SEBI’s new NAV rules to be applicable starting Feb 12 min read

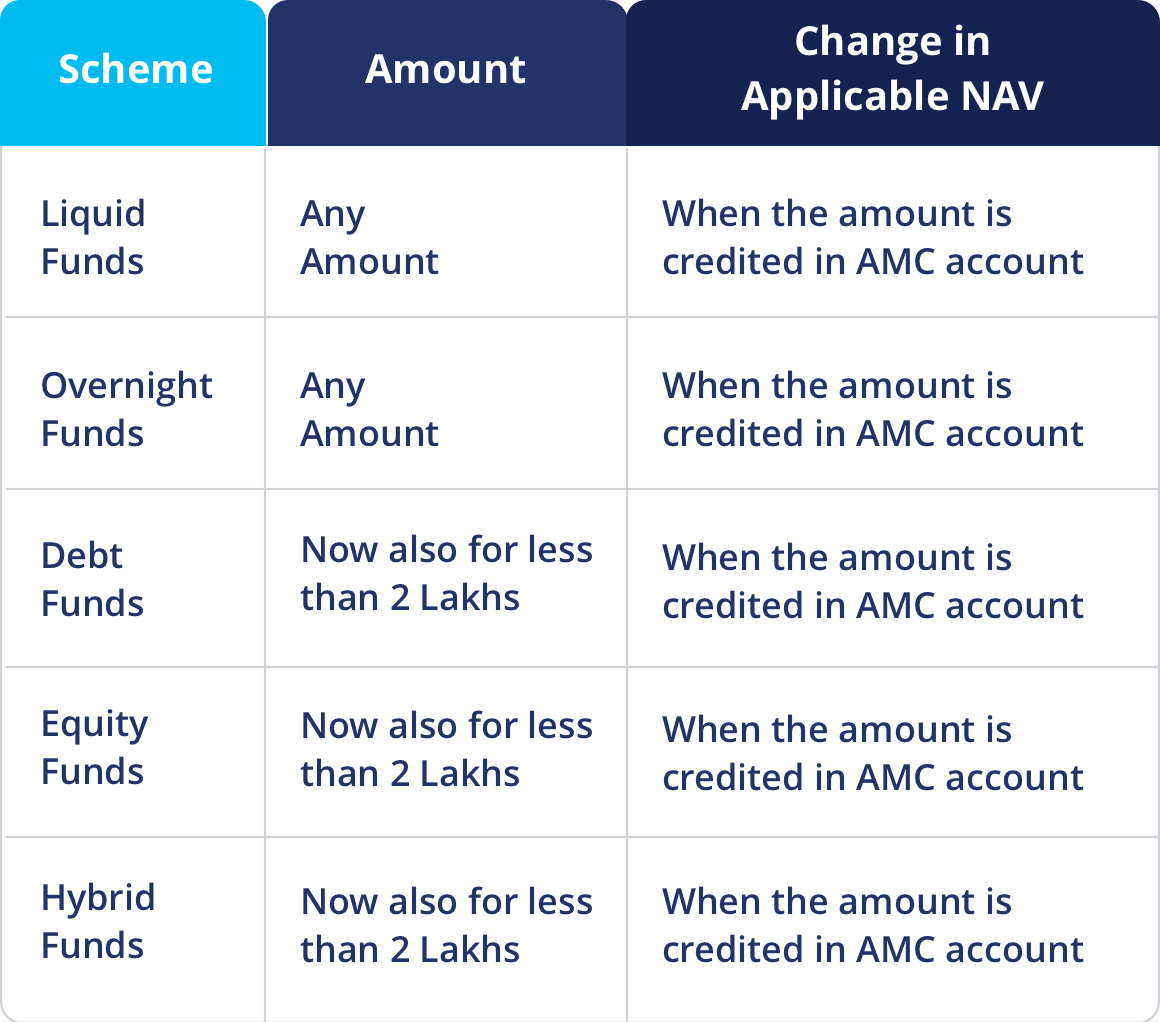

SEBI, in its latest circular, has said that the new NAV rules will be applicable starting Feb 1, 2021. The Securities and Exchanges Board of India has brought in new rules for NAV (net asset value) applicability for mutual fund schemes below Rs. 2 lakh.

SEBI circular had said that investors would get NAV once the money reaches the fund house irrespective of the investment amount from Feb 1.

As of now, investors get the same day NAV if they invest up to Rs 2 lakh before the cut off time. When the new NAV rules become effective, investors will get NAV upon realization of funds by the AMC.

However, the regulation will not be applicable to liquid and overnight funds as for schemes above Rs. 2 lakh and liquid and overnight funds already had this norm in place.

“It has been decided that in respect of the purchase of units of mutual fund schemes (except liquid and overnight schemes), closing NAV of the day shall be applicable on which the funds are available for utilization irrespective of the size and time of receipt of such application. The existing provision on NAV applicability for liquid and overnight funds and cut-off timings for all schemes shall remain unchanged,” SEBI said in a circular.

In the case of NFO subscriptions, allotment date will be considered, irrespective of credit date & application submission date.

When an investor wishes to switch into NFO from an existing scheme, the switch-out will be processed on existing schemes. Switch in will be allotted on the day NFO subscriptions are allotted.

For online transactions, there may be a time lag in the transfer of funds from investors’ accounts to the AMC account and hence may differ from case to case basis.

Conclusion

Now, starting Feb 1, whenever you invest in Mutual Funds you will get the NAV of the day when funds reach AMC. This regulation was already applicable for liquid & overnight funds and all the schemes amounting more than Rs. 2 lakhs.