NSE Revises Market Lot of Derivative Contracts of Indices and Stocks1 min read

In its recent circular dated Mar 31, 2020, NSE said that the lot size of indices and stocks derivative contracts will be revised.

This revision in market lot of derivative contracts on indices and stocks is in pursuance of SEBI guidelines for periodic revision of lot sizes for derivatives contracts.

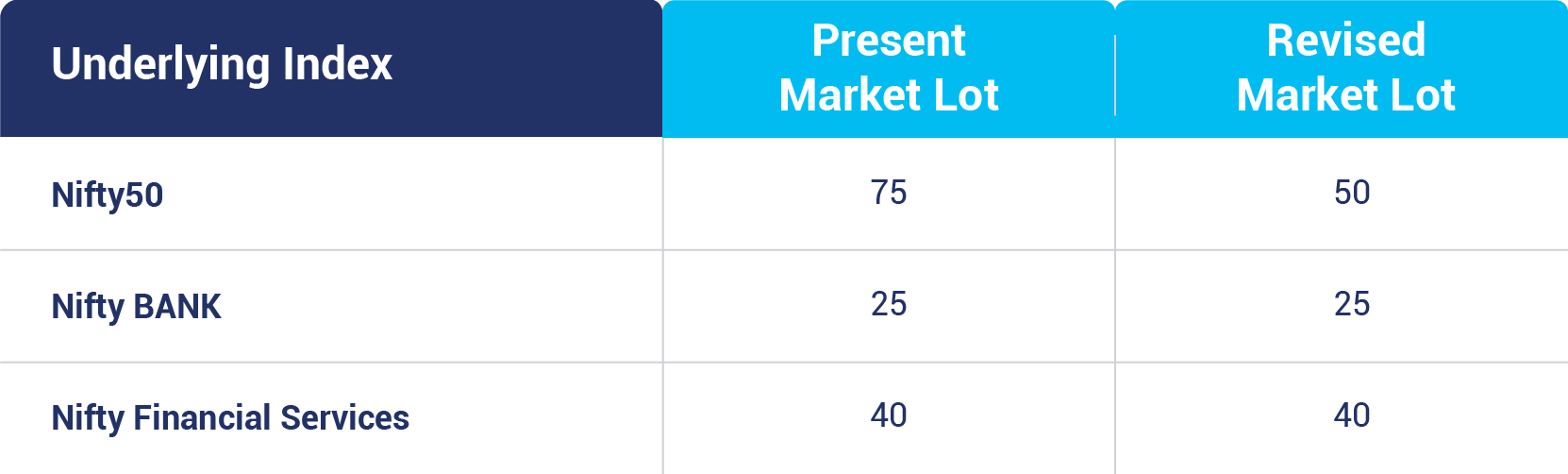

The market lots of derivatives contracts on Indices shall be revised as follows:

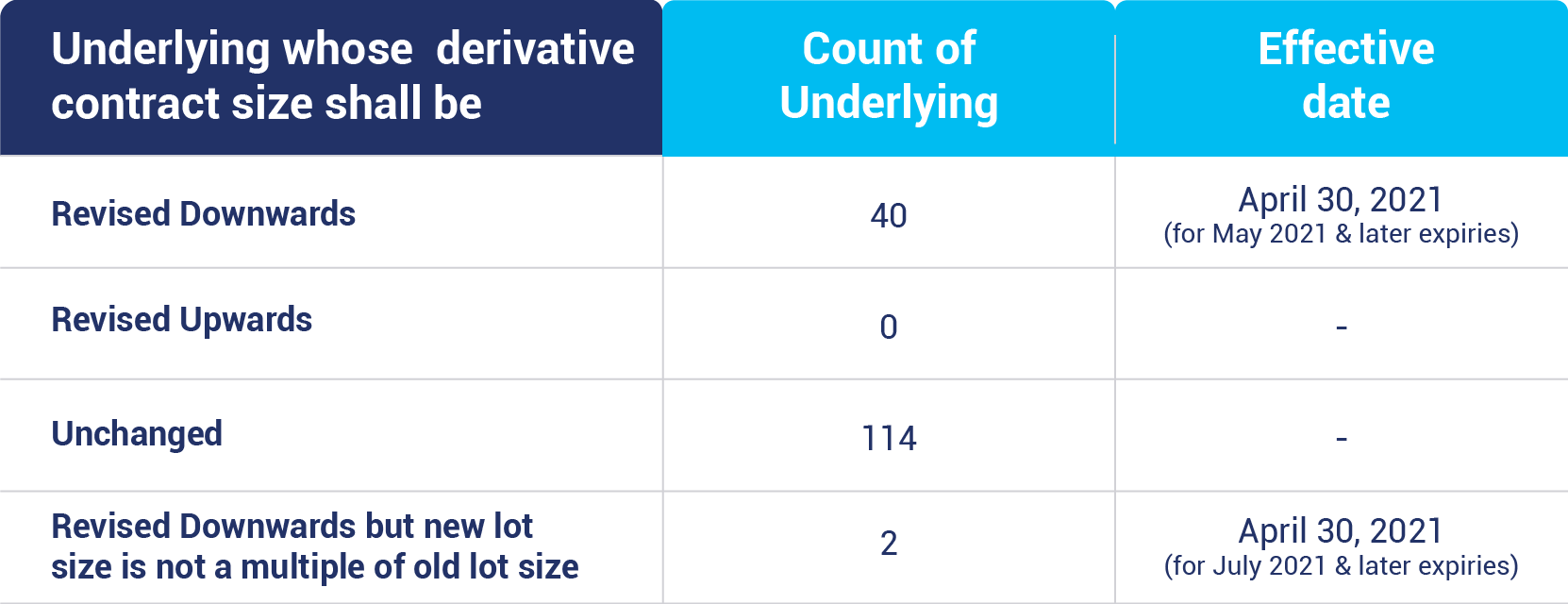

In another circular NSE said, as per the SEBI guidelines a lot of stock derivative contracts will also be revised as per the table given below:

In order to avoid operational complexities, NSE has said that only the far month contract i.e. July 2021 expiry contracts will be revised for market lots. Contracts with a maturity of May 2021 and June 2021 would continue to have the existing market lots. All subsequent contracts (i.e. July 2021 expiry and beyond) will have revised market lots.

Contracts with August 2021 Weekly expiry & beyond will have revised market lots.

For the purpose of the computation, the average of the closing price of the underlying has been taken for one month period of March 01st March 31st, 2021. This circular shall come into effect from April 30, 2021.

The day spread order book will not be available for the combination contract of May 2021 July 2021 and June 2021 July 2021 expiries, NSE said.

The lot size of all existing NIFTY long-term options contracts (having expiry greater than 3 months) shall be revised from 75 to 50 after the expiry of June 2021 contracts (i.e. June 25, 2021).