Investment Pack: A product for your long term investment journey6 min read

Paytm Money launched a marquee product “Investment Packs” in March 2019. These packs have provided a one-stop solution to both new and experienced investors, for their long term investment journey. Be it wealth creation or wealth preservation, over the last year, Investment packs have delivered returns in line with your investment objective while maintaining volatility as per your risk profile. We reflect closely on the return and volatility profile of each pack in this article.

Why did we create Investment Packs?

Investment packs are constructed by our in-house advisory team of experts based on rigorous and in-depth research. The aim behind investment packs is to help you invest as per your risk profile. This enables you to stay invested for the longer term by tiding over volatile markets. Remember the famous saying:

“ Time in the market is more important that timing the market”

Let us understand this with an example. It is Jan 2018 and you are a “moderate” risk investor. But just because the past performance of Midcap and Small cap oriented funds (having a high risk) have been spectacular you decide to invest all your money in these funds. Unfortunately for you, these categories started to fall massively in the months to come. Most likely, you would have panicked seeing the sharp fall and exited at a loss. Or you are at best holding on to your investments/SIP but are constantly worried about the poor returns over the last 18 months.

The point is that you need to stick to your investments only if you invest in-line with your risk profile. That is why it is compulsory for you take a free risk assessment questionnaire before putting in your hard earned money in investment packs. Risk profile and asset allocation are important but often overlooked aspects of investing, that we hope to set right through investment packs.

How did we create Investment Packs?

Each investment packs has 3–5 mutual fund schemes, diversified across asset classes (Equity/Debt), AMCs, Fund Managers, etc. We follow a three step process while constructing the investment packs (Read a detailed article on construction of investment packs):

- Investor Risk Assessment:

A detailed questionnaire that defines the risk appetite of the investor across 5 risk profiles starting from ‘Aggressive’ to ‘Low Risk’ - Suitable Asset Allocation:

Splitting your investment between Equity and Debt in-line with your risk profile as well as choosing the subcategories to invest in. - Fund Selection:

Select suitable funds for each asset class based on a robust internally developed methodology

Based on the minimum investment amount, we have two investment packs for each risk profile.

Broad overview of Investment Pack performance:

The asset allocation for each pack is based on the risk profile. Higher the level of risk you are willing to take on, the higher will be the allocation to equity vis-à-vis debt. You can read in-depth about the asset allocation for each pack in this article.

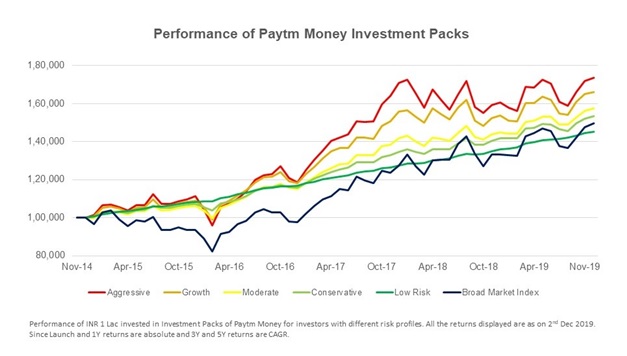

Let us now take a look at how an investment of INR 1 lakh, made 5 years ago, would have grown. We focus not just on the final investment value today but also on the path it has taken (volatility) to reach today’s value.

Aggressive pack, as you can see from the above graph, has generated the maximum returns while the Low Risk pack has given the least return. Does this mean everyone should invest in Aggressive packs? The answer lies in the path or the way investments have grown or volatility over the 5 year period!

The higher returns in the Aggressive pack comes with higher volatility i.e. investments tend to go up and down as per the market cycle. Thus it will be suitable only for ‘Aggressive’ investors who are looking for long term wealth creation and are ready to accept short term losses.

The ‘Low Risk’ pack in contrast, has little volatility and hence best suited for people looking to primarily protect invested capital. Investing is not about chasing returns, but doing it according to your risk profile which will surely help in reaching your financial goals — the major focus of investment packs.

Individual Pack Performance:

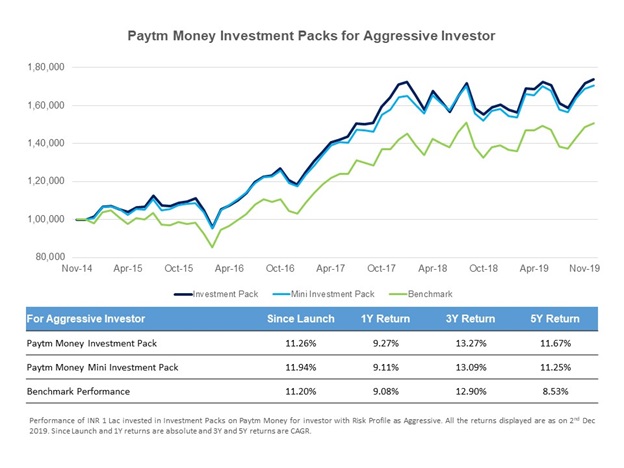

For Aggressive Investors:

These packs are meant for high risk takers and focus on long term wealth creation. Hence these packs have higher exposure to mid and small caps. This can lead to short term losses but can beat the benchmark by a considerable margin over the 5+ years investment period.

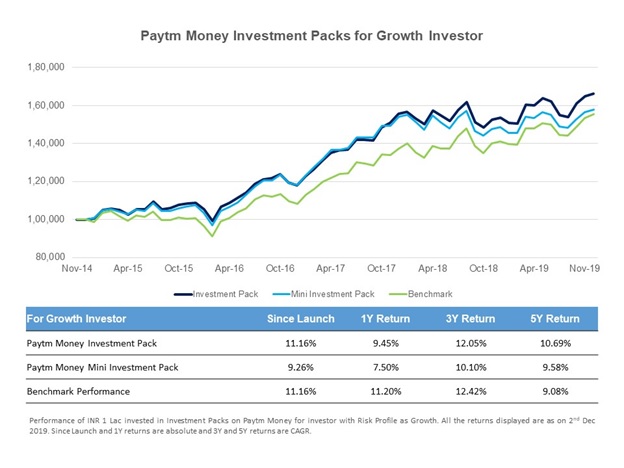

For Growth Investors:

A Growth investor is willing to take on lesser risk compared to an Aggressive investor. Hence the portfolio has higher exposure to Multicaps that enables benchmark beating performance over the 5Y period at comparatively lesser volatility, but the outperformance is also lower vs pack for “Aggressive” investor.

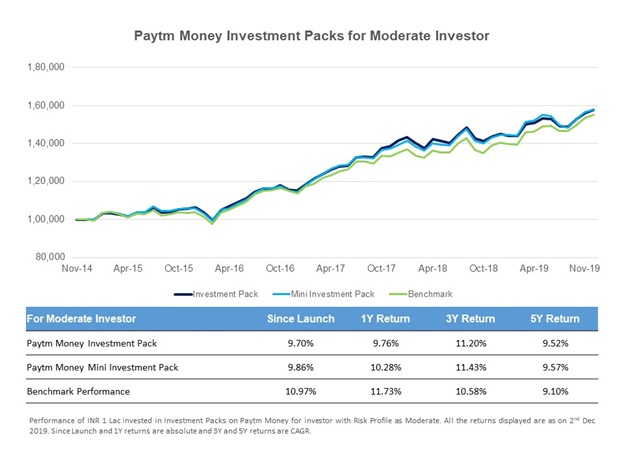

For Moderate Investors:

A Moderate investor seeks consistent investment growth and hence has portfolio that has equal allocation to Equity (mostly Large caps) and Debt. The pack has beaten its benchmark in 3–5 year investment horizon with medium volatility.

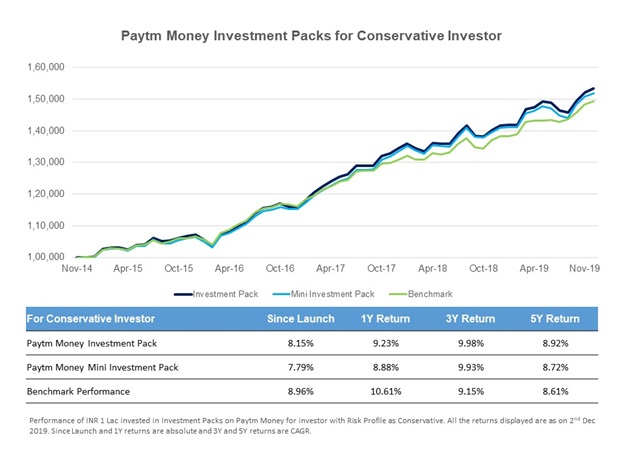

For Conservative Investors:

A conservative investor seeks capital preservation with little fluctuations in growth, hence this portfolio has suitable debt funds with shorter duration. Debt market has faced a series of issues over the past year and a half. However, our robust in-house debt mutual fund selection methodology has ensured that none of the debt funds in our packs faced any sharp and permanent NAV drops due to defaults of underlying paper. Hence conservative pack beats the benchmark over the 3Y period with low volatility as shown below.

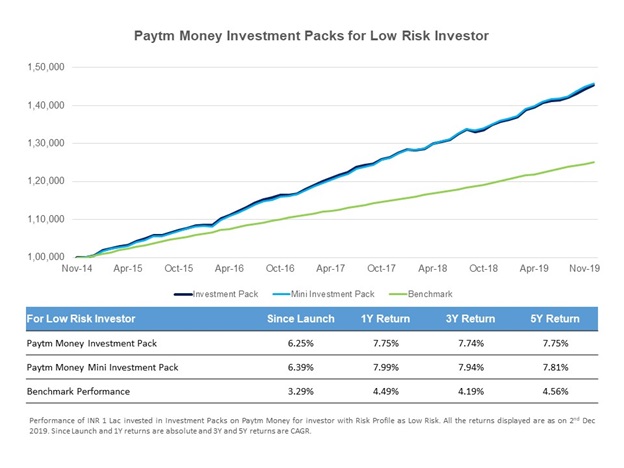

For Low Risk Investors:

A Low Risk investor wants to take on the least risk and his/her primary goal is to protect the invested capital. Hence debt funds chosen here are most conservative in terms of mitigating interest rate and credit risk. Thus a Low Risk investor has a smooth investment journey as seen in the graph below.

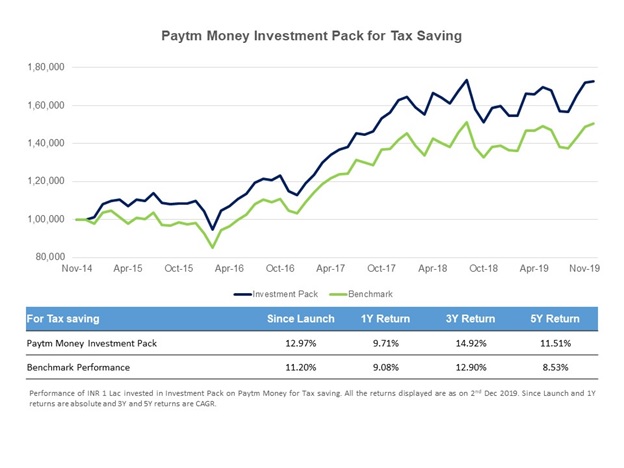

For Tax Saving:

This is a Goal/Solution-oriented pack that is available to all investors and helps in tax saving under 80C. These funds have a 3 year lock in period but we suggest you hold them at least for 5 years. The pack has significantly outperformed the benchmark in the 3–5 year investment horizon.

The way forward:

The advisory team will continue to closely monitor the performance of investment packs. If required, the advisory team will also change the pack composition (% allocation to equity/debt), sub-asset allocation and selected funds. This will ensure that your investments are up to date and you keep getting the best out of your investments, requiring no effort at your end!

If you have already invested in Investment Packs, continue investing through the SIP route to benefit from rupee cost averaging. If you haven’t invested yet, do check them out and invest today on Paytm Money.