How to Plan for your Retirement?5 min read

Retirement, the sun set years. This would mean different things for different people. Most probably you would think of getting away from the stress and humdrum of daily working life. You might want to pursue a hobby that you were putting off for lack of time, maybe travel to a few places or simply sit back and enjoy a well-deserved break.

All this and more is certainly within your grasp. What it requires is a little bit of thought, planning and diligent execution from your end. So let’s take a look at what you can do today to make your sun set years truly golden.

The need for retirement planning

For most of us, retirement maybe a long way off if you are in your late 20’s or early 30’s, doing well in your career, starting a family and have a lot of goals and dreams that you want to fulfil. You tend to give these a lot more priority like taking a foreign holiday or buying a home or even saving for your child’s education. Planning for retirement would take a back seat or worse, you would not have given it a serious thought.

This should not be how you approach saving for retirement. Along with all your other goals and aspirations, you should start saving for your retirement today. Ignoring this, simply because retirement is a long way down the line is not the right approach, rather you can use the long time horizon available to your advantage!

Facets of retirement planning

Goals like taking a vacation, buying home etc. are specific and get fulfilled at one shot. Retirement on the other hand is more of a journey. Thus it comes with its own set of specific needs that you would have to take into account.

Living expenses:

You need to cover for your regular living expenses post retirement. Given that your monthly income from your regular job ceases to exist, this becomes even more important. You can cover these expenses and maintain the lifestyle of your choice by creating a sufficient retirement corpus.

Healthcare needs:

Medical expenses tend to rise as a person ages and health insurance plays an important role to cover them. Do not rely solely on your employer’s insurance cover as you will lose this once you retire. Also after a certain age you would not be able to enroll for health insurance. So opt for a good health insurance today and make sure insurance premium is a part of annual expenses plan.

Tackling emergencies:

Life is unpredictable and there can be adverse situations which may require sudden cash outflows. Such situations would reduce the size of your corpus and affect your lifestyle post retirement. So, it is advisable to maintain a contingency fund which can cover six months’ worth of expenses during your working life and after retirement.

In the Indian context there would be a few other goals which have to be taken into account. Some of these are children’s wedding/education, leaving a part of your earnings to your children, etc. If and when each individual wants to achieve these goals is something personal, it can be before or after retirement.

The central character: Retirement corpus

Your investible surplus has to be spread across all your goals in an appropriate manner. The good thing about building your retirement corpus is that you can use the power of compounding to start small, stay invested for a long time and build a large corpus. To get an idea of the size of retirement corpus required, the following factors need to be considered:

- Intended age of retirement

- Current age

- Inflation

- Current expenses

- Rate of return expected on investments (pre-retirement and post retirement)

- Life expectancy

At what age you plan to retire is the starting point. Let us say you plan to retire at the age of 60 years. Now based on your current age, the time that you have to accumulate your retirement corpus will change. Let us take a look at the following example:

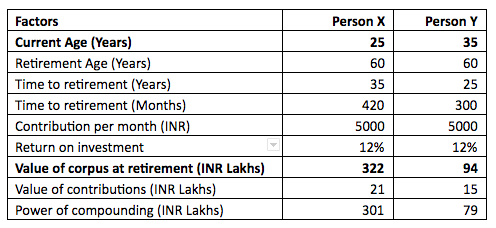

Two people X and Y, both plan to retire at the age of 60 years. Both contribute the same INR 5,000 towards their retirement corpus which earns them the same 12% per annum return. The only difference is when they have started saving for retirement. X starts early and has a 10 year head start compared to Y! All else being same, compounding does works wonders and builds a corpus almost three and half times for X as compared to Y. After all even Albert Einstein said “Compounding is the Eighth wonder of the world!”

Your current monthly expenses gives you a starting point but dig deeper into them. For example, rental expense will not be applicable post retirement if you are saving to buy a home. On the other hand, certain expenses like household help, medical expenses etc. would increase post retirement. Keeping these in mind, you can get an idea as to how much it will cost you to maintain your lifestyle.

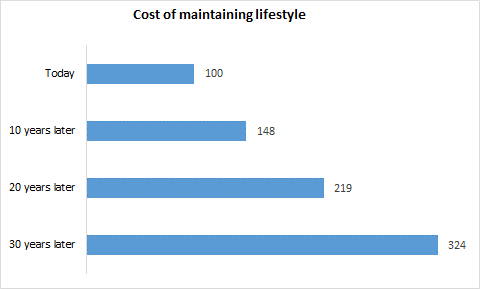

Lastly, do not forget the elephant in the room - Inflation. Inflation reduces the purchasing power of money. The effect of inflation over a long time frame is significant. The above chart makes it clear that, how the cost of maintaining lifestyle would change by the time one retires. What costs INR 100 today will cost INR 324 assuming a 4% inflation! Thus one cannot ignore inflation, especially while carrying out retirement planning.

What is next?

In the coming posts, we will explain how to calculate your retirement corpus and how much do you need to save to achieve that corpus. We will also discuss the suitable asset allocation at various stages of life and investment options that will help you achieve your required retirement corpus.

Till then do give retirement planning a serious thought. Remember “A journey well begun is half done!“