Kalyan Jewellers India IPO Details: Date, Price & Overview5 min read

The jewellery making company is all set to hit the stock market on 16th March. The public issue is backed by Warburg Pincus, comprising a fresh issue of Rs 800 crore and an offer for sale (OFS) amounting to Rs 375 crore.

Kalyan Jewellers India’s Rs 1,175 crore initial public offering (IPO) will open for subscription on March 16.

The company has fixed the issue price at Rs 86-87 per share and plans to raise Rs 1,175 crore at the higher end of the price band.

The initial public offering (IPO) will open on 16th March, Tuesday, and end on 18th March, Thursday.

The company had filed preliminary papers for IPO in August last year and got the Securities and Exchange Board of India’s nod in October.

Prospective investors can bid for a minimum of 172 shares and in multiples of 172 shares thereafter. The offer will include a reserved share quota worth up to Rs 2 crore for eligible employees. 35% of the issue will be reserved for retail investors.

Kalyan Jewellers IPO listing will be done on both BSE and NSE.

IPO Details

The offer size is pegged at Rs 1,175 crore, and it comprises fresh issue aggregating up to Rs 800 crore and an offer for the same of up to Rs 375 crore.

Kalyan Jewellers IPO price band has been fixed at Rs 86-87. It comprises a fresh issue of Rs 800 crore and an offer for sale (OFS) worth Rs 375 crore.

The market lot of the Kalyan Jewellers IPO is 172 Kalyana Jewellers shares. One can bid for a minimum of one lot while one can bid for the maximum 13 lots.

Half of the issue is reserved for qualified institutional buyers, 35% for retail investors and 15% for non-institutional bidders.

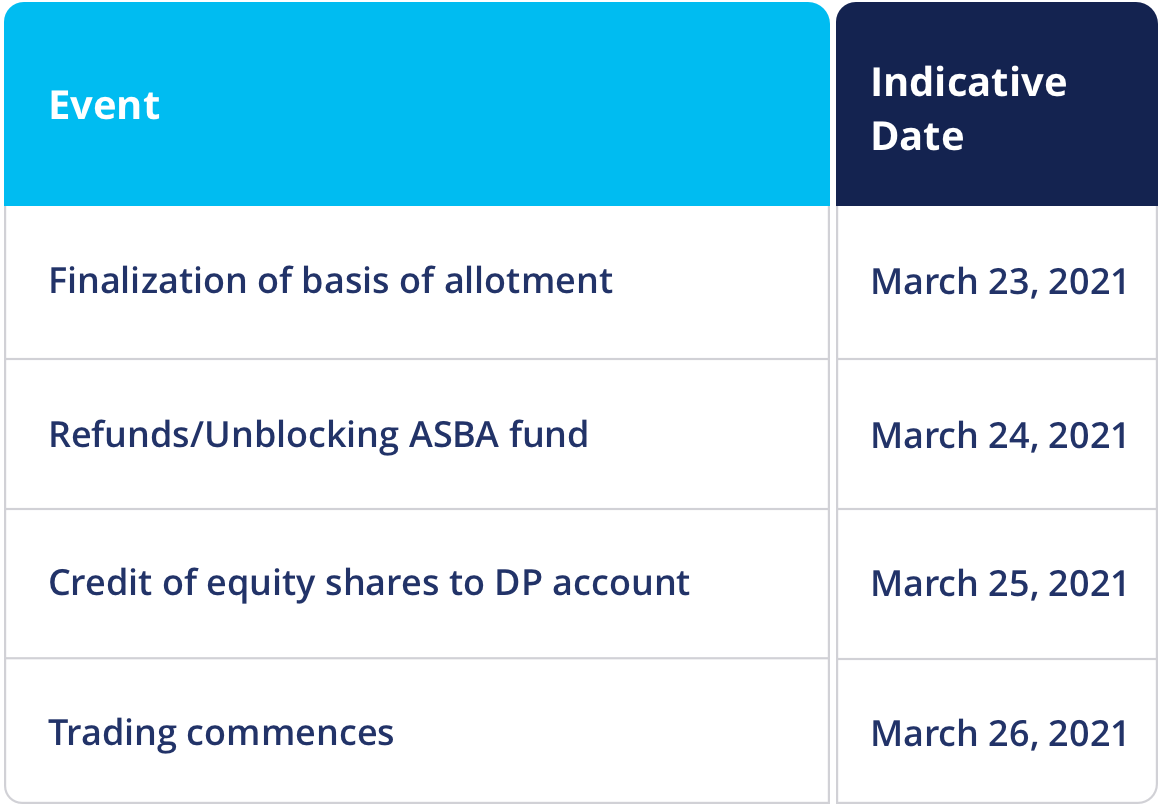

IPO Timeline

About The Company

The Kalyan Jewellers was first started by Kalyanaraman in Kerala in the early ’90s. Bollywood actors Amitabh Bachchan and Katrina Kaif are the known faces who endorse the jewellery makers and are among their brand ambassadors.

It is one of India’s largest Jewellery companies. The key business activities of the company is to design, manufacture, and sell a variety of gold, studded, and other jewellery products.

Initially, the company started with a single showroom in Kerala, and over the years, it has expanded its presence with 107 showrooms located across 21 states and union territories in India. It not only serves the domestic market but also serves overseas customers with 30 showrooms located in the Middle East.

The company generates a significant portion of revenues from gold jewellery, accounted for 74.77% in fiscal 2020 followed by studded (diamond and precious stone) and other jewellery segments.

In the financial year 2020, the company posted a net profit of Rs 142 crore.

Company’s Financials

Kalyan Jewellers reported a profit of Rs 142.27 crore for the year ended March 2020 against a loss of Rs 4.86 crore in the previous financial year; and a profit of Rs 141 crore in FY18.

Revenue in FY20 grew by 3.4 percent (year-on-year) to Rs 10,100.9 crore. In FY19, the revenue fell by 7.4 percent (year-on-year) to Rs 9,770.76 crore.

In the nine months period ended December 2020, the company posted a loss of Rs 79.95 crore against profit of Rs 94.3 crore in the corresponding period. In same period, revenue declined sharply by 30.7 percent to Rs 5,516.70 crore due to the COVID-19 impact.

Objective Of The Offer

One of the main objectives of the company to go public is to fund working capital requirements of their

company. It will also be used towards general corporate purposes.

Additionally, Kalyan Jewellers expects to achieve the benefits of listing of their Equity Shares on the Stock Exchanges and enhancement of their Company’s brand name and creation of a public market for their Equity Shares in India.

Strengths Of The Company

1. Along with being an established brand and n itself, It is one of India’s largest jewellery companies (with a pan-India presence) on the basis of revenue for the year ended March 2020.

2. The company’s hyperlocal strategy enabled it to cater to a wide range of geographies and customer segments.

3. Its grassroots ‘My Kalyan’ customer outreach network is a key element of its hyperlocal strategy enabling it to be a neighbourhood jeweller and is focused on marketing and customer engagement across urban, semi-urban and rural areas in India.

4. It has visionary promoters with strong leadership and a demonstrated track record supported by a highly experienced and accomplished senior management team and board of directors.

5. It has a wide range of product offerings targeted at diverse set of customers.

Risks Involved

1. The continuing impact of the outbreak of the COVID-19.

2.The strength of their brands is crucial to their success and they may not succeed in

continuing to maintain and develop their brands.

3.They may be unable to respond to changes in consumer demands and market trends in a

timely manner.

4. Inability to maintain or establish arrangements with contract manufacturers and suppliers Subject to quality control and disruptions from these parties operations.

5. Their ability to attract customers is dependent on the success and visibility of their showrooms.

6. Their ownership structure in the Gulf Cooperation Council states where they operate, while consistent with the approach taken by many other companies operating in the region, is subject to risks associated with foreign ownership restrictions and their shareholder arrangements with local shareholders.

Apply for IPOs of your favorite companies on Paytm Money App

1. Log in to the Paytm Money app and complete your fully digital KYC

2. Once the KYC is done, click on the IPOs on the home screen

3. On the IPO home screen, you can apply for the open IPOs

4. To apply, enter the bidding details like quantity, price, and so on

5. Enter UPI id & accept the mandate of the same on UPI app to successfully submit IPO

application

6. Once the allotment happens, you would be notified about your allotment status.

Conclusion

Post listing, Kalyan Jewellers will join the clan of some of the biggest jewellery names in India such as Tata Group’s Titan, Tribhovandas Bhimji Zaveri and PC Jeweller.