Social media is buzzing with newer trends every day. Millennials look forward to connecting with these to belong to specific communities. Some of the globally well-known trends are “Throwback Thursday”, “Oktober Inktober” and “No Shave November” among others.

Let’s take the case of ‘No Shave November’ for instance, which started as a cancer awareness and charity drive. In this, men started growing beards to look cool, and especially in November, they wouldn’t shave or even trim their beards.

This has directly impacted the grooming industry and the demand for men’s shaving products can be seen tumbling down in the past few years.

But Iss Beard Mei Kuch Kala Hai?

The immense popularity of the ‘beard look’, especially among the millennials, is making the razor market perspire with despair.

Last year, Procter & Gamble (P&G), Gillette’s parent company, wrote down the value of its 119-year-old grooming brand by $8 billion to adjust the carrying values of Gillette’s goodwill and intangible assets. Additionally, it blamed the popularity of beards, particularly among millennial men, to be one of the reasons for its falling razor sales.

Gillette, on one hand, witnessed a drop in men’s average monthly shaving frequency over the last decade. On the other hand, it also noticed a hike in the demand for electric shavers, epilators, and trimmers due to their durability and convenience.

So far in 2020, P&G’s US sales surged 10% as consumers stocked up ahead of the coronavirus outbreak. However, the organic sales of its grooming business including Gillette and Venus shrank. Also, during the June quarter, Gillette India’s total income fell 24.36% (YoY) to Rs. 352.74 crore due to the lockdown.

Will Gillette’s Karan-Arjun Come Back & Start Shaving Dobara?

Despite the ongoing shaving trends, experts believe that the industry can revive based on new marketing techniques and changing customers’ attitudes.

In the Asia Pacific, increased consumer spending on personal care products including low-cost hair removal equipment and personal grooming products is expected to drive growth. Also, increasing beauty consciousness among women, highly influential fashion trends, growing inclination towards shaving razors as a non-surgical and cheaper grooming alternative, could be the additional growth factors.

Wait, Kahani Mein Thoda Aur Twist Hai…..!

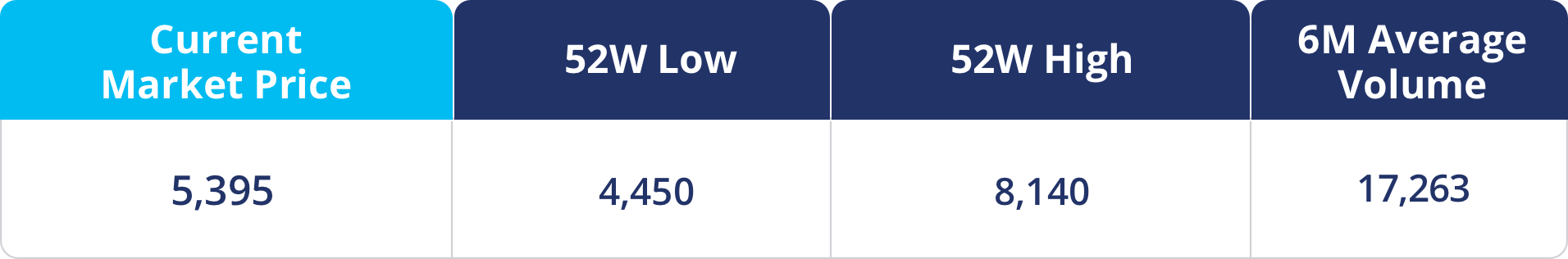

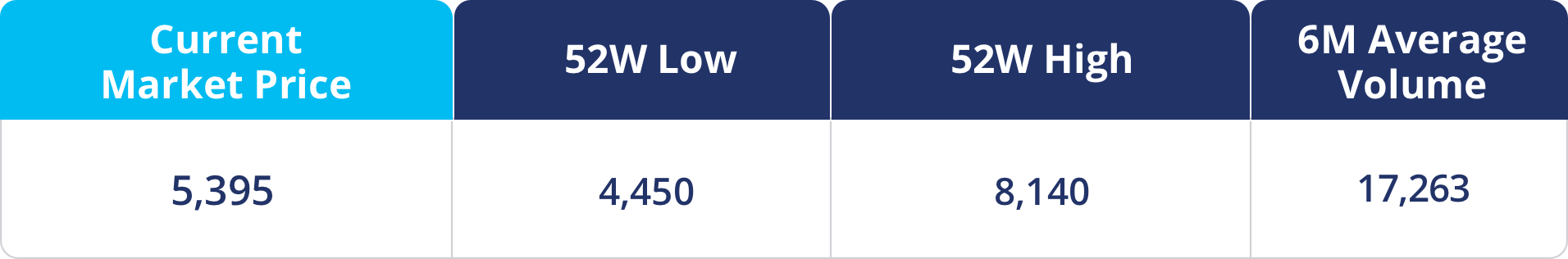

While all this happened, Gillette India’s share price has corrected by more than 20% over the last year due to lower sales.

Last month, in its yearly results, the company announced that for the June quarter, the sales stood at Rs. 351 crores, down 24% as compared to the previous year.

It expressed that the nationwide lockdown on account of COVID-19 disrupted its pan-India business operations. But, at the same time, it reassured that these unprecedented market challenges and uncertainties are of short term nature. And it continues to stay focused on its strategy to drive superiority, improve productivity, and aims to drive balanced growth.

Ab kya hoga…..socho aur samjho?

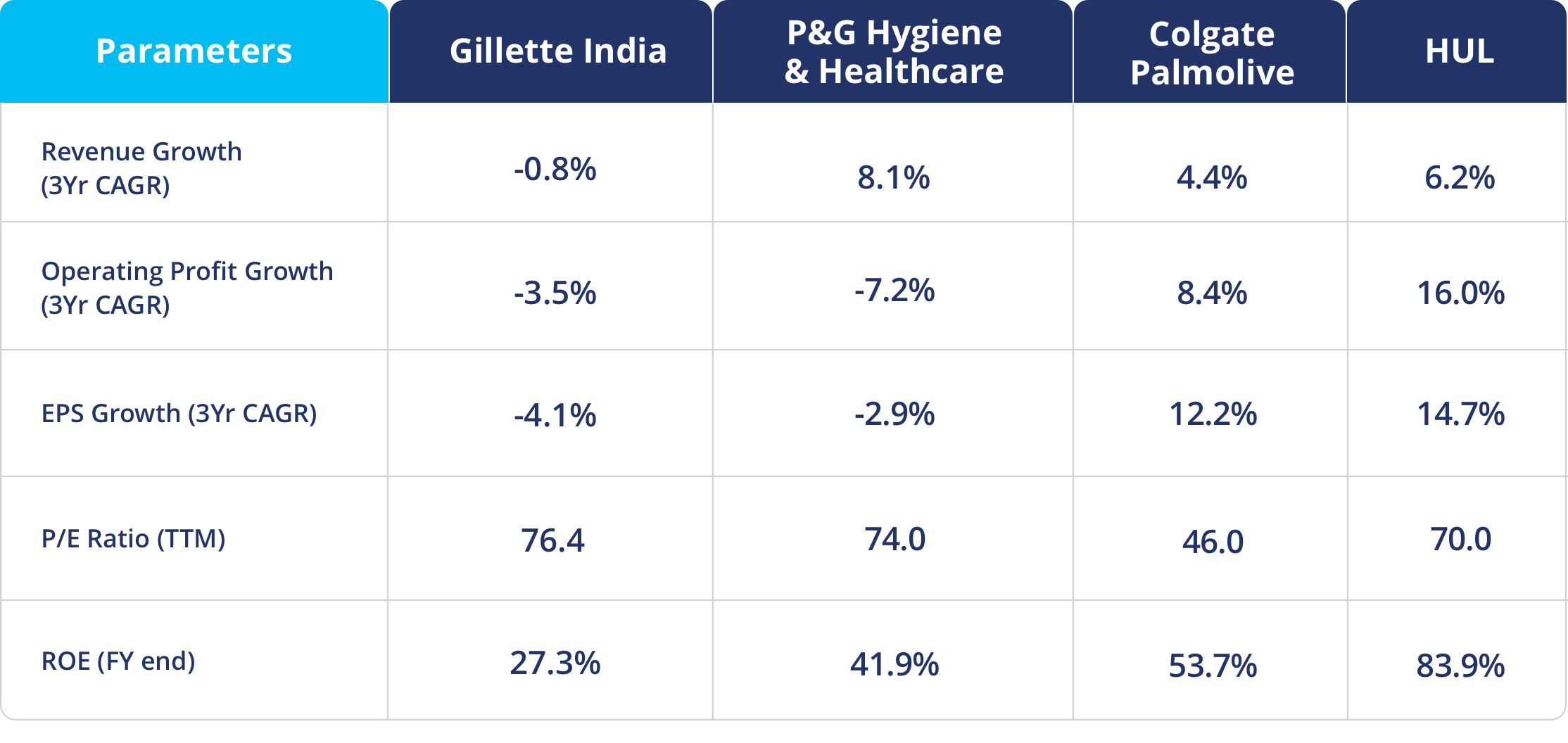

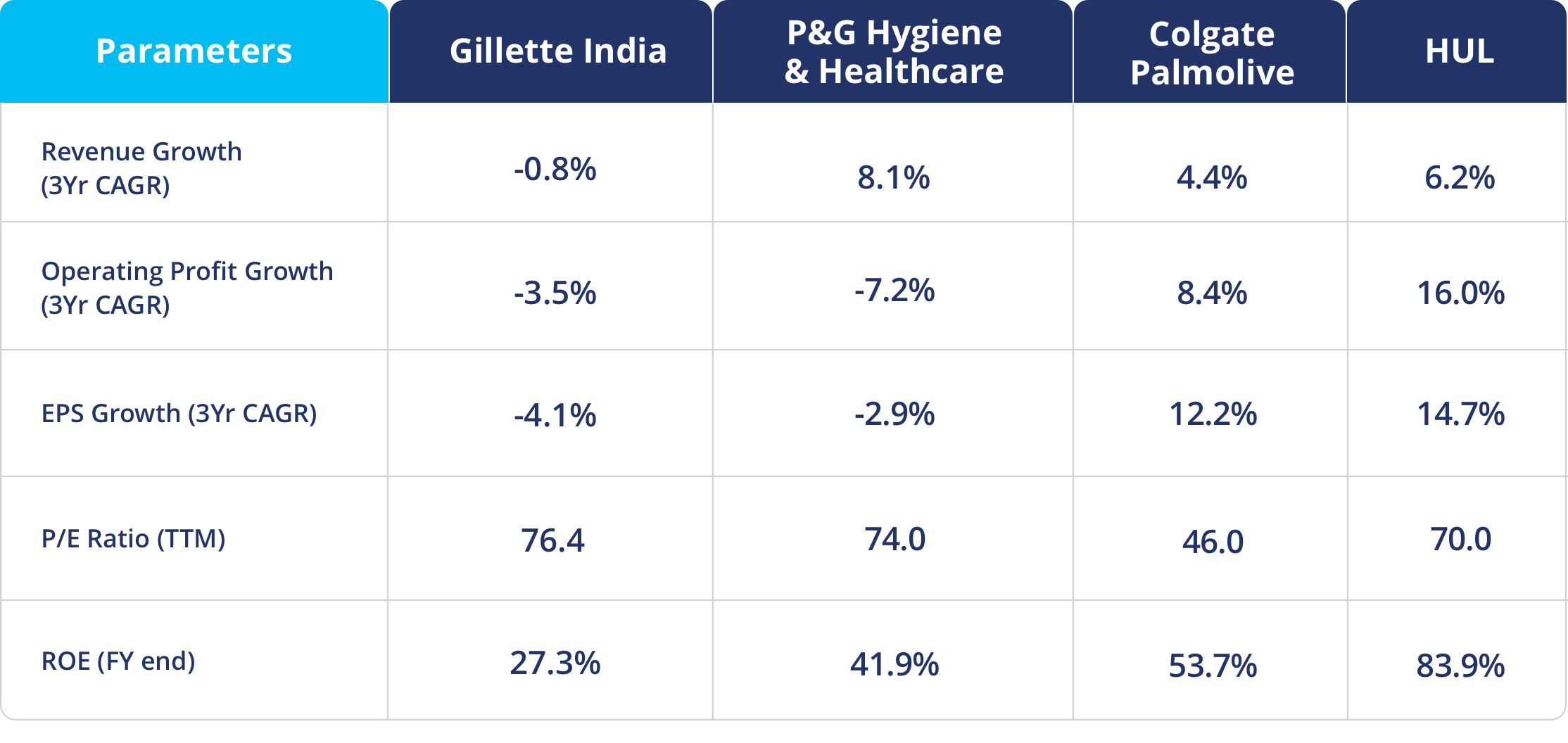

P&G hygiene and Gillette India are both listed entities in Indian stock markets.

Now you need to decide whether to worry over the falling demand for men’s grooming kits

or be excited about the growing market share of electric shavers, such as epilators and trimmers, and the potential that the female grooming segment carries.

Anyway, what’s your gut feeling about this trend? Let us know your comments & thoughts.

Do you think that relying on the market leader might be a good move since it can afford the

initial cash burn for marketing expenses and also holds enough prospects to easily adapt to the changing scenario?

Key Takeaways on Technical & Fundamental Analysis:

Gillette India has a Market Cap of INR 17,582 crore and is a mid-cap stock.