HDFC Bank: Then & Now5 min read

The evening of 26 October was memorable for HDFC Bank as Mr. Aditya Puri, the erstwhile MD & CEO, got retired after serving India’s largest private bank for 26 years.

Over a lakh employees, senior members, and the bank’s former officials attended the grand farewell which was a virtual event of 90 minutes wherein Mr. Puri passed on the reins to Mr. Sashidhar Jagdishan as the new CEO and MD of the bank. The latter has been part of the bank’s growth trajectory since 1996 and possesses a rich experience of over 30 years in banking, finance, and economics.

The change in the bank’s leadership came as per the Reserve Bank of India (RBI) norms which state that the age of a private bank’s CEO cannot go beyond 70 years.

On this crucial occasion, ICICI Bank (HDFC bank’s competitor) also thanked Mr. Puri for his contribution to the Indian banking sector and for being a continued source of inspiration. It also wished him good luck for his future endeavors.

Since the time the bank started functioning in 1994, Puri has been at its helm and under his excellent leadership, the bank has scaled great echelons. Now, as he gets ready for his second innings and the new CEO prepares to carry on the glorious legacy, it would be intuitive to see the entire journey of how it all started, what the future holds for the bank, and is there any likelihood of key man risks.

When did it all start?

HDFC bank came into being in 1994 as a Scheduled Commercial Bank and started operations in 1995 at an ordinary office in Kamala Mills compound in Lower Parel. It has been among the first few financial institutions that got RBI’s nod to set up a private sector bank under its policy of liberalizing the Indian banking industry.

Today, the bank boasts of a large network of 5,430 branches and 15,292 ATMs that spans across 2,848 cities and towns. It has a mission to become a world-class Indian bank. The bank aims to be a preferred banker to its retail and corporate clients. At the same time, it focuses to achieve profitability in a healthy manner that’s in line with its risk appetite.

The bank’s business philosophy stands on five pillars namely excellence, customer focus, product leadership, people, and sustainability. HDFC, its promoter and country’s leading housing finance company, possesses significant expertise in retail mortgage loans and its outstanding loan portfolio contains more than a million housing units.

Mr. Puri, who started working as the bank’s foremost head, built it from scratch and converted it into India’s biggest lender that employs around 1.20 lakh people. For the financial year 2019-20, he was the highest-paid banker among the other top bankers. A few months before retirement, he sold 95% of his stake, worth Rs 842.87 crore, and now is left with only 0.01% or 3.76 lakh shares of Rs 42.71 crore in the bank’s equity capital.

What has the bank achieved under the Puri regime?

A few months ago, Puri wrote in one of his emails “ a lot has been achieved in the 26 years of HDFC Bank Ltd, but the best is yet to come. From my first office with broken chairs to now, what we have achieved in this time is incredible, and doesn’t have too many parallels globally.”

Under his leadership, the bank launched the Parivartan initiative that empowers marginalized communities so that they can contribute to the nation’s growth equally. To date, the bank has changed the lives of 54 million people through rural development, skill development, promotion of education, financial literacy, healthcare, and hygiene.

Also, the bank has created immense wealth for its investors and is one of the largest employers of independent India. It went public in 1995 and to date, it has generated a CAGR of 30% (with dividends reinvested). That means if you had invested Rs 1 lakh in HDFC bank’s IPO in 1995, today you would be sitting at a wealth of Rs 7.05 crore.

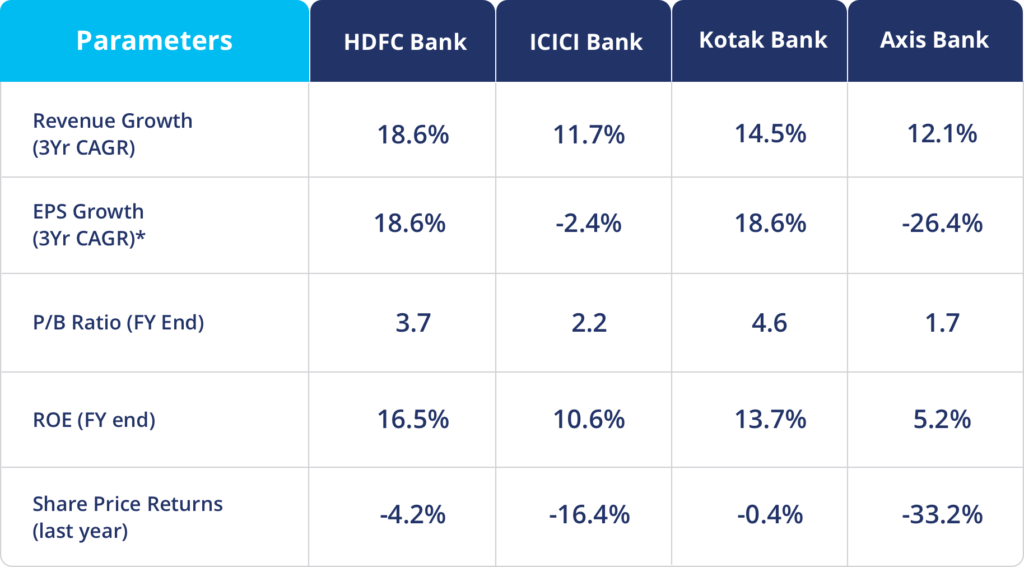

How about its performance indicators?

In the terms of asset quality, the bank has shown significant improvement. Its Gross Non-Performing Assets (NPAs) as a percentage of total loans stood at 1.08%, lesser as compared to 1.36% in Q1 and 1.38% in Q2 of the previous year. Simultaneously, its Q3 Net NPAs have also come down to Rs 1,756.08 crore as against Rs 3,790.95 crore last year.

Net NPAs refer to the bad loans that are left after deducting provisions from Gross NPAs.

Besides, the bank has been continuously bulking up its provisions over RBI-prescribed norms to take care of potential customer defaults that might arise due to pandemic-led slowdown. Its Q3 provisions and contingencies increased to ₹ 3,703.50 crores as compared to Rs 2,700.68 crore last year.

Since provisions are set aside from a bank’s profit to cover losses caused by NPAs, an increase in provisions may dent a bank’s overall profitability. From a profitability standpoint, the bank had a rather stormy quarter. Its Q2 net interest margin, a key measure of profitability, stood at 4.1% as compared to 4.3% in the last quarter.

Additionally, the bank’s dedicated focus to grow deposits enabled it to achieve a liquidity coverage ratio of 153%, way more than the RBI-prescribed limit. Its total deposits increased 20.33% to Rs 12,29,310 crore, and loans 15.76% to Rs 10,38,335 crore.

The bank has been very progressive and used the latest technology to gain a competitive edge and enhance its market share. Its success in web-enabling its core business and launch of Instant Account App helped it to add 2.5 lakh new customers during the lockdown.

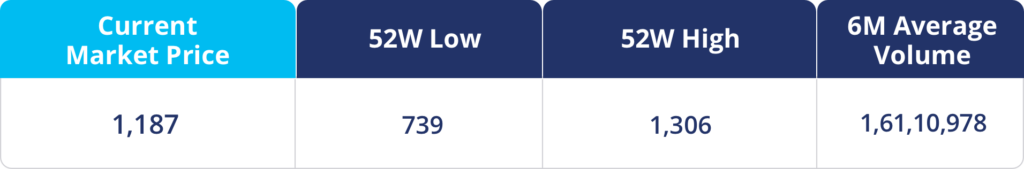

After the bank’s results were posted over the weekend, its stocks were up 3% in early trade on 19 October 2020.

What does the future look like for HDFC Bank?

Despite the challenges in the COVID scenario, the bank has exhibited growth, and business is expected to tend to pre-COVID levels. Its operational efficiency coupled with healthy revenue growth puts the bank in a positive light. Besides, even if defaults occur, prudent provisioning would help the bank to lessen the severity of damage and quickly recover to a normal growth pace. Improved asset quality, positive management outlook, superior underwriting, and an expected retail credit pick-up show a bright future for the bank.

The bank’s new leadership aims to leverage technology to increase its market share across key verticals and benefit from improved efficiencies to render a better return on assets. Additionally, with Jagdishan having led key strategic decisions of the bank as a change agent earlier and Puri reposing his faith in him, it is expected that the bank will continue its legacy of growth.

Fundamental & Technical Dose