Revised Transaction Charges in Bank Nifty Index2 min read

NSE has decided to revise the structure of transaction charges for eligible trades in BANK NIFTY index derivatives from August 2, 2021 to October 29, 2021. The revised transaction charges are as follows:

Bank NIFTY Index Futures:

The following conditions need to be satisfied before the new transaction charges can be applicable.

- The contract expiry date should be more than 7 calendar days from the given trading date

- Turnover is a non-intraday turnover (for each contract, non-intraday turnover will be computed day wise at client code level and aggregated at the trading member level for a month).

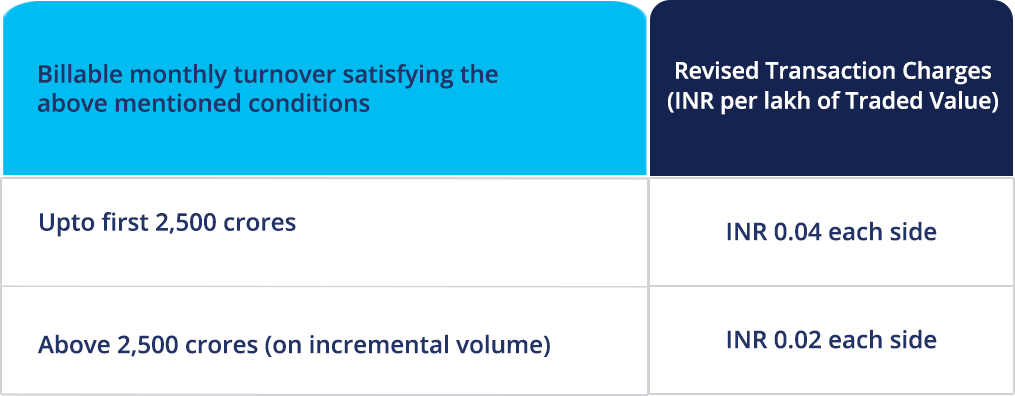

The table below shows the revised charges.

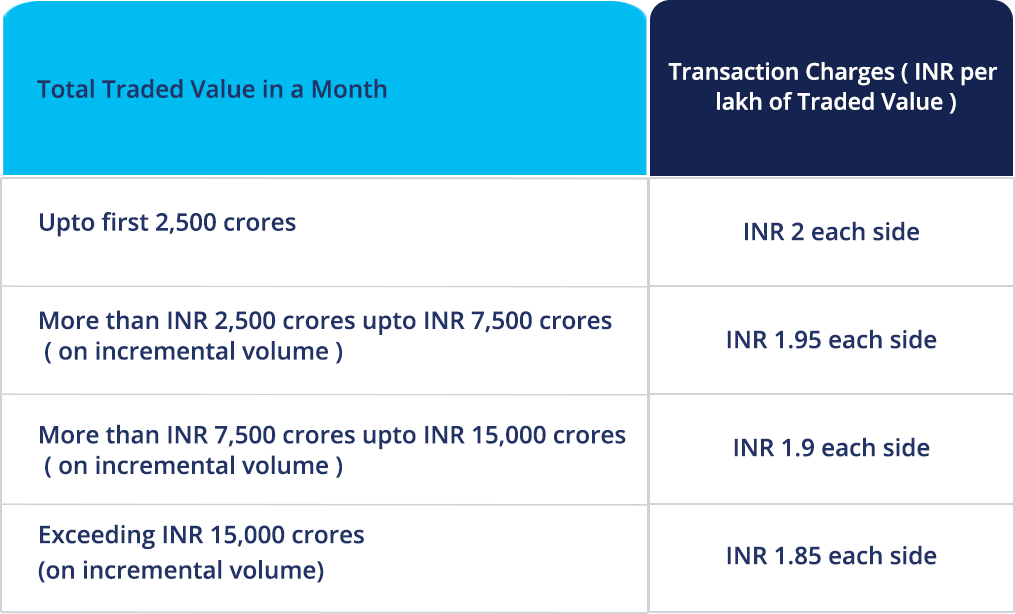

The table below shows the charges that existed before the revision in charges.

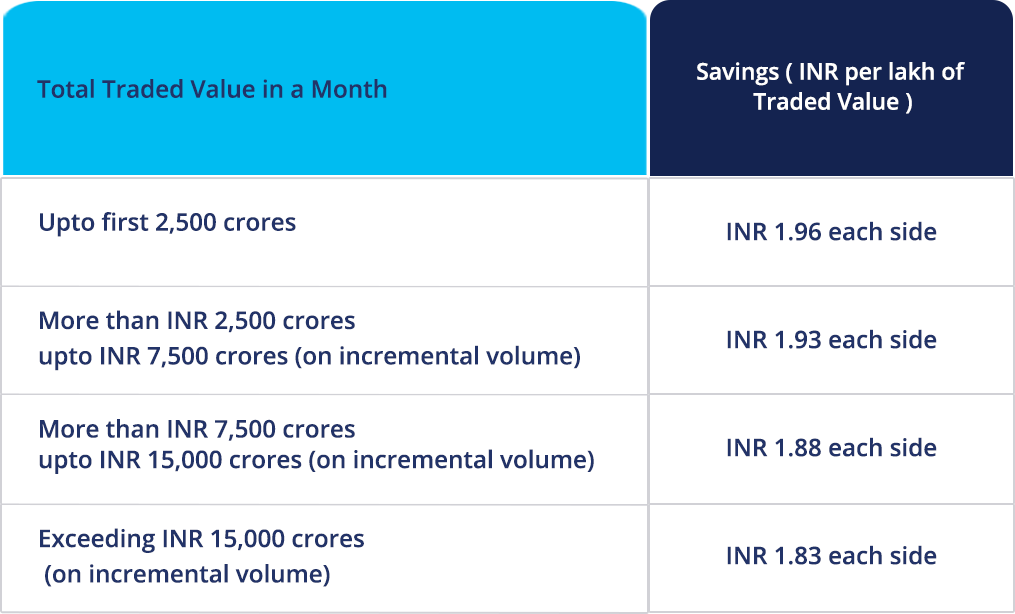

The table below shows the savings after the revision in charges.

Bank NIFTY Index Options:

The following conditions need to be satisfied before the new transaction charges can be applicable.

- The contract expiry is not the nearest expiry on the given trading day

- Premium turnover is a non-intraday turnover (for each contract, non-intraday turnover will be computed day wise at client code level and aggregated at the trading member level for a month).

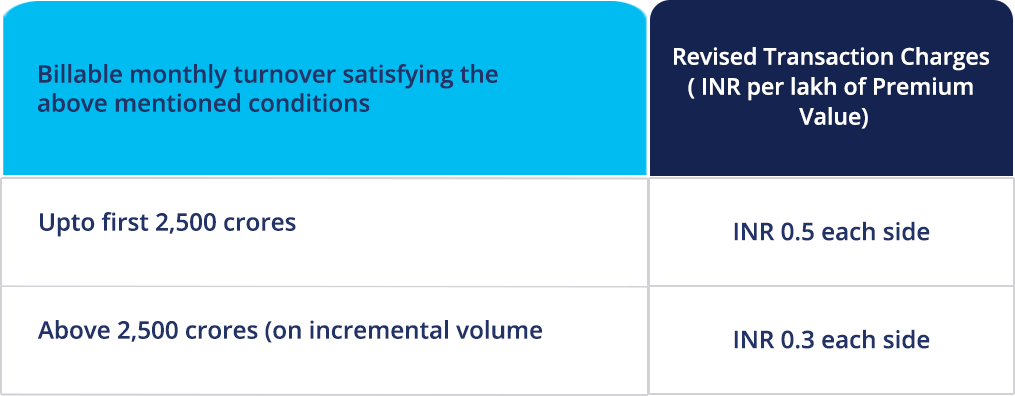

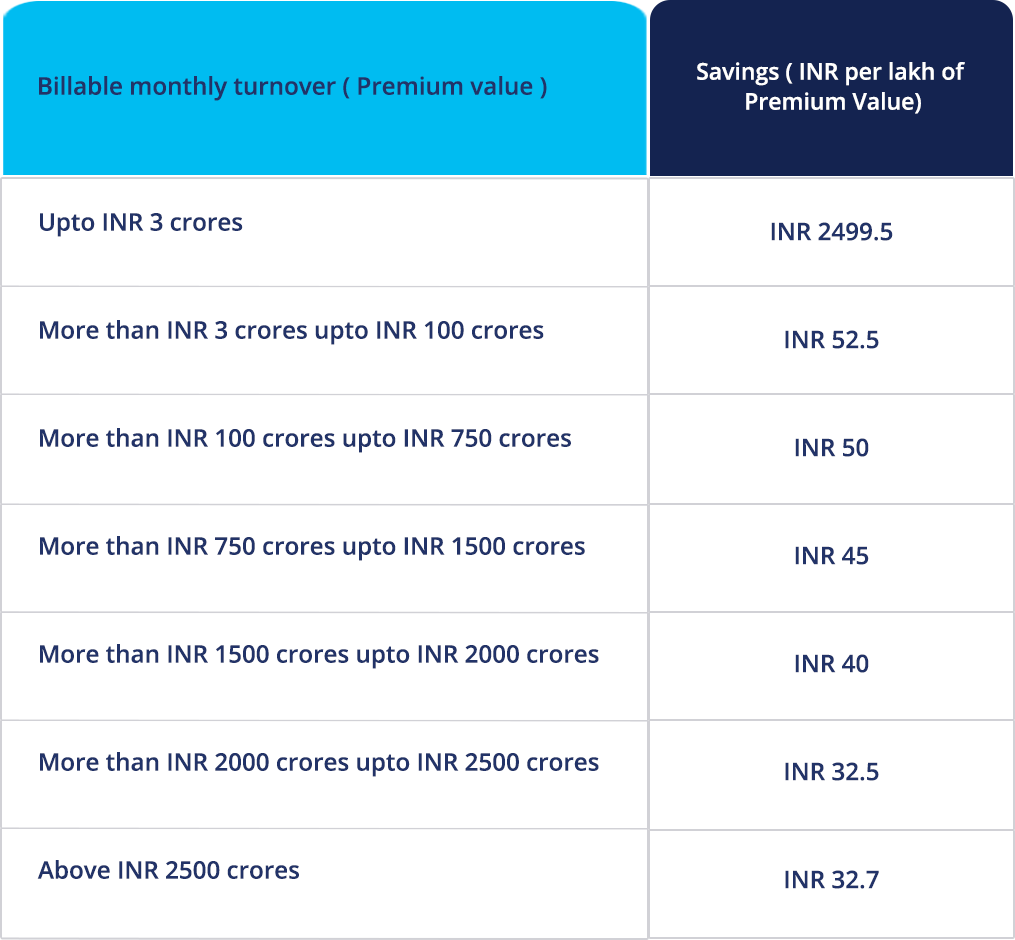

The table below shows the revised charges.

The table below shows the charges that existed before the revision in charges.

The table below shows the savings after the revision in charges.

This content is purely for information and investor awareness purpose only and in no way an advice or recommendation. You should independently research and verify the information you find on our website/application. The securities quoted are exemplary and are not recommendatory. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019.

Also Read- What Is A Bull Put Spread?