Nureca IPO Details – Date, Price & Overview6 min read

In 2020, many IPOs were launched in the second half of 2020 after market sentiments improved post the historic March crash. In the period April 2020 to January 2021, the country’s stock exchanges (both NSE and BSE combined) witnessed 19 IPOs and raised proceeds worth Rs. 34,003.78 crores in total.

The Indian market is set to witness more initial public offerings (IPOs) in 2021 as equity markets are zooming in on prospects after the Covid-19 vaccine release. The IPO market is likely to see a number of major launches due to this positivity which has led Sensex and Nifty to record new highs in 2021.

Many investors have their eyes stuck on the upcoming IPOs. Here are the details of Nureca IPO – its overview, opening, closing, and allotment dates.

Contents

Here’s a quick glimpse of Nureca’s Operations

Nureca is a B2C company engaged in the business of home healthcare and wellness products, which offers quality, durability, functionality, usability, and innovative designs. The company enables their customers with tools to help them monitor chronic ailments and other diseases, to improve their lifestyle.

The company believes in innovation and catering new products to the ever-growing needs of the home health care sector. It is a digital-first company wherein it sells its products through online channel partners such as e-commerce players, distributors, and retailers. Furthermore, it also sells products through the website “Dr Trust” – www.drtrust.in.

Nureca has most of the product lines supporting the home health market in India, making it a one-stop solution provider. “Dr Trust” is known for its innovative products in the market, with the segment showing significant potential for growth. Currently, the company offers various products under three brands namely, Dr. Trust, Dr. Physio, and Trumom.

Product Categories

Nureca provides an improved product mix to its customers and their preferences, thereby targeting a wider customer base. The company’s growth is further driven by its ability to make available an assortment of quality products under trusted brands built by the Company.

Nureca’s products portfolio has five categories of products

Chronic Device Products – that includes products such as blood pressure monitors, pulse oximeters, thermometers, nebulizers, self monitoring glucose devices, humidifier and steamers.

Orthopaedic Products – that includes rehabilitation products such as wheelchairs, walkers, lumbar and tailbone supports and physiotherapy electric massagers.

Mother and Child Products – that includes products such as breast pumps, bottle sterilizers, bottle warmers, car seats, and baby carry cots.

Nutrition Supplements – that includes products such as fish oil, multivitamins, probiotics, botin, apple cider, and vinegar.

Lifestyle Products – that includes products such as smart scales, aroma diffusers, and fitness trackers.

Growth in Home Health Segment

The Home Health Market in India and neighbouring countries is reportedly pegged at Rs.20,757.0 crore in 2019 and is expected to grow to Rs.38,920.7 crore by 2025 at a CAGR (Compound Annual Growth Rate) of 11.0%.

The growth is driven by rising awareness of health and wellness, increased spending power, the growing burden of chronic diseases, and the need for healthcare stakeholders to reduce healthcare costs.

Financials of Nureca

A quick glance at the financial performance of Nureca over the last three years highlights the fact that there has been significant growth in revenue. Their revenue from operations has grown at a CAGR of 122.68% during fiscal year 2018 to 2020.

Nureca IPO Listing Details

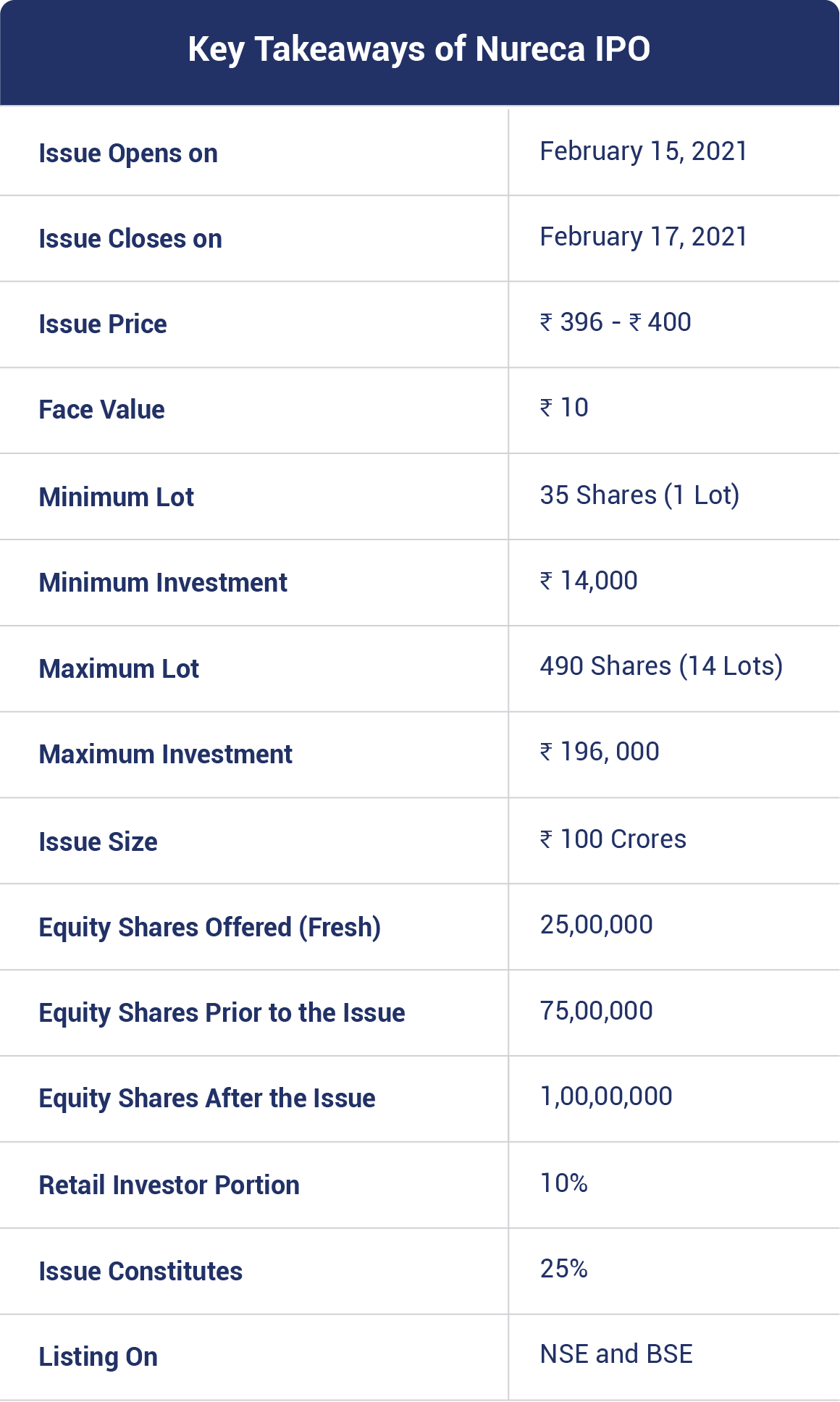

Nureca limited initial public offering of Rs. 100 crores will hit the market on February 15 and close on February 17, 2021. Nureca is issuing shares at a price band of Rs. 396 to Rs. 400 with a minimum lot size of 35 shares and in multiples thereafter. The company is offering up to 25,00,000 fresh equity shares with a face value of Rs. 10 each.

The Promoter of the company is Saurabh Goyal. The lead manager for the issue is ITI Capital Limited and the Registrar for this issue is Link Intime India Private Limited.

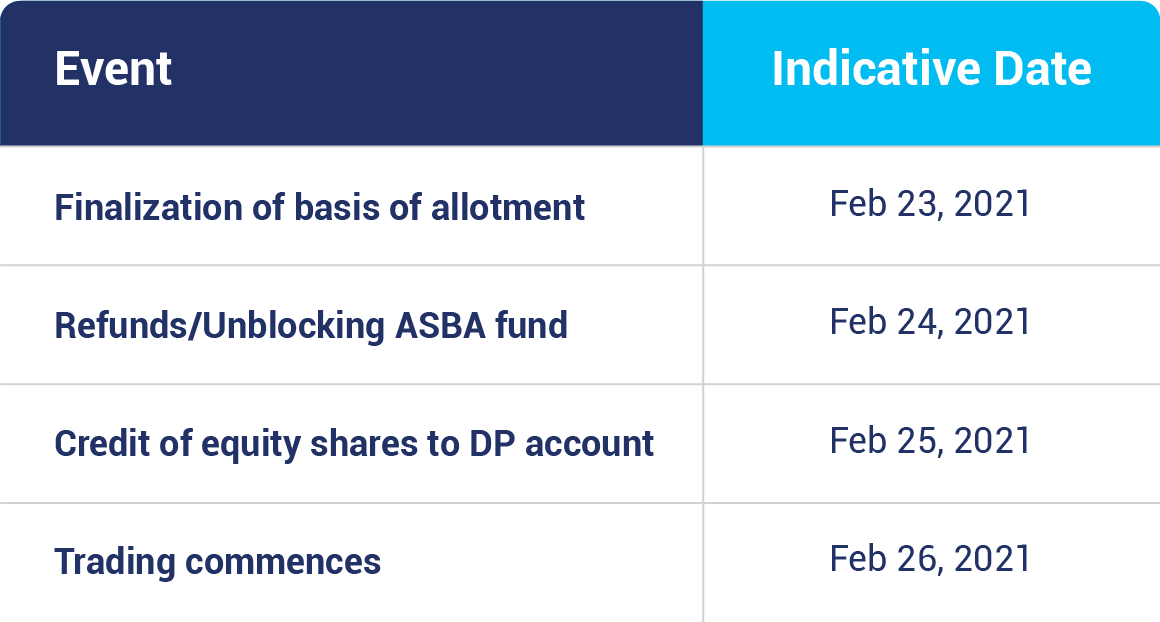

IPO Timeline

Nureca IPO Issue Objective

Nureca Limited proposes to utilise the net proceeds from the fresh issue towards funding its incremental working capital requirements and the rest towards general corporate purposes.

Additionally, the company expects to achieve the benefits of listing of their equity shares on the stock exchanges, enhancement of their company’s brand name, and creation of a public market for their equity shares in India.

Nureca Strengths & Business Risks

Strengths

- Strong portfolio of their products and consistent focus on quality and innovation.

- Asset light business model and competitive products.

- Combination of technical expertise and understanding of Indian consumer preferences.

- Experienced Promoter with a strong senior management team with domain knowledge.

Risks Involved

- Dependence on third-party manufacturers. Failure to produce or inability to meet regulations will impact the business.

- Dependence on channel partners like distributors and e-commerce partners.

- Promoters and members are involved in search and seizure operations by the IT department which can increase tax liability.

- Unsecured loans availed by the company can be recalled by lenders anytime.

- Negative cash flow in the past and may happen in the future.

- Inability to correctly assess demand for their products can affect business.

Summing up

While investing in an IPO, dates are highly important. The bidding on Nureca Ltd IPO will begin from 15 February 2021 on Monday and the last day to subscribe will be 17 February 2021 on Wednesday.

Share allotment to the investors of various categories will be shared on 23 February 2021 followed by the initiation of shares. On 25 February 2021, shares of Nureca Limited will be credited online to the account holder’s Demat account.

By the next day i.e., 26 February 2021, Nureca Limited shares will enter the world of the stock market through NSE and BSE exchanges. Thus, the IPO process cycle will be completed and trading and investing methods will be opened!

How to apply for IPO on Paytm Money

- Log in to the Paytm Money app and complete your fully digital KYC for the stock, if not done already.

- Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

- You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

- Next, you must add details for bidding such as quantity, amount, and so on. Maximum 3 bids are allowed.

- After that, you have to enter your UPI id so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

- Once you accept the mandate, your application will be successfully submitted.

- Once the allotment happens, you will be notified about your allotment status.

Key Takeaways of Nureca IPO