Mixed Bag Reaction to Q4 FY21 IT Cos Earnings4 min read

Indian information technology companies are among the most favored tech partners globally. These companies are the leading sourcing destination across the world. As per ibef.org, the sector accounts for approximately 55% market share of the US$ 200-250 billion global services sourcing business in 2019-20.

India’s IT behemoths – TCS, Infosys, and Wipro announced results for the Jan-Mar quarter and the market showed mixed reactions to the same.

Even though TCS, Infosys & Wipro reported growth in topline & bottom line in the fourth quarter. However, other factors such as a TCS reported a fall in constant currency sales, lower deal wins in the case of Infosys, and flat on quarter earnings reported by Wipro kept the market sentiment in check.

TCS and Infosys announced a dividend of Rs. 15 each, whereas Infosys also announced a share buyback plan worth Rs 9,200 crore, at Rs 1,750, a premium of 25% to the Apr 13 closing price. Also, attrition in Infosys & Wipro was higher than that in the previous quarter.

Let’s look at the detailed earnings of these IT companies

Tata Consultancy Services

Tata Consultancy Services reported a nearly 15% increase in consolidated Q4 profits at Rs 9,246 crore, compared to Rs 8,049 crore a year earlier, as India’s top IT services firm reportedly benefited from an uptick in cloud services demand during the Covid-19 crisis.

The company’s revenue for the three-month period was up around 9.4% on year to Rs 43,705 crore and the Jan-Mar operating margin stood at 26.8%. TCS board recommended a final dividend of Rs 15 per share.

TCS stated that revenue from its banking, financial services, and insurance business rose 15.5%, the most among its units. The business was also the biggest contributor to the company’s consolidated revenue, which jumped by 9.4%.

TCS said it added 19,388 employees in Q4, the highest ever in a quarter

However, even after the robust earnings, the shares of the company fell over 5% intraday on Apr 12 as the company declared earnings. The NSE IT index closed down over 3% today when the benchmark closed over 1% higher.

As per the media reports, the reason could be an on-year fall in sales on a constant currency basis, which may have resulted in some concern. TCS saw sales fall by 0.8% in constant currency terms in 2020-21.

Infosys

Information Technology giant Infosys reported a 2.6% on quarter fall in its consolidated net profit to Rs 5,078 crore for the quarter ended March.

The company reported a 2.8% QoQ growth in consolidated revenues for the quarter to Rs 26,311 crore. In constant currency terms, the IT behemoth’s revenues rose 2% on a sequential basis in the March quarter. The revenue performance in the quarter was aided by 34.4% year-on-year constant currency growth in digital services.

If we look at the company’s year-on-year performance, the top line grew nearly 10%, whereas the bottom line was up 17% in the March quarter.

The Bengaluru-based company guided for 12-14% sales growth in constant currency terms in 2021-22 and an operating margin band of 22-24% reflecting the excellent demand conditions.

Infosys also approved a share buyback plan worth Rs 9,200 crore. The company said it will buy back shares from shareholders at Rs 1,750, a premium of 25% to the Apr 13 closing price. The company also announced a final dividend of Rs 15 per share.

However, the shares of Infosys were down 6% at Rs 1,320 on the BSE in intra-day trade on Apr 15, after the company announced the fourth-quarter results. As per media reports, market participants booked profits on the back of robust earnings.

The company said that the share buyback would be through the open market and not the tender route which may have disappointed investors.

Voluntary attrition of the IT giant stood at 15.2% during the quarter as opposed to 10% in the previous quarter.

The company said that deal wins in this quarter were worth $2.1 bln, significantly lower than the $10 billion reported in the last quarter.

Wipro

Wipro reported its earnings on Apr 15 with a near 1% on quarter fall in its consolidated net profit to Rs 2,974.3 crore for the Jan-Mar period.

The IT bellwether reported a near 4% quarter-on-quarter growth in consolidated revenue to Rs 16,245 crore for the quarter. In constant currency terms, the company’s revenue grew 3%. Wipro’s operating margin for the quarter stood at 21%.

The company reported revenues of Rs 15,891 crore from its information technology vertical, which increased 3.7% from the previous quarter.

On a constant currency basis, the company’s IT segment’s revenues grew 3% sequentially in the quarter ended March. And its IT services operating margin for the quarter stood at 21%.

The BFSI segment contributed 30.5% to the revenue, while consumer and technology contributed 17% and 13% respectively.

The company said that it expects revenues from IT services to grow around 2% – 4% on a sequential basis in the June quarter. It said that the revenue from the IT services business will be in the range of $2.195 billion to $2.238 billion in the Apr-June quarter.

Despite flat earnings in the fourth quarter, shares of Wipro surged 8.9% to end at Rs. 469.20 in the spot market today as the technology major reported better than estimated earnings for Jan-Mar. The stock hit its lifetime high of Rs. 473.65 during the day.

The company’s attrition rate during the quarter stood at 12.1% which was higher as compared to the 11% reported in the December quarter.

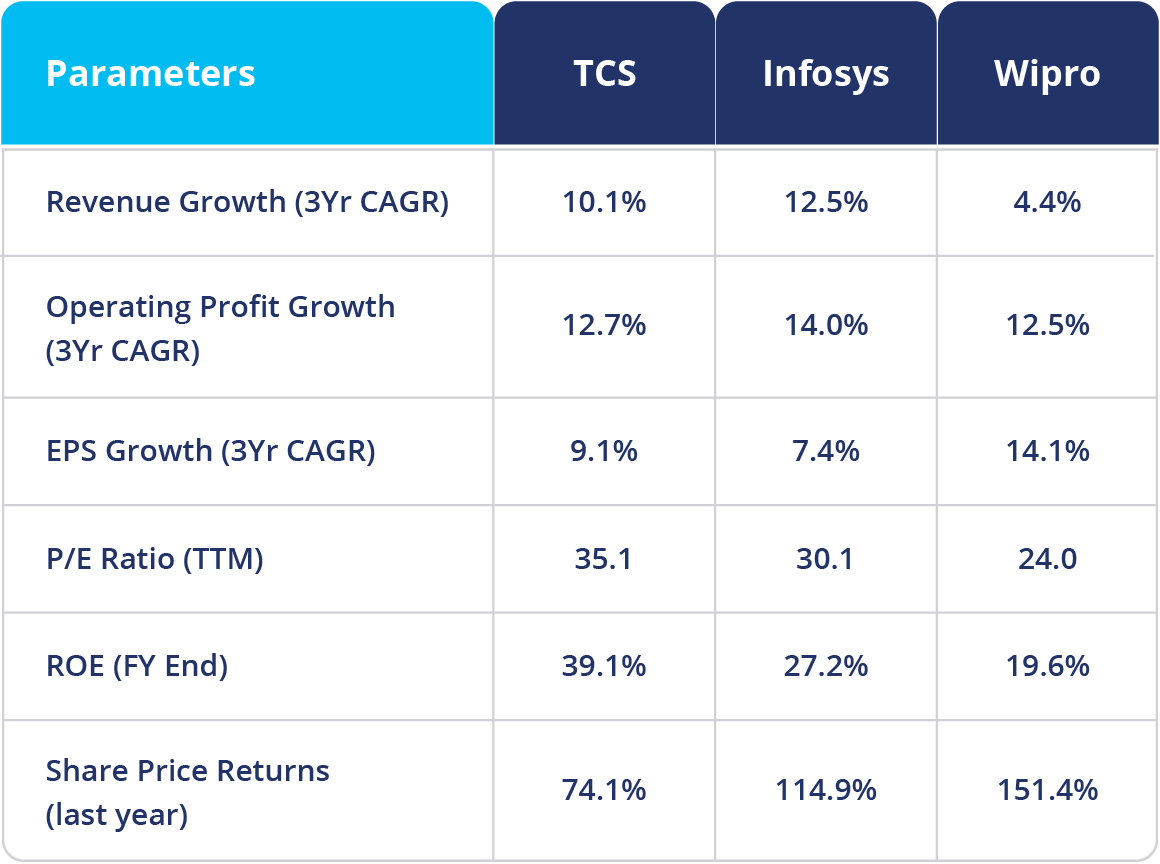

Fundamental & Technical Dose

Source – Annual Report & Market Data

Disclaimer – This content is purely for information and investor awareness purpose only and in no way an advice or recommendation.