How India Invests in Mutual Funds?9 min read

Discover how Indians are fast adopting investments. Here are trends we are seeing at Paytm Money and how we expect 2020 to shape up.

2019 in every sense was a defining year for all of us at Paytm Money. We completed our first year of operations, received overwhelming love and trust, and the support of over 7 Million users. We can’t thank you enough for that 🙂

Every day we work in pursuit of our stated goal – to bring wealth creation opportunities to millions of Indians. We are continually amazed by the usage, behavior and investment trends on Paytm Money in terms of the scope of the product that we are trying to build, and the way it has unfolded over the last year. We have witnessed a massive adoption trend by our users across cities, towns, and villages which has resulted in positioning Paytm Money as the largest investment platform in the shortest possible time in India.

Looking back at 2019, let us see how India invested.

> 98% coverage of India now on Paytm Money:

There are about 19,100 unique pin codes in India, and we have investors from 18,792 of them; which covers 98% of India.

We had always believed that digital distribution is the way to drive the investing culture in our country, and it is humbling to see early signs of this coming true. We understand that we have a long way ahead from here and we are only excited about what’s to come.

Top Cities from where users invested:

Mutual Fund as a sector is extremely under-penetrated in India with 85% of the existing investors of the industry residing in the Top 30 cities of India. Therefore, it comes as no surprise to see this list of cities that highlights where the major fraction of our investors came from, which is closely aligned with the industry trend:

- Mumbai

- Bengaluru

- Hyderabad

- Pune

- Ahmedabad

Over 65% of our investors come from beyond 30 cities

One of the most rewarding achievements for us has been the adoption we are able to see in the B30 cities (beyond the top 30 cities in India as per the AMFI definition); a feat that has left many confounded. Over 65% of our investors are from smaller cities and towns. Here are the towns from where we drew the maximum participation:

- Bardhaman

- Guntur

- Varanasi

- Jodhpur

- Agra

While we are thrilled to see this development – it is heartening to see that we also have many investors from towns like Wayanad, Gadchiroli, Srinagar, Siliguri, Chitradurg, Porbandar, Kanyakumari, Pondicherry, Chittorgarh, Valsad, Udipi, Kota, Jhansi, and many many more.

We are bringing more new investors to the Mutual Funds industry:

At the start of the year, about 80% of our investors were new to capital markets; this, however, is no longer the status quo. In a span of just over a year, we have had many existing mutual fund investors joining Paytm Money. We attribute this shift to our continued focus on disciplined investing (via SIPs), and our platform capabilities like real-time transactions processing (users do not have to worry about following cut-off times that they did traditionally), faster portfolio updates, advanced insights, statements, and switch; but besides all other factors, it is stability that has driven the high transaction processing success rates.

What adds to the joy of building Paytm Money is to witness that over 70% of users that are starting their investment journey with us are first-time investors in capital markets.

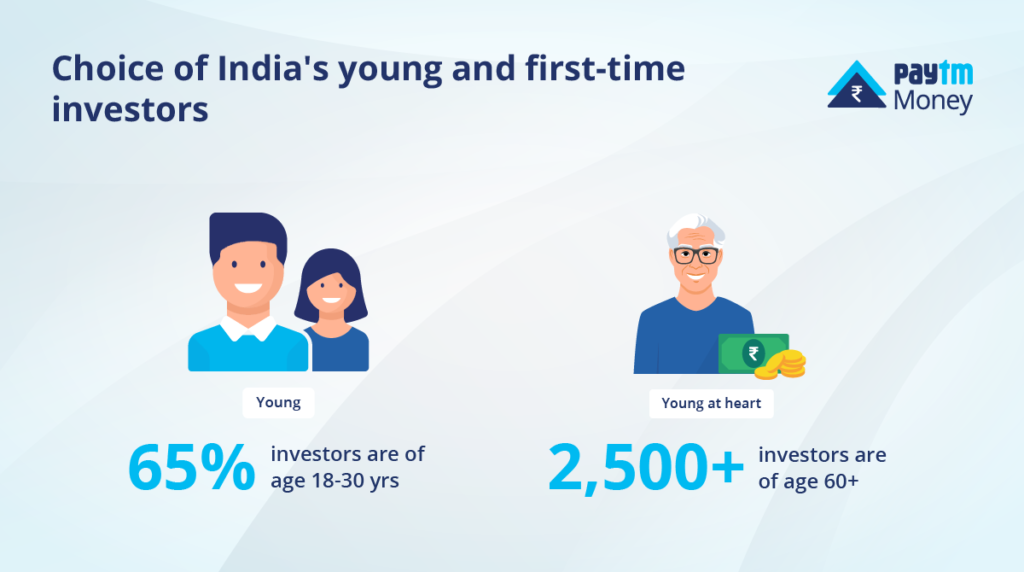

Choice of India’s young & first-time investors:

With a substantial share of our investors coming from the younger demographic, we continue to be the choice of the young and first-time investors.

Over 65% of our investors are between the age group of 18-30 years. In fact, many of these investors are students and first-time jobbers. While the young investors love the blazing fast experience on our app, it is the simplicity and convenience of investing that has attracted many ‘young at heart’ users. We have over 2,500+ investors who are 60+ in age. So, what’s your excuse for not investing?

We have the fastest process to complete KYC and start investing!

One of the biggest reasons that users gave for staying away from investing was the tedious, paper-based and time-consuming process of getting their KYC verified, with multiple back and forth action items. When we started our operations, it took about 3-5 working days for users to be fully investment-ready. Backed by technology, we have been able to ensure that over 90% of all our users are able to complete their KYC & onboarding process and become ready to invest within 30 minutes.

Fastest times:

For a first time user to be investment-ready: < 2 minutes

For an existing investor of mutual funds to be investment-ready: < 1 minute

Over 92% of our investors have a Profitable Portfolio:

Everyone invests with the ultimate intention to build wealth over a period of time, and we feel it is extremely important for us, as a platform, to help our users make informed investment decisions.

Portfolio in Profits:

94% of first-time investors of mutual funds are in profit (unrealised gains).

92% of existing investors of mutual funds are in profit (unrealised gains).

Our constant communication with users has always been about disciplined investing over the years via SIPs, and we intend to continue our emphasis on this message. Investing via SIP is one of the best ways of accomplishing long-term and short-term financial goals for any individual. Markets will fluctuate in the short term, hence, an investment must always be done with a long term horizon in mind.

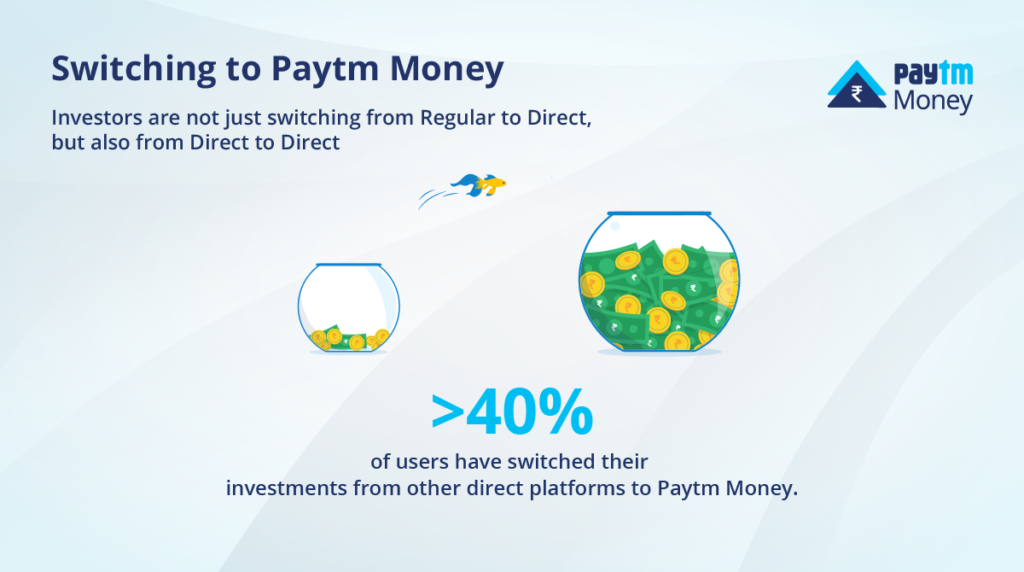

Switching to Paytm Money:

It is our effort in pursuit of delivering a comprehensive investing experience to our users that led to the launch of the ‘Switch to Direct’ feature in the latter half of the year; a feature that allowed investors to switch to direct plans on Paytm Money.

While our expectation largely settled on the premise that this feature would mostly be used by investors to move their regular mutual funds to direct, what came to us as a big surprise was to see over 40% of users switch their investments from AMCs and other direct platforms to Paytm Money.

We see more existing investors now preferring to invest via Paytm Money, and we attribute this to the fact that our platform operates at the industry-leading 99.8% success rate for transaction processing.

Our Peak Investments – Small & Large

We cater largely to investors from smaller cities & towns along with mostly new investors. As our focus has always been on SIP, over 85% of our SIP transactions are valued at INR 500 or less. Thanks to the stability of our platform, investors trust us with high transaction sizes as well.

Max amount invested in a single transaction: INR 50 Lacs

Peak top-up amount to portfolio: INR 24.74 Lacs

When it comes to investing, we don’t set any limits; we allow our users to invest up to INR 99.99 Lacs per transaction.

More SIPs than anywhere else:

Our focus has predominantly been on disciplined investing and the message has been well received and resonates with over 75% of our investors who choose to invest via SIPs as their preferred mode.

When it comes to new SIPs registered, Paytm Money now contributes to ~ 40-45% of all SIPs in Direct MF route and to ~ 12-14% of all SIPs registered in the Mutual Fund industry every month.

The simplicity, convenience, and ability to invest as little as INR 100 through our platform has birthed a trend where we see new investors starting with small investment size and following it with a top-up in their investments via lump-sum transactions.

We continue to grow at a fast pace, but we have a long way to go:

Value of Investments: INR 10-12 Crores / day

Pace: Our peak has been INR 1.49 Cr / hour

SIPs Registered: 7,000+ / day

Max Users Registered: 20,000+ / day

Avg SIPs / user: 2.7

UPI as a mode of investing: >35%

The pace of growth at Paytm Money has been exciting and humbling, to say the least; from the time we have started, we were aware of the possibilities and we are more aware now of the miles we are yet to cover and are nothing but excited and driven.

2020 and the way ahead:

From the very day of our launch, we have constantly worked towards bringing in the simplest and most convenient way of investing for you. We were not perfect, we are not perfect, and we strongly feel that there is much more for all of us to do to further simplify investing.

What are we planning ahead?

Digital Gold:

Paytm Gold – the first wealth management product from Paytm will be managed, going forward, by Paytm Money. Paytm Gold has more users than the estimated ~19 Mn investors of India’s mutual fund industry; we feel this audience is best suited to be introduced to Mutual Fund investments.

Mutual Funds:

Thanks to your love and trust that has made us the largest MF investment platform in India in less than a year, we feel we have just made investing simpler now and that there is a lot more we can do to deliver an awesome investment experience. We are working closely with many of our partner AMCs to bring a much more superior experience to you this year.

NPS:

Planning for retirement is one of the most important things you must do; unfortunately, accessibility to an awesome product like NPS has been restricted to few. Our NPS offering is in the final stages of development, and we are beyond delighted about bringing it to you packed with many industry-first product and feature offerings.

Stock Investing:

We are absolutely overwhelmed with the amount of interest we have received about the upcoming Stock Investment product from Paytm Money. It is taking us a bit longer than we had anticipated earlier and this is largely because we intend to build this for first-time investors.

Most investors have stayed away from Stock Markets not because they are risky, but more so because the existing stockbroking platforms are a mix of features that seem very complex and intimidating to many. We are solving this by removing a lot of complexities involved, and hope to bring to you a very simplified investing platform like never before – one that will not just help people like you and us invest, but make it convenient even for someone who drives an auto-rickshaw, runs a small tea-shop, sells you vegetables or groceries, or even delivers your food.

An investment platform that truly lets every Indian participate in India’s economy by enabling them to invest in Indian companies. Coming your way- very soon.

Our journey has just started…Upwards and Onwards!

Thank you

Team @ Paytm Money