Laxmi Organic India IPO Details – Dates, Price & Overview4 min read

Raigad, Maharashtra-based Laxmi Organic, one of the largest manufacturers of ethyl acetate in India with a share of nearly 30% in the Indian ethyl acetate market, is now gearing up for an Initial Public Offering (IPO).

The company plans to raise Rs 600 crore from the IPO. Half of the proceeds will be from the fresh issuance of shares to expanding capacity and repaying debt.

The company’s IPO will hit the market alongside Craftsman Automotive on 15th March and has fixed a price band of Rs 129-130 per share for its issue. The company will have a post-issue market capitalisation of Rs 3,428 crore.

Laxmi Organic IPO will open for subscription on Monday, March 15, and close on Wednesday, March 17.

About The Company

The company has a 30% market share in the Indian ethyl acetate market and is the only manufacturer of diketene derivatives in India.

Its AI segment includes ethyl acetate, acetaldehyde, fuel-grade ethanol, and other proprietary solvents whereas the SI segment includes ketene, diketene derivatives namely esters, acetic anhydride, arylides, amides, and other chemicals.

Its products are being used in various industries like pharmaceuticals, agrochemicals, inks & coatings, dyes & pigments, paints, printing & packaging, etc. Alembic Pharmaceuticals Limited, Laurus Labs Limited, Granules India Limited, Hetero Labs Limited, and several others. DAM Capital is the lead book manager for the IPO.

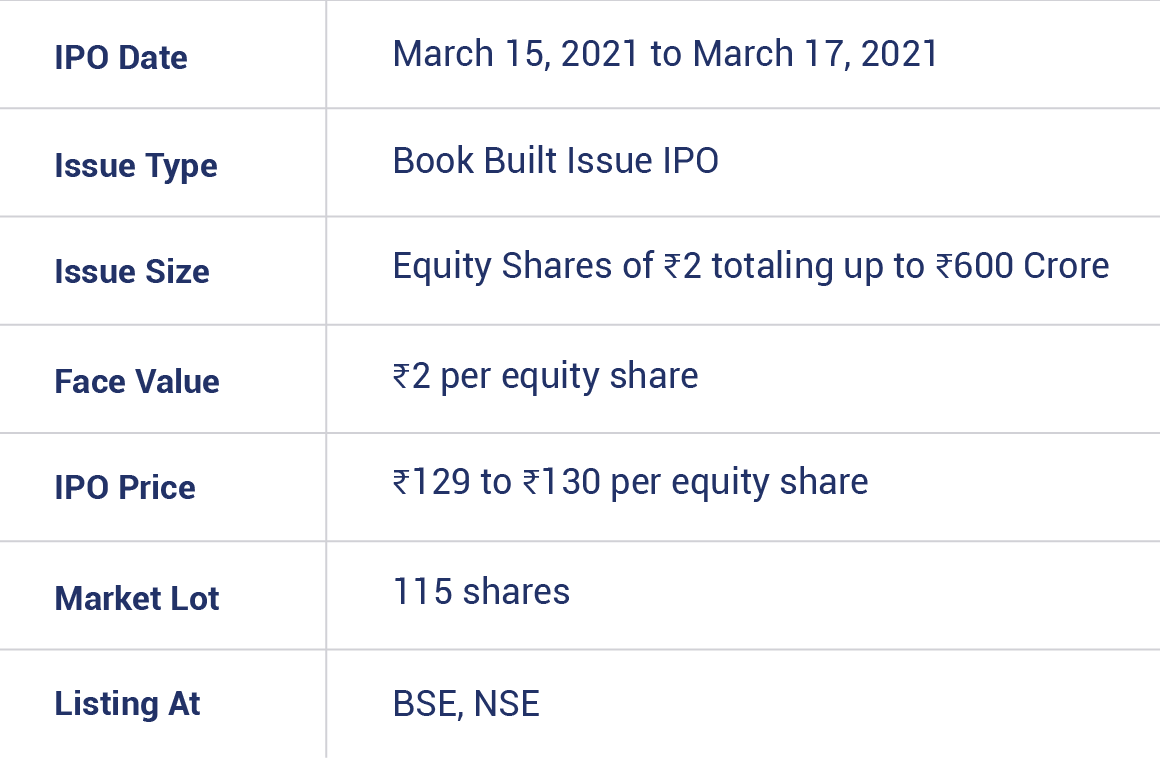

IPO details

The initial public offer (IPO) of Lakshmi Organic consists of a fresh issue and offer-for-sale of Rs.600 crores. The company has set a price band of Rs.129-Rs.130 per share.

The same is set to open for subscription on March 15th, Monday, and will be available till 17th March, Wednesday.

The lot size for this IPO is 115 shares and in multiples thereafter. The face value of each share is Rs.2.

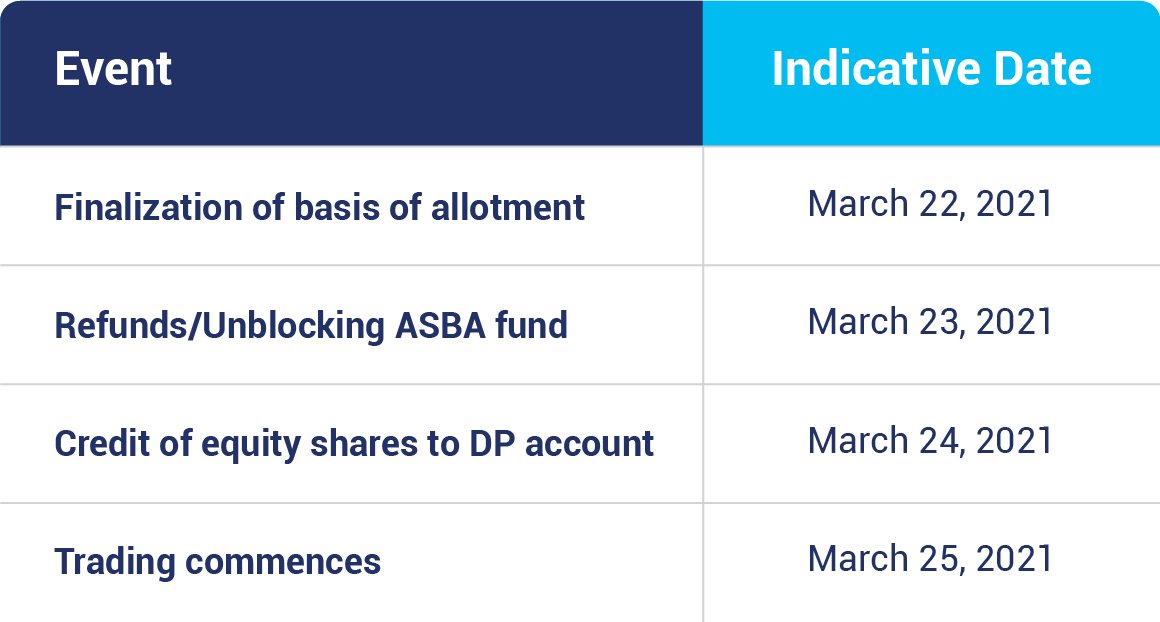

IPO Timeline

Previous Financials

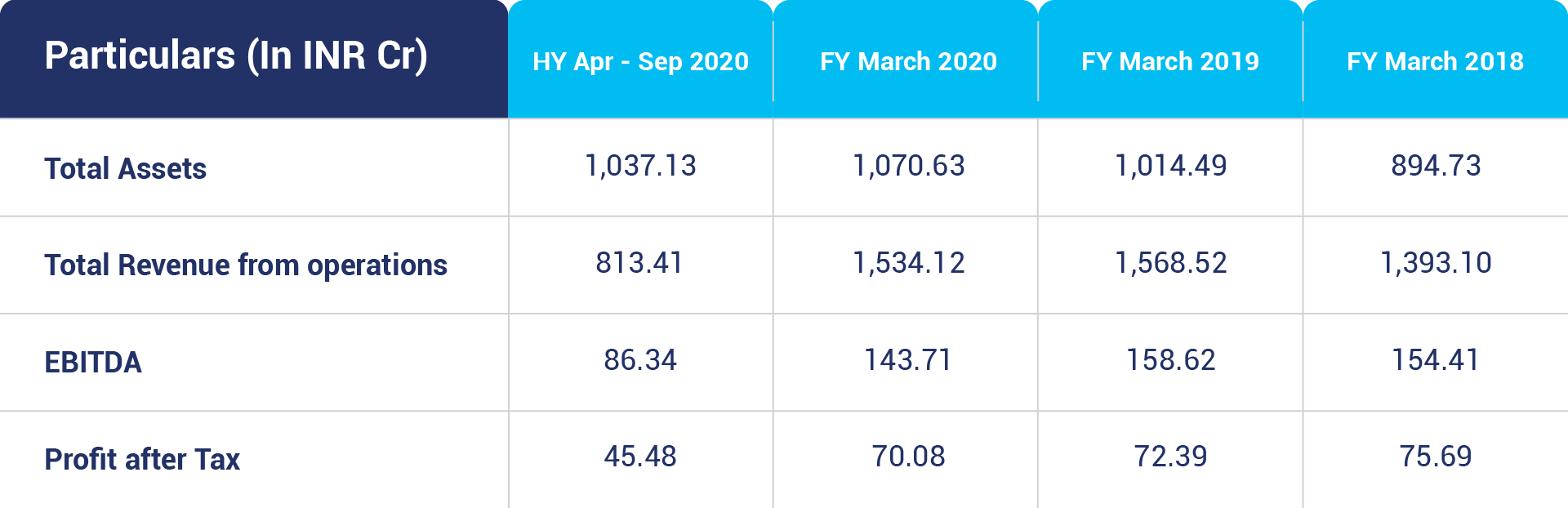

The company’s revenue grew annually at 4.9% to Rs 1,534 crore while net profit dropped by 3.6% to Rs 70.2 crore between FY18 and FY20. The lower profit was due to the impact of floods on plant utilisation and higher amortization. The utilization of the specialty chemical plant rose to 67% in December 2020 compared with 41% in April 2020. In the first half of FY21, the company posted revenue of Rs 813 crore with a profit of Rs 45.5 crore.

Reasons To Go Public

The company wants to use the amount towards investing in subsidiary firm, Yellowstone Fine Chemicals Private Limited (YFCPL) to partly finance the capex to establish a new manufacturing facility. To finance the capex for expansion of SI manufacturing facility and to finance business working capital requirements.

The company will also be needing the raised amount to purchase plants and machinery for infrastructure development at SI facility. Also, it will be making prepayment or repayment of borrowings availed by the company and subsidiary, Viva Lifesciences Pvt Ltd (VLP).

Company Strengths

1. It is the only company in its particular field and has leverage and growing potential owing to the same. Laxmi Organic is the only Indian manufacturer of diketene derivatives with a significant market share and one of the largest portfolios of diketene products.

2. It is the sole leading manufacturer of ethyl acetate with a significant market share. It was the largest exporter of ethyl acetate from India in the six months ending September 2020.

3. The company’s technology development efforts and execution capabilities have enabled it to not only garner a leading position in the domestic Speciality Intermediates market but also made it a leader in several products on a global level.

4. The industry in which Laxmi Organic operates has high entry barriers due to inter alia, the involvement of complex chemistries in the manufacturing of products and the requirement to be enlisted as a supplier after due qualification of the products with certain customers.

Company’s Weakness

1. All the manufacturing facilities of the company are located in one geographical area. Therefore, any disruption can affect its production capabilities and profitability.

2. The company has considerable long-term debt of INR90.15 crores. Over the last four years, this has increased at a CAGR of 28.92%.

Now, Apply for IPOs of your favorite companies on Paytm Money App in less than 30 seconds

1. Log in to the Paytm Money app and complete your fully digital KYC

2. Once the KYC is done, click on the IPOs on the home screen

3. On the IPO home screen, you can apply for the open IPOs

4. To apply, enter the bidding details like quantity, price, and so on

5. Enter UPI id & accept the mandate of the same on UPI app to successfully submit IPO

application

6. Once the allotment happens, you would be notified about your allotment status.

Conclusion

Laxmi Organic Industries Limited is the leading manufacturer of ethyl acetate with a significant market share. The total income of the company grew at a CAGR of 8.27%. The drop in income in 2020 was due to the fall in the prices of acetates and other chemicals during the pandemic.