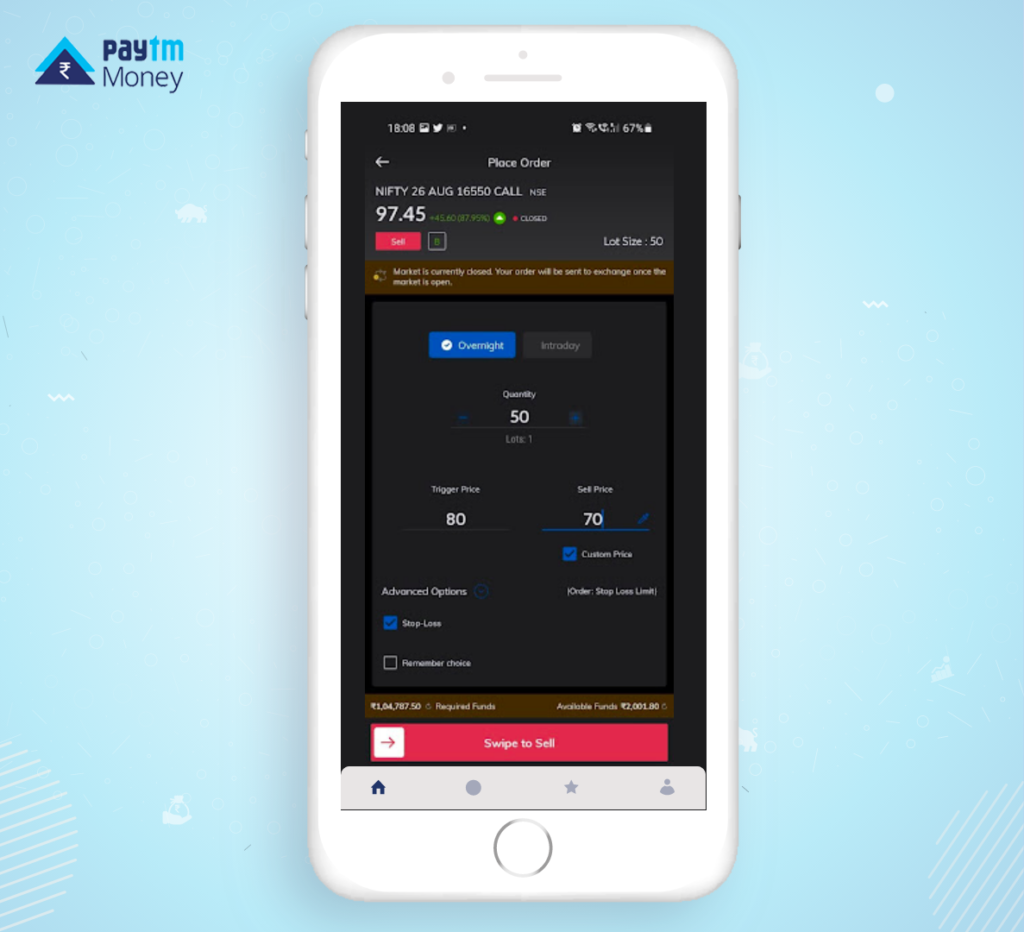

Sometimes the price may suddenly fall below Rs. 78 and your sell order may not be executed. To minimize this risk, you must keep a higher gap between Trigger Price and Limit Price. If your Trigger Price is at Rs. 80 and Limit Price is at Rs. 70 as shown in below image. Once the order gets triggered, trade will be executed at the best available price.

What Measures Has Paytm Money Taken To Avoid Freak Trades?

- At Paytm Money, we have blocked all the market orders for Stock Futures and Stock Options. We ask our users to place Limit Orders only.

- Even if the user places a Market Order for any stocks, we convert those orders to a Limit Order by using a certain %age of Market Protection.

Disclaimer

This content is purely for information and investor awareness purpose only and in no way an advice or recommendation. You should independently research and verify the information you find on our website/application. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019