SEBI has changed the norms of Intraday margins effective Tuesday, 1 December 2020, it has introduced the concept of peak margin reporting in which stockbrokers will not only calculate margin based on the End-Of-The-Day position but the intraday peak position.

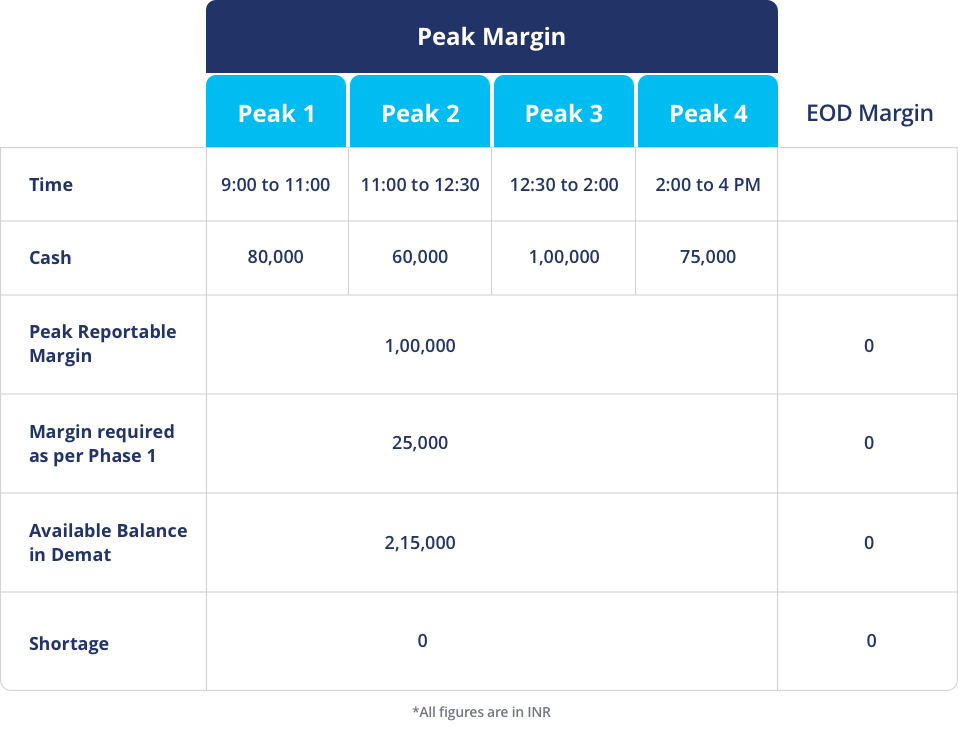

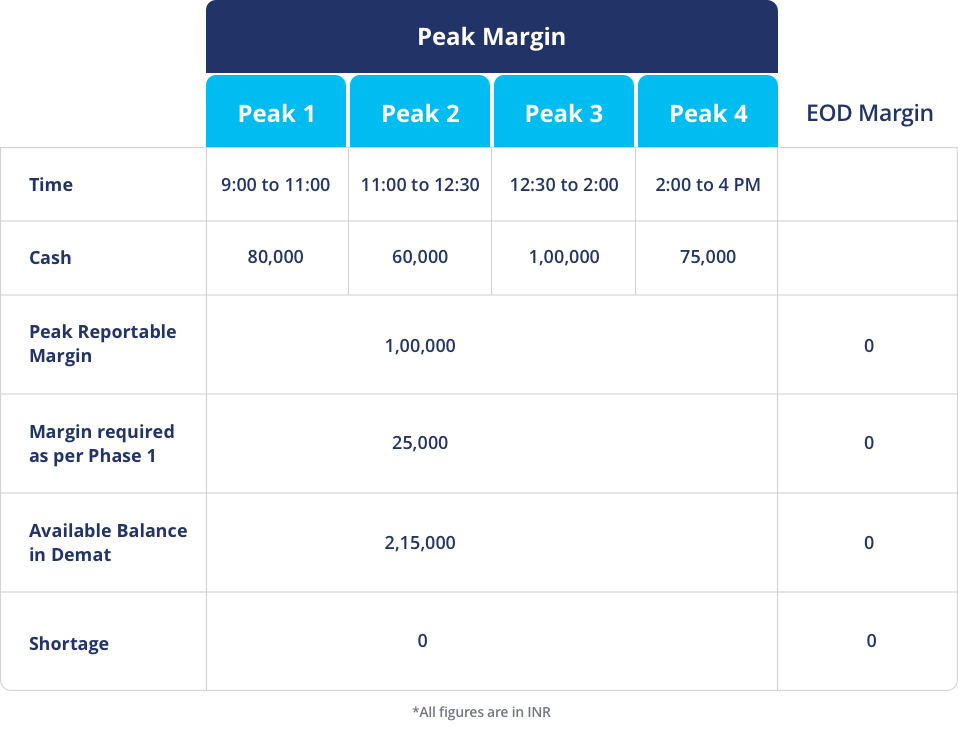

To arrive at an intraday peak position margin, clearing corporations will randomly take 4 snapshots during the day of all the margins. The number of times snapshots need to be sent in a day may be decided by Clearing Corporation subject to a minimum of 4 snapshots in a day.

The highest margin out of these four snapshots will become the peak margin of the day. This method will be applicable to the cash and derivatives segments.

Daily peak margin obligation of the client will be compared with his/her margin available with the broker and the higher shortfall in collection of margin obligation shall be considered for levying of penalty as per the extant framework, as per SEBI’s circular.

In the cash market, the peak margin will be applicable till T+2 i.e till the clients pay-in for the delivery positions. In the case of normal pay-in and profit booked in intraday trade, the broker can give a credit benefit on T+2 when the pay-in is generally completed after 11.30 am.

There will be a phased adoption of this over 3 phases of 3 months each and full adoption by September 1, 2021.

Phase 1 (Dec-Feb) – In the first phase, the client should have 25% of the peak margin available with the broker.

Phase 2 (Mar-May) – The client should have 50% of the peak margin available with the broker.

Phase 3 (Jun-Aug) – In the third phase, SEBI has said that the client should have 75% of the peak margin.

Phase 4 (Sep onwards) – By Sep 2021, clients should have 100% of the peak margin obligation available with the broker during the day.

Let’s See How The Peak Margin Would Work:

For instance, let’s assume that you have 500 shares of Tata Motors and you sell those at 10 am and 11.30 am in two tranches, with sufficient upfront margin because of early pay-in of shares.

But the price of Tata Motors falls and you wish to buy 500 shares back at 1.00 pm and 3.00 pm in two tranches. Here, the net obligation is zero since you sold 500 and bought the same back.

However, while calculating the peak margin, the clearing corporation will take 4 snapshots from 9.00 am to 4.00 pm and the margin will be based on the highest snapshot.

Change in Leverages

Due to the applicability of the peak margin calculation, there will also be a restriction on maximum intraday leverages offered by brokerage firms. Starting Dec 1, 80% of credit from selling holdings will be available for further trades on the same day. If you sell your holdings and use the proceeds for intraday trading, you may avoid buying back the stock sold if you don’t have sufficient funds for the intraday trade.

This means that if a client sells shares worth Rs 1 Lakh for delivery, they will be able to buy the same stock or any other stock to the tune of Rs. 80,000 while the remaining Rs. 20,000 will be available to clients on T+1 or next trading day.

Conclusion

SEBI has announced changes in the calculation of intraday & delivery margin

-From Dec 1 the credit offered for taking other positions after selling delivery will be cut down to 80% of sale value from the current 100%

-There will be limitations on Maximum Intraday Leverage offered by brokers.

-If you utilize sale proceeds of Delivery transaction towards doing Intraday Trading, Avoid buyback of the delivery sale unless you have sufficient extra margin available in the account.