Leverage – A Double-Edged Sword4 min read

Here’s an explainer on how leverage works in the equity and derivatives market.

Let’s start with the basics.

What is Leverage?

Leverage refers to a mechanical advantage which amplifies a small input force to achieve greater output in physics. Financial leverage follows the very same principle. It amplifies an investor’s buying power in the market.

Trading that employs leverage is called leverage trading. Leverage trading refers to the use of borrowed capital to get much higher potential return on your investment. It allows you to open positions that are much larger than what your original capital would allow you otherwise.

The idea here is to borrow capital to buy more contracts of an asset expecting that the position’s returns would be greater than the cost of borrowing.

SBIN Example

Let us take the example of State Bank of India (SBIN) to understand leverage trading and non-leverage trading in detail. Let the spot price and July futures contract price be the same at Rs. 420. Let us also assume that we have Rs.2,30,000 at our disposal. We have two options to pick from.

Option 1: Buy SBIN stock in the equity market

Option 2: Buy SBIN futures in the derivatives market

Let us understand each option in detail.

Option 1: Buy SBIN stock in the equity market

a. When SBIN goes to Rs. 450

Buying SBIN requires us to check the price of SBIN in the market and also the number of stocks we can buy with Rs. 2,30,000.

With Rs. 2,30,000 at our disposal, we can buy Rs.2,30,000/Rs. 420 = 547 stocks. And when SBIN is trading at Rs. 450 we can square off the position for a profit.

Amount received = 547 * Rs. 450 = Rs. 2,46,150

Amount required to buy 547 stocks = 547 * Rs. 420 = Rs. 2,29,740

Profit = Rs. 2,46,150 – Rs. 2,29,740 = Rs.16,410

Let us calculate the return = (Rs. 16,410/Rs. 2,29,740) * 100 = 7.14%

b. When SBIN goes to Rs. 390

Let us now see what happens if the price goes down to Rs. 390.

Amount received = 547 * Rs. 390 = Rs. 2,13,330

Loss = Rs. 2,29,740 – Rs.2,13,330 = Rs. 16,410

Loss % = (Rs. 16,410/2,29,740) * 100 = 7.14%

Let us now see option 2

Option 2: Buy SBIN stock in the futures market

a. When SBIN goes to Rs. 450

Let the lot size be 1500. This means the number of stocks that must be bought is 1500 or a multiple of 1500.

The futures price is Rs. 420.

Therefore, the contract value is = Rs. 420 * 1500 = Rs. 6,30,000

Let us say that the margin is about 35%. So, to enter into the contract, we need to provide =

35% * Rs. 6,30,000= Rs. 2,20,500

This means that we can buy 1 lot of SBIN futures for Rs. 2,20,500.

Futures contract value at the time of selling = 1500 * 1 * Rs. 450 = Rs. 6,75,000

This means a profit of = Rs. 6,75,000 – Rs. 6,30,000 = Rs. 45,000

A move from Rs. 420 to Rs. 450 made a profit of Rs. 16,150 in the spot market but a profit of Rs. 45,000 in the futures market.

Let us remember that investment for the futures trade is Rs. 2,20,500. Therefore, the return should be calculated keeping this as the base.

(Rs. 45,000 / Rs. 2,20,500) * 100 = 20.408%

b. When SBIN goes to Rs. 390

Let us now assume that the price goes down to Rs. 390

Futures contract value at the time of selling = 1500 * 1 * Rs. 390 = Rs. 5,85,000

This means a loss of = Rs. 6,30,000 – Rs.5,85,000 = Rs. 45,000

Loss % = (Rs. 45,000/Rs. 2,20,500) * 100 = 20.408

From the above examples, it is clear that leverage is a double-edged sword. While it increases the profit potential, it also increases the loss potential as can be seen in the examples above.

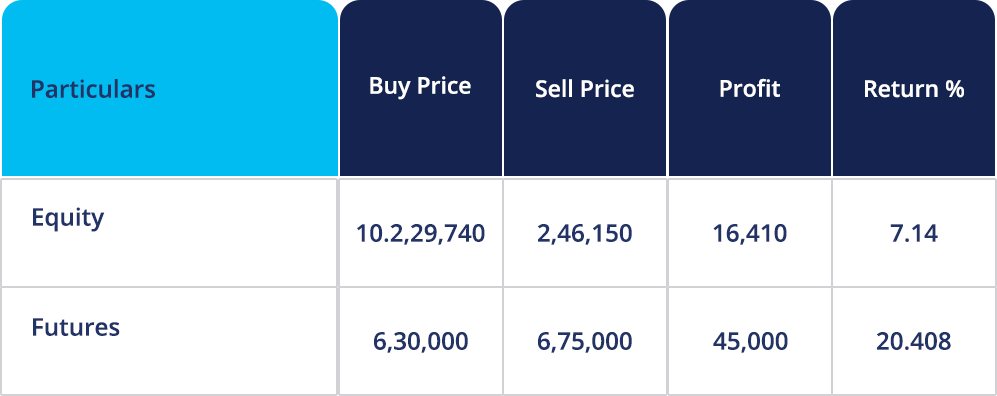

The table below shows how return % in the case of futures is more compared to the case of equity for the same price movement.

In Rs.

Now let us explore some of the advantages and disadvantages of leverage trading.

Advantages:

- It amplifies buying power which enables us to purchase more units with only a fraction of the actual cost

- It gives traders the potential to have higher profit on each trade

Disadvantages:

- It amplifies risk exposure

- Losses sustained while engaging in leverage trading are way more than what would have incurred if you didn’t trade on leverage at all.

Disclaimer – This content is purely for information and investor awareness purpose only and in no way an advice or recommendation. You should independently research and verify the information you find on our website/application. The securities quoted are exemplary and are not recommendatory. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019