Nifty50 Turns 25 | Started at 1,107, Now We’re At ~15,0002 min read

So, our beloved index Nifty50 turned 25 on April 22, 2021.

Nifty50 is India’s benchmark, 50-stock index representing 13 sectors listed on the NSE. With hitting the 15,000 mark just two months before turning 25, Nifty50 has gone through quite a few changes. Let’s see how.

But first, a bit of history.

A Quick Look Back

1996:

Nifty50 launched with a base of 1,000 and was trading at 1,107 by April 1996.

2000:

Touched 1,800 in the midst of the IT boom.

Index futures on the Nifty50 were added to the cart.

2001:

Floated Index options based on Nifty50.

2007:

Zoomed past 5,000.

2017:

GST launch, earnings results and monsoon contributed to the index sky-rocketing to 10,000.

2021:

Nifty50 hit the 15,000 mark this February.

Sectors In The Spotlight

We aren’t alien to the fact that our economy has seen massive changes over the years.

Newer technologies and newer industries took the spotlight and gobbled up the old-timers. The sector weightage in the Nifty50 index follows a similar trend.

Back in 1996, leading the front was Consumer with a sector weightage of 17.6% in the index and then PSU Banks with 12.2%. Today this position is taken up by Financial Services with an allocation of 38.0%, followed by IT with 16.8% as of March 31, 2021.

Get the gist? IT was nowhere back in 1996 and now it holds the #2 spot. Financial Services was bumped up from 12.2% to 38.0% and doesn’t just include PSU Banks anymore but also life insurance companies and NBFCs.

How times have changed.

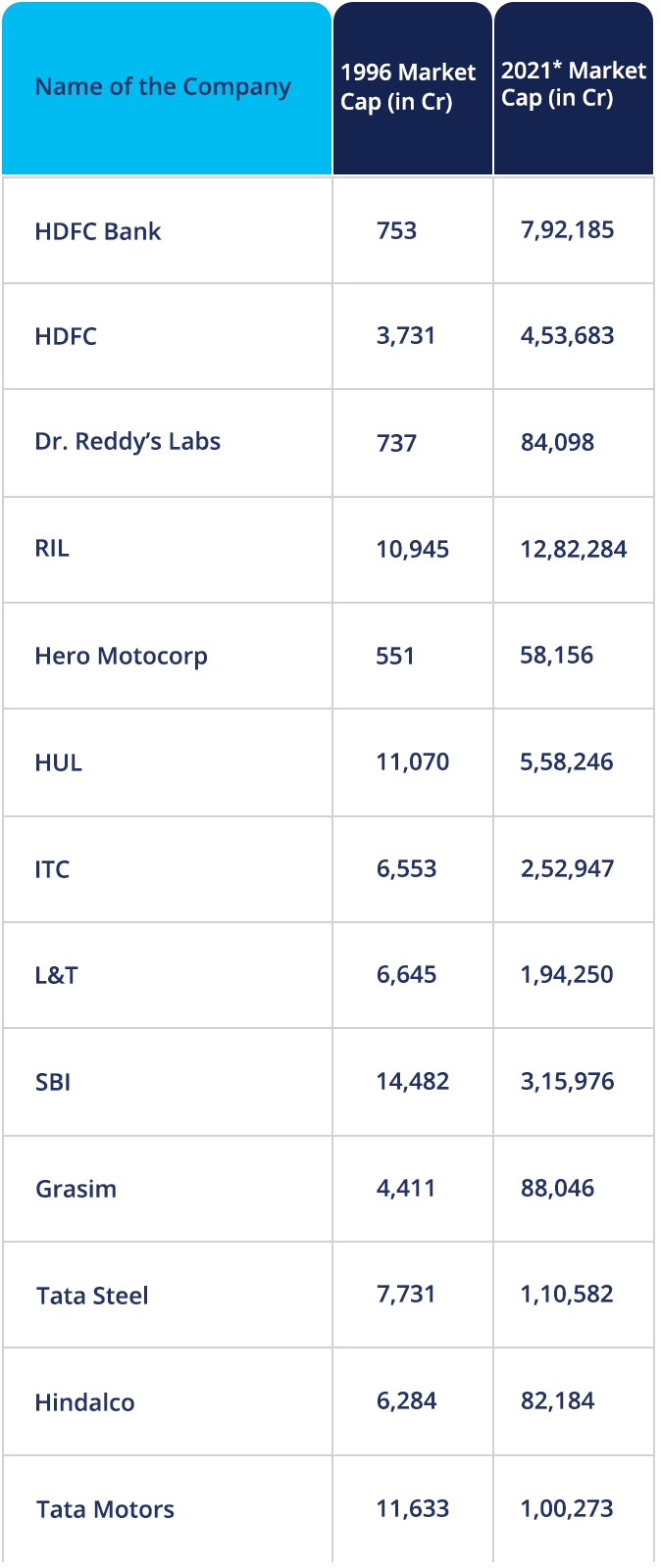

Those Who Stood Strong

Did you know that only 13 stocks out of 50 have managed to stay put in the index from 1996 till now? Here’s how their market cap has changed in 25 years.

Source – Business Standard, Moneycontrol

*as on 27th April 2021

Pat On The Back

Today, not only is Nifty50 one of the most important indexes of India, it is also the most-traded derivatives index and the most-tracked index by domestic exchange-traded funds (ETFs).

All in all, the index has seen it’s fair bit of ups and downs and has yet managed to provide a CAGR of 11.15% from its inception to March 31, 2021.

But still, it has a long, long way to go.

Disclaimer – This content is purely for informational purpose and in no way advice or a recommendation. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.

Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019.