Krsnaa Diagnostics IPO Details- Dates, Price & Overview3 min read

Four IPOs set to raise over Rs 3,600 crore this week and Krsnaa Diagnostics is another IPO to join the race. Devyani International, Windlas Biotech, Exxaro Tiles are three other companies which will be going public on 4th August.

The Rs.1,213 crores Krsnaa Diagnostics IPO is all set to hit the Dalal street on 4th August, 2021. Each share in this IPO will be priced between Rs.933 – Rs.954. The IPO will open on 4th August, Wednesday and close on 6th August, Friday.

Krsnaa Diagnostics IPO comprises of fresh issue of Rs 400 crore and an offer for sale of 85.25 lakh shares aggregating up to Rs 813 crore. The face value of each share will be Rs.5 and the minimum order quantity is 15 shares. KFintech will be the registrar for this IPO.

Know the company:

Krsnaa Diagnostics is one of the fastest-growing diagnostic chains in India. Krsnaa Diagnostics has an extensive network of diagnostic centres across India with a key focus on non-metro, and lower tier cities and towns. As of December 31, 2020, it operates 1,801 diagnostic centres that are offering radiology and pathology services across 13 different cities in India.

The company was incorporated in 2010 and was dubbed as one of the fastest-growing diagnostics chains in India. It has a diverse range of diagnostic services that it provides, which include imaging/radiology services (X-rays, MRI, etc.), routine clinical laboratory tests, pathology, and teleradiology services.

The main customers for the company are private and public hospitals, medical colleges, and community health centres.

Promoters:

The Promoter of the IPO is Rajendra Mutha, who is the Chairman at Krsnaa Diagnostics Limited. The lead managers on the issue will be JM Financials, DAM Captial Advisors, Equirus Capital and IIFL Securities. The official Registrar for the IPO is KFin Technologies Private Limited.

IPO timeline:

Objective of the offer:

- The funds from this IPO will be used to finance the cost of establishing diagnostics centres at Punjab, Karnataka, Himachal Pradesh and Maharashtra.

- It will be used towards the repayment /pre-payment, in full or part, of certain borrowings availed by our Company,

- The proceeds will also be used for general corporate purposes.

- In addition, the Company expects to receive the benefits of listing of Equity Shares on the Stock Exchanges including enhancing its visibility and its brand image among its existing and potential customers and creating a public market for its Equity Shares in India.

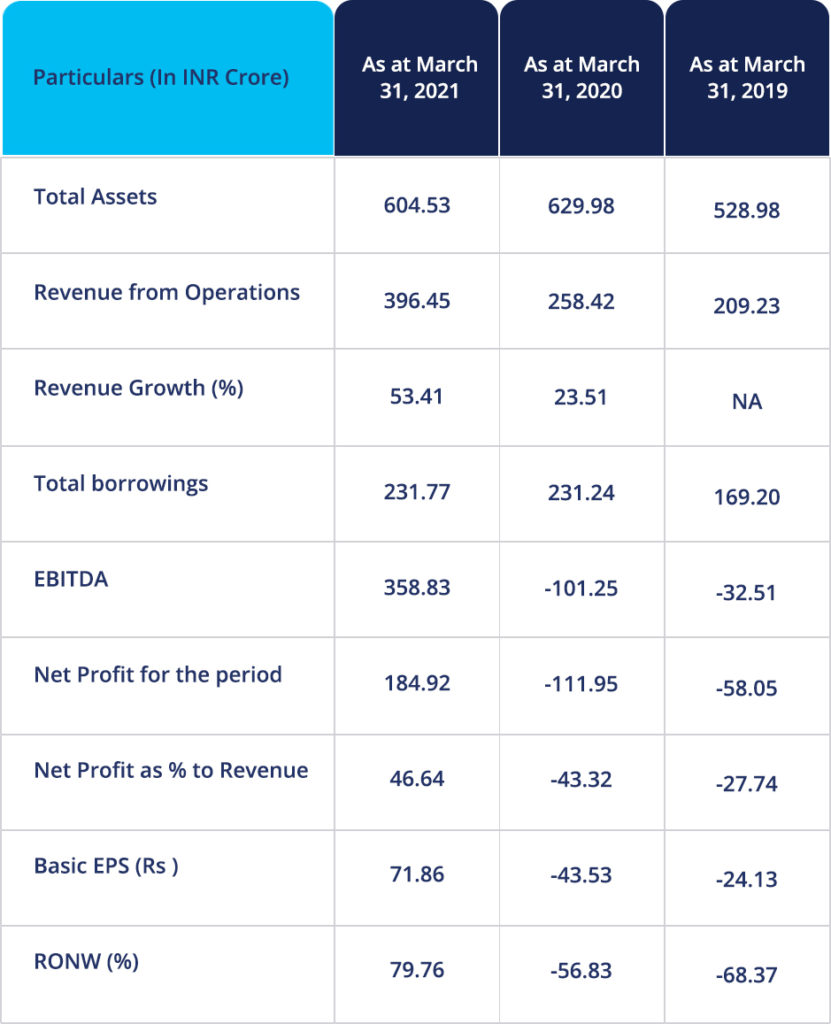

Important Financial data:

Strengths of the company:

- It is a leading and scaled diagnostics company.

- It has a strong brand equity;

- The company has an extensive footprint across India with robust infrastructure;

- The company has a business model with robust revenue visibility; and

- It is well positioned to capitalize on healthcare spending across public and private sectors.

Risks involved:

- A substantial portion of the revenue from the company’s operations depends on payments under contracts with public health agencies.

- The COVID-19 pandemic may significantly affect its results of operations, financial position and cash flows.

- Business interruption at its diagnostic centres and the tele-radiology reporting hub could result in business losses;

- Strong reliance on IT systems and telecommunication network in providing diagnostic services.

- The company has recorded restated losses and negative net worth in the past.

- Inability to arrange financial guarantees or invocation of such guarantees may adversely affect financial condition.

Sources – RHP, BLRM

This content is purely for informational purpose and in no way an advice or recommendation. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.