Your trading experience just leveled up!

We’re excited to launch the new and improved Order Pad — redesigned for maximum speed, precision, and flexibility. Whether you’re a long-term investor or an active trader, this upgrade brings powerful tools right to your fingertips.

- What’s New? A Quick Look

- 1. Instant Segment Switch

- 2. MTF (Pay Later): Buy More with Less

- 3. Clear Breakdown of Costs

- 4. Built-in Market Depth

- 5. Smart Alerts for Market Status

- Why This Redesign Matters?

- ✅ For Everyone:

- 💰 For MTF Users:

- 📉 For Active Traders:

- 🛠 Behind the Product

- 🔄 1. Dynamic Product Type Switching

- 📊 2. Real-Time MTF Eligibility & Margin Simulation

- 💰 3. Charges Breakdown Engine

- 📉 4. Market Depth Integration

- 🕒 5. Market Status & AMO Handling

- 🧠 6. Unified Validation & Rejection Messaging

- ⚙️ 7. Performance & Scalability

- 🚀 Final Note from Engineering

- Frequently Asked Questions:

- 🔹 Q1: What is MTF or Pay Later?

- 🔹 Q2: What’s the difference between Delivery, Intraday, and MTF?

- 🔹 Q3: Why do I see different “Required Amounts” for the same stock?

- 🔹 Q4: What does “+ Charges” mean under the required amount?

- 🔹 Q5: What is the purpose of the “Depth” link next to Limit Price?

- 🔹 Q6: What’s the benefit of placing a Stop Loss, Cover Order, or Bracket Order?

- 🔹 Q7: How do I know if my trade was placed or rejected?

- 🔹 Q8: Can I switch between order types mid-way?

- 📢 Final Word

And if you’re using or curious about Pay Later (MTF) — this is the game-changer you’ve been waiting for.

What’s New? A Quick Look

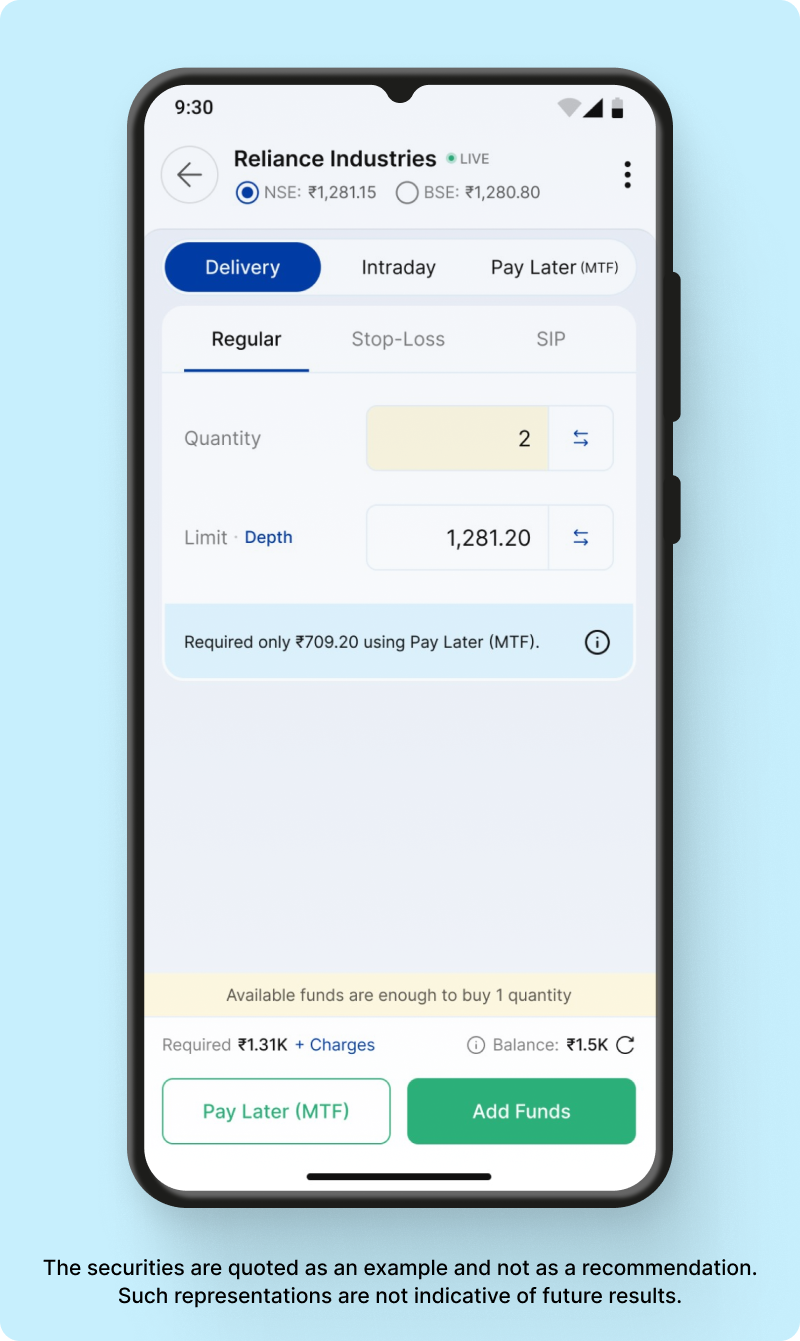

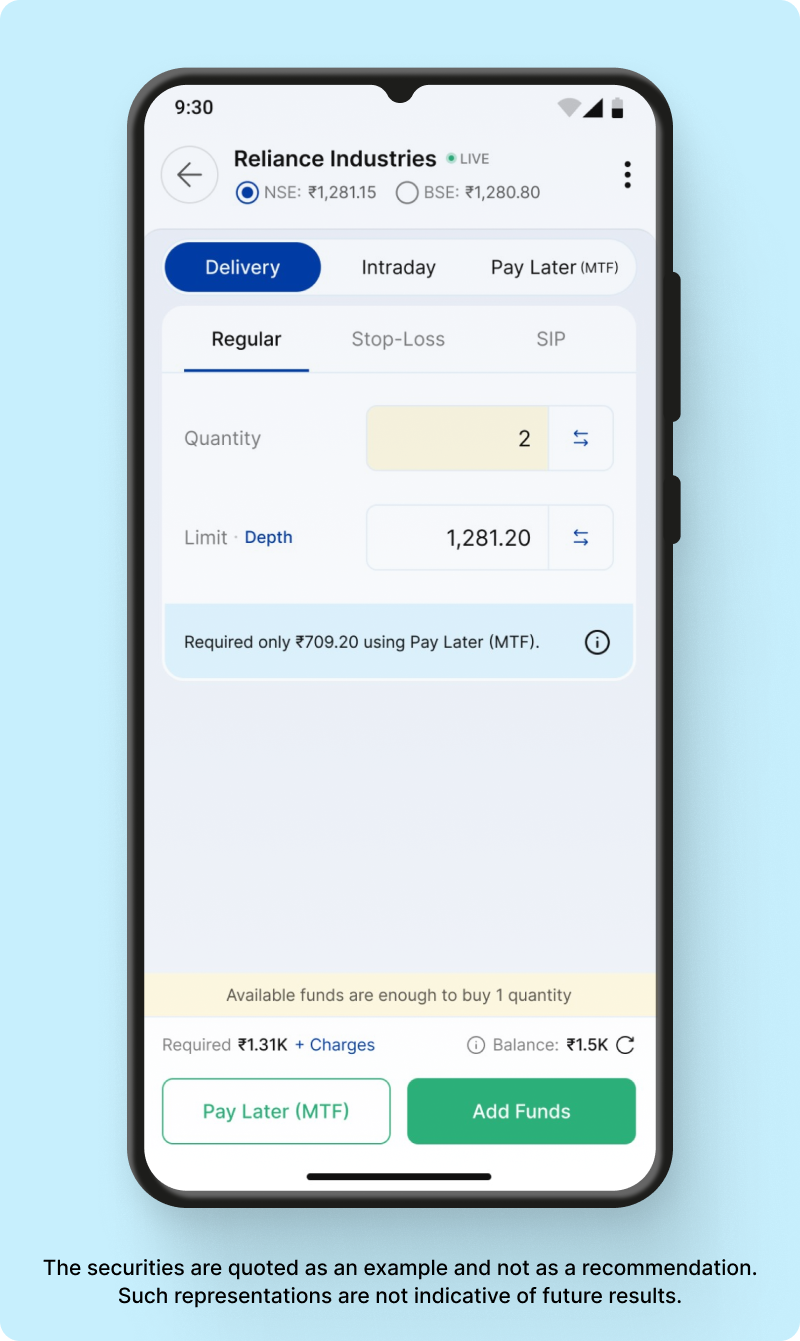

1. Instant Segment Switch

Choose between Delivery, Intraday, or MTF (Pay Later) with a single tap. No clutter. No confusion.

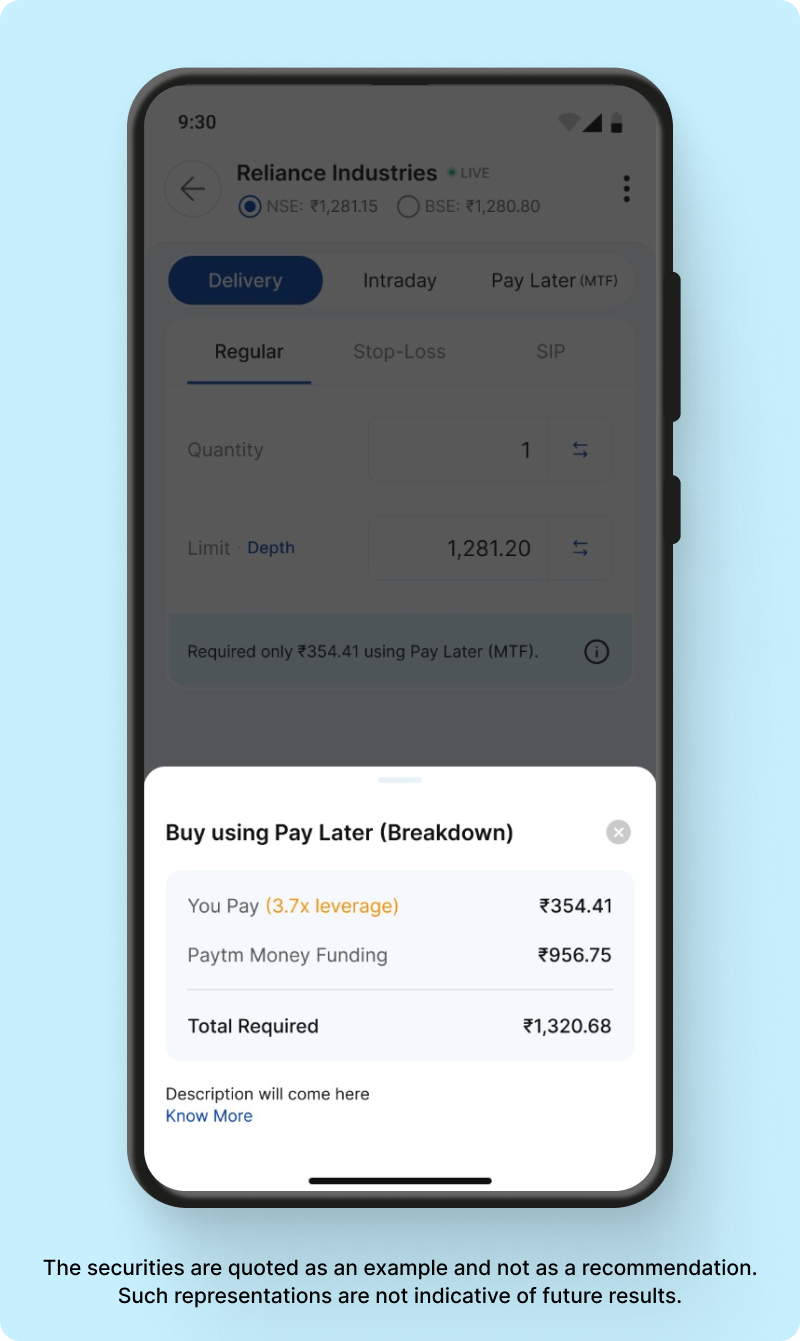

2. MTF (Pay Later): Buy More with Less

No need to pay the full amount right away — place your trade with less money using MTF (Pay Later). MTF lets you:

✅ Buy stocks today by paying only a part of the amount

✅ Carry positions beyond one day

✅ Amplify returns with available margin

💡 Example:

Want to buy Reliance at ₹1,467?

- Delivery: ₹1,467 required

- MTF (Pay Later): Only ₹587 needed!

It’s shown right there on the Order Pad — side-by-side for clarity. No hidden conditions.

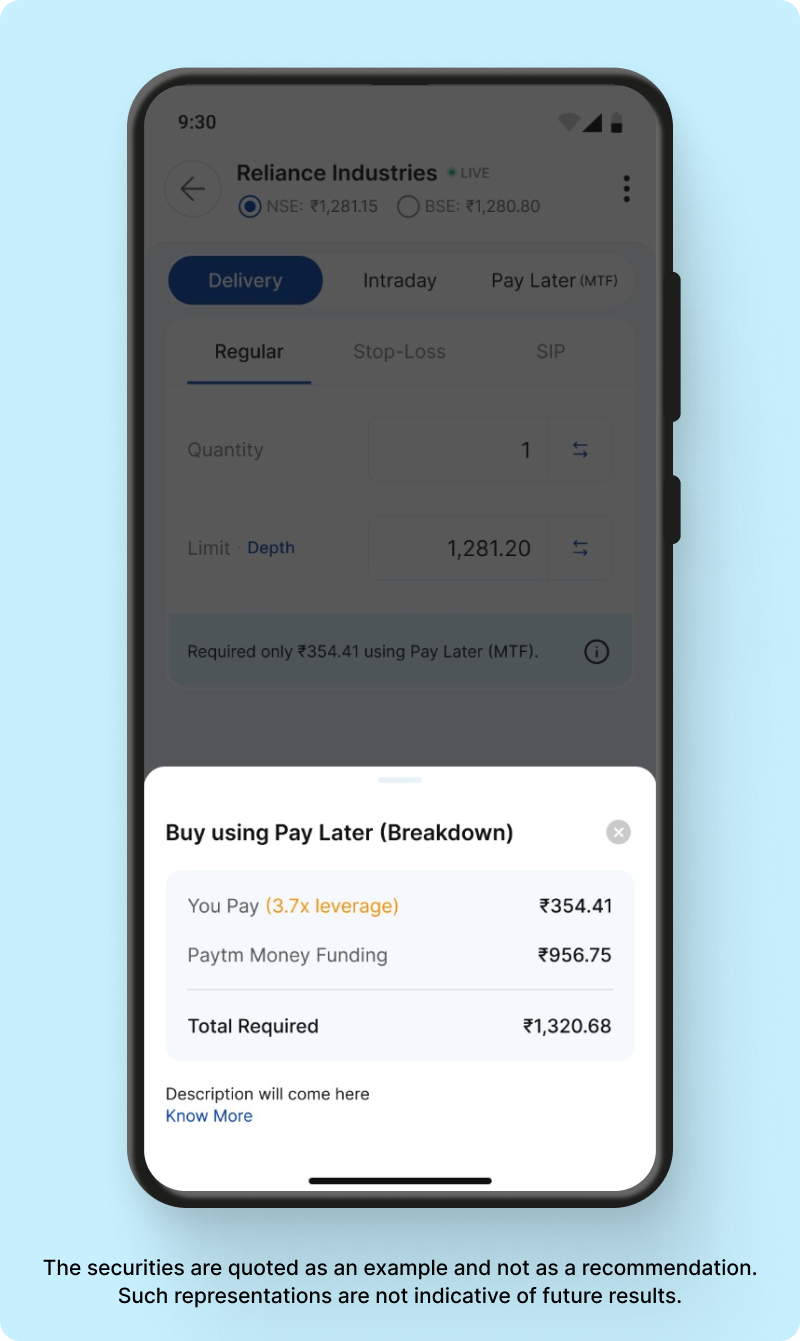

3. Clear Breakdown of Costs

You now see:

- Exact amount required

- Available balance

- “+ Charges” breakdown with just a tap

No last-minute surprises. You’re in control.

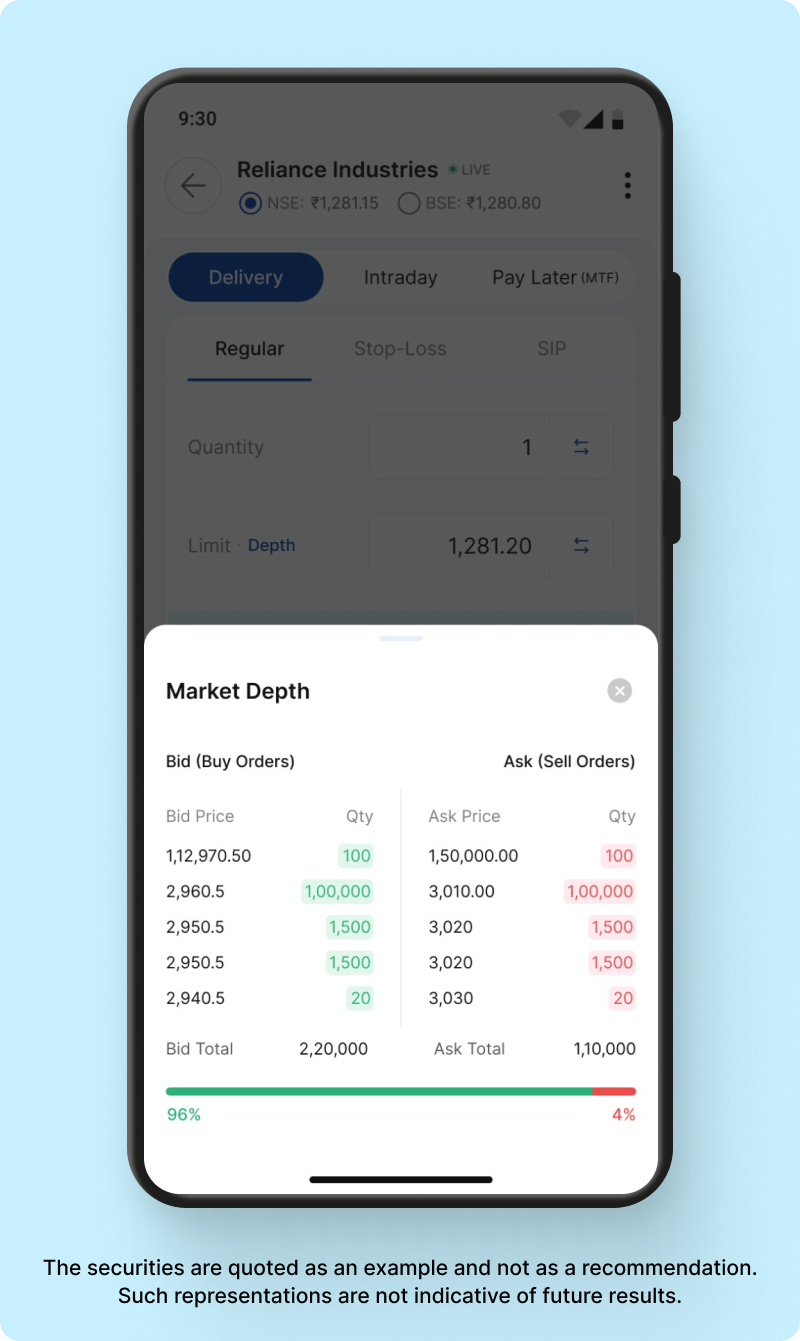

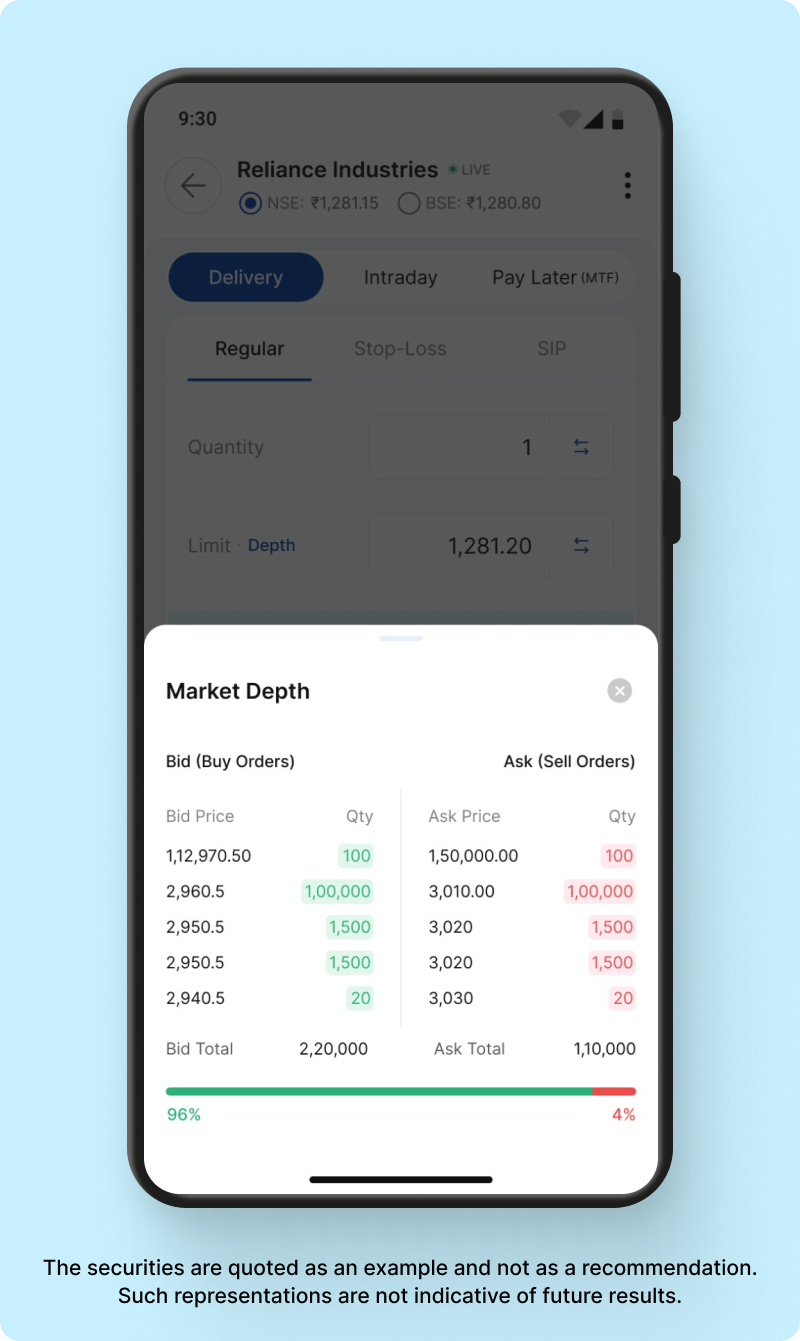

4. Built-in Market Depth

Check the live order book and auto-select the best bid/ask with a single tap. Depth is just one click away.

5. Smart Alerts for Market Status

If markets are closed, the app tells you clearly:

“Market is currently closed. Your order will be sent once the market opens.”

Saves time. Avoids confusion.

Why This Redesign Matters?

✅ For Everyone:

- Faster trade placement

- Less input, more clarity

- Confidence in margin visibility

💰 For MTF Users:

- Always know your required margin

- Compare side-by-side with Delivery and Intraday

- Maximize buying power without overextending capital

📉 For Active Traders:

- Avoid rejections due to insufficient balance

- Pre-filled controls reduce entry mistakes

- Custom price setting gives full flexibility

🛠 Behind the Product

While the redesigned Order Pad focuses on speed, clarity, and user-first design — a significant amount of backend engineering and infrastructure readiness made this possible. Here’s a behind-the-scenes look at the IT efforts that powered the upgrade:

🔄 1. Dynamic Product Type Switching

- Built a real-time API orchestration layer to enable seamless toggling between Intraday, Delivery, and MTF modes.

- Ensured instant recalculation of margins, charges, and validations without requiring additional user input.

📊 2. Real-Time MTF Eligibility & Margin Simulation

- Integrated deeply with our margin engine to fetch MTF eligibility and available limits dynamically.

- Supported side-by-side margin display logic with fallback for edge cases (e.g., illiquid or MTF-ineligible stocks).

💰 3. Charges Breakdown Engine

- Built a modular charges service to fetch live data for brokerage, exchange fees, and statutory charges.

- Implemented smart caching and fallback to ensure zero latency even during peak hours.

📉 4. Market Depth Integration

- Created an exchange-synced market depth module that auto-refreshes order book data in real time.

- Enabled auto-selection logic to choose optimal bid/ask rates — reducing execution lag.

🕒 5. Market Status & AMO Handling

- Developed a centralized market schedule validation service to handle closed market messages, AMO slots, and expiry day rules.

- Prevented invalid AMO placement for expired contracts — particularly on expiry days post 3:30 PM.

🧠 6. Unified Validation & Rejection Messaging

- Engineered a single-source validation engine to map backend error codes to user-friendly messages.

- Ensured that rejection reasons like “Insufficient balance” or “Price out of range” are shown clearly and consistently across platforms.

⚙️ 7. Performance & Scalability

- Refactored Order Pad services using microservice architecture for better load distribution.

- Benchmarked under load to ensure <200ms latency even with 10x user traffic.

🚀 Final Note from Engineering

This Order Pad revamp reflects the close collaboration between Product, Engineering, Design, QA, and Infra teams. It’s not just a UI refresh — it’s a foundational upgrade engineered to scale, support MTF growth, and minimize friction in order execution.

The backend is now robust, modular, and analytics-ready — laying the groundwork for upcoming features like Bracket Orders, Smart Basket Orders, and Predictive Margin Warnings.

Frequently Asked Questions:

🔹 Q1: What is MTF or Pay Later?

MTF (Margin Trading Facility) lets you buy stocks with part capital and pay the rest later. Think of it as trading on leverage — responsibly.

🔹 Q2: What’s the difference between Delivery, Intraday, and MTF?

Delivery: You buy shares and hold them in your demat account.

Intraday: You buy and sell on the same day. Lower margin required, but you must square off before 3:15 PM, else the system will square off between 3:15 to 3:30 pm, as per configured timings.

MTF (Pay Later): You buy with part capital and carry the position overnight or longer using margin funding.

🔹 Q3: Why do I see different “Required Amounts” for the same stock?

The amount depends on the product selected:

Intraday = Lower margin required (as you sell by day end)

Delivery = Full order value needed

MTF = You only pay a portion today; the rest is funded

This side-by-side visibility helps you compare before placing the order.

🔹 Q4: What does “+ Charges” mean under the required amount?

It refers to brokerage + exchange + statutory charges like STT, SEBI fees, etc.

Tap on “Charges” to see a transparent breakup before you place the order.

🔹 Q5: What is the purpose of the “Depth” link next to Limit Price?

Market Depth provides live information of the top 5 buy and sell prices, along with the number of orders at each level and makes it simpler for the user to:

- Choose the best available price

- Adjust your order more intelligently

- Improve chances of execution

Tapping “Depth” shows the order book and lets you auto-select prices with a single tap.

🔹 Q6: What’s the benefit of placing a Stop Loss, Cover Order, or Bracket Order?

Each order type gives you better control:

Stop Loss: Auto-sells if the price moves against you

Cover Order: Combines a market order with a compulsory stop loss — useful for intraday traders

Bracket Order: Coming soon..

🔹 Q7: How do I know if my trade was placed or rejected?

Once you swipe to buy/sell:

- You’ll see confirmation or rejection instantly

- If rejected, the reason is shown clearly

- For example: “Insufficient balance” or “Price not in allowed range”

🔹 Q8: Can I switch between order types mid-way?

Yes. You can toggle between:

- Regular / Stop Loss / Cover / Bracket

- Delivery / Intraday / MTF

Your values and symbols remain intact — the order pad adjusts margins and requirements accordingly.

📢 Final Word

This new Order Pad isn’t just prettier — it’s built to empower smart trading:

- More visibility

- Faster execution

- MTF-friendly by design