The consumer durables market in India represents large untapped areas that global corporations intend to harness as the next best growth opportunity. As of 2019, the market size of Indian appliance and consumer electronics was Rs 76,400 crore (US$ 10.93 billion).

The key demand drivers would be rising disposable incomes and easy access to credit by the potential consumer. Even the Government of India is keen on developing this sector and has taken several supportive policy measures. It permitted 100% Foreign Direct Investment (FDI) under the automatic route in Electronics Systems Design and Manufacturing, hiked the FDI in single-brand retail from 51% to 100%, and is also envisaging to increase the multi-brand retail FDI limit to 51%.

Along with policy support, the government also intends to incentivize and encourage self-reliance in the manufacturing of electronic components and develop a robust base for the same within India. As a step in this direction, starting from 15 October 2020, the government banned the import of air conditioners with refrigerants.

Prime Minister Narendra Modi said in June, “We import more than 30% of our demand for air conditioners. We have to reduce it fast.” Post that, India’s Directorate General of Foreign Trade announced that the import policy of air conditioners with refrigerants is being amended to ‘prohibited’ from ‘free’ i.e India will not be able to import air conditioners with refrigerants, the move comes on the back of Atma Nirbhar Bharat Abhiyan.

Some reports suggested that the government intended to curb duty-free import of air conditioner units from free trade agreement (FTA) countries such as Thailand, Malaysia, and Vietnam.

Before the ban, fully built ACs could be imported from countries like Thailand, Malaysia, and Vietnam without paying any duty. However, for an AC without refrigerant, full duty had to be paid. Therefore, many Chinese companies took advantage of that arrangement and were reportedly setting up factories in countries such as Thailand, Malaysia, and Vietnam to bring products to India directly under FTAs.

Earlier, under the FTAs, finished products like ACs attracted zero duty but the components had to pass through an inverted duty structure. After the government’’s ban on gas-filled units, the same can now be imported as a component, on which one would have to pay duty.

Import ban leke aya Khusiyon ka Tyohar..

Indian air conditioner market was driven by Chinese companies because of its cost-effectiveness, even though durability was a question. India being a population heavy country, the government has decided that we would manufacture for ourselves, and as a stepping stone towards self-reliance and to curb non-essential imports, it has banned air conditioners imports.

For major players, the move won’t have much of an impact because most of the manufacturing is being taken care of in India. But, smaller players who used to import indoor/outdoor units from China under the duty-free regime, might take a hit.

At the same time, market leaders like Voltas, Panasonic, and LG have welcomed the government’s decision and believe that it’s a step in the right direction. This would not only be

a boon for companies who have established a full-fledged manufacturing facility in India like Amber Enterprises but also boost domestic manufacturing capabilities.

This import ban is also likely to encourage global corporations to take up manufacturing in India. For instance, GMCC and Hitachi Highly have made substantial investments to set up compressor-manufacturing facilities in India.

Apart from that, Indian refrigerant manufacturers like SRF, Navin Fluorine, and Gujarat Fluorochemicals would also see an increase in sales as a result of the import ban.

Bear & Bull Play

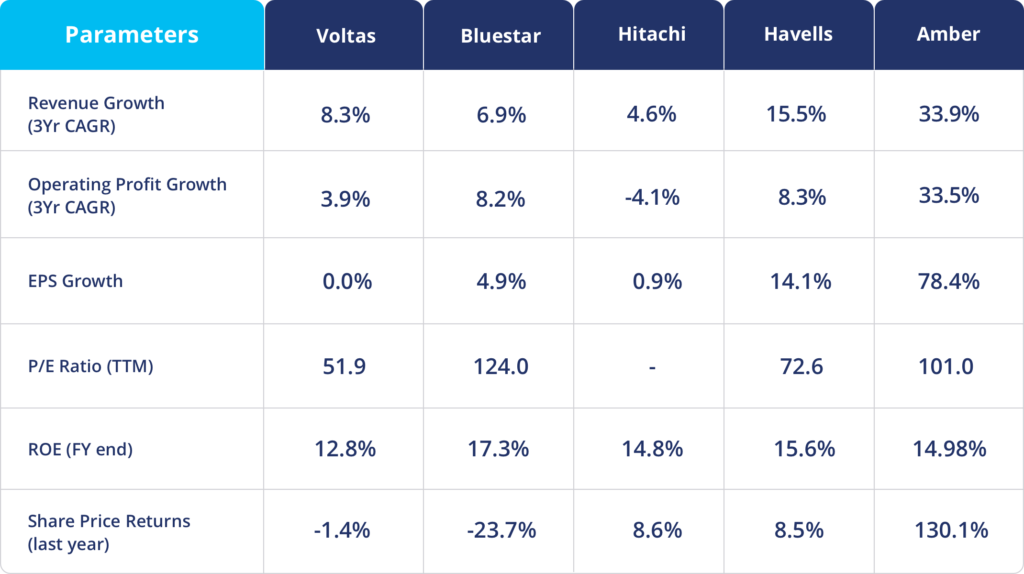

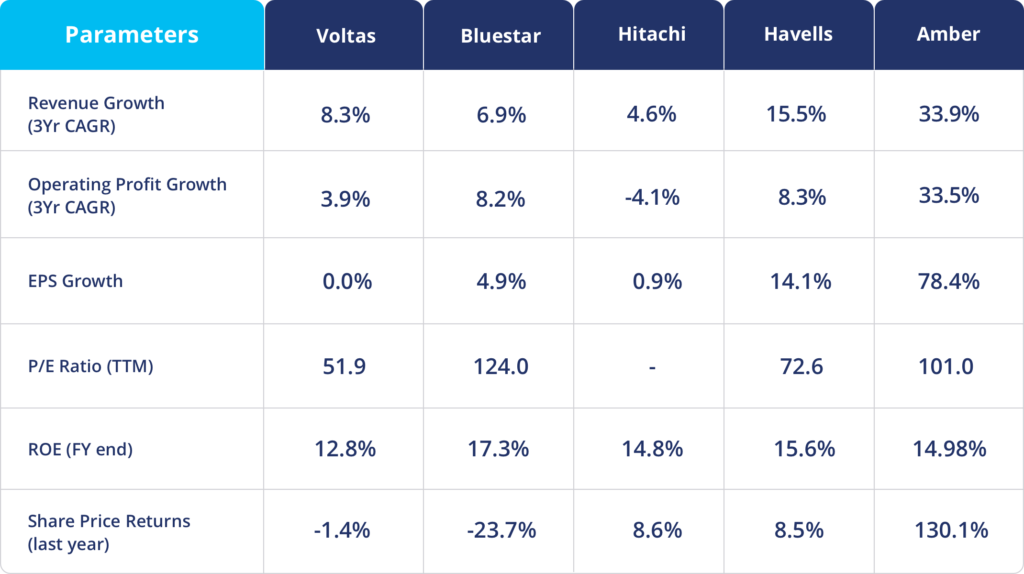

Investors cheered the government’s move to ban the import of split and window air conditioners and heavy buying in stocks such as Voltas, Blue Star, Johnson Controls-Hitachi Air Conditioning, and Havells was seen. Along with these, stocks of Amber Enterprises, which manufactures air conditioners surged.

Right from the day of announcement i.e from Oct 15, stocks of Voltas, Blue Star, Johnson Controls-Hitachi Air Conditioning, and Havells gained 1-6%, whereas Amber Enterprises was up over 9% after the announcement.

The anticipation of higher sales, revenue growth, and in turn anticipated an increase in net profits in upcoming quarters, pushed the shares of these stocks upwards.

Expert Opinion!

Market experts believe that the government’s move was in line with the reducing import dependence in this segment.

The majority of imports in this segment come from China and Thailand. Dolat Capital, in a recent report, said that this will impact the complete AC units, which is around 28-30% of AC import volumes.

It added that this move will increase opportunities for contract makers like Amber Enterprises, which can see higher assembly work.

Brokerage firm IIFL reportedly said that Growth prospects for original design manufacturers like Amber Enterprises will significantly increase. Original design makers to gain if brands decide to step up local manufacturing or sourcing.

Brokerage house Jefferies said that Rs 3,600 crore is the upper-end impact of the ban as per the FY20 data and the value segment implies less than 15% of the overall AC industry size in India. Therefore, the value segment AC players like Voltas, LG, Samsung could see some marginal market share gains.

Fundamental & Technical dose