With increasing market participation from retail investors since March 2020, SEBI & NSE are working day and night to safeguard them from any mishappenings.

This has come in the form of the circular dated 26th March 2021 on the Order Based Surveillance Measure.

Though it seems like a normal routine circular, it is a very big step taken by SEBI & NSE to strengthen trading and minimize the price manipulation activities from the overall market. Since the majority of the volume comes from the F&O segment, logically, the major impact will also be in the F&O segment.

Although SEBI has introduced systems to minimize such manipulation since 2009 through several rules, this surveillance rule is really hitting the big boys and rewarding the retail customers in the new financial year 😉.

Problem Statement

You may call it a fake price or a shadow price for better understanding. Traders call it “spoofing.”

It is a method used by big participants to create a shadow market demand which attracts and traps small retail investors with unfair pricing, less supply or perhaps even no supply contracts. Such price manipulation has been used by several proprietary trading firms and big traders in the market. Most of these players use Automated/Algorithmic trading systems so their response time is quick compared to human reaction time.

Impact of Order Based Surveillance Measure

The circular mentions “Excessive order modification/cancellations with intent to avoid executions. “

What does this mean?

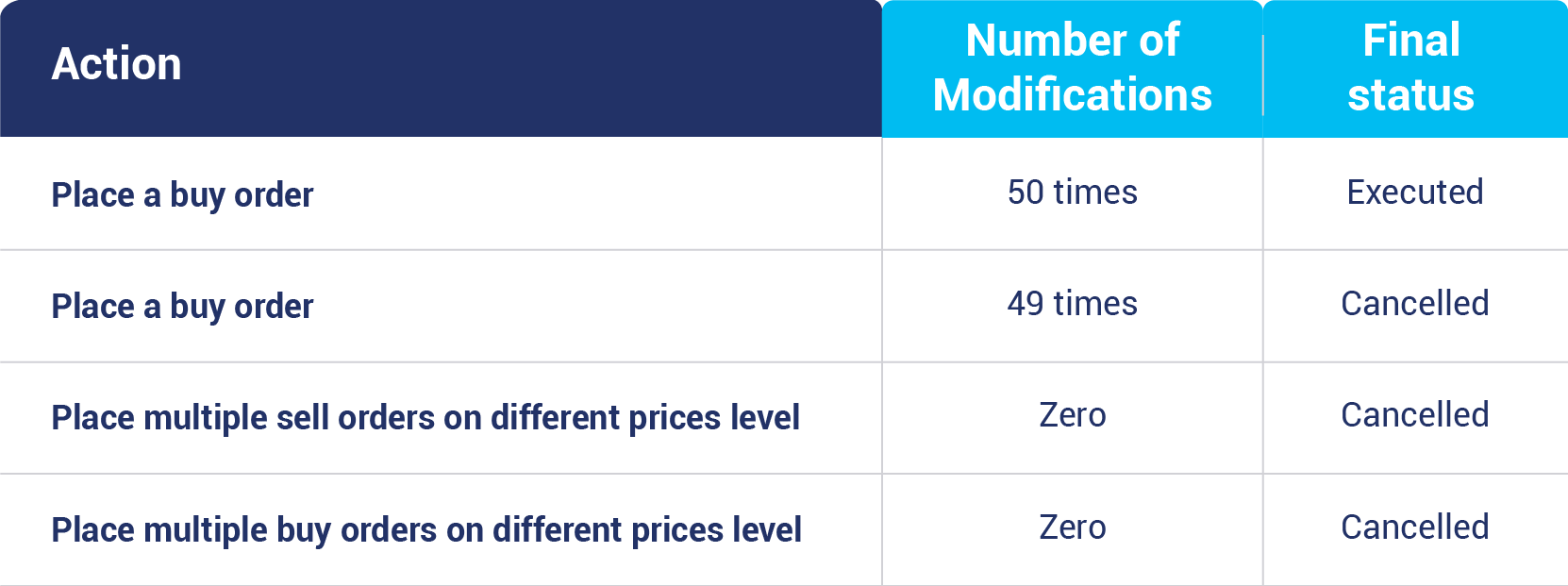

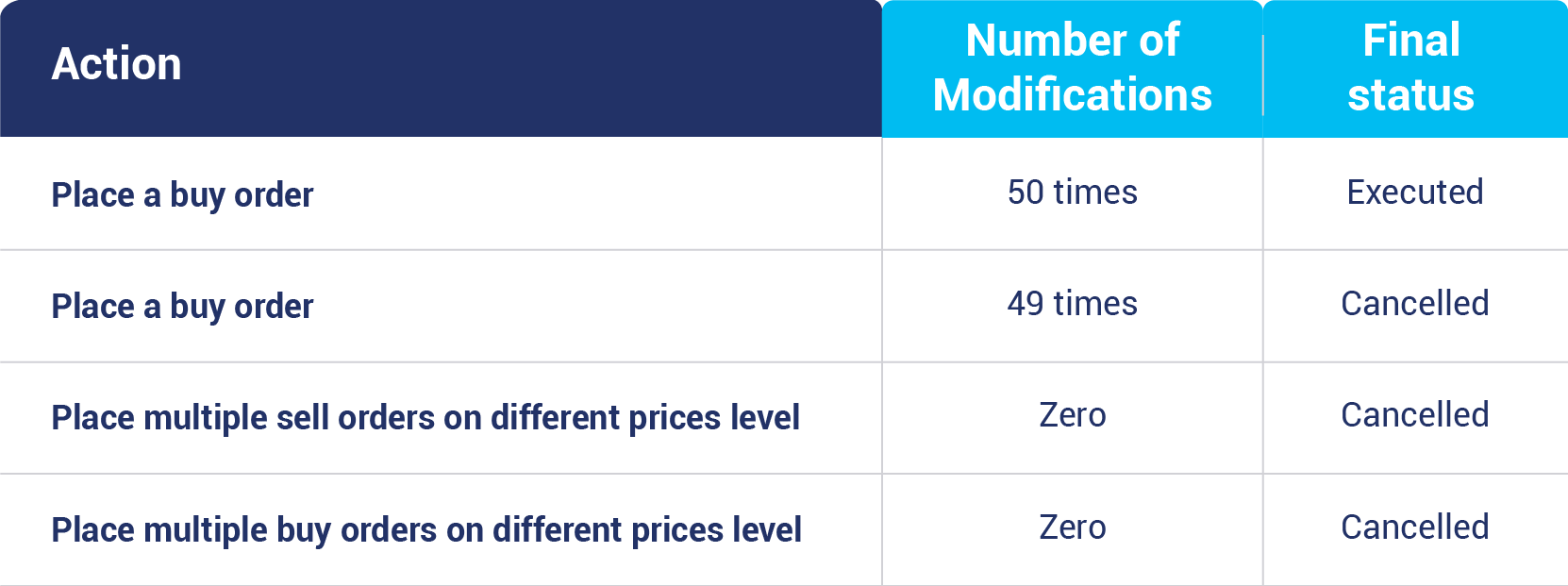

Let’s understand with the help of an example

Earlier, one could place an order for Nifty or bank nifty options, keep modifying the price and then execute after so many price alterations or simply cancel the order in the end since there is no tracking for such price modifications though the user was creating a noise/shadow market/price manipulation.

Such activities will now be tracked by the exchange

Currently, the ratio of number of orders placed to traded (order executed) should not be more than 50, which is already a great move to protect the markets. In addition, the exchange will monitor the order value as well.

The penalty is no longer limited to a fine in terms of money but there will also be a disablement of trading, from a minimum of 15 minutes to a maximum up to 2 hours (which is approximately 33% of the overall market time).

Icing on the Cake for Retail Participants

Retail participants do not alter their orders as frequently as big trading players or institutions. Even if they do, that number may rarely exceed 50. Thus, there would be little to no impact on retail players.

Since this rule will hit the price manipulator in a big way, forcing them to minimize the modifications and stop the fake demand, it will allow for fair market pricing for retail investors.

How does it impact market players?

- A Positive for Retail Players

- A Negative for Big prop players

- A Negative for Market making trading desks.