Krishna Institute of Medical Sciences IPO Details – Date, Price & Overview3 min read

Krishna Institute of Medical Sciences (KIMS) is one of the largest corporate healthcare groups in Andhra Pradesh and Telangana in terms of the number of patients treated and treatments offered.

It provides multidisciplinary integrated healthcare services, with a focus on primary secondary and tertiary care in Tier 2-3 cities and primary, secondary, tertiary and quaternary healthcare in Tier 1 cities.

The company operates 9 multi-speciality hospitals under the ‘KIMS Hospitals’ brand, with an aggregate bed capacity of 3,064, including over 2,500 operational beds as of March 31, 2021, which is 2.2 times more beds than the second-largest provider in Andhra Pradesh and Telangana.

It offers a comprehensive range of healthcare services across 25 specialties and super specialties, including cardiac sciences, oncology, neurosciences, gastric sciences, orthopaedics, organ transplantation, renal sciences and mother and child care.

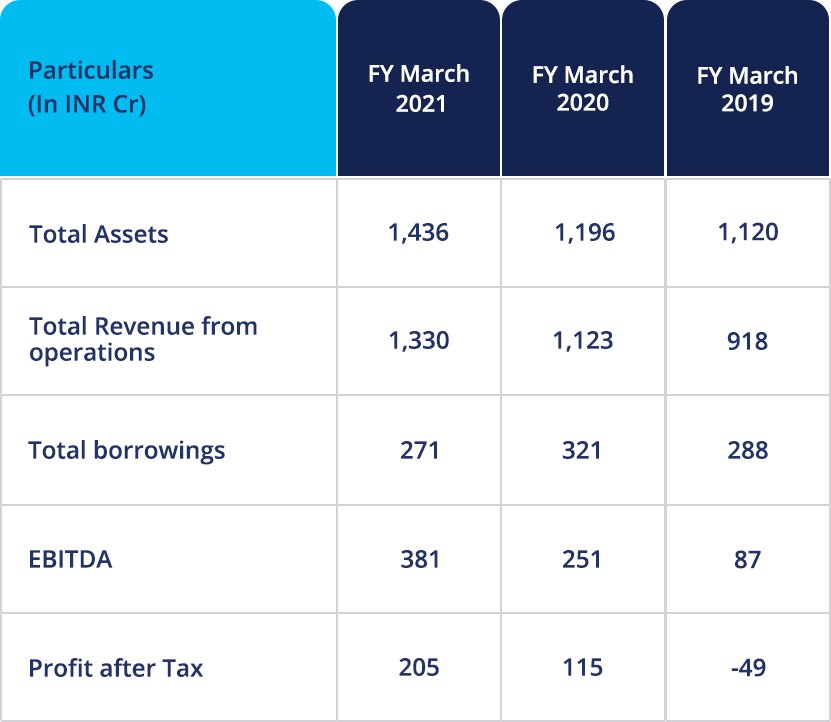

Financial Performance

Let’s take a quick look into a summary of the financial performance of the company to understand its performance of the business and evaluate the growth prospectus:

IPO Details

Krishna Institute of Medical Sciences IPO will open for subscription on June 16 and will close on June 18. The share will be offered in a price band of Rs. 815 to Rs. 825 with a lot size of 18 shares. The company is offering up to 26,027,191 equity shares in its IPO and aims to raise an issue amount of Rs. 2,143.74 Crores.

Kotak Mahindra Capital Company, Axis Capital, Credit Suisse Securities (India), and IIFL Securities are the book running lead managers to the public issue. The listing will also provide a public market on NSE and BSE for equity shares in India.

IPO Timeline

Objective of the Offer

The company proposes to utilise the Net Proceeds of the fresh offer towards the repayment or pre-payment, in full or part, of certain borrowings availed by the company. The funds will also be used for funding capital expenditure requirements of their company and meeting expenses related to general corporate operations.

Other than the aforementioned objectives, the company expects to receive the benefits of listing the equity shares on the Stock Exchanges and enhancement of its brand name and creation of a public market for its equity shares in India.

Strengths & Risks

Strengths

- Regional leadership-driven clinical excellence and affordable healthcare.

- Ability to attract, train and retain high-quality doctors, consultants and medical support staff.

- Track record of strong operational and financial performance.

- Well-positioned to consolidate in India’s large, unorganized yet rapidly growing and underserved affordable healthcare market.

- Disciplined approach to acquisitions resulting in successful inorganic growth.

- Experienced senior management team with strong institutional shareholder support.

Risks

- High dependence on healthcare professionals, including doctors that it engages on a consultancy basis for business.

- The COVID-19 pandemic has affected its regular business operations and may continue to do so.

- Revenues are highly dependent on its hospitals in Hyderabad (Telangana). The company is also significantly dependent on certain specialties for a majority of its revenues.

- The company has ceased operations at some of its facilities in the past and may continue to do so in the future.

- Its indebtedness and the conditions and restrictions imposed by its financing arrangements may limit its ability to grow the business.

- The company doesn’t own or perpetually lease certain hospital buildings and ancillary facilities.

Conclusion

Krishna Institute of Medical Sciences IPO will open on Wednesday, June 16 and will close on Friday, June 18. The share will be offered in a price band of Rs. 815 to Rs. 825 with a lot size of 18 shares and the company aims to raise the issue amount of Rs. 2,143.74 Crores.

Source – RHP, BRLM

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.