Indigo Paints IPO Details – Date, Price & Overview5 min read

The New Year 2021 has indeed started on a good note for investors, especially with three IPOs hitting the market within one week. This is the second IPO of the year after the Indian Railways Finance Corporation (IRFC) one.

Owing to the covid-19 pandemic, the year 2020 started out on a reasonably bad note for the IPO markets. But after recovery from June, onwards, IPOs have delivered one record-breaking performance after the other.

With a basket full of good IPOs waiting for us, 2021 could be a year of IPOs.

Contents

Company’s whereabouts

Indigo Paints made its business debut in the year 2000 and in a span of fewer than two decades, the company climbed the ladder quickly. It is now recognised as one of the top 5 paint manufacturers in the country.

The paint manufacturing company is based out of Pune. It initially started out with the manufacture of lower-end cement paints, and gradually expanded its range to cover most segments of water-based paints like exterior emulsions, interior emulsions, distempers, primers, and so on.

Being one of the fastest-growing amongst the top five paint companies in India, it sells its products under the brand ‘Indigo’, through its distribution network across 27 states and seven union territories.

As of March 2018, 2019, and 2020, its distribution network comprised 33, 33, and 36 depots, and 9,210, 10,246, and 11,230 active dealers in India, respectively. In the same period, the total number of tinting machines that it placed across the network of dealers was 1,808, 3,143, and 4,296, respectively

The company boasts about its attrition rate and at a backdrop of an annual attrition rate of about 25% in the Indian paint industry, Indigo Paints stands out with an attrition rate of under 3%.

IPO Listing Details

The total issue size of Indigo Paints IPO is up to Rs. 1,169.12 crores that consist of a fresh issue of Rs.300 crore and the rest is an offer-for-sale of up to 58,40,000 equity shares by promoters and investors. The company has set a price band of Rs1,488-1,490 per share.

The same is set to open for subscription on January 20, Wednesday and will be available till January 22, Friday.

Equity shares are proposed to be listed on the BSE and NSE. Kotak Mahindra Capital Company, Edelweiss Financial Services, and ICICI Securities are the book running lead managers to the offer.

The lot size for this IPO is 10 shares and in multiples thereafter.

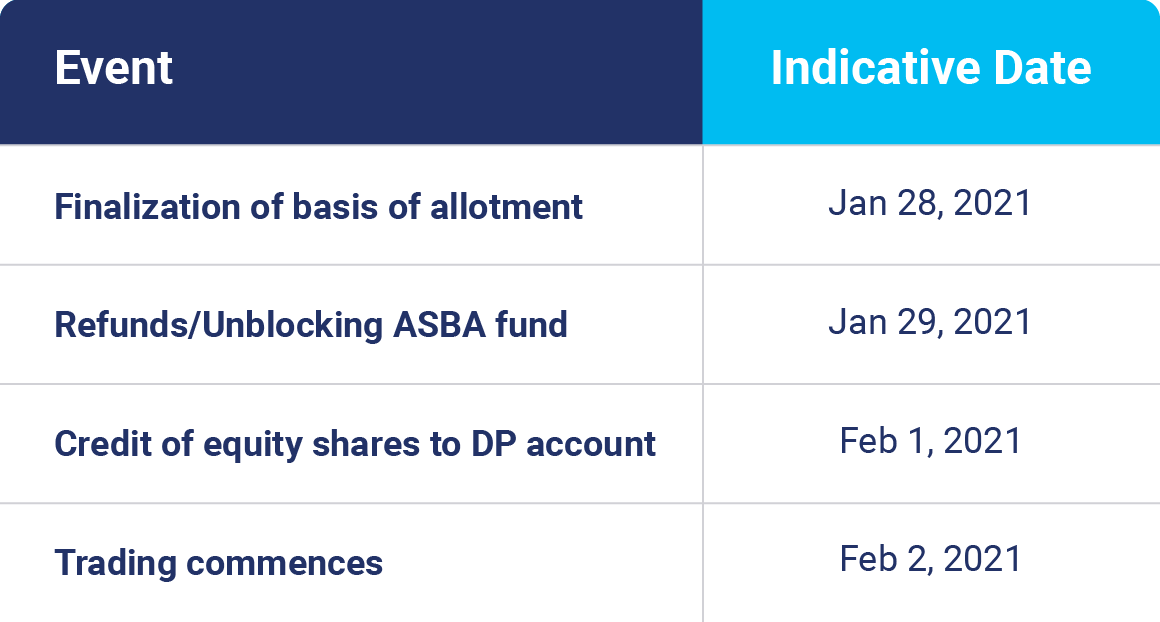

IPO Timeline

Company’s interest in going public

Indigo Paints has proposed to utilise the net proceeds from its fresh issue for expansion of the existing manufacturing facility at Pudukkottai, Tamil Nadu. It wants to set up an additional unit adjacent to the existing facility (Rs 150 crore), purchase tinting machines and gyroshakers (Rs 50 crore); repay certain borrowings (Rs 25 crore); and general corporate purposes.

Company’s strengths

•Indigo Paints has made its name in the industry by offering newer products that no one earlier thought of foraying into and therefore is dominant in its own way.

•The company has managed to leverage its brand equity to install tinting machines across its distribution network.

•The top managerial roles in the company are taken up by senior professionals from the paint industry with considerable experience.

•The long-term debt of Indigo Paints is under control making it a financially strong company.

Risks involved

•The company’s future and profits largely depend on its relationships with dealers and the community of painters. Any impact of these relationships with the associates, or the company’s inability to enter into new relationships, could negatively affect its business and results of operations.

•While the company holds a strong command in the paint manufacturing segment, a couple of wrong steps in effectively competing could have a significantly unpleasant effect.

•A substantial share of company sales comes from the state of Kerala and any disruptive developments in this particular state could badly affect its business.

•Company does not enter into long-term agreements with its dealers and any breakdown in continuing present understandings could adversely affect its business and results of operations.

•Highly competitive business and any failure to effectively compete could have an adverse effect.

•Inability to identify or respond to evolving preferences, expectations, or trends in a timely manner will impact the business.

•Proposed capacity expansion plans relating to manufacturing facilities are subject to the risk of unanticipated delays in implementation and cost overruns.

Promoters and Shareholding

Promoters of the company are Hemant Jalan, Anita Jalan, Parag Jalan, Kamala Prasad Jalan, and Halogen Chemicals Private Limited. The promoters, in aggregate, hold 2,73,56,615 equity shares, representing 60.05 percent of the paid-up equity share capital of the company.

Hemant Jalan is the Managing Director and Chairman of the company. While Anita Jalan and Narayanan Kutty Kottiedath Venugopal are Executive Directors on the board. Praveen Kumar Tripathi, Sunil Goyal, Ravi Nigam, and Nupur Garg are the independent directors of the company.

How to Apply for IPO on Paytm Money

1 Log in to the Paytm Money app and complete your fully digital KYC for the stock, if not done already.

2 Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

3 You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

4 Next, you must add details for bidding such as quantity, amount, and so on. Maximum 3 bids are allowed.

5 After that, you have to enter your UPI id so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

6 Once you accept the mandate, your application will be successfully submitted.

7 Once the allotment happens, you will be notified about your allotment status.

On a closing note

Being on the list of the country’s top manufacturers, Indigo Paints is one of the fastest-growing paint companies in India and has displayed strong income and margin growth in recent years.

Investors can give a mindful thought and can invest in the stocks for the long-term as the company is small, but its growth rate would be higher than larger corporations.