Heranba Industries IPO Details – Date, Price & Overview4 min read

Taking a step forward, Gujarat-based Heranba Industries is all set to venture into the field of the stock market. Heranba Industries’ Rs.625 crores initial public offering (IPO) will open for subscription next week on February 23 and close on February 25, 2021.

In the year 2020, from June onwards, as IPOs have delivered one record-breaking performance after the other.

The offer comprises a fresh issue of shares worth Rs 60 crore and an offer for sale of 90,15,000 shares.

If you are in a dilemma to invest in this IPO or not, we have curated some vital information that’ll help to make a decision.

Company Details

The company finds its roots back in 1996 when technocrats and two brothers from Gujarat, Sadashiv K Shetty, and Raghuram K Shetty formed a company with the objective of providing innovative products to farmers to maximize their farm output.

The Gujarat-based crop protection chemical manufacturer manufactures different types of pesticides including insecticides, fungicides, herbicides, and other pest control products. It is also one of the leading domestic producers of synthetic pyrethroids like cypermethrin, bifenthrin, deltamethrin, lambda-cyhalothrin, etc.

The company exports its products to more than 60 countries around the world and has close to 50 percent of its revenue from exports.

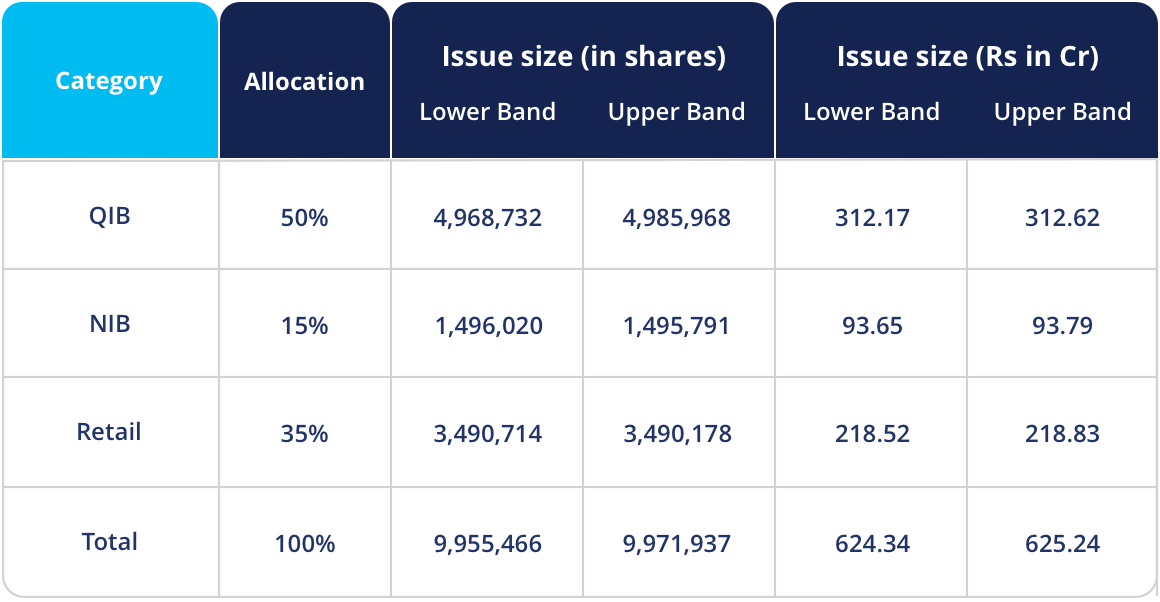

Issue Details

The initial public offer (IPO) of Hernaba Industries consists of a fresh issue of Rs.625 crore and the rest is an offer-for-sale. The company has set a price band of Rs626- Rs.627 per share.

The same is set to open for subscription on February 23rd, Tuesday and will be available till February 25th, Thursday.

The lot size for this IPO is 23 shares and in multiple thereafter.

The book running lead managers to the issue are Emkay Global and Batlivala & Karani Securities while the registrar is Bigshare Services. However, the two merchant bankers involved herein with the issue have handled just one public issue in the past three years.

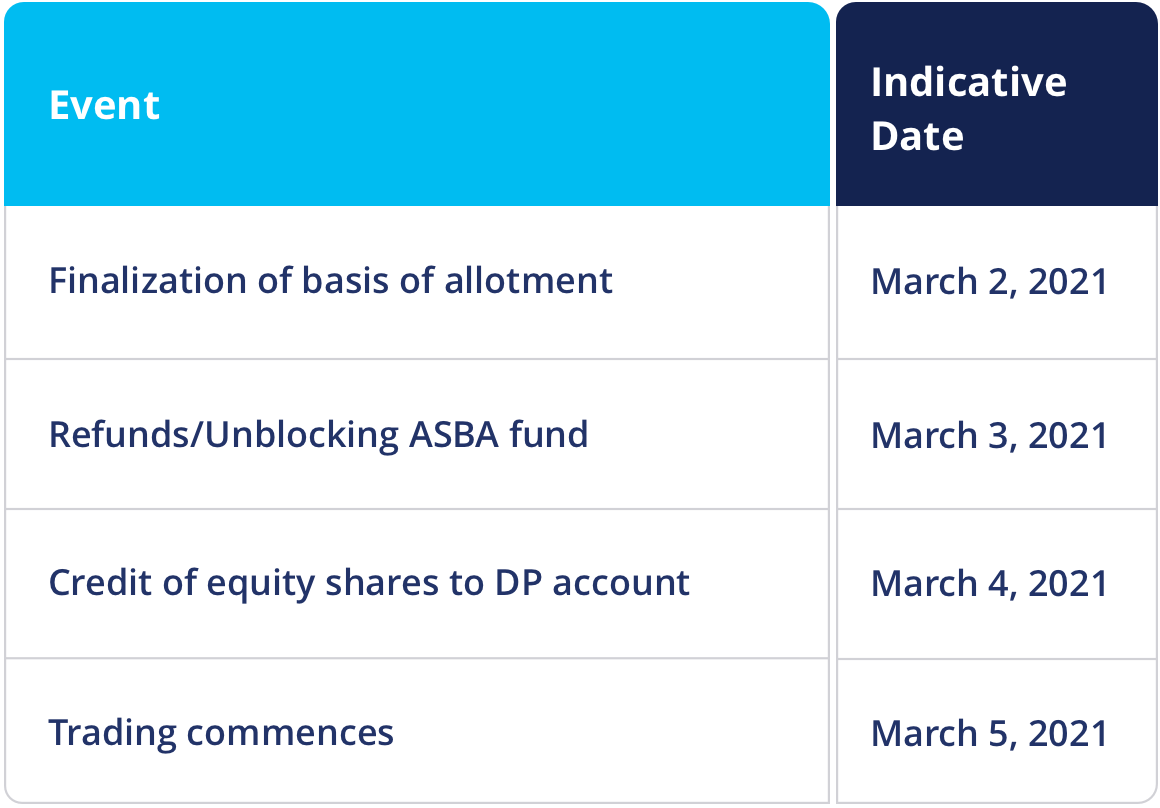

IPO Timeline

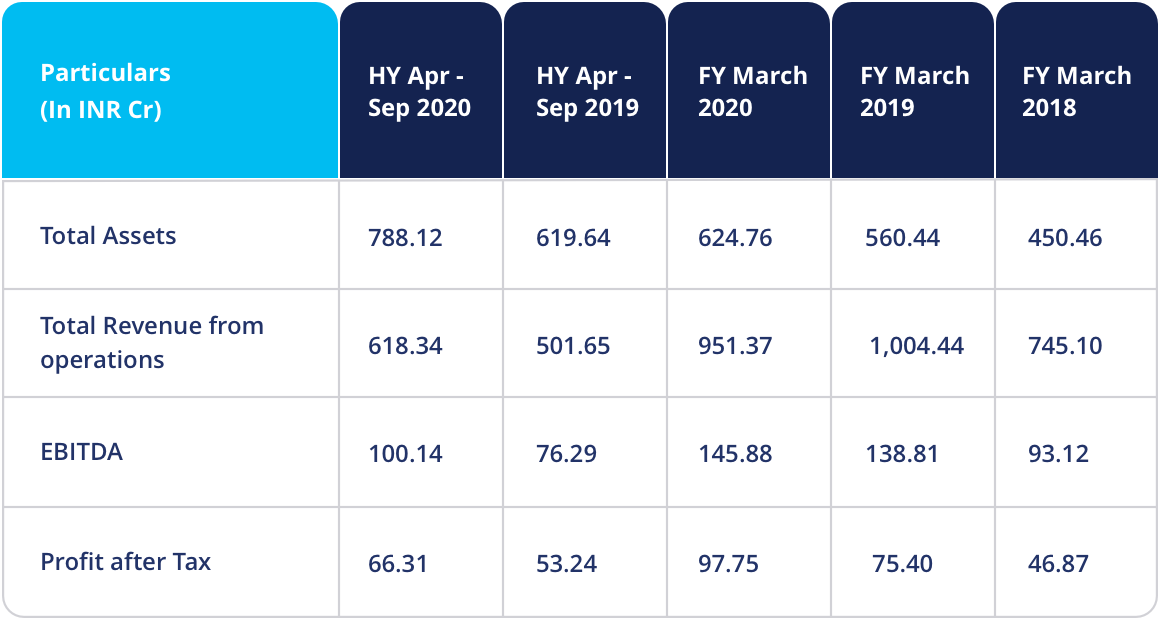

Company Financials

A quick glance at the financial performance of Heranba Industries over the last three years highlights significant growth. During this period, the total income of the company showed growth at a CAGR of 8.85%. Further, between 2018 and 2020, the profit after tax grew at a CAGR of 27.76%. Also, the company’s total assets grew at a CAGR of 11.52%.

Company’s Interest In Going Public

The company intends to use the proceeds from the share sale to fund working capital requirements and for general corporate purposes. Additionally, Heranba Industries expects to achieve the benefits of listing their Equity Shares on the Stock Exchanges and enhance the company’s brand name and creation of a public market for their Equity Shares in India.

The company also aims to use the net proceeds of fresh issue less the offer expense to fund expenditures towards general corporate purposes.

Strengths & Risks Involved

Strengths

- The company boasts a diverse portfolio from the manufacturing of intermediates to the sale of branded formulations, both in the domestic and international markets, offers ample opportunities to enhance revenue and profitability.

- It has more than 9400 distributors/dealers sponsored by its 21 stock depots spread across 16 states and one Union Territory in India to meet market demand.

- The company has a diverse and stable client base that provides the required stability since the top ten clients don’t contribute to more than 20-odd percent of the company’s revenues.

Risks Involved

- Change in government policies for industries likes these can face a challenge as the products manufactured by Heranba generate hazardous effluents.

- While there are no companies in the exact same business as Heranba, it faces competition from other companies in the Agrochemicals sector.

- There are outstanding legal proceedings involving the Company, Promoters, and certain Directors that may adversely affect its business, financial condition, and results of operations.

- Raw materials constitute a significant percentage of Heranba’s total expenses. Any increase in prices and any decrease in the supply would materially adversely affect its business.

- The company is subject to uncertainties in demand and there is no assurance that these customers and suppliers will continue to purchase its products or sell raw materials to it or that they will not scale down their orders. This could impact the business and financial performance of the company.

How to Apply for IPO on Paytm Money

- Log in to the Paytm Money app and complete your fully digital KYC for stock, if not done already.

- Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

- You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

- Next, you must add details for bidding such as quantity, amount, and so on. Maximum 3 bids are allowed.

- After that, you have to enter your UPI id so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

- Once you accept the mandate, your application will be successfully submitted.

- Once the allotment happens, you will be notified about your allotment status.

Conclusion

Heranba Industries has a presence in a wide range of products across the entire value chain of synthetic pyrethroids.

Heranba’s top ten customers constituted not more than 22.03% and 20.85% of its sales for the six months period ended September 30, 2020, and for Fiscal 2020, respectively, both in the domestic and the international markets.