Netflix wins the 2020 binge game, retains its throne6 min read

“Did you watch Queen’s Gambit on Netflix?” was probably the most asked question over the last month. All we could see were memes, posts, and discussion threads on social media about this show on Netflix. The streaming company recently debuted the widely praised series The Queen’s Gambit and Bridgerton, a new season of “The Crown”. The George Clooney film The Midnight Sky was also much applauded.

The Covid-19 and what seemed like a never-ending lockdown that gave OTT platforms a much-needed boost for their businesses. With work from home shenanigans, the only resort people had to escape from the monotonous life was to latch on to series and movies on the OTT platforms.

Globally, millions of people stayed entertained by Netflix shows such as Tiger King, The Crown and Regency romp Bridgerton, which remains far larger than latecomer rivals such as Disney + Hotstar, Apple TV+, Alt Balaji, and so on.

Benchmarking at 200 mln

Netflix reported its fourth-quarter earnings earlier this week in which the streaming company said that its global subscribers crossed 200 million by the end of 2020.

Despite all the new competition and Netflix’s recent price hikes, the service managed to reportedly add 8.5 million subscribers in the fourth quarter, a couple million more than analysts were expecting, which were predominantly outside the U.S.

The OTT giant added 25.9 million customers in the first six months of last year and ended up adding a record 36.6 million customers in all. Subscriber additions reportedly topped Wall Street estimates of 6.1 million.

After the addition of new subscribers, Netflix’s global subscriber base reached 203.7 million. The company, which started its streaming service in 2007 added the highest subscribers in 2020 than in any other year, boosted by viewers who stayed home during the lockdown.

As per the media reports, the company’s most of its subscriber growth in 2020 i.e. 83% of new customers – came from outside the US and Canada. Europe supplied 41% of its new customers – almost 15 million subscribers, while Asia added 9.3 million customers, which is the second-highest after Europe.

Lights! Camera!! Action!!! – Shows that Sailed Netflix’s Boat

The diversity of shows on Netflix is what will help the streaming shark continue to grow, both at home and abroad, in the face of growing competition.

The English-language “Queen’s Gambit” and “Bridgerton” were both major hits for Netflix. “Queen’s Gambit” was reportedly viewed by 62 million households in its first 28 days of service, while “Bridgerton” is on track to reach 63 million accounts.

“Lupin,” a French crime series starring Omar Sy, has become the second-biggest debut in the company’s history. It’s on track to be watched by 70 million households in its first 28 days on the service.

Winning hearts with the “I’m feeling lucky option”

With Netflix and other OTT platforms having vast content on their apps, people are often confused as to what they should watch and end up endlessly scrolling through the options. The company has taken another step towards customer satisfaction by its “I’m feeling lucky option.”

During its fourth-quarter (Oct-Dec) earnings call, the company confirmed the development. “A new feature that we’ve been testing and we’re going to now roll out globally because it’s working for us, where our members can indicate to us that they just want to skip browsing entirely, click one button and we’ll pick a title for them just to instantly play,” said Greg Peters, Chief Operating Officer and Chief Product Officer at Netflix during the call.

Taking Debt Off the Watchlist

2020 was indeed the best year for Netflix, as the company stunned investors and reportedly announced that it’s “very close” to becoming a true cash-flow-generating company and that it no longer needs to borrow to finance its operations.

The debt was a looming concern for Netflix as the company has consistently reported profits, but it had to borrow billions of dollars to fund its spending on new programs. The world’s largest streaming service had raised $15 billion through debt in less than a decade. It had a negative free cash flow of $3.3 billion in 2019, its worst on record. Since then, it’s turned a corner.

The company projected that it will no longer need to borrow billions of dollars to finance its broad slate of TV shows and movies.

Netflix reportedly said that it expected free cash flow to break even in 2021, adding in a letter to shareholders, “We believe we no longer have a need to raise external financing for our day-to-day operations.”

Free cash flow will be close to the break-even point in 2021, Netflix said. Analysts had projected a negative $619.7 million.

Utha Liya Re Baba, Mereko Nai…Share Price Ko

After the world’s largest streaming company announced its results, a milestone of 200 mln subscribers, and said that it will no longer need to borrow money to finance its operations the company’s shares on Wall Street surged 14% to add more than $30 billion to its market capitalization, helping boost the broader tech-heavy Nasdaq 100 index.

Shares of Netflix rose nearly 13% in extended trading as the financial milestone validated the company’s strategy of going into debt to take on.

Kitne OTT Hai..?

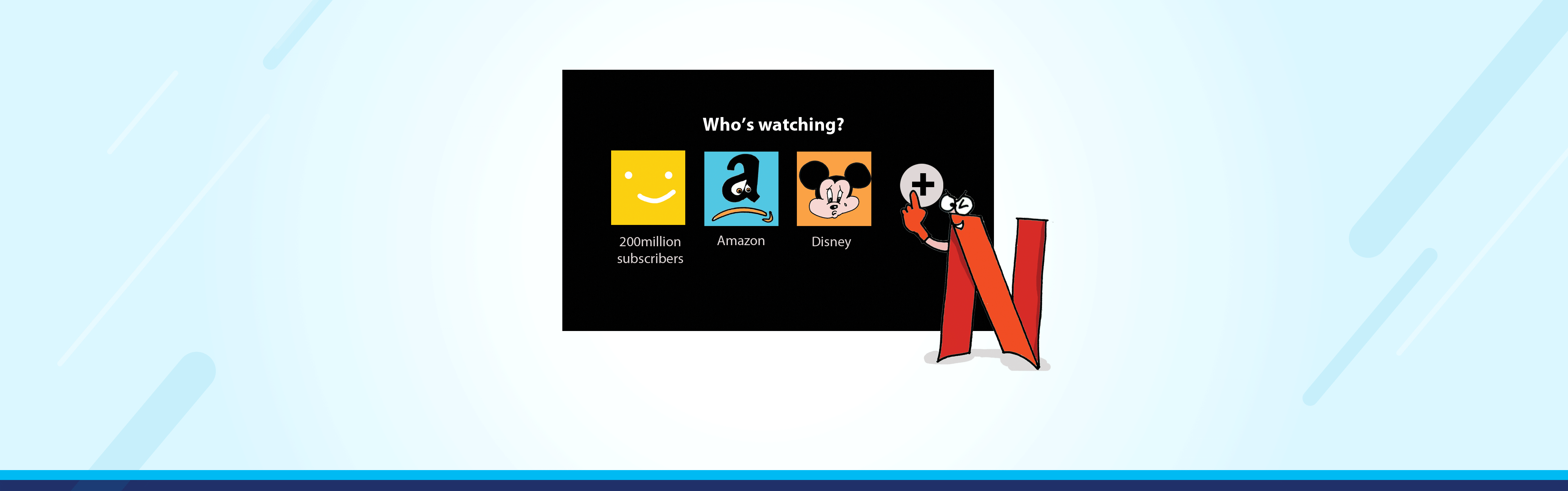

Netflix has many global and local competitors that have announced their aggressive streaming strategy.

In December, Walt Disney unveiled a hefty slate of new programming for Disney+, while AT&T Inc’s Warner Bros scrapped the traditional Hollywood playbook by announcing it would send all 2021 movies straight to HBO Max alongside theaters.

Disney said in December it had already signed up 86.8 million subscribers to Disney+ in just over a year.

Commenting on the competition Netflix’s Co-Chief Executive Reed Hastings reportedly said, “It’s super-impressive what Disney’s done.” Disney’s success, he added, “gets us fired up about increasing our membership, increasing our content budget.”

Meanwhile, Disney and other streaming companies have shifted their focus to the paid streaming business as the pandemic has left movie theatres, theme parks, and cruise ships desolate.

Way Forward

During the pandemic, Hollywood productions had to be shut and other media corporations were coping with the content shortage. On the contrary, Netflix was releasing its built up hit series and movies amid the lockdown. In 2021, the company is all set to release a new movie every week.

Going forward, the company is also expected to be generating cash and it reportedly said to be exploring returning excess cash to shareholders via share buybacks. As per media reports, analysts at J.P. Morgan Securities said the company is likely to begin share buybacks in the second half of the year.

If you look at Netflix’s subscriber forecasts, the company has said that for the Jan-Mar quarter it would sign up 6 million more global subscribers.