August 2019: These Mutual Fund Schemes saw Maximum Investments on Paytm Money3 min read

Equity markets witnessed heightened volatility in the month of August, amid fears of a looming global recession, US-China trade tensions and muted corporate earnings growth. Government tried to boost investor sentiments by announcing a certain policy measures while RBI cut interest rates and committed to positive systemic liquidity to tackle the growth slowdown.

For the last few months, Small cap equity funds saw highest investments on our app. It is good to see that investors continue making investment decisions based on long term performance of the schemes in this category, even though their short term returns are poor. Chasing short term returns is not the right approach to investing. Investors should also keep in mind that debt categories such as Gilt should be looked with at least a 3 year investment horizon.

Mutual Fund Schemes seeing maximum number of investments across categories*:

- HDFC Small Cap Fund Direct – Growth

- Mirae Asset Emerging Bluechip Fund Direct – Growth

- Mirae Asset Tax Saver Fund Direct – Growth

- Nippon Small Cap Fund Direct – Growth

- SBI Small Cap Fund Direct – Growth

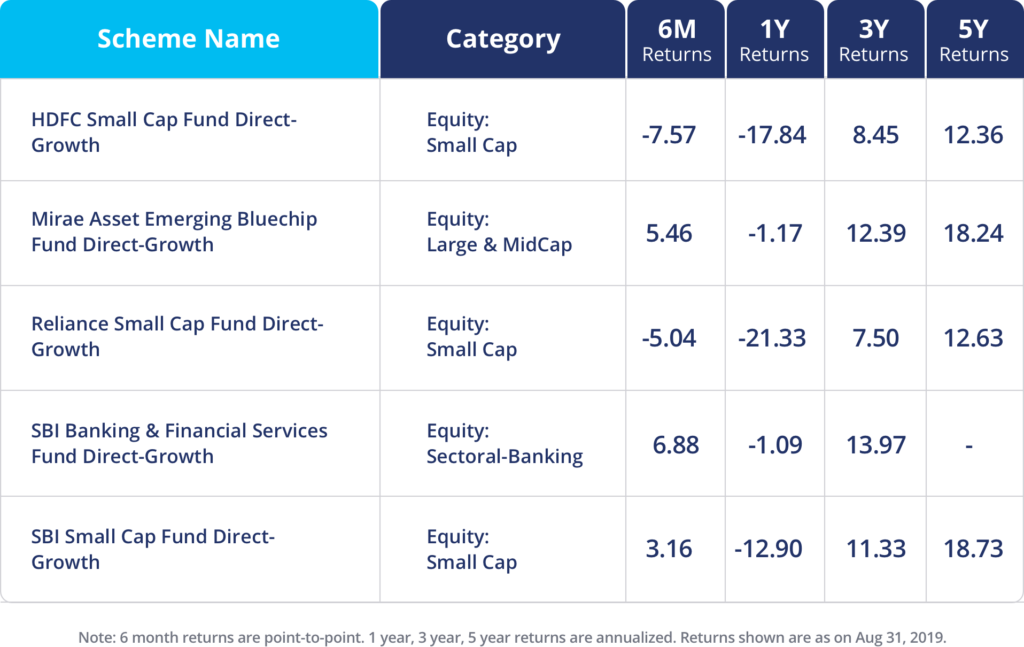

In Equity category, Small Cap funds have continued to see high traction in the past few months. Top 5 funds that saw maximum number of investments across equity categories in August 2019 remained the same as given below:

Explore more Equity Schemes here

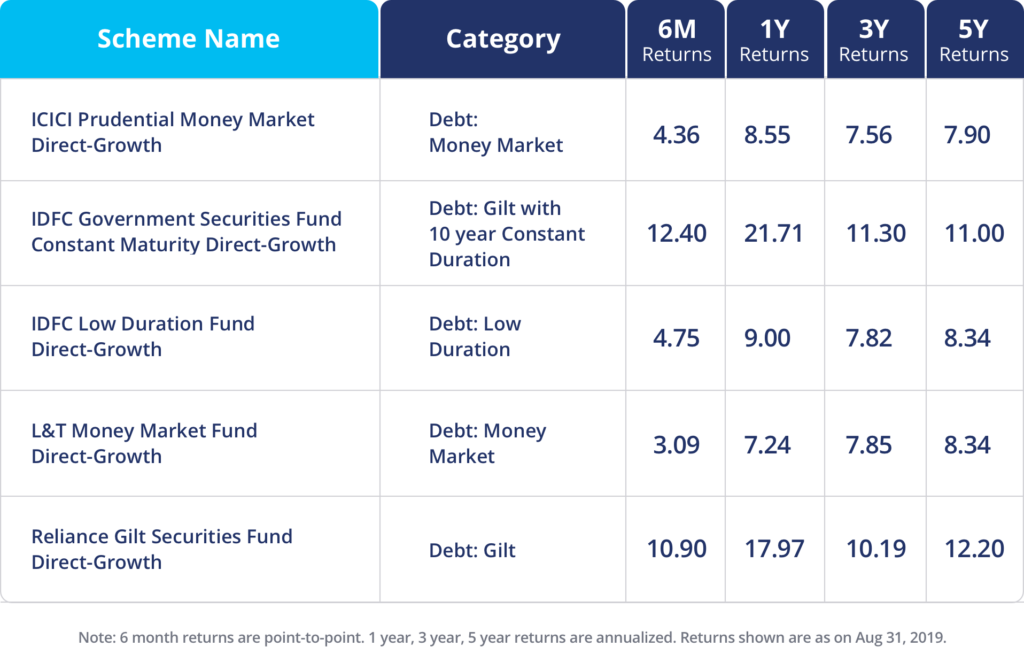

In the Debt mutual funds category, Gilt funds which predominantly invest in Government Securities and Money Market funds were the most bought funds on the platform in the last few months. Top 5 funds that saw maximum number of investments across debt categories* in August 2019 continued to remain the same as given below:

Explore more Debt Schemes here

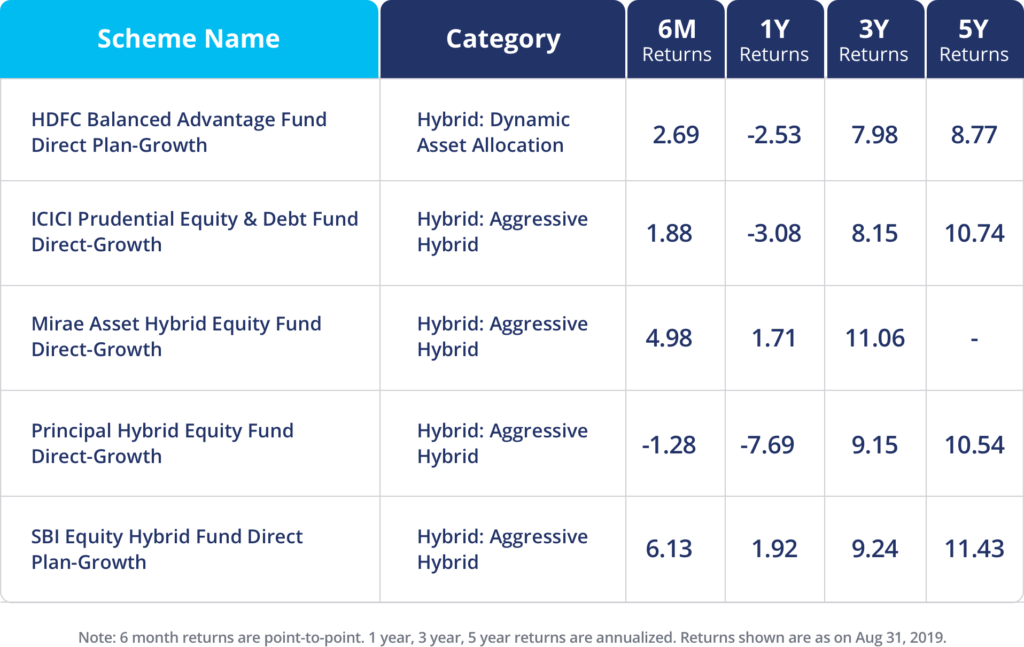

Among Hybrid or Balanced funds investors preferred aggressive hybrid funds over other hybrid sub categories as seen in the last three months. Top 5 funds that saw maximum number of investments across hybrid categories in August 2019 also continued to remain the same.

Explore more Hybrid Schemes here

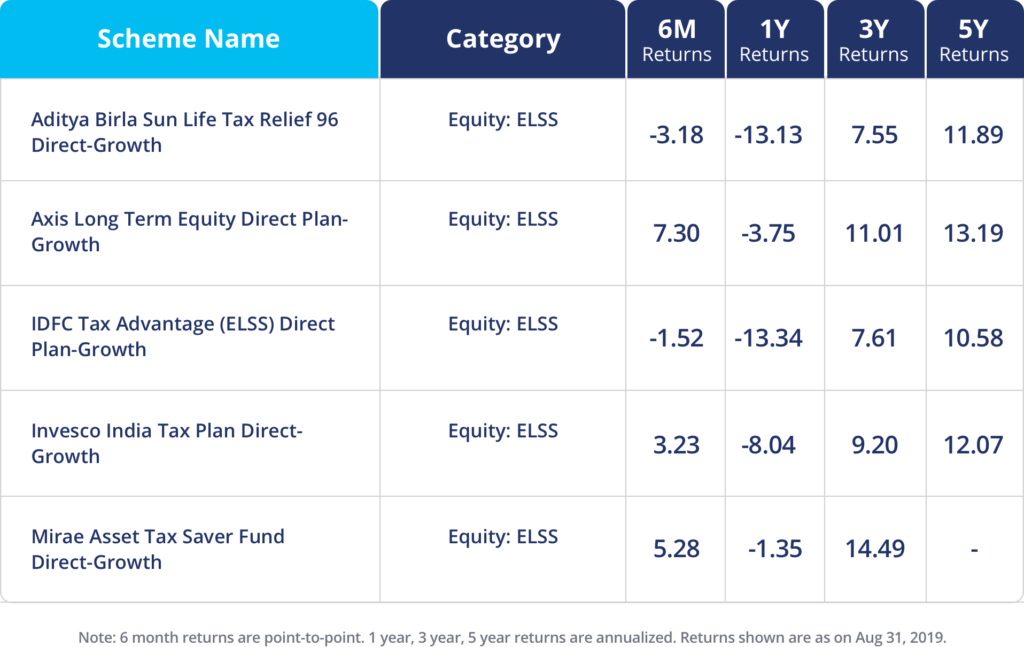

Top 5 funds that saw maximum number of investments in tax saver (ELSS) category in August 2019 were same as the last three months:

Explore more ELSS Tax Saver Funds here

As an investor you should take into account your investment objective, investment horizon and risk profile before making any investment decisions. Don’t merely invest in Mutual Funds looking at the returns or without understanding the risks associated.

For users who always wanted to invest in Mutual Funds but don’t know how to get started, we suggest them to explore Investment Packs on Paytm Money app which are designed to take care of your investment needs based on your risk profile & make this investment choice simpler for you!

Note: Maximum investments is on the basis of number of investment transactions. * denotes non-inclusion of liquid category while calculating maximum investments across categories on Paytm Money. All schemes are arranged alphabetically; this is mere presentation of investment statistics on Paytm Money by volume of investments and should not be considered as investment advice.

Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.