MTAR Technologies IPO Details – Price, Date & Overview4 min read

It’s raining IPOs, and the latest company to join the queue is the engineering solutions providing company MTAR technologies.

The company manufactures critical and differentiated engineered products in the nuclear, space and defense, and clean energy segments, and owns seven manufacturing facilities in Hyderabad, including an export-oriented unit.

The Hyderabad-based company’s Rs 596-crore initial public offering (IPO) will open for subscription on Wednesday, March 3, 2021, and will close on 5th March 2021.

The engineering solutions company has fixed the price band for the issue at Rs 574-575 apiece and is looking to sell Rs.1.037 crore shares, a mix of fresh issues, and an offer for sale.

IPO details

The initial public offer (IPO) of MTAR Technologies consists of a fresh issue and offer-for-sale of Rs.1,037 crores. The company has set a price band of Rs.574- Rs.575 per share.

The same is set to open for subscription on 3rd March, Wednesday, and will be available till 5th March, Friday.

The lot size for this IPO is 23 shares and in multiples thereafter.

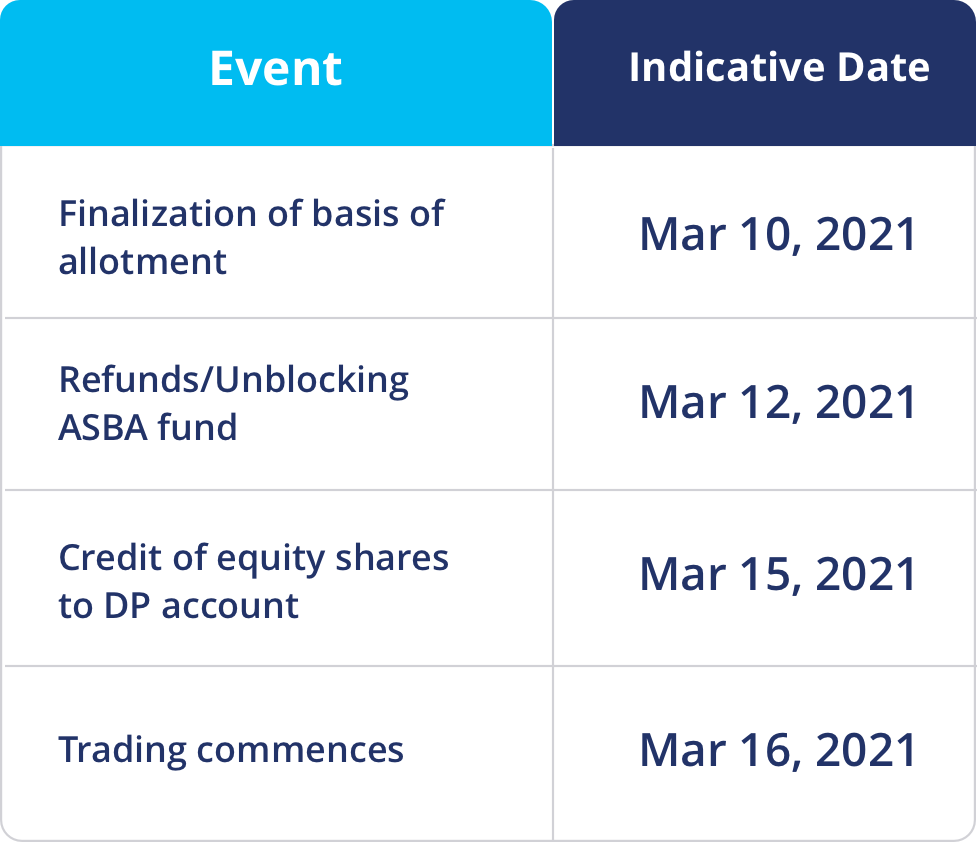

IPO Timeline

About the Company

MTAR Technologies Limited first began its operations in 1970 as a partnership firm and was incorporated into the company in 1999. In 1970, MTAR established its first Unit for orders from Bharat Heavy Electricals Limited (BHEL).

The Hyderabad-based company is engaged in the manufacturing of mission-critical precision components with close tolerances (5-10 microns), and in critical assemblies, to serve projects of high national importance, through its precision machining, assembly, testing, quality control, and specialized fabrication competencies, some of which have been indigenously developed and manufactured.

Currently, the company has seven state-of-the-art manufacturing facilities in Hyderabad, Telangana that undertake precision machining, assembly, specialized fabrication, brazing, heat treatment, testing, quality control, and other specialized processes.

Reasons To Opt For The IPO

This Offer comprises of a Fresh Issue by the Company and an Offer for Sale by the Selling Shareholders. The Company will not receive any proceeds from the Offer for Sale.

The Company proposes to utilise the Net Proceeds from the Fresh Issue and the proceeds of the Pre-IPO Placement towards funding the following objects:

1. Repayment/prepayment in full or in part, of borrowings availed by the Company

2. Funding working capital requirements;

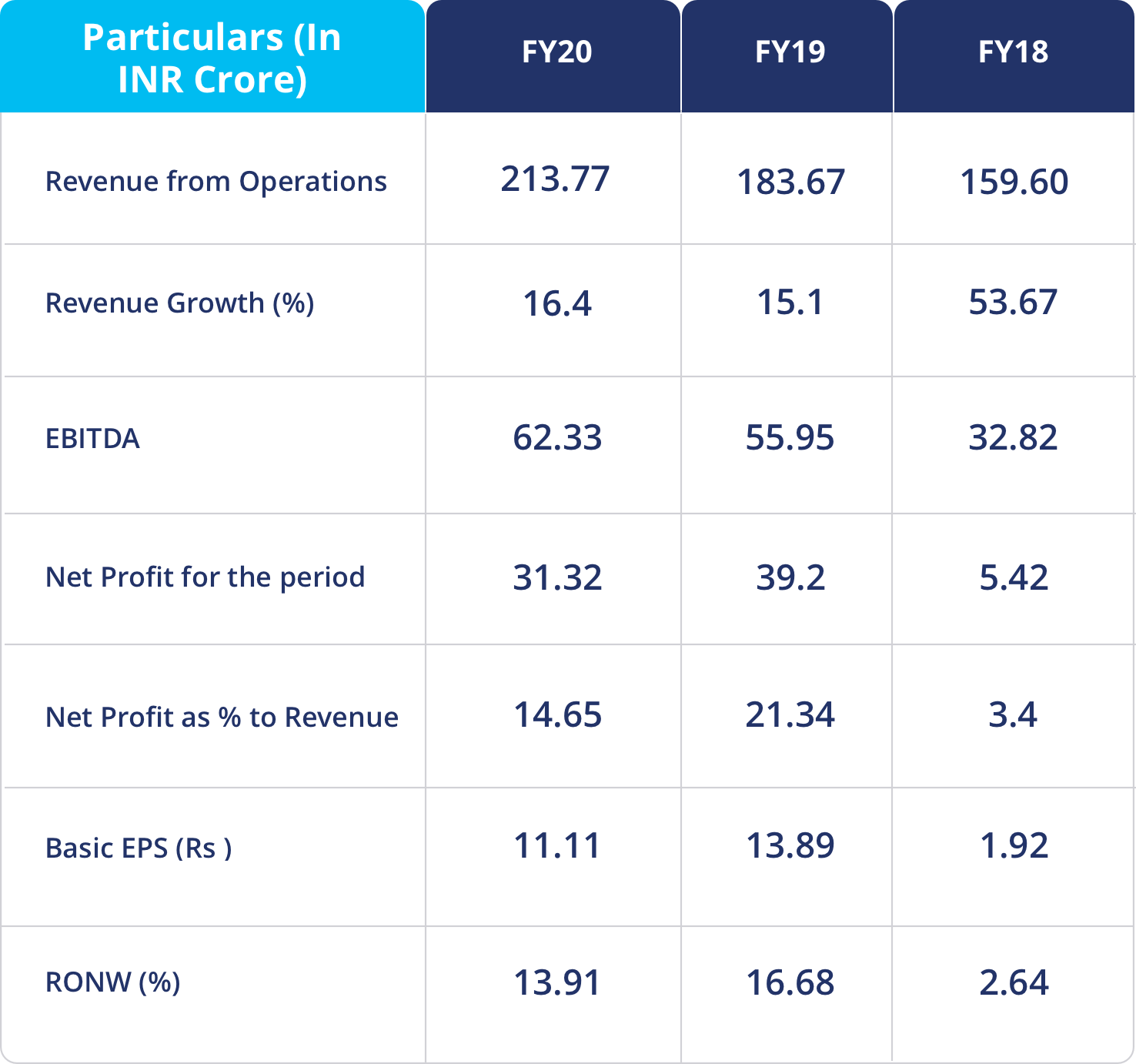

Important Financial data

In the Fiscal ended 2020, and in the six months ended September 30, 2020, their total income was Rs.218.14 Cr and Rs.122.61 crores respectively.

Their restated profit for the period/year has grown at a CAGR of 140.31%, from Rs.5.42 Cr in Fiscal 2018 to Rs.3.13 Cr in Fiscal 2020, and was Rs.17.22 crores and Rs.19.21 crores for the six months ended September 30, 2019, and for the six months ended September 30, 2020, respectively.

In the Fiscal ended 2020, and in the six months ended September 30, 2020, they reported EBITDA of Rs.62.33 crores and Rs.36.09 crores respectively.

Their aggregate Order Book as of November 30, 2020, was Rs.356.50 crores comprising Order Book in the nuclear, space and defense, and clean energy sectors of Rs93.88 Cr, Rs 172.95 crores, and Rs.8.69 crores respectively.

Company’s Strengths & Weaknesses

Strengths

- It has a significant interest coverage ratio and the lowest gearing ratio in the industry.

- MTAR is not being a typical defense or capital goods company still has a healthy order book at 1.7x FY20 revenue and superior profitability ratios as compared to its peers.

- The company has a strong clientele and has been servicing NPCIL for over 16 years. It manufactures and supplies specialised products such as fuel machining heads, drive mechanisms, bridges, and columns.

- The company has shown a steady performance over the past few years and has a track record of growth in financial performance.

Risks involved

- The precision engineering industry has strict quality requirements and ensuring adherence to the same can be costly. Also, errors can cause a lot of damage.

- Any disruption in supply can negatively affect business revenues.

- Pricing pressure from customers may adversely affect its gross margin, profitability, and ability to increase our prices, which in turn may materially adversely affect its business, results of operations, and financial condition.

- MTAR Technologies owns a large range of equipment, resulting in increased fixed costs. If it is unable to generate adequate cash flow it may have a material adverse impact on its operations.

Apply for IPOs through Paytm Money App in few steps

1. Log in to the Paytm Money app and complete your full digital KYC

2. Once the KYC is done, click on the IPOs on the home screen

3. On the IPO home screen, you can apply for the open IPOs

4. To apply, enter your bidding details like quantity, price, and so on.

5. Enter UPI id & accept the mandate for the same on the UPI app to successfully submit IPO

application.

6. Once the allotment happens, you will be notified about your allotment status.

Conclusion

MTAR Technologies IPO opens on March 03, 2021, and closes on March 05, 2021. The company largely depends on a few customers for a large chunk of its revenue. Any change in government policies could impact its revenue.