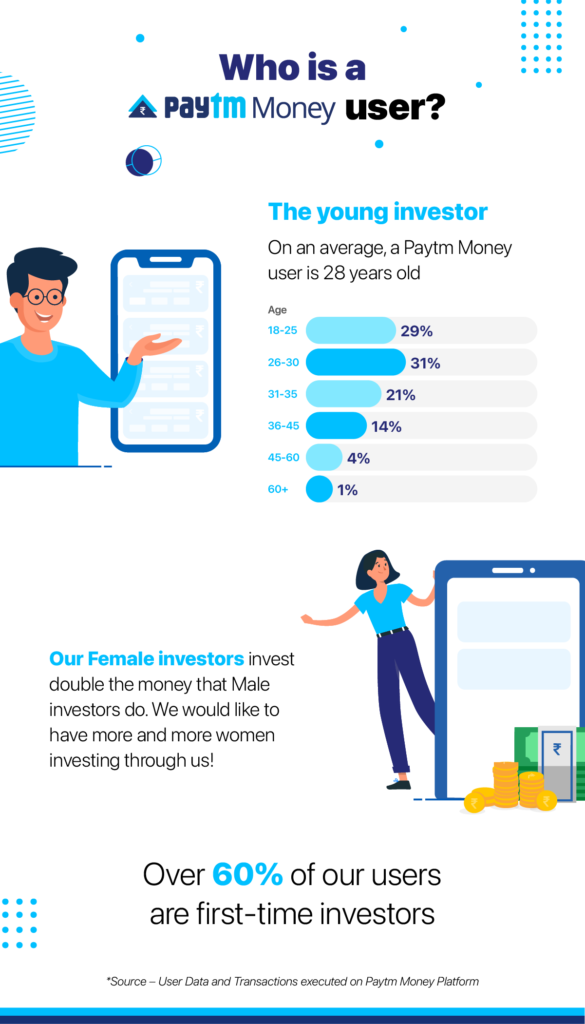

Paytm Money Annual Report: How the young Indian millennial invests4 min read

At Paytm Money, a wholly owned subsidiary of Paytm, we are bringing a fully digital investing experience for Indians. Over the last two years, we have added many exciting products and features to our all-in-one investment app, to make investing accessible.

“In the last one year we have seen a transformation in our users in the way they invest. Through education, open dialogue we have been able to bring the idea of wealth creation & products to new users. We strongly believe that wealth management in the country needs to be democratised, embraced, and adopted by all and we are confident that Paytm Money will play a key role in enabling and empowering users.”

Varun Sridhar, CEO, Paytm Money

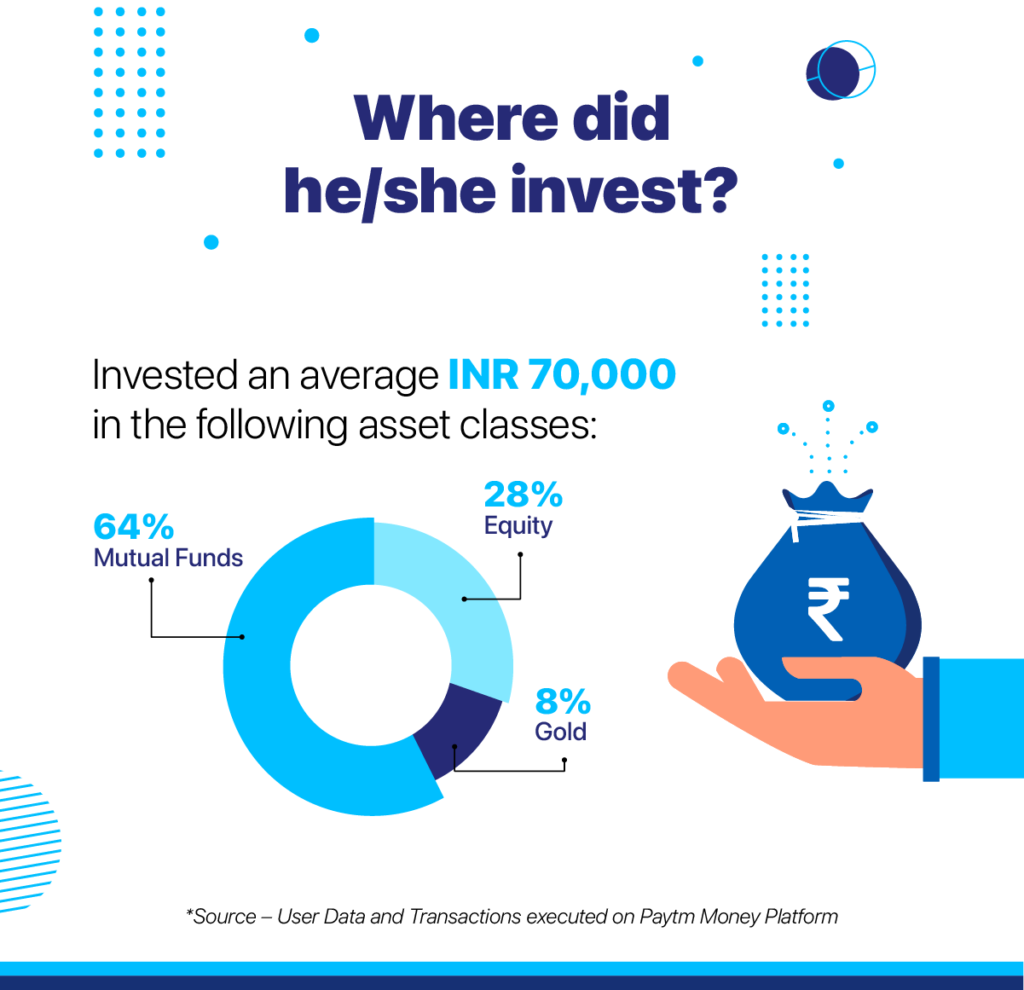

We analysed the data at Paytm Money, and here’s a look at our annual report that shows where our users are investing on an average.

Our simplified user experience allows you to start your investment journey with zero paperwork, seamless digital KYC, automated payments, updated portfolio and powerful insights to take well informed investment decisions. At Paytm Money, we offer trading at brokerage of ₹10 per order for Intraday and F&O.

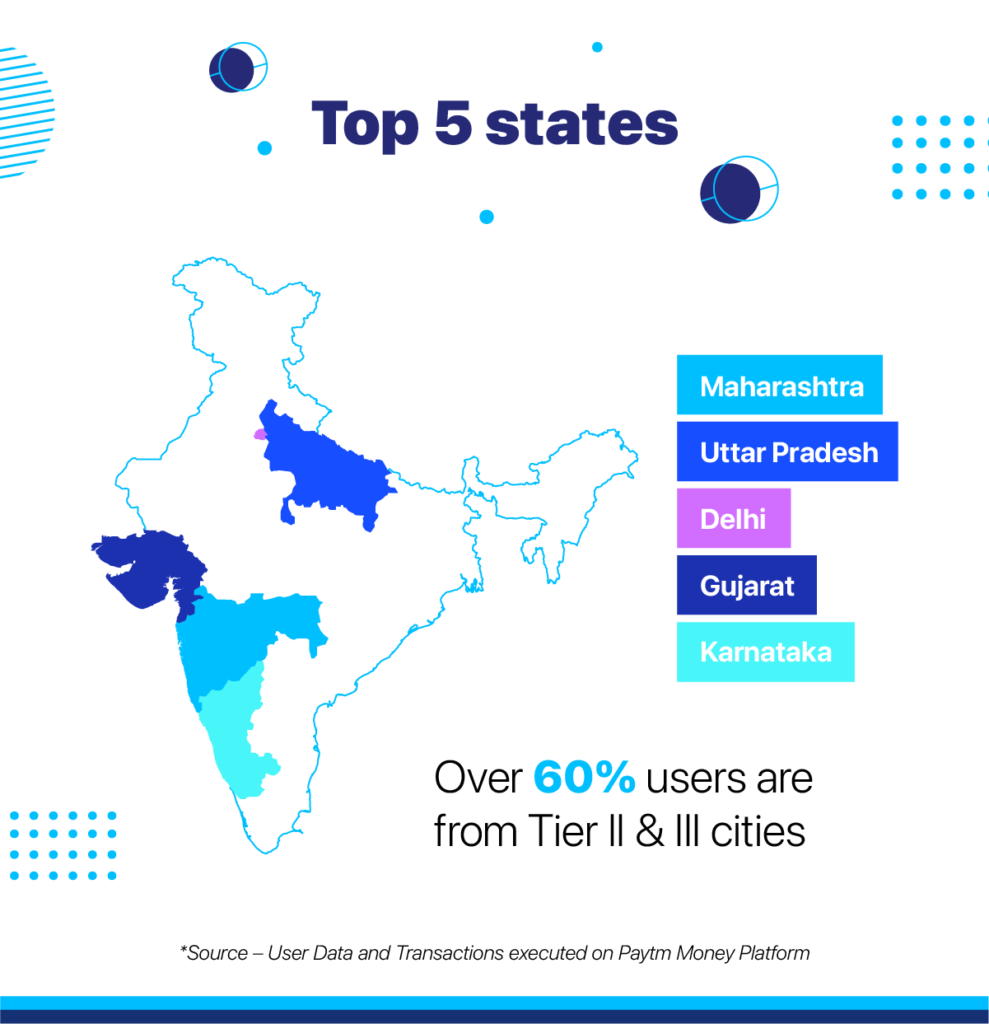

Most of our users come from the states of Maharashtra, Uttar Pradesh, Delhi, Gujarat, Karnataka, but over 60% of our users are from beyond the metropolitan cities.

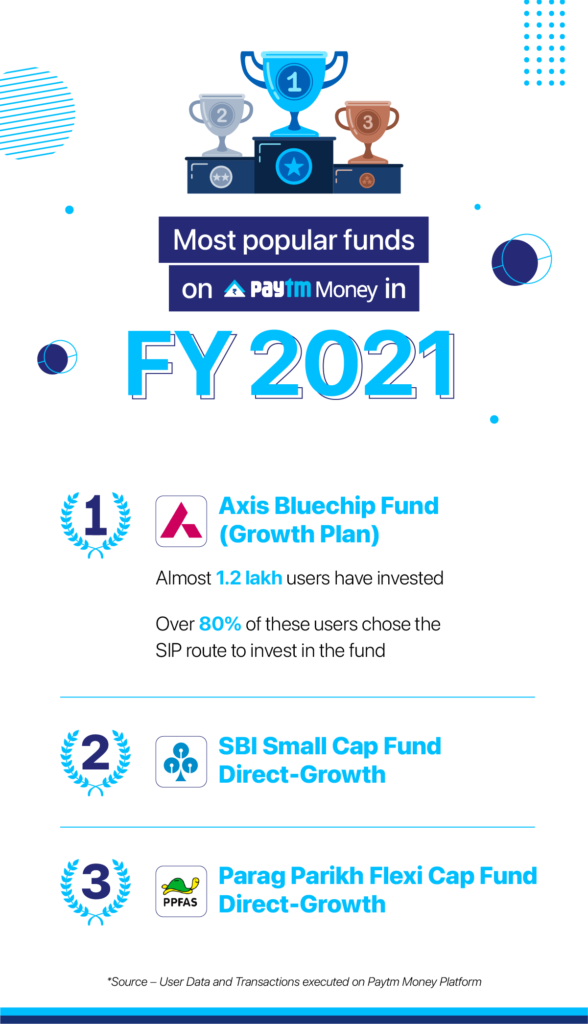

Here’s a look at our most popular offerings, and how our users have leveraged them in FY2021

1. Mutual Funds

Mutual funds are a popular investing option for Indians. There are various types of mutual funds that a user opts for — equity, debt, liquid, among others. Here are some of the highlights in Mutual Fund space as per user transactions and data analysed on Paytm Money:

- Our users are great in terms of Financial Discipline. Over 76% of our users did transact in SIPs and 75% of the total transactions were made through SIPs.

- On an average each user registered 5 SIPs and did 19 SIP transactions .

- Each user did 10 lumpsum transactions on an average

- Average amount invested grew by ~29%

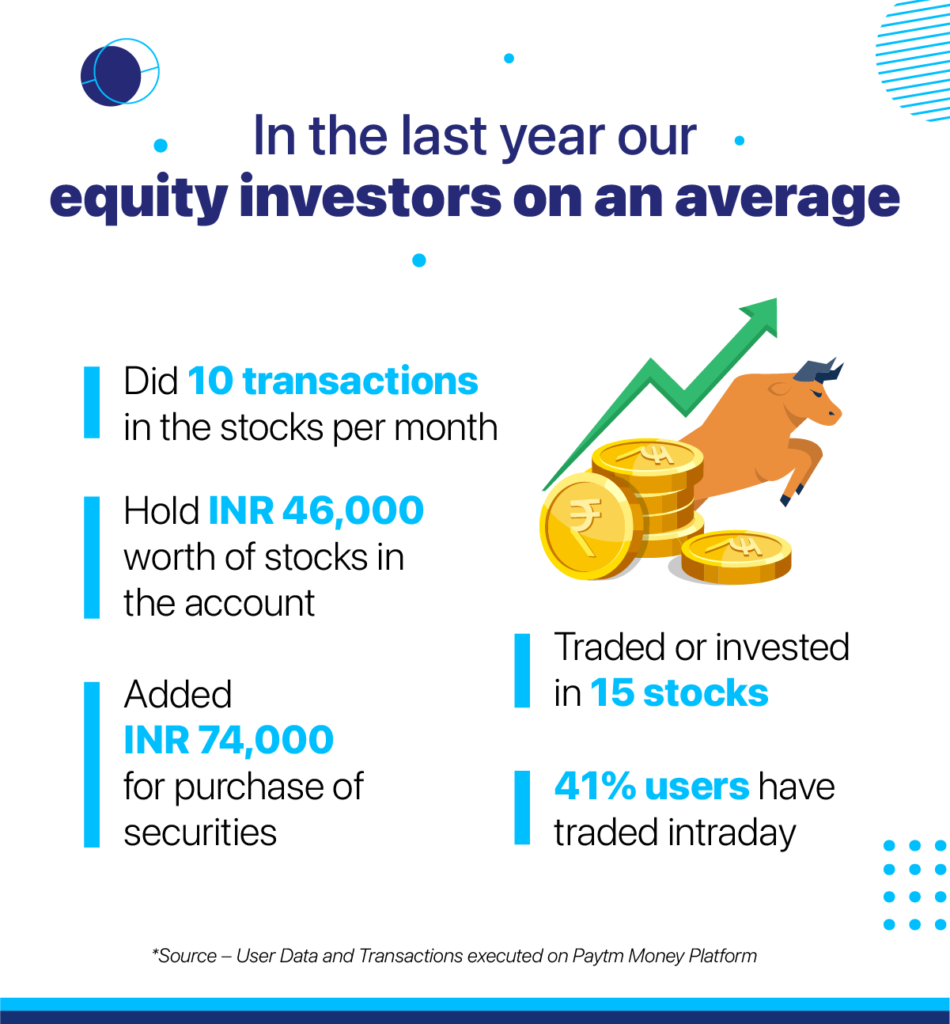

2. Equity

We launched our Equity platform in the month of August (2020) and within a short period of time, we have opened over 2.1 lakh accounts (as on March 31 2021), as per data analysed on Paytm Money.

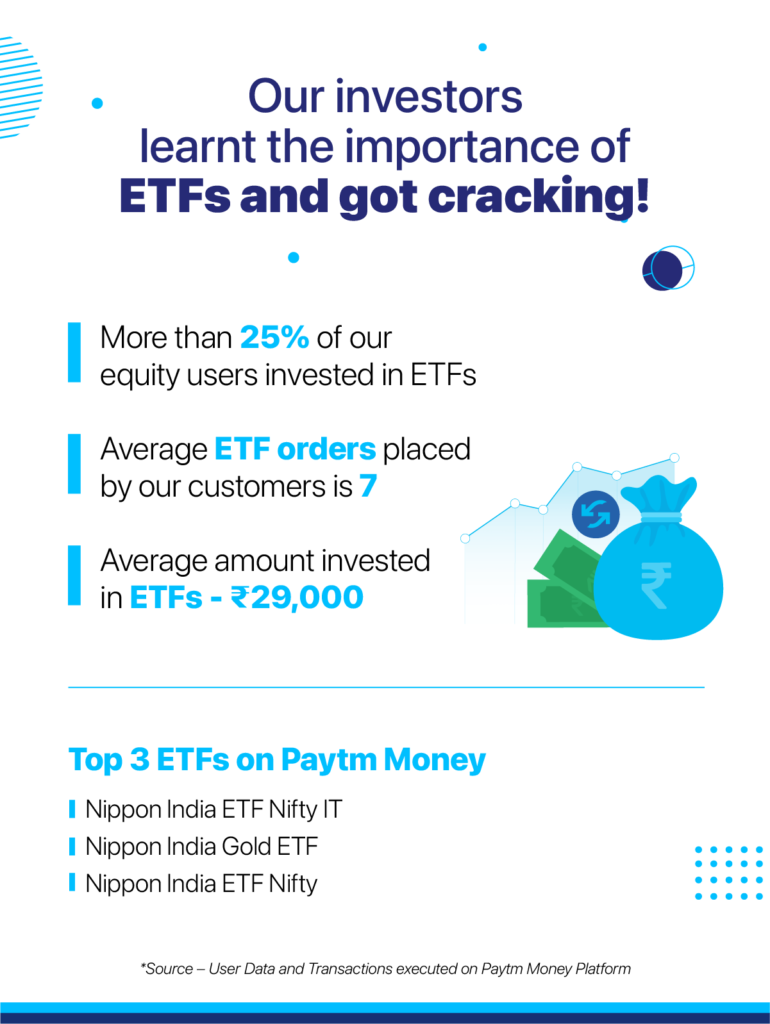

3. Exchange Traded Funds

ETFs also have been gaining a lot of traction in India recently, driven by rising awareness, product simplicity, and cost effectiveness. ETFs are cost-efficient as compared to traditional index oriented mutual funds due to lower expense ratios and hence the higher returns which makes them a valuable wealth product for new investors. ETFs also serve as a great volatility-hedging strategy for HNIs and veteran investors.

We have conducted Masterclasses on ETFs, a first of its kind of an attempt to educate investors more on ETF investments. Over 5000 people attended our Masterclasses conducted by industry experts.

4. Futures and Options

Futures and Options trading are the most preferred derivative instruments in the stock exchange. Paytm Money provides for all the features required for a derivative trader, and at the same time it does not complicate the user interface for a newbie trader which is unique in the industry. The charting provides over 180 studies & patterns usually tracked by the pro traders all in an easy to use interface on one’s mobile. The price alert feature allows traders to get real-time alerts on any F&O contracts.

Our customers love to trade more in Nifty options and invest more in Call options of Nifty. On an average these users have placed more than 10 orders.

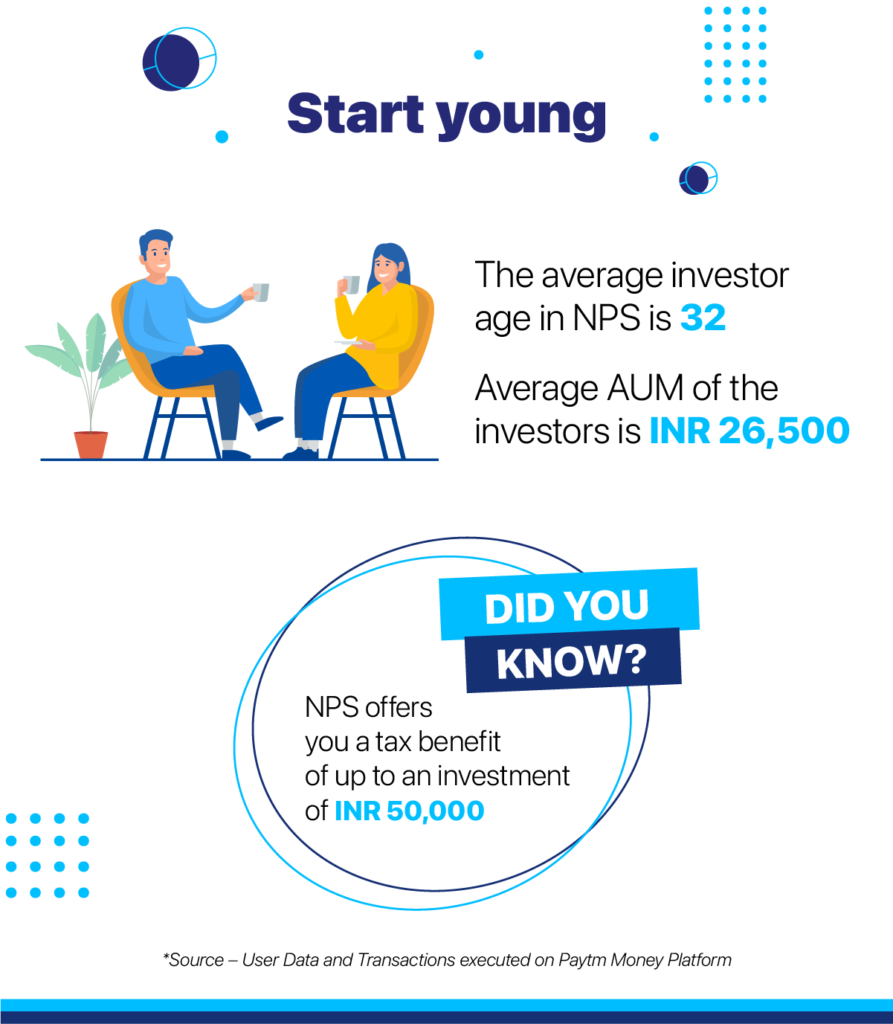

5. National Pension Scheme

Our tax-saving offerings have been a great hit among the investors! Often touted as India’s best retirement plan, Indians have been taking a step closer to start planning for the retirement of their dreams.

Young India, You are on the right track! – We did multiple campaigns on how NPS can benefit even the young population in planning their retirement

6. Gold

It is an open secret that Indians love gold! Paytm has introduced a way to invest in Gold digitally in the year of 2017. In the last year we have seen growth in the transactions as users rushed to invest in Gold.

7. Initial Public Offering

Investing in IPOs used to be a difficult process but we have made that simple for our customers. Users can invest in IPOs in just two clicks on Paytm Money.

Disclaimers

Investments in securities market are subject to market risks, please read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results. Brokerage will not exceed the SEBI prescribed limit. Please refer www.paytmmoney.com/stocks/pricing for further information. SEBI Registration no.-INZ000240532, BSE-6707, NSE-90165. For detailed Disclaimer and Terms and Conditions, please visit our website https://www.paytmmoney.com. Regd Office:136, First Floor, Devika Tower, Nehru Place, New Delhi- 110019.

The Digital Gold, Mutual Funds and NPS offering is non Exchange traded products and Paytm Money Ltd (PML) is acting as an agent for distributing the same. Please note all disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.