India Pesticides Limited IPO Details- Dates, Price & Overview4 min read

Agro-chemical manufacturer India Pesticides initial public offer (IPO) worth Rs. 800 crore will open for subscription on June 23, 2021 and close on June 25, 2021. The total offer size is up to Rs. 800 crore with a fresh issue of equity shares worth Rs. 100 crore and an offer for sale up to Rs. 700 crore.

The pesticide major has fixed the price band at Rs. 290 – 296 per piece.

KFin Technologies Pvt Ltd is the registrar for this particular IPO while Axis Capital and JM Financial are book running lead managers to the offer.

Know the company :

Uttar-Pradesh-based India Pesticides Ltd is a Research and Development (R&D) driven agro-chemical manufacturer of Technicals with a growing Formulations business. It is amongst the fastest growing agro-chemical companies in India in terms of volume of technicals manufactured in Fiscal 2020. The company is also the sole Indian manufacturer and among top five manufacturers globally for several Technicals, such as, Folpet and Thiocarbamate Herbicide. It also manufactures herbicide, insecticide and fungicide Formulations.

The company has a strategic focus on R&D and its R&D capabilities include two well-equipped in-house laboratories registered with the DSIR. As of date of this Red Herring Prospectus, it has obtained registrations and license to manufacture from the CIBRC and the Department of Agriculture – Uttar Pradesh for 22 agro-chemical Technicals and 125 Formulations for sale in India, and 27 agro-chemical Technicals and 35 Formulations for export.

It manufactures and sells various formulations of insecticides, fungicide and herbicides, growth regulators and acaricides, which are ready-to-use products. As of March 31, 2021, it manufactures over 30 Formulations.

Details of the IPO:

- The total issue amount is Rs. 800 crores out of which, fresh issue is fixed at Rs. 100 Cr and Offer for Sale at Rs. 700 Cr

- The post issue implied market cap is Rs. 3,409 crores at upper band

- The IPO will open on June 23, 2021 and close on June 25, 2021

- The price band of each share is fixed between Rs. 290 to Rs. 296

- There are upto 27,586,206 equity shares on offer at lower band

- The face value of each share is Rs. 1

- The lot size is 50 shares

- Category: Issue break-up 100 % , QIB: 50% NIB: 15% Retail: 35%, Total: 100%

IPO Timeline:

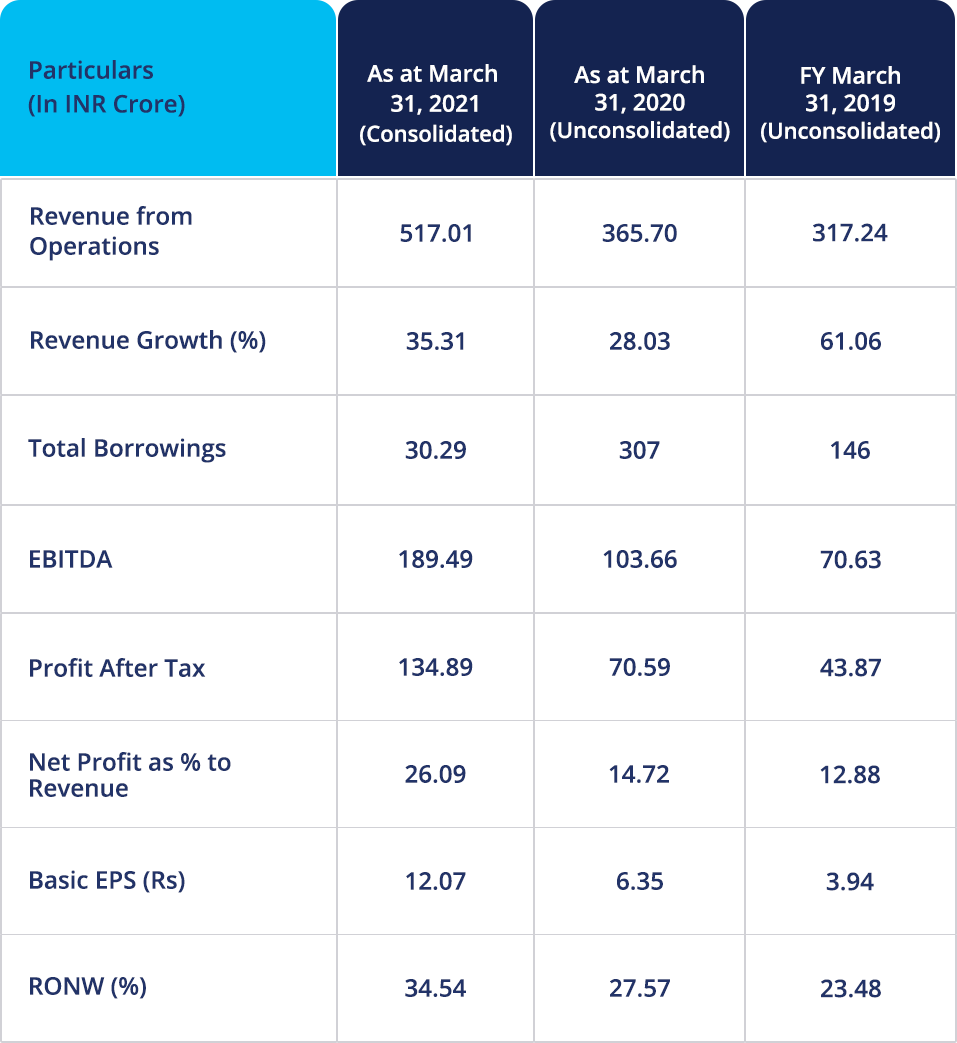

Financials of the company:

Objective of the offer:

The company proposes to utilise the Net Proceeds of the fresh offer towards the following. Through the IPO, the funding working capital requirements of the Company. The proceeds will be used for general corporate purposes.

Also, in addition to the aforementioned objectives, the Company expects to receive the benefits of listing of the Equity Shares on the Stock Exchanges and enhancement of it’s brand name and creation of a public market for their Equity Shares in India.

Strengths of the company:

- The company is among the fastest-growing agrochemical manufacturers in terms of volume of Technicals manufactured.

- The company is focused strongly on Research and Development (R&D) and product development capabilities.

- The company boosts a portfolio of niche and quality specialized products.

- They maintain a long-term relationship with key customers.

- The company has an advanced manufacturing facilities with focus on environment, health and safety.

- It has string sourcing capabilities and extensive distribution network.

- Experienced promoters and strong management team.

Risks involved:

- The company is overcoming hurdles created by the Covid-19 pandemic.

- The company is unable to meet the quality standard norms prescribed by the central and state governments in the country and governments of other countries where the company exports products.

- The company is showcasing inability to identify and understand evolving industry trends, technological advancements, customer preferences and develop new products may adversely affect business.

- It is subjected to strict technical specifications, quality requirements, regular inspections and audits by its customers including various Multi National Companies in the market.

- The current scenario is such that its business is working capital intensive and there is insufficient cash flows from its operations or inability to borrow to meet our working capital requirements will impact business.

- The Company needs to comply with certain restrictive covenants under its financing agreements.

Sources – RHP, BRLM

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.