GR Infraprojects IPO Details- Dates, Price & Overview3 min read

GR Infraproject’s Rs 962 -crore IPO will hit Dalal Street for subscription on Wednesday, July 7, 2021. The price band has been fixed at Rs 828 – 837 per share. The public issue will be entirely an offer-for-sale (OFS) of up to 1.15 crore equity shares by existing promoters and shareholders.

The GR Infraproject’s IPO opens on July 7, 2021, and the closing date for the same is July 9, 2021. The issue might list on Jul 19, 2021. Kfin Technologies Private Limited is the registrar for this IPO.

About the company

GR Infraprojects is an integrated road engineering, procurement, and construction company with experience in construction activities and road/highway projects. It mainly undertakes civil construction projects under the EPC and BOT (Build Operate Transfer) basis in the road sector but also diversified into manufacturing activities of thermoplastic road-making paints, electric poles, road signages, and fabricating metal crash barriers.

Until April 2021, the company has completed more than 100 road construction projects successfully, and currently 4 BOT projects are under construction. The company owns three manufacturing facilities at Udaipur (Rajasthan), Guwahati (Assam), and Sandila (Uttar Pradesh) and has a fabricating and galvanization unit at Ahmedabad, Gujarat.

IPO details:

- The issue opens on Wednesday, July 07, 2021 and closes on Friday, July 09, 2021

- The offer size is pegged at Rs. 962 crore

- The total shares on offer are up to 11,508,704 equity shares at lower band

- The price band is set at Rs. 828 to Rs. 837

- The minimum order quantity is 17 Shares

- The face value of each share is Rs. 5

IPO timeline:

Objective of the IPO

By going public, the company plans to achieve the share listing benefits on the BSE and NSE. It also intends to make an offer for sale of upto 11,508,704 shares.

In addition to the aforementioned objectives, the Company expects to receive the benefits of listing of the Equity Shares on the Stock Exchanges and enhancement of it’s brand name and creation of a public market for its Equity Shares in India.

Company Promoters

Vinod Kumar Agarwal, Ajendra Kumar Agarwal, Purshottam Agarwal, and Lokesh Builders Private Limited are the company promoters.

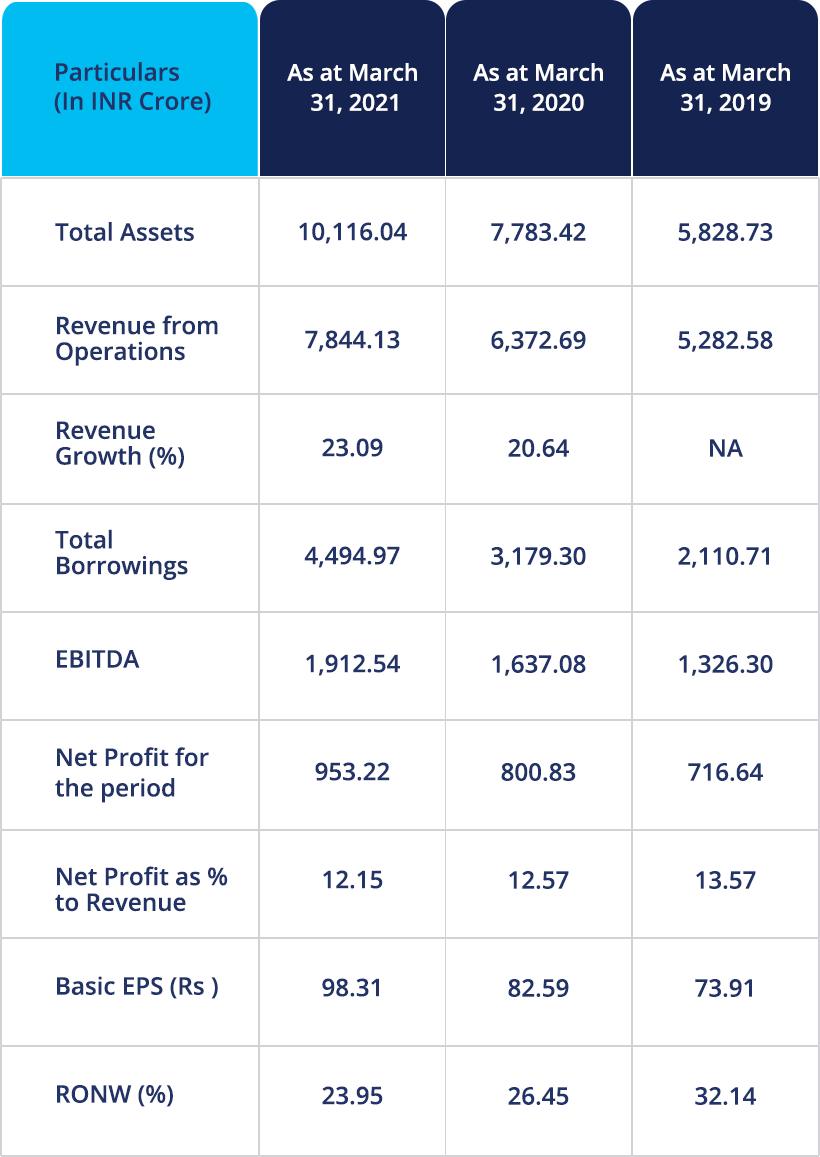

Financial data

Let’s take a look at the financial details of the company:

Strengths of the company:

- The company has a proven expertise in road projects i.e. state and national highways, culverts, flyovers, airport runways, tunnels, etc.

- It has showcased a strong project execution capabilities.

- It has a robust financial performance track record.

- The company has an efficient team of promoters and managers.

Risks involved:

- The continuing effect of the COVID-19 pandemic creates uncertainty.

- Inability to meet the obligations, conditions and restrictions imposed by its financing agreements could impact business.

- Lack of new contracts or termination of existing contracts in civil construction will impact business due to major revenue dependence.

- Business is extremely capital intensive. Insufficient cash flows will affect operations.

- Outstanding legal proceedings against the Company, its directors and promoters.

- Delays in the completion of construction of current and future projects could lead to termination of concession and other EPC agreements or cost overruns.

- Increased prices of construction materials, fuel, labour and equipment could have an adverse effect on its business.

Conclusion

The initial public offer (IPO) of GR Infraprojects Limited will open for subscription on Wednesday, July 7 and close on Friday, July 9. The price band has been fixed between Rs. 828 – 837 per share with a lot size of 17 shares and the company aims to raise an issue amount of Rs. 962 Crores.

Source – RHP, DRHP, BRLM, Moneycontrol

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.