Laurus Labs -A Seemingly Multibagger in Making4 min read

The pharmaceutical sector has been among the top performing sectors in the Indian stock market since April, as the Covid-19 pandemic turned investors’ spotlight on health care companies.

Laurus Labs has been the highlight out of the pharma lot as the stock zoomed over 400% since the beginning of this financial year.

The company’s ongoing transformation from a raw material supplier to a drug manufacturer that made Laurus Lab more profitable has attracted the attention of foreign and domestic investors.

The company, since 2016, has reportedly invested Rs. 300 crore every year in plants, research, scientists, filing abbreviated new drug applications, and drug master files.

Besides the world’s most valuable market in the US, the company is also reportedly targeting high-growth markets such as Latin America, South Africa, and other emerging markets.

Kitne Generic Drugs The?

Laurus Labs is well known for being one of the largest suppliers of active pharmaceutical ingredients used in the production of antiretroviral drugs, used to treat the Human Immunodeficiency Virus or HIV.

The company’s core business is to supply Active Pharmaceuticals Ingredients that include intermediates, Generic Finished dosage forms, and Contract Research services to the global pharmaceutical industry.

Laurus has a portfolio of more than 60 commercialized APIs with a strong presence in ARV, Oncology, Anti-diabetic, and Hepatitis C therapeutic segments.

Further, the company has forayed into formulation on a large scale from Unit II in the financial year 2019-20 resulting in major revenue being reportedly contributed from that segment i.e. about 29% in 2019-20 as against about 2% during 2018-19.

Deal Done with Richcore

Laurus Labs has recently acquired a 73% stake in Richcore Lifesciences (RICH), a Bengaluru based biotech company.

“Laurus Labs has signed a definitive agreement to acquire 72.55% of Richcore’s shares from Eight Roads Ventures and VenturEast for a value of Rs. 246.7 crore,” the company said in a press release on Nov 25.

This acquisition marks Laurus Labs’ entry into the broader biologics and biotechnology segments, providing the company access to its high growth areas, globally and in India.

Laurus Labs will help and drive Richcore to achieve scale and improve product offerings. With this acquisition, Laurus adds a fourth revenue stream to its three existing divisions – API, Formulations, and Synthesis.

Quarterly Earnings Update

The drug maker, in its recent earnings report of Jul-Sep this year, reported an over a four-fold jump in its bottomline, the consolidated net profit was Rs. 242.27 crore as compared to Rs. 56.55 crore previous year on account of robust sales.

Consolidated revenue from operations of the company stood at Rs. 1,138.84 crore for the quarter under consideration. It was Rs. 712.42 crore for the same period a year ago.

“Our Consolidated revenue for the quarter increased 60% driven by growth in all the divisions. Our EBITDA (earnings before interest, taxes, depreciation, and amortization) margins continue to improve with better operating leverage, and our profitability has also improved substantially to Rs. 242 crore for the quarter,” Laurus Labs Founder and CEO Satyanarayana Chava said.

The board of directors has approved an interim dividend of 80 paise per equity share of ₹2 each, the filing said.

Who Is Betting On Laurus

The company’s stock has increased more than four times in its value since April led by buying from foreign portfolio investors and domestic individual investors.

In the period from April to September, FPIs increased their holding in the company by 9.45 percentage points to 20.74% with investors like Norway’s Government Pension Fund Global and Societe Generale among the new shareholders, the latest shareholding data showed.

Also, retail and high net-worth investors have also raised their stake in the company substantially during the same period. The stake of retail investors has risen to 15.89% at the end of September quarter from 6.28% in the quarter ended March whereas that of high net-worth individuals has jumped to 11.95% from 8.85% in the same period.

Way Forward

Laurus Labs has reportedly undertaken a massive capex program of around Rs. 1200 crore out of which Rs. 500 crore is allocated for formulations and is largely funded through internal accruals.

In another media report, the drugmaker has said that it plans to spend as much as Rs. 1500 crore ($202 million) over the next 24 months to expand its production capacity.

The demand for Indian active pharmaceutical ingredients is increasing as some media reports suggest that the global drug companies push towards diversifying supply chains out of China and production-linked incentives by the government boosted local manufacturing of bulk drugs are a boon for the company.

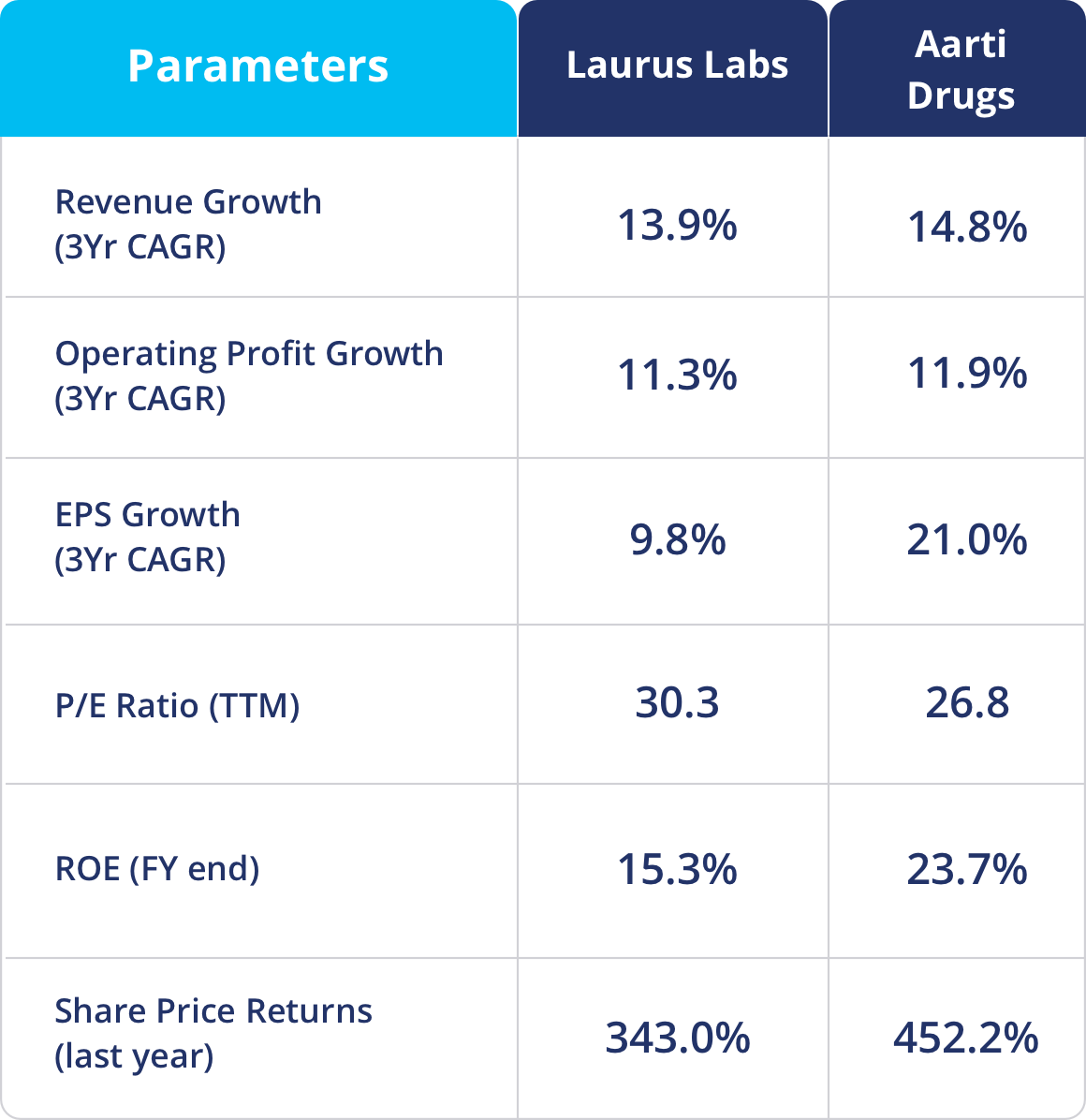

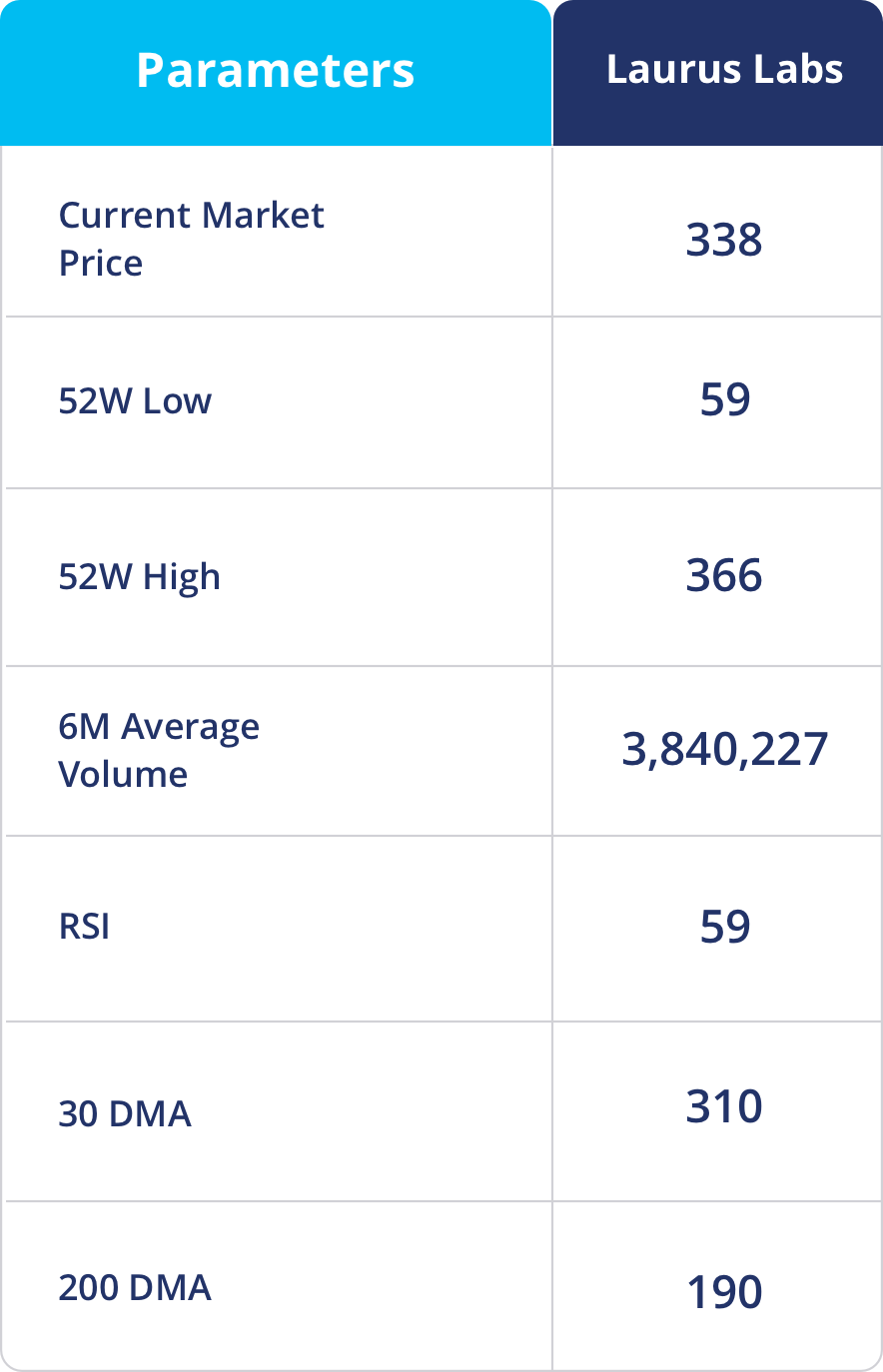

Fundamental & Technical Dose