A Beginner’s Guide to Selecting Index Funds4 min read

“I have heard of Mutual Funds. But, what are these Index Funds?”

An Index fund is also a mutual fund. You would have come across popular subcategories such as Large cap or Multicap mutual funds. Index fund is one such subcategory of mutual funds.

Index Funds — Explained

Index funds are passively managed funds that track the composition of an underlying index (Nifty 50, BSE Sensex etc.). This differs from an actively managed fund, where the fund manager takes active overweight/ underweight positions on stocks and sectors based on his/ her research and views to generate superior returns compared to the benchmark.

Basically, active fund managers are working harder to potentially make you more money on your investment and are going to charge you more, hence a relatively higher expense ratio. On the other hand, the Index Fund manager has to imitate the composition of stocks in the underlying index and hence would be charging you a relatively lower expense ratio.

Passive investing has been gaining investor’s attention in the recent past, as actively managed Large Cap funds have struggled to beat their benchmarks. We, at Paytm Money, have discussed the basic concepts of active and passive investing through this article on Index vs Large cap funds.

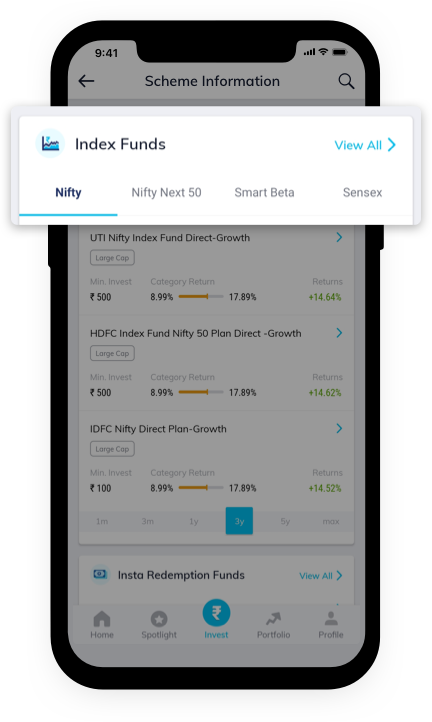

Now various types of Index Funds are readily available on Paytm Money app. Download the app here.

Do all indices have Index Funds tracking them?

There are a large number of equity indices available in India. These include broad market indices such as Nifty 50, Sensex, Nifty 500 etc., sector specific indices (Bank, Auto, IT etc.) and thematic indices (Consumption, Infra, MNC etc.).

Not all indices have Index funds tracking them. It is also not advisable that a retail investor puts his money in sector or thematic Index Funds. It is better to stick to Index Funds tracking broad market indices.

For your ease of reference, here are a few Index Funds tracking some popular broad market indices:

NSE Nifty 50

- UTI Nifty Index Fund Direct - Growth

- HDFC Index Fund Nifty 50 Plan Direct - Growth

- IDFC Nifty Direct Plan - Growth

Nifty Next 50

- ICICI Prudential Nifty Next 50 Index Direct - Growth

- IDBI Nifty Junior Index Fund Direct - Growth

- UTI Nifty Next 50 Index Fund Direct - Growth

BSE Sensex

- HDFC Index Sensex Direct Plan - Growth

- Nippon India Index Fund Sensex Plan Direct - Growth

- LIC MF Index Sensex Fund Direct - Growth

What does an Index Fund seek to achieve?

The aim of an Index Fund is to track as closely as possible the performance of the underlying index. For example, a Nifty 50 Index Fund will invest in stocks comprising the Nifty 50 index in the same proportion as in the index. The fund attempts to achieve returns equivalent to the Nifty 50 index by minimizing the performance difference between the benchmark index and the fund (known as tracking error).

Parameters to look for:

Two important parameters to consider while investing in index funds are:

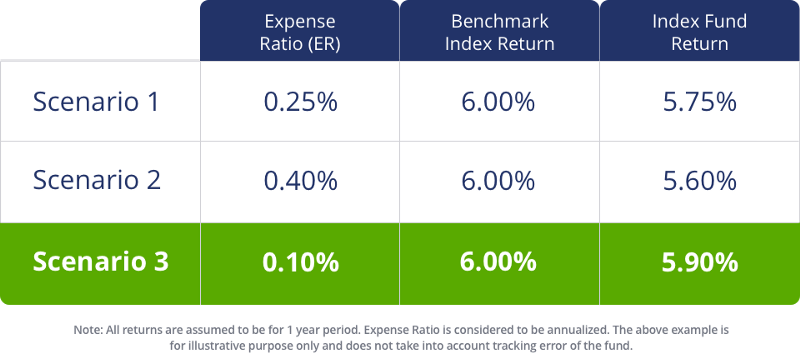

1.Expense Ratio (ER) - From our discussion we know that Index funds are low expense products compared to actively managed funds. There is no scope for outperforming the benchmark. The difference between benchmark and index fund returns majorly arises due to expense ratio.

Consider a Nifty 50 index fund (that tracks Nifty 50 benchmark index). The benchmark index is assumed to give a 6.00% return in the past 1 year. Take a look at the returns given by the index fund for different ERs.

Thus you should prefer index funds that have a lower expense ratio (scenario 3).

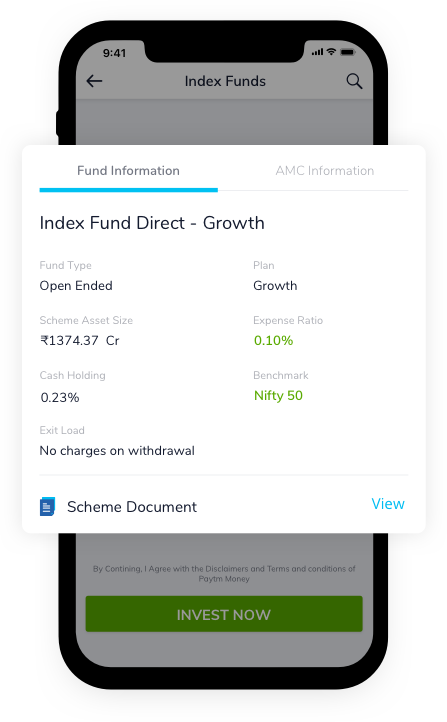

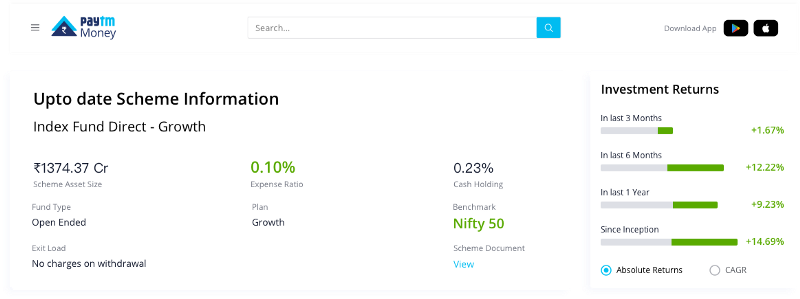

For your reference, Paytm Money app always showcases the latest expense ratio of any Mutual Fund scheme that is available in India on its app and its website.

The web view is shown below:

2.Tracking Error (TE) - Tracking error is a statistical parameter that tries to capture the level of deviation between the index fund return and benchmark index return. TE measures how good the fund manager is in tracking the underlying benchmark index performance. There are multiple sources of TE such as maintaining cash in the fund to handle redemption, time lag between benchmark index rebalancing and index fund rebalancing and so on.

As an investor, what is important is to look for funds with lesser Tracking Error. A lesser tracking error means that the index fund tracks the benchmark index closely. Remember, this is the basic aim of an Index Fund!

Conclusion:

Two parameters you need to keep in mind while choosing an index fund:

Parameter 1: Lower the expense ratio, the better it is for you!

Parameter 2: Lower the tracking error, the better it is for you!

A new investor looking for equity exposure can start with index funds to get a flavor of the equity markets. This is an equity product and hence an investment horizon of more than 3 years is preferred.

At Paytm Money, we have a handpicked list of “Index Funds” under the Investment Ideas section. The list has been created based on the parameters we have discussed in the article. We are certain , this would make your investment decisions regarding picking an index fund a tad easier.