Gold is Forever: Top 5 Reasons to Invest in Gold2 min read

Gold has been an asset in demand for centuries. It’s a safe haven for investors, as it has always maintained its purchasing power – throughout history, and even now; but the way one purchases gold has changed. Digital Gold has revolutionised the way people buy and sell gold by making gold investments seamless and affordable.

Here’s why you should invest in Gold:

It’s highly liquid

Gold has been used as a currency longer than any other currency in history, and though it’s not used as a currency anymore, it’s easy to buy or sell, whenever needed. It’s a tangible asset and has the most long-term value as compared to any other currency or asset in the world. You can also get a loan against gold, without any hassles. In addition, Digital gold has made the buying/selling process easier and seamless. A couple of clicks is all it takes!

It’s 100% secure

When you buy digital gold online, you are allocated physical gold stored in insured, certified lockers, and you can get the delivery of physical units at any time. This eliminates the risk of theft or storage hassles without having to worry about quality.

Hedge against inflation:

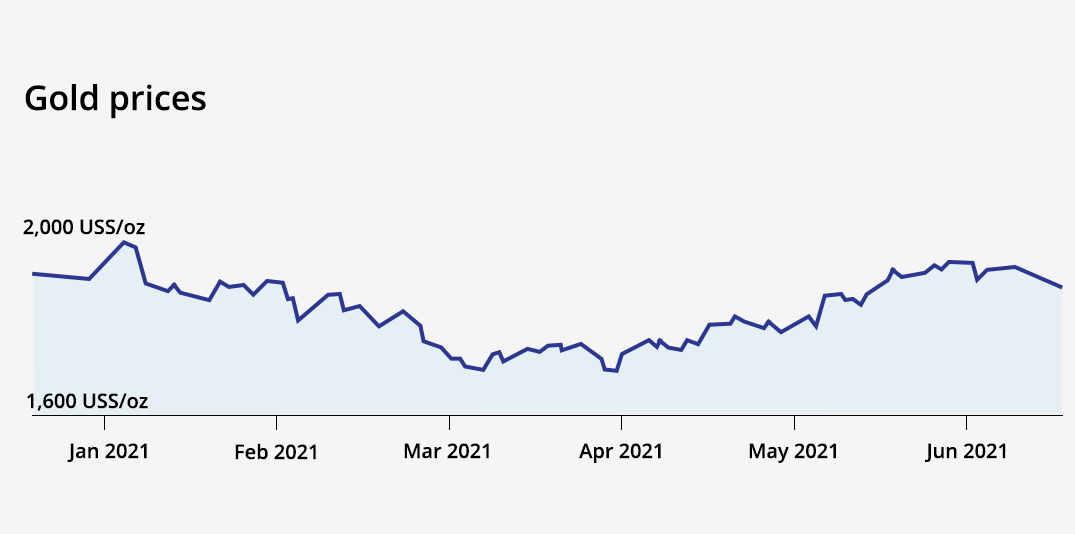

The track record of Gold goes more than 5000 years and gold has also given great returns in the long term. With inflation, while the value of the currency goes down, gold fares well. In the last five years, gold prices have doubled, and quadrupled in a decade.

Starts at as low as Rs. 1

What it means is you can keep investing small amounts of money on gold over a longer period of time to get high returns – helping you opt for a leaner investment, and enabling you to invest the way you want.

Diversify your portfolio

When markets are volatile, gold is believed to be a safe bet. Experts believe that adding gold to your portfolio reduces the risk as it has zero to low correlation to any other assets. It’s also believed that gold and equities have an inverse correlation – which means the value of gold rises when shares are falling in value.

About 7 million investors trust Paytm Money with their gold investments. 🙂

Why buy digital gold on Paytm Money?

- 24k 99.99% purity, BIS certified and 100% secure

- No minimum amount needed to start investing

- Buy & sell 24*7

- Create a customised savings plan

Disclaimers: Paytm Money Ltd Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. The Digital Gold offering is non Exchange traded products and Paytm Money Ltd (PML) is acting as an agent for distributing the same. Please note all disputes with respect to the distribution activity, would not have access to the Exchange investor redressal forum or Arbitration mechanism.