As we are through the financial year 2020-21, here are a few important pointers that one needs to know about taxation. Whether you are an investor or a trader, this blog will help you understand the way taxation works for the transactions you’ve made in both Equity and F&O segments.

- Taxation for Investors

- How to download Tax P&L Statement?

- Taxation for Traders

- How is Turnover calculated?

- Understanding the Tax P&L report you have received

- When Is An Audit Needed In F&O?

- An Explainer on Presumptive Taxation & Audit under section 44AD (applicable to a majority of businesses including F&O trading)

Taxation for Investors

If you Buy and Sell in Equity – Delivery that falls under-investing. While investing, you need to pay taxes only when you make profits in that financial year. There are two types of capital gains for investors.

- Short Term Capital Gain (STCG): The Equity stocks that are bought and sold (Delivery transactions) within 365 days are considered as Short Term investments. STCG tax will be 15% on the total profits that you make.

Example: Assume that you have bought 30 quantities of TATA CONSULTANCY SERVICES at Rs 2800 per share on 20 March 2021, and sell them at 3100 on 18 December 2021.

Buy Price: 2800

Sell Price: 3100

Quantity: 30

Duration : 91 days (Short Term as it’s lesser than 365 days)

Profit made = (3100 * 30) – (2800 * 30) = 9000.

You made a profit of Rs 9000 in the above-given example. You have to pay 15% Short Term Capital Gain Tax on the Rs 9000 which will be Rs 1350.

- Long Term Capital Gain (LTCG): If you buy Equity stocks for delivery and hold it for more than a year, then this is considered a Long term investment. You have to show the LTCG if you sell the stocks that were bought a year back.

The LTCG tax comes into the picture if you have made a profit of more than 100000 from all the Long Term transactions. And the tax will be 10% of the overall profits you have made (Above Rs 1,00,000).

Example: Let’s say you have bought 200 shares of RELIANCE INDUSTRIES at 1200 on 20 November 2019, and sold it at the rate of 1850 on 01 February 2021.

Buy Price: 1200

Sell Price: 1850

Quantity: 200

Duration : 439 days (Long Term as it’s greater than 365 days)

Profit = (1850 * 200) – (1200 * 200) = 130000.

You made a profit of Rs 130000 in the above given example. As you have made a profit of Rs 1,30,000 and is greater than 1,00,000, you have to pay 10% tax from the Rs 30,000 which will be RS 3000.

At Paytm money, we have made it really easy to file your tax returns.

How to download Tax P&L Statement?

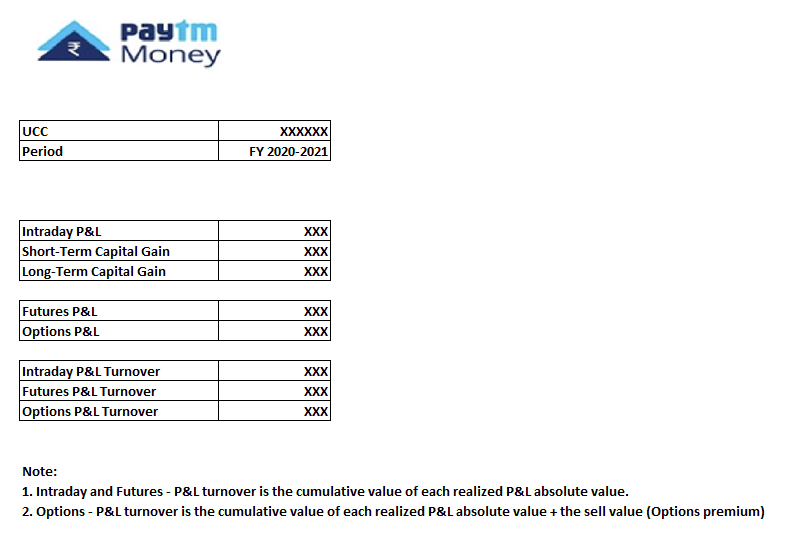

Your Tax P&L report is sent to you via email at the end of the year. Also, you can simply download it from the app or website when you need it from the statements section in the app.

Taxation for Traders

Profits and losses earned from trading (Equity Intraday, F&O Overnight / Intraday) are considered as business income. These are two types of business incomes in this context.

- Speculative business income: Any profit or loss derived from Equity intraday trading is considered into this, as it comes under speculation translation as per Income tax provision.

- Non-speculative business income: Any profit or loss derived from F&O overnight or intraday trading is considered into this.

Speculative and non-speculative business incomes together are considered in other income (outside salary, bank interest, rent received, etc). This is taxed as per the income slab you fall in.

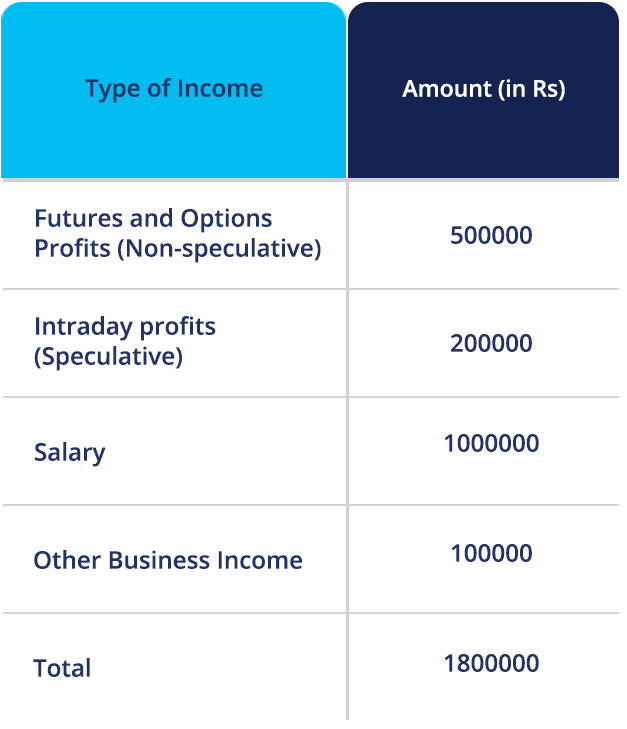

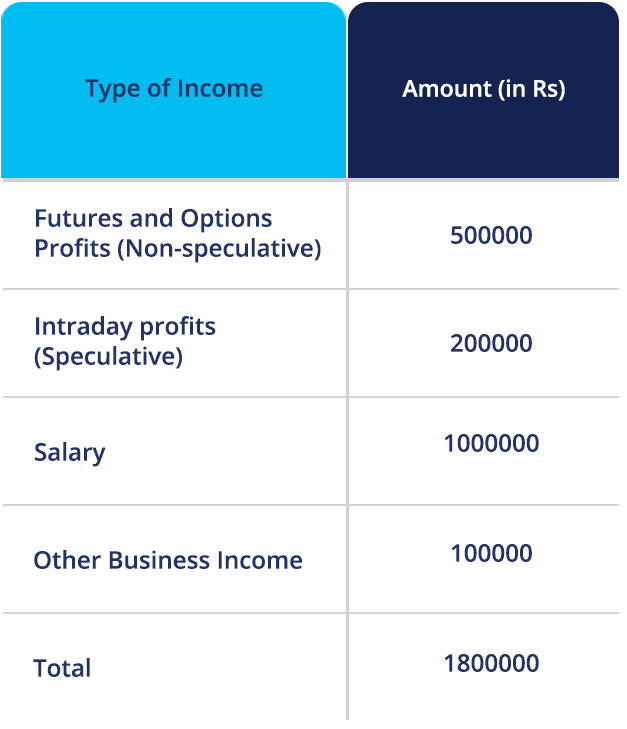

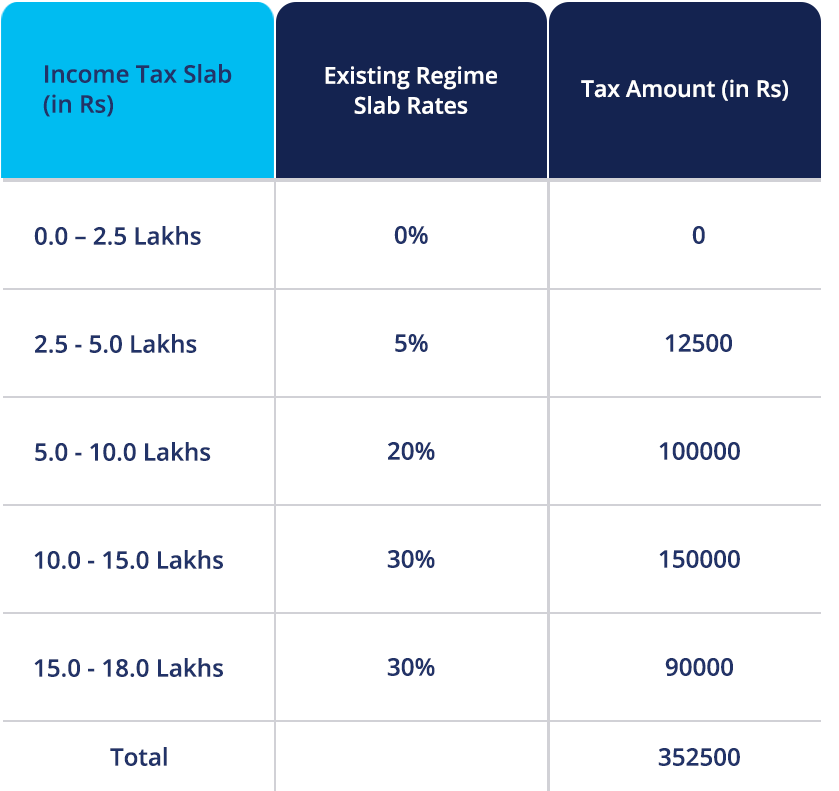

The below example will give you a perspective on Business income taxation.

Let’s say you make profits under the Speculative and Non-speculative business income, and calculate the taxable amount.

Total income will sum up to Rs 1800000.

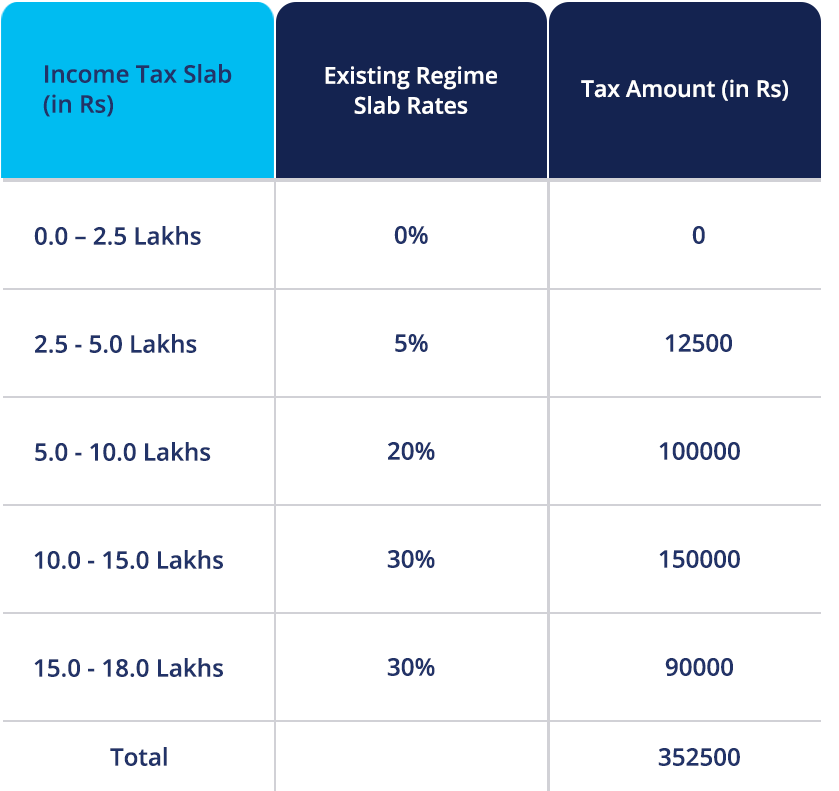

You have the option to select both Existing Regime Slab Rates and the New Regime Slab Rates for FY 20-21. You can check with an auditor and select it based on your other deductions.

Let’s keep the existing regime slab rates in mind and figure out the taxable amount.

Total payable tax will be Rs 352500 considering the above example as per the Existing Regime Slab Rates.

Also, a trader should get his/her tax audited based on the total Turnover that they make throughout the financial year.

How is Turnover calculated?

- Equity Cash – Intraday (Speculative business income): The absolute sum of profits and losses.

If I buy 10 shares of Nestle at Rs 6000 and sell them on the same day at Rs 5500 then the loss will be Rs -5000.

If I buy 20 shares of Infosys at Rs 1200 and sell them on the same day at 1300 then the profit will be 2000.

Intraday turnover will be = (5000 + 2000) = 7000.

- Futures (Non-speculative business income): The absolute sum of profits and losses. Works the same way as Intraday.

If I buy 75 units (1 lot) of Nifty Futures at Rs 14500 and sell them on the same day at Rs 14450 then the loss will be Rs -3750.

If I buy 25 units (1 lot) of Bank Nifty Futures at Rs 33300 and sell them on the same day at 33350 then the profit will be 1250.

Futures turnover will be = (3750 + 1250) = 5000.

- Options (Non-speculative business income): The absolute sum of profits and losses + Premium on Sale of Options.

If I buy 25 units (1 lot) of Bank Nifty Options at Rs 500 and sell them on the same day at Rs 450 then the loss will be Rs -1250.

Sale of Options will be (450*25) = 11250

Turnover will be (1250 + 11250) = 12500

If I buy 75 units (1 lot) of Nifty Options at Rs 300 and sell them on the same day at 350 then the profit will be 3750.

Sale of Options will be (350*75) = 26250

Turnover will be (3750 + 26250) = 40000

Total turnover will be = (12500+ 40000) = 52500.

We will post another blog that will help you understand when should an Audit be done, and how can you carry forward the Losses / Gains across years.

Understanding the Tax P&L report you have received

- ‘Summary’ tab in the Tax P&L statement shows you the total profits/losses that you’ve made along with the turnover for a given financial year across all the segments.

- If you open the ‘Equity segment’ tab in the Tax P&L statement, you can see the transaction-wise P&L made in the Equity segment with the dates.

- If you have traded in the F&O segment, you can additionally see the F&O detailed P&L under the ‘F&O segment’ tab.

- The ‘Open F&O contracts’ tab gives you the open positions as of 31st March 2021 if you had any.

We suggest that you visit an auditor before filing your tax returns.

Now, here’s a very important question often asked on F&O.

When Is An Audit Needed In F&O?

Let’s segregate the conditions for when an audit is needed into turnover-based and non-turnover based.

- Turnover based conditions

The thumb rule is that an audit is needed for businesses whose turnover exceeds 1 crore. There are some exceptions to this rule which are as follows. However, there are two exceptions here.

– Declaring income under presumptive taxation under 44AD (8%/6%) the limit is 2 crores

– When cash receipts and payments < 5% of total receipts and payments respectively, the limit is Rs. 10 Crores.

- Non-Turnover based conditions

– A business person who has opted for presumptive taxation (8%/6%) in any of the last 5 years but does not opt for the same in the current year.

– “Specified professions” with profits < 50% of turnover.

– Other “specified businesses” not declaring minimum profit under presumptive taxation (F&O trading does not fit into this category)

An Explainer on Presumptive Taxation & Audit under section 44AD (applicable to a majority of businesses including F&O trading)

44AD allows small businesses to declare income at a predefined percentage (8%/6% for non cash/cash turnover respectively) of turnover, as long as turnover is < Rs. 2 Crores.

Traders, here are two points to remember if one has opted for presumptive taxation in a Year 1 (Y1), and wish to declare losses or income at less than the presumptive rate in any of the next five years (Y2 to Y6):

- One cannot use presumptive taxation for five years after that particular year that one declares losses or income.

- If your total income > the basic exemption limit, audit will be applicable.

Is audit applicable if you declare losses or profit at less than the presumptive rate even if turnover is within the prescribed limit of 1 Crore or 10 Crores?

Under the new clause Finance Act 2016, audit is needed if a taxpayer has declared income at the presumptive rate in any of the previous five years but wants to declare losses or income at less than the presumptive rate in the current year, provided his total income in the current year exceeds the basic exemption limit.