Much Anticipated IPO Of Lodha Builders To Hit The Markets On Apr 73 min read

MacroTech Developers, popularly recognised under the brand “Lodha” is among the largest real estate developers in India, with residential sales value for the financial years 2014 to 2020.

The company’s core business is residential real estate development with a focus on affordable and middle-income housing. Over 58% of demand for the company comes from the affordable housing and middle-income housing segment and the company has almost 60,000 homes delivered in last 7 yrs i.e average of 8,000 to 10,000 homes a year.

Currently, the company has residential projects in the Mumbai Metropolitan Region (MMR) and Pune. In 2019, it forayed into the development of logistics and industrial parks and entered into a joint venture with ESR Mumbai 3, a subsidiary of ESR Cayman Limited, the Asia Pacific-focused logistics real estate platform. The company also develops commercial real estate, including as part of mixed-use developments in and around its core residential projects.

MacroTech Developers’ brands include “Lodha”, “CASA by Lodha” and “Crown – Lodha Quality Homes” for its affordable and middle-income housing projects, the “Lodha” and “Lodha Luxury” brands for its premium and luxury housing projects, and the “iThink”, “Lodha Excelus” and “Lodha Supremus” brands for its office spaces.

It has a strong focus on de-risking projects and improving its return on investment with a fast turnaround time from acquisition to launch to completion.

As of December 31, 2020, the company has 91 completed projects comprising approximately 77.22 million square feet of Developable Area, of which 59.13 million square feet is in affordable and middle-income housing, 12.15 million square feet is in premium and luxury housing, 5.21 million square feet is in office space and 0.74 million square feet is in retail space.

The company also has 36 ongoing projects comprising approximately 28.78 million square feet of Developable Area. Under its logistics and industrial park portfolio, the company has ongoing and planned developments of approximately 290 and 540 acres, as of December 31, 2020, respectively.

In addition to their ongoing and planned projects, as of December 31, 2020, they have land reserves of approximately 3,803 acres for future development in the MMR, with the potential to develop approximately 322 million square feet of Developable Area.

As of now, the company has 2.8 cr sq ft under construction, 4.5 cr sq ft planned projects, and additional land of 4600 acres in MMR

Important Financial Data

MacroTech Developers revenue from operations in FY20 was Rs.12,442.59 crore as against Rs. 11,906.97 crores in FY 19 which reflect a year-on-year growth of nearly 4.5%. Take a look at the company’s other financial data in the table below:

IPO Details

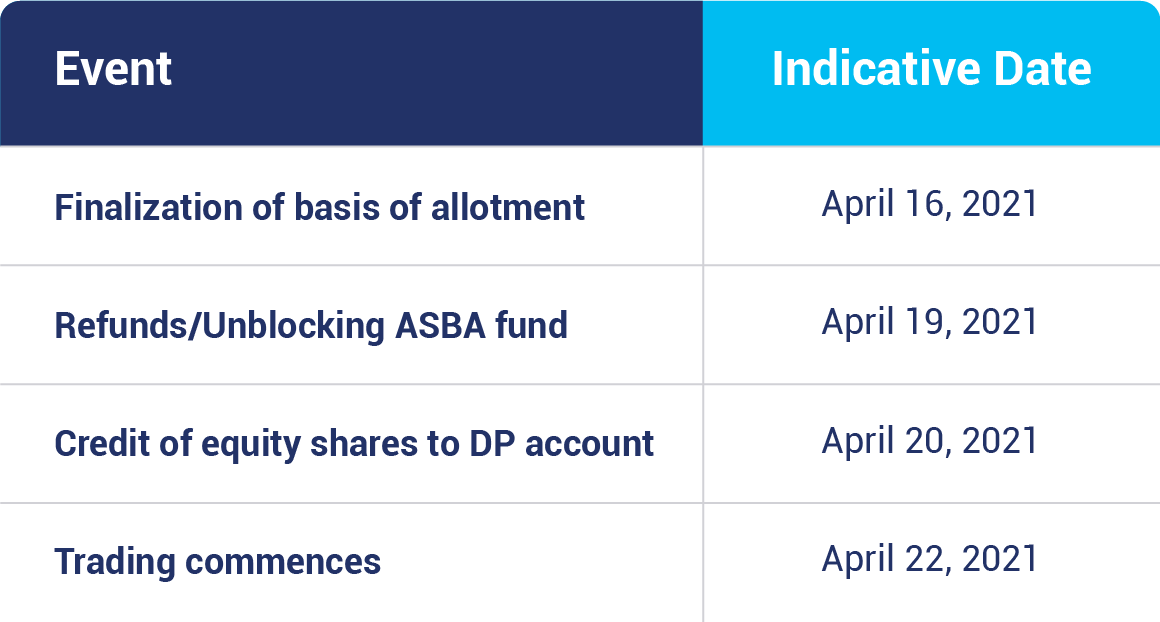

MacroTech Developers IPO opens for subscription on April 7 and closes on April 9. The shares will be offered in the price band of Rs.483 to Rs. 486 with a lot size of 30 shares. The company is offering 51,440,328 – 51,759,834 shares in its IPO and aims to raise an issue amount of Rs 2500 crores.

As the IPO proceeds, the company aims to reduce the aggregate outstanding borrowings by the Company on a consolidated basis and acquire land or land development rights.

Additionally, the Company intends to strengthen its capital base and expects to receive the benefits of listing the Equity Shares on the Stock Exchanges, including among other things, enhancing the visibility of its brand and its Company.

Conclusion

The IPO of MacroTech Developers, one of India’s leading property developers, will open on Wednesday, April 7, and closes on Friday, April 9. The shares will be offered in a price band of Rs.483 to Rs.486 with a lot size of 30 shares. The company aims to raise the issue amount of Rs 2500 crores

Disclaimer – This content is purely for informational purposes and in no way an advice or recommendation