How a Coffee Pe Charcha Revolutionised India’s Home Finance Scene6 min read

Buying their own space is the dream of every Indian, irrespective of the professional background and their earnings. Only a handful Indians make it to the final process of getting a home loan, while several lose the battle amidst the income proofs and documents chaos.

To give these dreams a shape and make them a reality, three colleagues once met for a coffee and spoke about how the crores of Indians are disabled when it comes to accessing personal home finance. They were determined that any person who is willing to buy his/her dream home, should have the opportunity to do so.

These three colleagues, Jaithirth Rao, popularly known as Jerry Rao, P.S. Jayakumar, and Manoj Viswanathan, who are retail industry veterans, decided to accept this challenge and change the Home Loans landscape. They did not want creditworthy people to stop from taking the big step, only because credit was simply inaccessible to them.

The Three Musketeers

Former Citi Group colleagues – Jerry, Jaya, and Manoj discussed how a Pani Puri vendor would avail a loan and fulfill his dream of buying his own house, and how accessibility to loans was a big issue for an unorganised set of workers.

They kept wondering – Why is the loan process so complex? Why is there such a gulf in the treatment provided to a premium customer and someone from an informal segment? Why are customers in dark about their own loan process? Trying to address these questions, they started exploring “affordable housing”, which sounded like a really promising idea but was somehow not gaining the traction it deserved.

They would often meet at CCDs and Malls and discuss this gap in the lending business. They spent a lot of time enquiring about the problems faced by potential customers and builders who were flirting with the idea of affordable homes.

After several long conversations, many site visits, and endless brainstorming sessions they could finally put their finger on the problem. While at one end the urban shortage of homes by 2025 was expected to touch 34 million units with a demand for 1.85 million units of housing being generated per year, at the other end the banks were stuck on a ‘one size fits all’ system to evaluate the customers.

Even if somehow one was considered for a loan, the process was like an endless labyrinth of procedures where the clients entered blindly with very little understanding. With a large population belonging to the informal segment, customers often did not possess the long list of documents labeled essential by the traditional banks and were turned away.

Sensing an opportunity in the market where an enormous gap existed between demand and access, Jerry, Jaya, and Manoj joined hands to start their own company, Home First Finance.

The Journey Begins

With a working experience in the home financing sector and from meeting the builders and potential customers, the founders had got an idea of what their customers’ grief was.

But what made Home Finance First unique was its customized, tech-savvy, and customer-centric approach. The lender focused on catering to people working in the unorganised sector who may not have the necessary documents to avail a “standard” bank loan.

Right from its beginning, the company proved itself different with small innovations like disbursing the builders’ amount due directly into their bank account for quicker payments, back in 2010 when NEFT & RTGS were not popular instruments.

The company also ensured that they had just one point of contact for the customer for all loan procedures which made it easier for clients to coordinate. The company executives visited customers at their choice of place to collect documents at their convenience which was new in the lending space back in 2010.

Doing away with the age-old lending norms, the company removed the mandatory requirement of income proof, preferring instead to evaluate each customer without a set template. With one of the earliest campaigns called ‘We see you, not your documents’, Home First has made home into the hearts of its customers.

Initial Challenges

When the trio started the company with the unique proposition of availing housing loans to unorganised sector workers, they faced some challenges. One of the major challenges was to evaluate and understand the customer’s creditworthiness and make an evaluation system around it.

For instance, consider the case of a Pani Puri vendor who operated out of a railway station and had a wife who earned some money out of her tailoring job. The challenge for Home First Finance was to evaluate their combined income without relying on formal channels. In such cases, the company representatives would visit the vendor stalls on odd days, weekends, and check the footfall to assess the approximate family income. The real actual challenge for the company was to build a sustainable system around this.

Keeping up with themselves

As the company’s initial success enabled it to establish itself across other geographies by 2012, it had to maintain the same level of success rate and it did. The company also went full throttle on technological innovations with cloud computing onboarded for back-end logistics and machine learning to assist the centralization of underwriting.

During this period Bessemer Venture Partners joined the founders with Series A funding, and the company approved 1000 loans in March 2013. In 2014, just 4 years after its foundation Home First announced itself as a profitable company, and from there on, there was no looking back.

Home First reached 5000 disbursals within the next two years, and in 2017, secured Series C funding from TrueNorth. Home First had now established itself as synonymous with ‘Affordable Housing’ and one of the biggest names in the category across the nation with a credit rating of A+.

And today!

It has been six years since the company has hit the 5,000 customer mark. From a venture that started out just 10 years ago in a small office outside of Bangalore, Home First is now a Mumbai-based company and is present across 11 states with 70 branches.

Started by 3 visionaries, it is now a certified Great Place To Work with a team of 700+ people with the same vision – to shape the future of financing homes and empower people to live better. The common apprehensions towards home loans have been carefully worked on, keeping alive the ever-present promise – We will take you home.

Home First now has 50,000+ customers and most of them are present on the Home First app and can track the progress of their loan anytime, anywhere. All customer data is securely stored on the cloud platform. With a scalable model, machine learning, and robust understanding of local markets to sanction a loan within 48 hours against an industry average of 8-10 days, HomeFirst is a business designed to solve problems once synonymous with Home Loans.

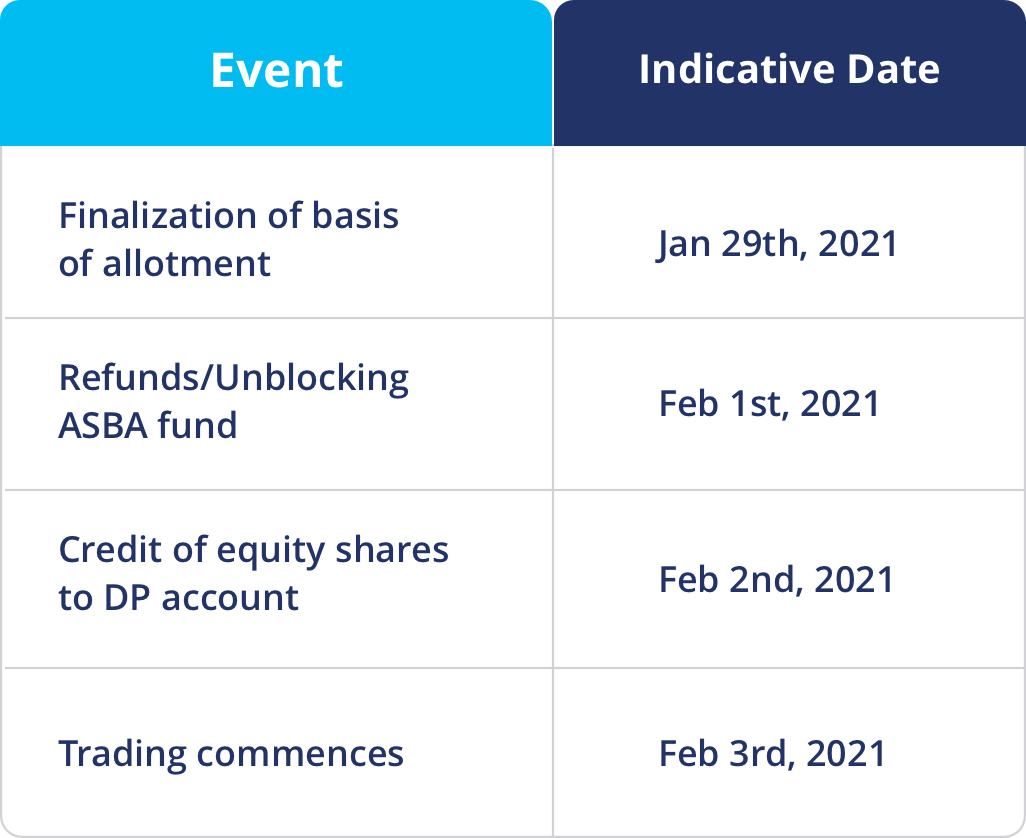

Home First Finance IPO

The mortgage financier, will open its Initial Public Offering (IPO) on Jan 21 to raise up to Rs. 1,153 crore with a price band of Rs.517 to Rs. 518 per share. The IPO will be open from Jan 21 to Jan 25.

The proceeds from the stake sale will be used to Augment its capital base to meet the future capital requirements, arising out of the growth of the business and assets. The company expects to achieve the benefits of listing of our Equity Shares on the Stock Exchanges and enhancement of the brand name and visibility among existing and potential customers.