Options trading can be a complex and risky endeavor, and it is important to understand the risks involved before engaging in any options trading strategy. That being said, here are a few general strategies you could use to generate weekly income.

Selling Covered Calls

In this strategy, call options are sold against shares of an underlying asset that you already own. The premium received from selling the call option generates income. If the underlying asset remains below the strike price of the call option, the option will expire worthless and the investor will keep the premium. However, if the underlying asset rises above the strike price, the investor may have to sell the shares at the strike price, limiting potential gains.

Selling Cash-Secured Puts

This strategy involves selling a put option against an underlying asset with the intention of buying the asset if the option is exercised. The premium received from selling the put option generates income. If the underlying asset remains above the strike price of the put option, the option will expire worthless and the investor will keep the premium. However, if the underlying asset falls below the strike price, the investor may have to buy the asset at the strike price from the put option buyer.

Iron Condor

This strategy involves selling both a call option and a put option with the same expiration date, but at different strike prices. The distance between the two strike prices determines the potential profit and risk. The premium received from selling the options generates income, and if the underlying asset remains within the range of the two strike prices, the options will expire worthless and the investor will keep the premium. However, if the underlying asset moves beyond either strike price, the investor may face potential losses.

Let us look at some of these strategies using the Bank Nifty* as an example.

Bank Nifty Covered Call Strategy

The covered call strategy is a popular options trading strategy for generating income from an underlying asset while also providing downside protection. Here’s how the strategy can be applied to the Bank Nifty.

1. Identify the underlying asset: In this case, the underlying asset is Bank Nifty.

2. Buy Bank Nifty shares: Bank Nifty has 12 constituents stocks.

- Axis Bank Ltd.

- Bandhan Bank Ltd.

- Bank of Baroda

- Bajaj Finserv Ltd.

- HDFC Bank Ltd.

- ICICI Bank Ltd.

- IndusInd Bank Ltd.

- Kotak Mahindra Bank Ltd.

- Punjab National Bank

- State Bank of India

- Federal Bank Ltd.

- AU Small Finance Bank Ltd.

*The securities are quoted as an example and not as a recommendation

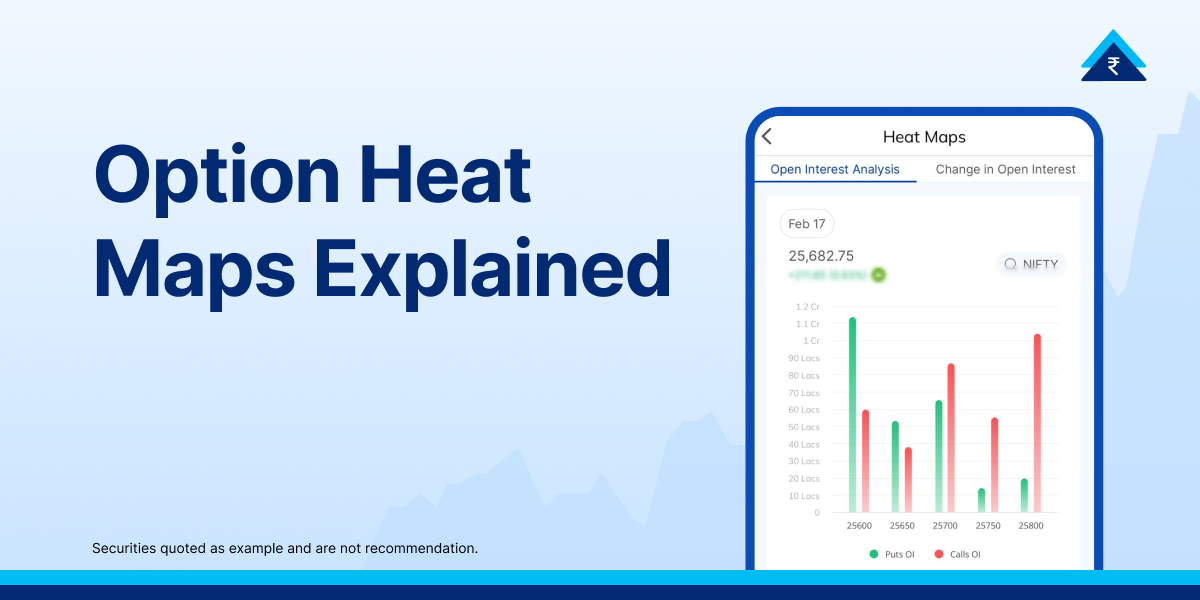

3. Sell Call options: Sell call options against the Bank Nifty shares you own. This is done by selling call options contracts with a strike price above the current market price of Bank Nifty. You may consider selling Call Option strike which has the highest Open Interest. Only 1 call option contract can be sold for one set of Bank Nifty shares. Option selling needs MARGIN which can be partially financed by Margin PLEDGING the stock which you have bought.

4. Receive premiums: For selling the call options, you will receive a premium from the buyer of the option. This premium is yours to keep regardless of whether or not the option is exercised.

5. Profit/Loss: If the Bank Nifty share price remains below the strike price of the call option at expiration, the option will expire worthless and you will keep the premium. However, if the Bank Nifty share price rises above the strike price of the call option at expiration, you may have to sell the shares at the strike price, limiting potential gains.

6. Repeat: If you want to continue generating income from the strategy, you can repeat the process by selling call options again with new strike prices and expiration dates.

The three institutions with the highest weights from the aforementioned list are HDFC Bank, ICICI Bank, and SBIN. All of the shares must be purchased in accordance with the Bank Nifty weightage. You might need to invest around Rs. 10 lakhs for this (BankNifty 40,000 X 25 lot size = 10,00,000).

Bank Nifty Cash Secured Put Strategy

Consider using the cash-secured put strategy to build up your Bank Nifty stock portfolio before beginning the covered call strategy. Cash secured Put is an options trading strategy that involves selling put options on an underlying asset with the intention of buying the asset if the option is exercised. Here’s how the strategy can be applied to the Bank Nifty.

1. Identify the underlying asset: In this case, the underlying asset is Bank Nifty.

2. Identify the desired strike price: Determine the desired strike price at which you would be willing to buy Bank Nifty shares if the option is exercised.

3. Sell Put Options: Sell put options contracts with the desired strike price and expiration date. Remember that by selling the put options, you are obligated to buy the Bank Nifty shares at the strike price if the option is exercised.

4. Receive premiums: For selling the put options, you will receive a premium from the buyer of the option. This premium is the seller’s income regardless of the outcome of the trend.

5. Set aside cash: Set aside cash in your account to cover the purchase of the Bank Nifty shares in case the option is exercised. This may need approx Rs. 10 lakhs capital ( BankNifty 40,000 X 25 lot size = 10,00,000).

6. Profit/Loss: If the Bank Nifty share price remains above the strike price of the put option at expiration, the option will expire worthless and you will keep the premium. However, if the Bank Nifty share price falls below the strike price of the put option at expiration, you may be required to purchase the shares at the strike price using the cash set aside. The premium you have collected after selling the options will remain with you.

7. Repeat: If you want to continue generating income from the strategy, you can repeat the process by selling put options again with new strike prices and expiration dates.

8. Covered call: After you have a portfolio of bank nifty stocks, you can execute a covered call strategy.

Risks in Executing Aforementioned Strategies

It is important to note that the Covered Call and Cash-secured Put strategy is not risk-free, and it is possible to lose money if

Risk related to Covered Call – It is possible to lose money if the underlying asset price falls significantly. Additionally, there is a possibility of being assigned to sell the shares at the strike price if the underlying asset price rises above the strike price.

Risk related to Cash-secured Put Strategy – There’s a possibility of losing money if the underlying asset price falls significantly. Additionally, it is important to have the cash set aside here in case the option is exercised.

These are just a few examples of Nifty & Bank Nifty option strategies to generate weekly/monthly income, and each strategy comes with its own set of risks and rewards. Before engaging in any options trading strategy, it is important to thoroughly understand the market and to consult with a financial advisor.

Disclaimer – Investments in the securities market are subject to market risks, read all the related documents carefully before investing. This content is purely for informational purposes only and is in no way to be considered as advice or a recommendation. The content, examples, and strategies illustrated here are obtained from publicly available sources and are for educational purposes only. Readers are advised to exercise caution, as options trading involves substantial risk and is not suitable for all types of investors. The securities are quoted as an example and not as a recommendation. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete Terms & Conditions and Disclaimers visit: https://www.paytmmoney.com/stocks/policies/terms