SEBI reinstates cut-off time, except debt & conservative hybrid funds1 min read

Investors can now take a breather as, starting Monday (Oct 19), SEBI has reinstated the pre-pandemic cut-off timings for all the schemes except debt funds and conservative hybrid funds.

Simply put, cut-off timings determine whether you will get scheme units based on the same day’s NAV or that of the next day when you invest in any mutual fund. Cut-off timings hold good even when you want to exit a scheme.

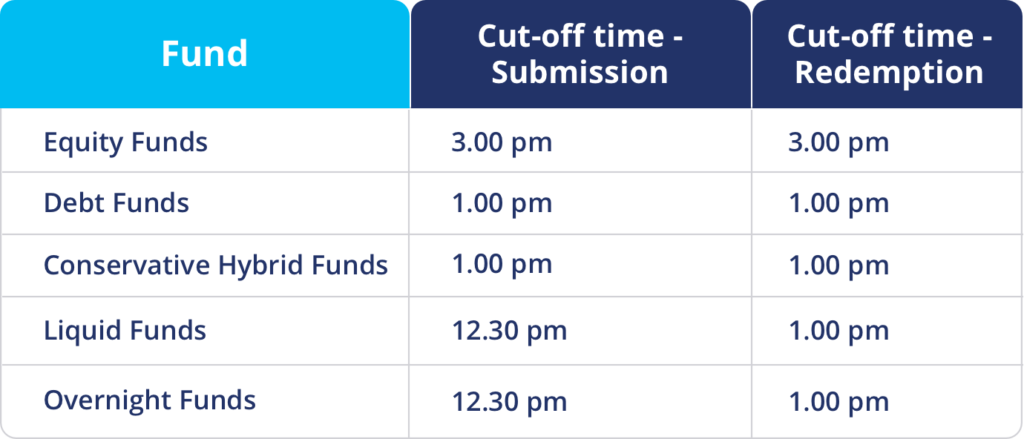

Let’s look at the current cut-off timings

Earlier, for liquid funds, the subscription and redemption cut-off time was 2 pm and 3 pm respectively. Whereas, for debt and equity schemes, the subscription and redemption cut-off was 3 pm.

What is cut-off timing & why is it important

When you invest in any mutual fund on a business day, the NAV (Net Asset Value) at which units are allocated to you depends on the time at which the AMC receives your SIP/lumpsum payment. Thus NAV allotment is defined based on cutoff time.

The cut off time differs across scheme categories – equity, debt, and liquid funds.

Why did SEBI tweak cut-off timings?

The RBI in April had shortened debt and currency market hours, allowing trades from 10 am to 2 pm due to the COVID pandemic. Following RBI’s suit, SEBI had also tweaked the cut off timing for mutual fund investments owing to disruptions caused by the pandemic to the financial services industry.

However, with lockdown being lifted in most of the country, AMFI had requested the regulator to reinstate the earlier cut off timings for mutual funds.

Conclusion

Now you have previous cut-off timings reinstated for all the funds barring Debt and Conservative Hybrid Funds.