RailTel Corporation of India IPO Details – Date, Price & Overview5 min read

RailTel Corporation of India Limited is an information and communications technology infrastructure provider and is one of the largest neutral telecom infrastructure providers in India. It is a Mini Ratna (Category-I) Central Public Sector Enterprise, wholly-owned by the Government of India and under the administrative control of the Ministry of Railways.

The company was incorporated on September 26, 2000, with the aim of modernizing the existing telecom system for train control, operation, and safety and to generate additional revenues by creating nationwide broadband and multimedia networks by laying optical fiber cable by using the right of way along railway tracks.

As of Jan 31, 2021, its optic fiber network covered over 59,098 route kilometers and covered 5,929 railway stations across towns and cities in India. The transport network is built on high-capacity dense wavelength division multiplexing technology and an internet protocol/multi-protocol label switching network over it to support mission-critical communication requirements of Indian Railways and other customers.

Services Offered by RailTel

- Telecom Network Services

- Telecom Infrastructure services

- Managed Data Center and Hosting services

- Project (System Integration Services)

Awards & Recognition

- Award for the “Best Social Wi-Fi Project” category at the My India Wi-Fi India Summit and Awards 2018.

- Received an award at the Digital Innovation and Cyber Security Summit 2019 organized by the Department of Information Technology and Electronics, Government of Haryana.

- Received Governance Now PSU award 2020 in Digital PSU Category.

Contents

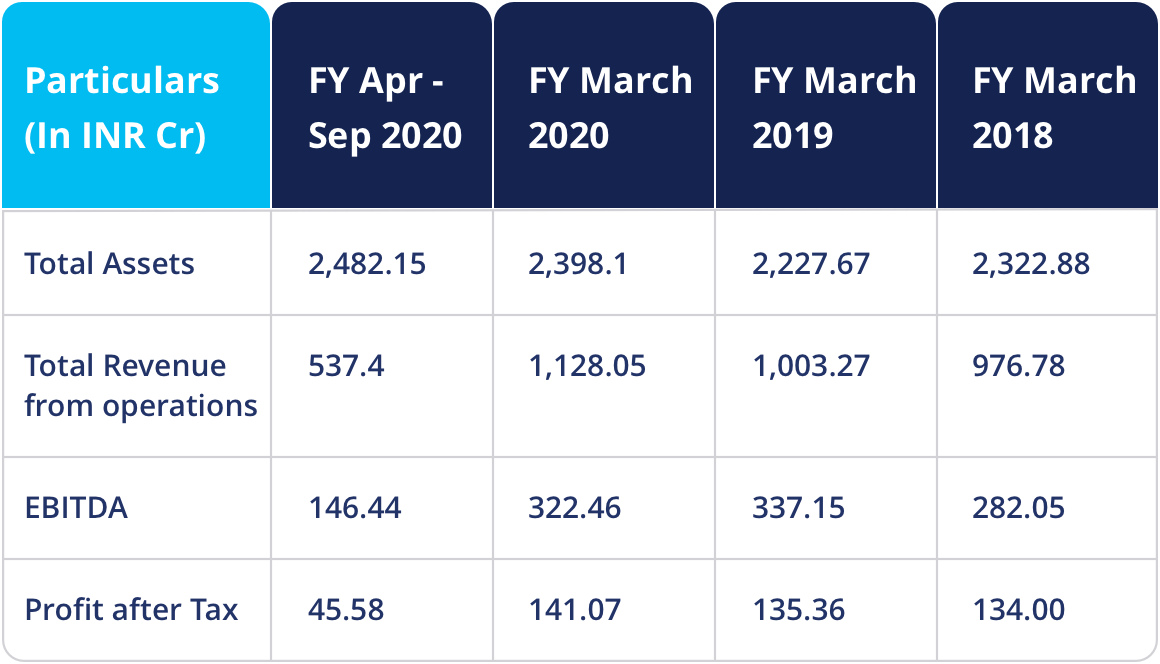

RailTel’s Financial Data

A quick look into the past financial performance of the company to understand the performance of its business and evaluate its growth prospectus

RailTel revenue from operations has grown at a CAGR (Compound Annual Growth Rate) of 7.47% from Rs. 976.78 crore in the fiscal year 2018 to Rs. 1,128.05 million in the fiscal year 2020 and in the fiscal year 2019, it had the lowest gearing ratio among key telecom companies in India.

It has been profitable since fiscal year 2007 and has consistently declared and paid dividends since 2008. Its net profit margin of 12.50% in the fiscal year 2020 was the highest among the key telecom companies and key IT/ICT companies in India while its operating profit margin was the highest among others in the sector.

RailTel IPO Listing Details

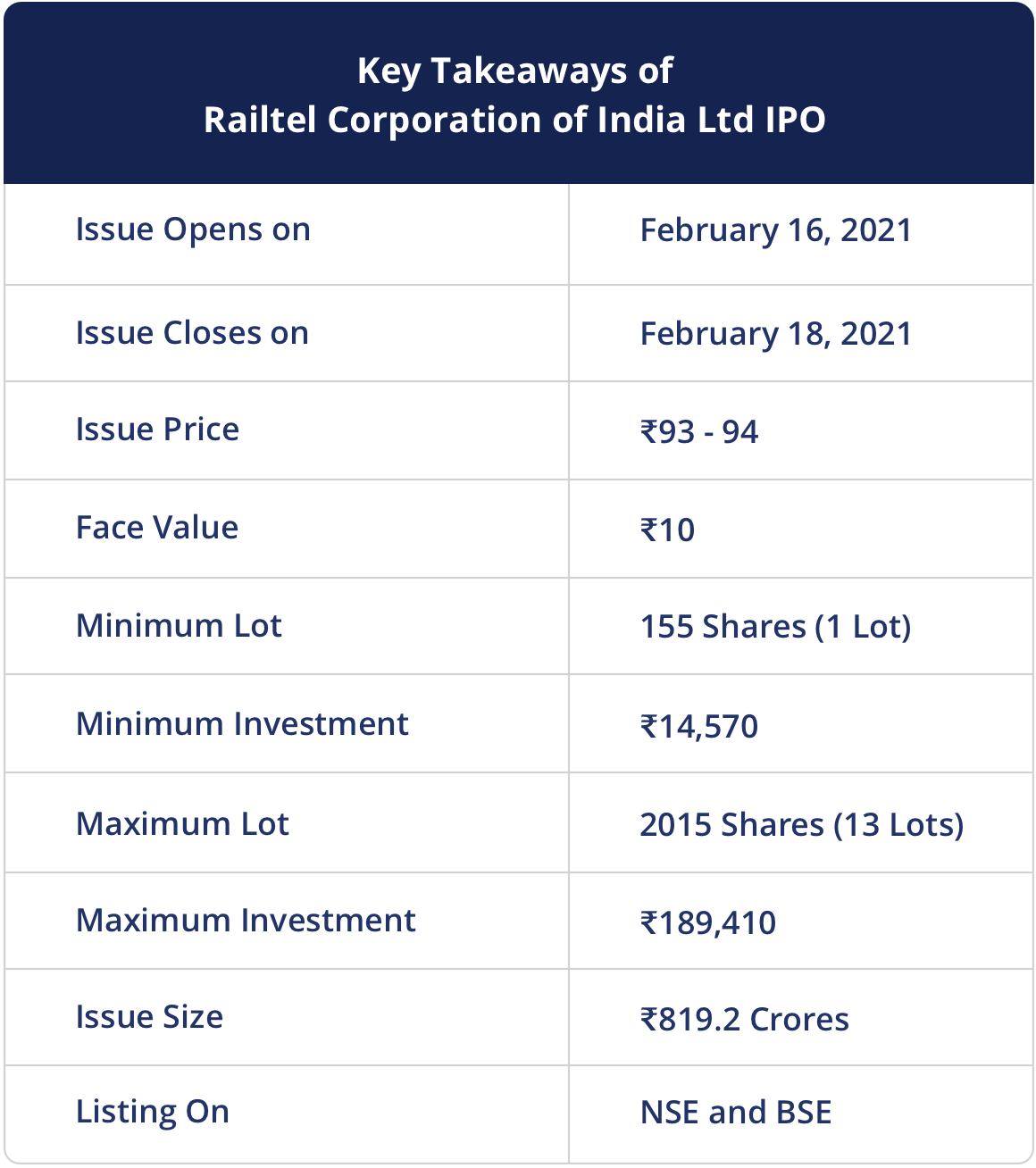

RailTel Corporation of India is coming up with an initial public offering of Rs. 819.2 crores, set to open on Tuesday, 16th February and close on 18th February 2021. The company is issuing shares at a price band of Rs. 93 to Rs. 94 with a minimum lot size of 155 shares and in multiples of 155 equity shares thereafter. RailTel is offering up to 87,153,369 equity shares by the government with a face value of Rs. 10 each.

The President of India, acting through the Ministry of Railways, is the promoter of the company. The lead managers to the issue are ICICI Securities Limited, IDBI Capital Markets & Securities Limited, SBI Capital Markets Limited, and the Registrar to this issue is KFin Technologies Private Limited.

RailTel proposes to utilize the net proceeds from the fresh issue to carry out the disinvestment of equity shares. Additionally, the company expects to achieve the benefits of listing its equity shares on the stock exchanges, enhancement of its brand name, and creation of a public market for its equity shares in India.

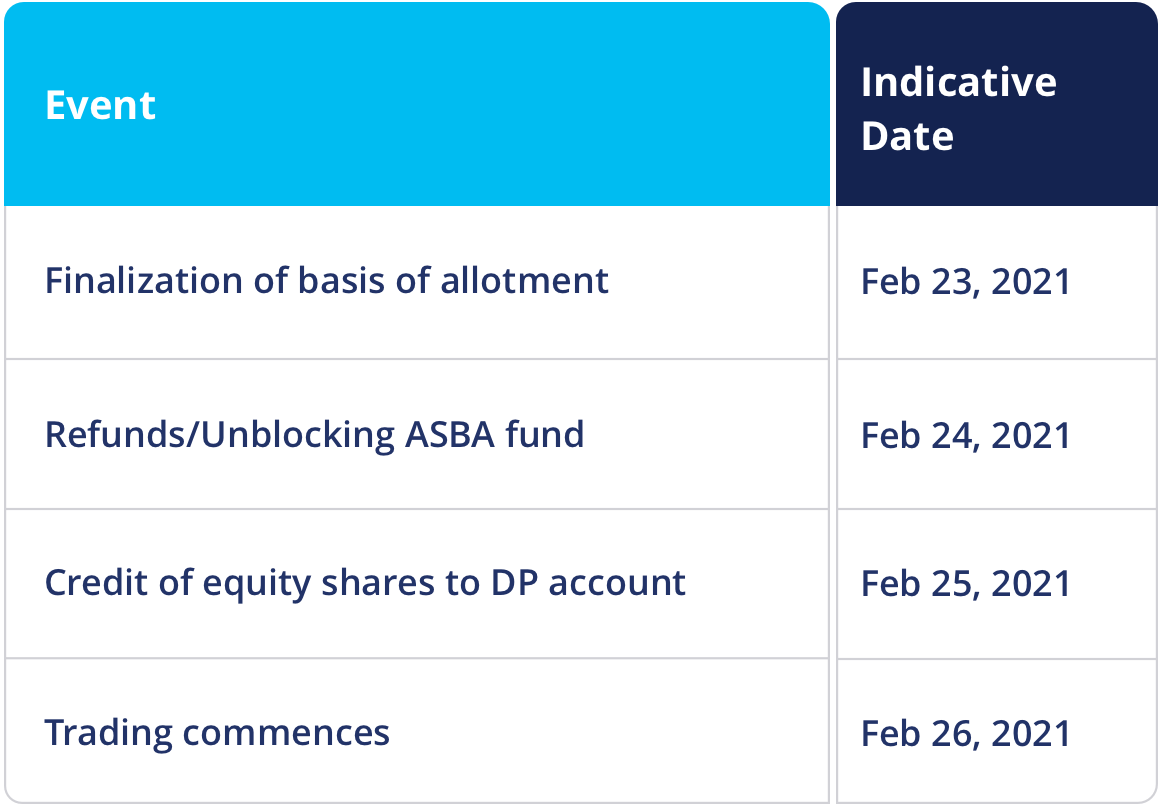

IPO Timeline

Strengths & Risks Involved

Strengths

- Among the largest neutral telecom infrastructure providers in India with a pan-India optic fiber network.

- A diversified portfolio of services and solutions.

- A key partner to the Indian Railways in digital transformation.

- Experience in executing projects of national importance with a robust pipeline of projects.

- Strong track record of financial performance.

- Experienced senior management and committed team.

Risks Involved

- The Telecom Industry is highly regulated and changes in laws, policies, and regulations could impact business adversely.

- A substantial portion of revenue comes from PSU customers, hence, government decisions and policy changes can impact negatively.

- Inability to update to modern telecom technology standards will impact the business.

- Adverse developments in legal proceedings that are involved could impact the business.

- Internet security concerns and illegal distribution by third-parties could adversely affect its broadband internet access services.

- Loss of Key suppliers or their failure to deliver equipment or perform services in a timely or satisfactory manner will impact the business.

How to apply for RailTel IPO through Paytm Money

- Log in to the Paytm Money app and complete your fully digital KYC for the stock, if not done already.

- Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

- You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

- Next, you must add details for bidding such as quantity, amount, and so on. Maximum 3 bids are allowed.

- After that, you have to enter your UPI ID so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

- Once you accept the mandate, your application will be successfully submitted.

- Once the allotment happens, you will be notified about your allotment status.

On a Closing Note

The offer for sale by one of the largest neutral telecom infrastructure providers in India – RailTel Corporation will open for subscription on February 16 and close on February 18, 2021. The issue price band is Rs 93 to Rs 94.

id=”key”