Strategy to follow in Midcap and Smallcap funds3 min read

You would have come across many articles or advisers talking about the advantages of investing through SIP. It is a fact that investing in inherently volatile assets like equity mutual funds is done best through SIPs. It disciplines your investing and helps you with rupee cost averaging, both of which are expected to help you create long term wealth.

Let us suppose you started a SIP in Dec 2016 in a Midcap or Small cap fund. You would have seen your fund performing well through 2017. But since January 2018, you would have been disappointed and even a tad worried about the fund performance. After continuing to invest through SIP for the past 3 years or so, you find that the returns generated by your investment is either negative or low positive (lesser than a safe and predictable Bank FD!)

So what are we missing here, is there more than what meets the eye with respect to these investments?

What exactly is Long Term?

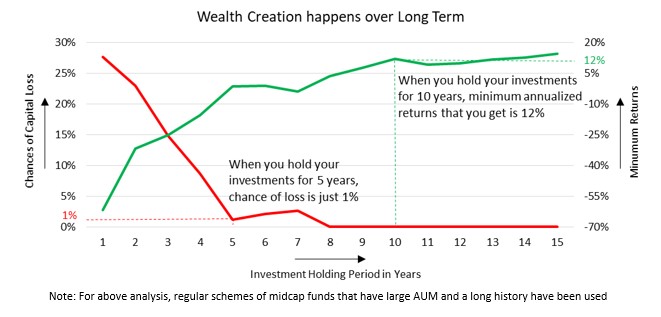

Most financial advisors keep suggesting “stay invested for the long term”. Let us find out, how long exactly is this “Long term”. To figure this out we analyzed the historical data for Midcap mutual funds. Take a look at the chart below:

Moving from left to right in the above graph, as the investment holding period in years increases, the chance of making losses decreases (red line keeps coming down) and the minimum returns that you can expect increases (green line keeps moving up). The shorter the holding period, the greater the chance of losing your invested capital i.e. you have higher chance of making negative returns on your investment.

It is said that “Investing should be more like watching paint dry or watching grass grow”. So the key is PATIENCE. For example, when you hold your investment for 5 years, the chance of making negative returns drops to just 1% (red line)! Long term wealth creation is a real possibility with a minimum return of 12% (green line) when investments are held for a 10 year period.

“Invest and forget” or “invest and monitor”?

A question that you may now have is whether to “invest and forget” or “invest and monitor” at regular and appropriate time intervals. Clearly the answer is that you need to monitor and evaluate the fund performance at regular and appropriate time intervals.

To decide what these appropriate time intervals are, we need to take a closer look at how SIP investing really works. SIP investing is slightly different from lump sum investing with respect to how we view the invested time horizon. This is an often overlooked aspect of SIP, which we will discuss separately in coming weeks.

Do you mean I should hold on to the SIP I started 3 years ago?

The answer is YES! 3 years is too short a time period for evaluating the returns of your SIP in Midcap or Small cap funds. Actually, it does not even matter whether you invested through SIP or Lump sum. Either way, you need to remain invested for the long term i.e. at least 5 years in categories like Midcap and Small cap.

Given its many advantages, you should certainly invest through SIP. To make sure you have a thorough understanding of how long to hold your SIPs, we will write a blog post in the coming weeks focusing on this important SIP fact!

In case, you are not sure which midcap and small cap funds to choose, do check out our filtered list created for you. It is available under Investment Ideas titled “High Risk for High Returns” on the Paytm Money app.