All You Need To Know About Paytm Money Margin Calculator3 min read

Paytm Money’s Margin Calculator helps a trader to know the total margin required for taking a trade in Derivatives Segment.

What is Margin?

In the cash segment, you pay the share price upfront and buy those shares, but in derivatives, you just pay a part of the share price or margins while buying. These margins are different for all the scrips. Therefore, it’s better to calculate required margins beforehand and check if the required funds are available.

As per the new SEBI circular a broker has to collect the complete SPAN + Exposure margin from the customer to carry forward Futures and Options positions to the next day.

To access Margin Calculator you need to click on the three-dot menu in the stocks dashboard on the Paytm Money app and select Margin Calculator option, whereas on the website you can click on the User name present on the Top Right Corner of the Equity Page and then Select the Margin Calculator Option.

To check the required margin, one has to enter the scrip (position) details he / she wishes to place a trade in and add the scrip (position) for calculation.

The user can add multiple scrips (positions) to get the details at a time to know the overall margin requirement.

If you take a hedge position, i.e. Long Nifty Future & Buy Nifty Put, the overall margin required to enter the trade will be less than the individual margin required.

Total Margin

The Total Margin Required for a trade is the addition of Span Margin and Exposure Margin.

If we add an options Position then it also includes Option Premium. Let’s understand the terms Span Margin, Exposure Margin, and Option Premium.

SPAN Margin

SPAN Margin, is the minimum margin required for entering a Futures position (Both Buy & Sell) and writing /selling an Option position. This is mandated as per the exchange.

Exposure Margin

The Exposure Margin is the margin blocked by the Broker to cover MTM Losses. This is over and above the SPAN Margin.

The SPAN and Exposure margins are specified by Exchanges. So at the time of initiating a futures trade or option sell trade, the client has to adhere to the initial margin requirement.

Our Margin Calculator helps you in getting these values calculated, so a customer can come to know the Total Margin Required before placing the trade. The SPAN + Exposure Margin also known as the Initial margin is blocked by the exchange.

Option Premium

Buying an option position requires a customer to pay full premium and not margins. While selling / writing an option requires him to pay Margins.

When you add a buy position in option, you might have margin benefits on futures and short option positions which will show in the Margin Calculator.

Let’s look at how the Margin Calculator Works

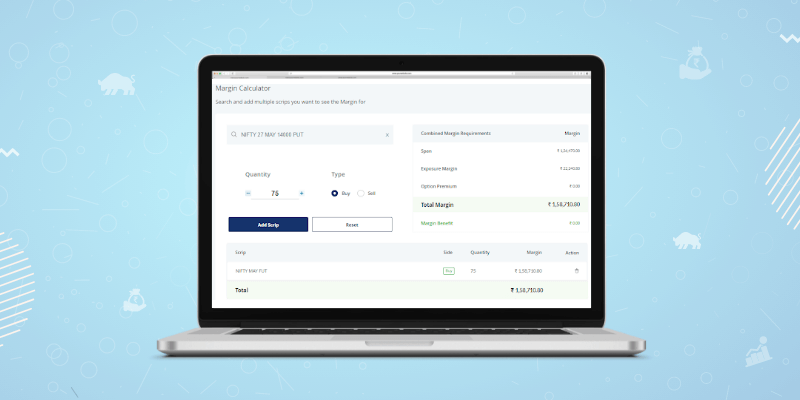

Only Long Position in Nifty Futures

Please look at the break-up of Initial Margin Required (SPAN + Exposure) which is the Total Margin.

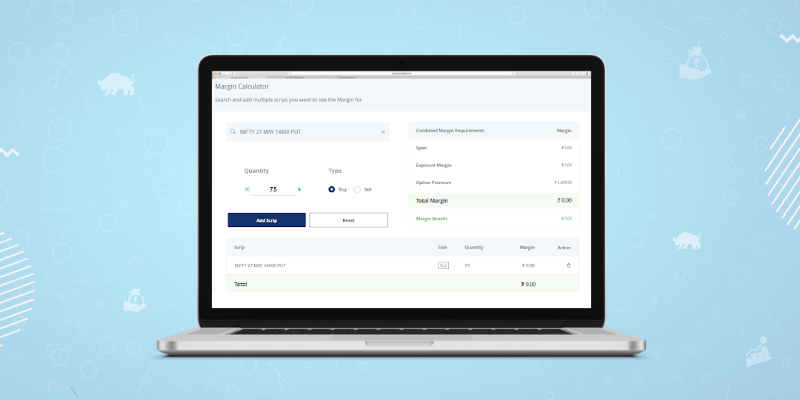

Options Long Position – Buy Nifty PUT

Only Options Premium required – Rs. 1605 as seen below.

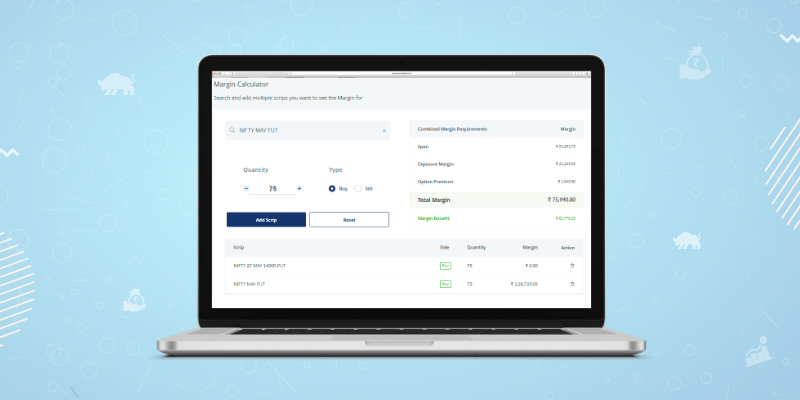

When we Take a Hedge Position (Nifty Future Long + Nifty PUT)

As you can see when we bought individual positions the Margin Required for Nifty Future was approx Rs.158710 and the premium required for Nifty PUT is Rs.1605.

However, the Margin is reduced to Rs.75940 when both positions are taken together.

Conclusion

The margin calculator of Paytm Money will always help you in calculating enough margins for any trade you wish to execute. The tech team of Paytm Money works relentlessly to provide you with the best in class features and make trading easy for you.

Disclaimer – “Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.

Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete Terms & Conditions and Disclaimers visit www.paytmmoney.com.”