December 2019: These Mutual Fund Schemes saw Maximum Investments on Paytm Money3 min read

The equity and debt markets started the month of December on a volatile note as RBI left the repo rate unchanged and sharply cut the growth forecast for the year, but witnessed a good run up as the month ended. Easing US-China trade tensions, victory of the ruling Conservative party in UK elections and indication by the US Fed that there will be no rate hikes in 2020 led to Nifty and Sensex touching their all-time highs in December. Debt markets, which were troubled by fiscal slippage concerns at the month start also rallied with the announcement of ‘Operation Twist’ by RBI i.e. the simultaneous buying of 10 year bonds and selling of short term bonds to bring down the long term borrowing costs of the government.

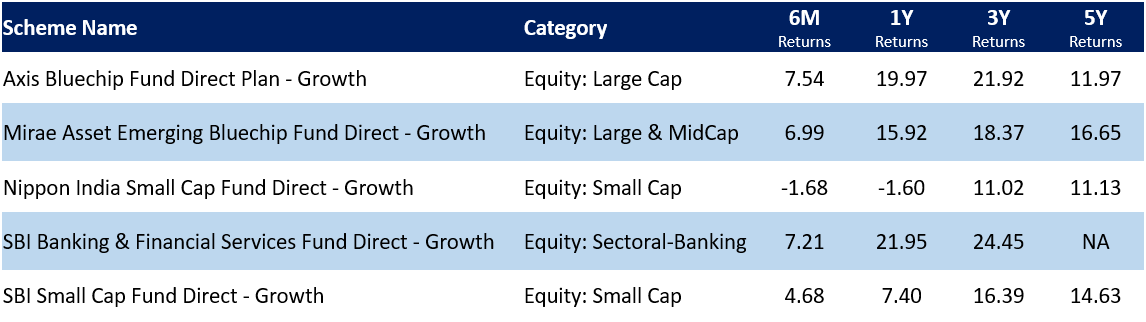

Equity funds continue to witness huge investments on our platform. Investments were primarily in Large cap, Large and Midcap, ELSS and Small cap categories. Investors should continue to look at these funds from a long term perspective of 5 years or more and not base their decisions on short term volatility that is inherent in equity funds. This volatility can be used by the investor to his/her advantage by taking the SIP route and benefiting from rupee cost averaging.

Mutual Fund Schemes seeing maximum number of investments across categories*:

1. Axis Bluechip Fund Direct Plan – Growth

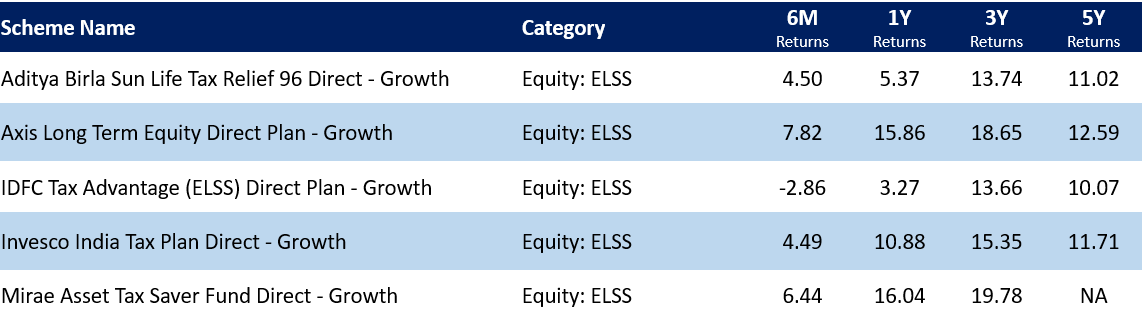

2. Axis Long Term Equity Direct Plan – Growth

3. Mirae Asset Emerging Bluechip Fund Direct – Growth

4. Mirae Asset Tax Saver Fund Direct – Growth

5. SBI Small Cap Fund Direct – Growth

Large cap funds now see maximum traction amongst the equity mutual funds along with small cap funds, owing to the narrow rally in the markets. The list of top 5 equity funds that saw maximum investments in December 2019 are as shown below:

Explore more Equity Schemes here

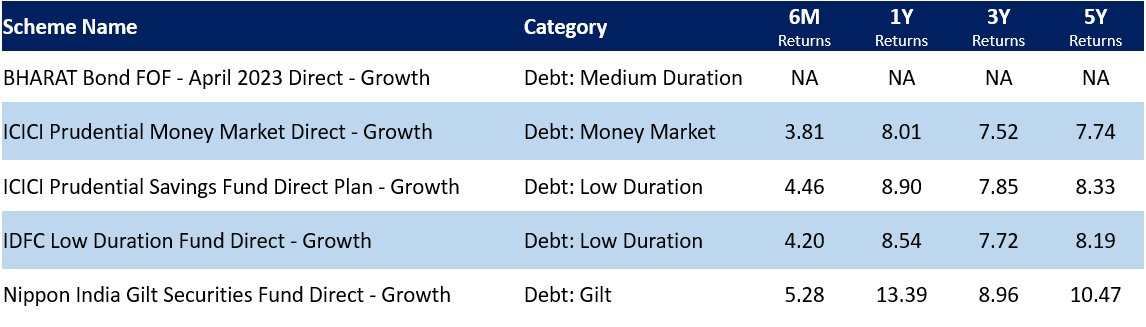

Bharat Bond FoF, which was launched as an NFO during the month witnessed maximum investments in the debt category. Investors continued to place their faith predominantly in low duration and Money market categories to steer clear of credit and interest rate risk in December 2019. Top 5 debt mutual funds* that saw maximum number of investments on our platform are shown below:

Explore more Debt Schemes here

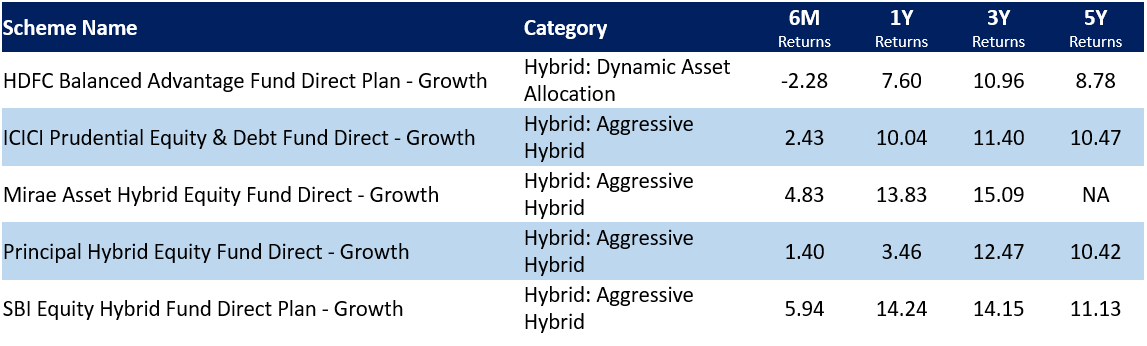

In the hybrid category, investors continue to prefer Aggressive hybrid funds over the other sub-categories. Top 5 funds that saw maximum number of investments across hybrid categories in December 2019 are as shown below:

Explore more Hybrid Schemes here

The list of Top 5 ELSS funds that witnessed maximum number of investments are:

Explore more ELSS Tax Saver Funds here

Do not base your investment decisions solely on fund returns! Instead, focus on your investment objective, investment horizon and risk profile while making an investment decision.

For users who always wanted to invest in Mutual Funds but don’t know how to get started, we suggest them to explore Investment Packs on Paytm Money app which are designed to take care of your investment needs based on your risk profile & make this investment choice simpler for you!

Note: Maximum investments is on the basis of number of investment transactions. * denotes non-inclusion of liquid category while calculating maximum investments across categories on Paytm Money. All schemes are arranged alphabetically; this is mere presentation of investment statistics on Paytm Money by volume of investments and should not be considered as investment advice.

Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.