We have always believed in an investor-first approach and have been in constant touch with the needs of our investors. Also, we have been relentlessly making our investment platform smarter to support secure and informed mutual fund investments.

In this journey, we realized that due to an ever-dynamic capital market and identical portfolio compositions of mutual fund schemes, our investors were experiencing challenges in diversifying their portfolio. At the same time, they wanted smart avenues to earn higher returns in the short run. Besides, they were also exploring ways to hide their portfolio details while showing all these features to others on their investing App.

As a solution to the above issues, we have rolled out the latest offerings on the app i.e. Portfolio Masking, Portfolio Overlap & Super Saver Funds. Now you would be able to diversify your portfolio with ease and also feel all the more secure at the time of investing in your preferred mutual funds.

Let’s know more about each one of them.

1. Portfolio Masking

Have you ever wished for an option to hide your portfolio details and amount when you are showing something on your investment App to others? Of course, you have. Hence we have worked it out to help you mask your portfolio details with the blink of an Eye. When you click on the ‘Portfolio’ button at the bottom of the app, you will be taken to the ‘My Portfolio’ page. Here, you will see an eye icon displayed next to the current value.

Upon clicking it, the eye shuts and you get a masked view wherein details of your portfolio, returns of mutual funds, portfolio allocation, and investments on Paytm Money will be hidden. Additionally, it also hides portfolio values on the portfolio listing page via AMC, portfolio values on Fund Manager detail page and NPS investment amount, and return & Fund holdings’ current values and returns. As long as you don’t change it, your portfolio masking remains in an active state.

2. Portfolio Overlap

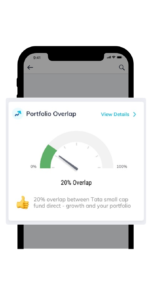

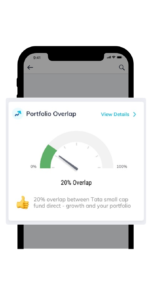

When you invest in multiple funds, it might happen that these funds may have similar stock holdings. In such a scenario, your portfolio may have overlaps that not only makes it less diversified but may also expose you to higher risk. With the help of the Portfolio Overlap feature, you would be able to identify if a fund has a similar allocation like your existing portfolio. Additionally, you can see whether or not it is suitable to invest in the fund based on the riskometer of the fund, and your risk profile. In this way, you may avoid a fund that has invested in the same set of companies and come up with a much-diversified portfolio.

To access this feature, you may go on the ‘Mutual Fund Details’ page, scroll down to find the portfolio overlap card below the fund manager details. Here, as an invested user, you get to know the percentage of portfolio overlaps between the fund and your portfolio. You can also click on ‘View Details’ to know the schemes and companies that are overlapping with your current portfolio.

3. Super Saver Funds

Super Saver Funds is an instant-redemption liquid fund that helps you to manage your short-term savings smartly. With the potential to deliver relatively higher returns than your savings bank account, this fund provides you ready access to cash without sidestepping on the returns aspect. Also, you get to enjoy the safety of investments as the fund invests in debt instruments like commercial paper and the likes. It lets you make daily withdrawals of up to Rs 50,000 or 90% of the invested amount, whichever is lower and the proceeds get credited to your account within 24 hours during business days.

In order to invest in the fund, go to the ‘Invest’ button at the bottom of the page. On the Discover Mutual Funds for Investments page, tap on ‘Super Saver Funds’ followed by tapping on ‘View Funds’. You can select a fund of your choice and invest via SIP or the Lump-sum mode.

Conclusion

Investing is simplified and made convenient on Paytm Money. To get the most benefit from our features, download the Paytm Money app today and get investment ready within minutes.

Happy Investing :- )