January 2020: These Mutual Fund Schemes saw Maximum Investments on Paytm Money2 min read

The month of January was a rocky one for equities as global events dented investor sentiments. Nifty and Sensex fell 1.69% and 1.28% respectively. US – Iran tensions, Coronavirus outbreak, sell off in equities owing to incoming Union Budget and weak corporate earnings were among the major reasons to impact the equity market in January. Debt markets broadly remained flat.

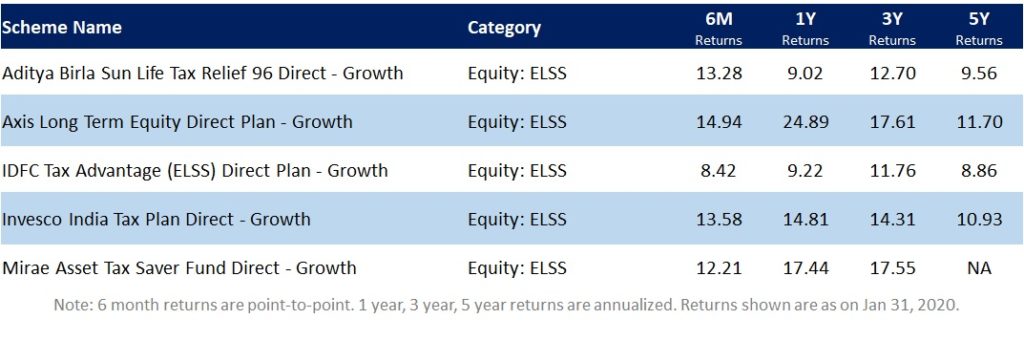

Investors on our platform continued to invest in equity schemes. With the tax saving season being back, ELSS funds saw maximum investments followed by large cap and small cap funds. However, small cap funds are highly volatile in nature in the short term. So make sure that you are comfortable with the risk involved in these schemes before investing in them. Invest according to your risk profile to avoid any unwanted surprises. Also, you can mitigate the volatility to an extent by investing via SIP route. Investors should look at the long term consistency of returns instead of looking at short term returns before investing in mutual funds.

Mutual Fund Schemes seeing maximum number of investments across categories*:

- Axis Bluechip Fund Direct Plan – Growth

- Axis Long Term Equity Direct Plan – Growth

- Mirae Asset Emerging Bluechip Fund Direct – Growth

- Mirae Asset Tax Saver Fund Direct – Growth

- SBI Small Cap Fund Direct – Growth

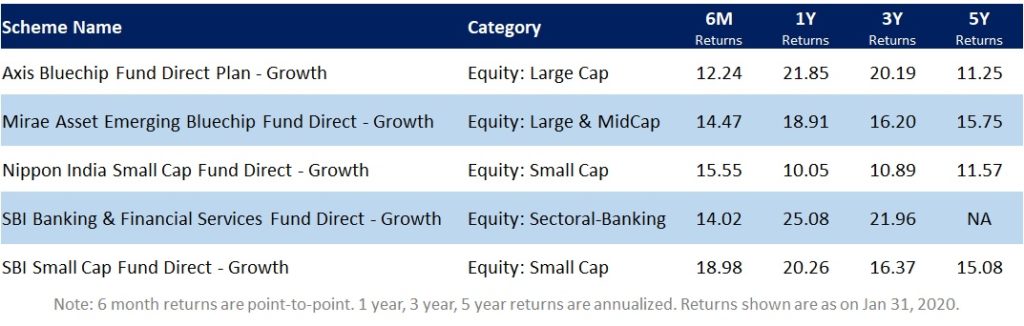

Large cap funds continued to see maximum investments along with small cap and banking and financial services funds. The list of top 5 equity funds that saw maximum investments in January 2020 are as shown below:

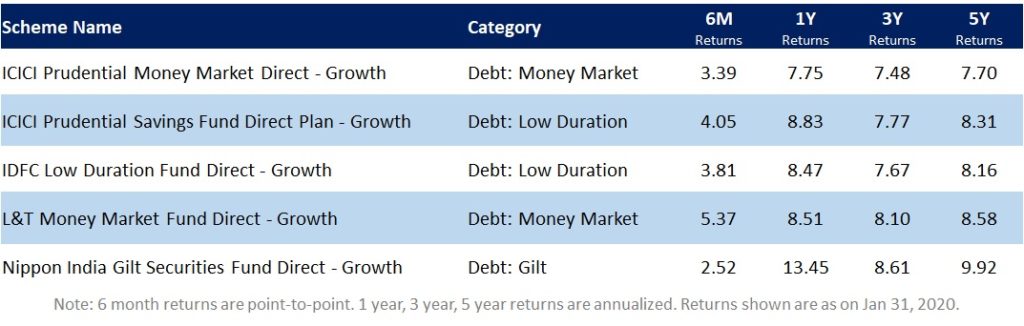

Shorter duration categories such as Money market and Low duration funds witnessed maximum investments from users. Top 5 debt mutual funds* that saw maximum number of investments in January 2020 on our platform are shown below:

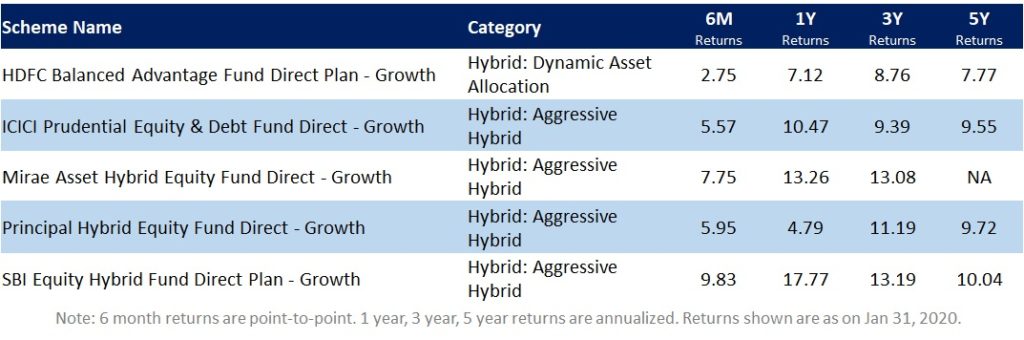

Balanced schemes that saw maximum investments in December 2019 continued to garner investments in January 2020 too. Top 5 funds that saw maximum number of investments across hybrid categories are as shown below:

The list of Top 5 ELSS funds that witnessed maximum number of investments in January 2020 are:

As mentioned earlier, do not base your investment decisions solely on short term returns, rather take your investment objective, investment horizon and risk profile into account while investing.

For users who always wanted to invest in Mutual Funds but don’t know how to get started, we suggest them to explore Investment Packs on Paytm Money app which are designed to take care of your investment needs based on your risk profile & make this investment choice simpler for you!

Note: Maximum investments is on the basis of number of investment transactions. * denotes non-inclusion of liquid category while calculating maximum investments across categories on Paytm Money. All schemes are arranged alphabetically; this is mere presentation of investment statistics on Paytm Money by volume of investments and should not be considered as investment advice.

Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.