Shyam Metalics and Energy IPO Details – Date, Price & Overview5 min read

Shyam Metalics and Energy is India’s leading integrated metal producing company. Its primary focus is on manufacturing ferroalloys and long steel products such as iron pellets, steel billets, sponge iron, etc. The company is one of the largest manufacturers of ferroalloys in terms of installed capacity and the fourth-largest player in the sponge iron industry.

The company currently operates three manufacturing plants that are located at Sambalpur in Odisha and Jamuria and Mangalpur in West Bengal. Also, their Sambalpur and Jamuria manufacturing plants have obtained quality certifications.

The customers of the products of the company vary from institutional customers to end consumers which cater to the company’s growth through its wide distribution network.

Additionally, the company has a consistent track record of delivering operating profitability, and since the commencement of the operations, they have delivered a positive EBITDA in each of the Fiscals.

Impact of Covid-19

On account of the COVID-19, India had imposed a nationwide lockdown. However, since the manufacturing of steel was determined to be an essential commodity, the company continued operations at its Sambalpur manufacturing plant.

But, its Jamuria and Mangalpur manufacturing plants were operating with few operational production plants and a limited workforce. Post May 23rd, 2020, these plants also increased their operations and workforce in a phased manner by the specific guidelines issued by the State Government.

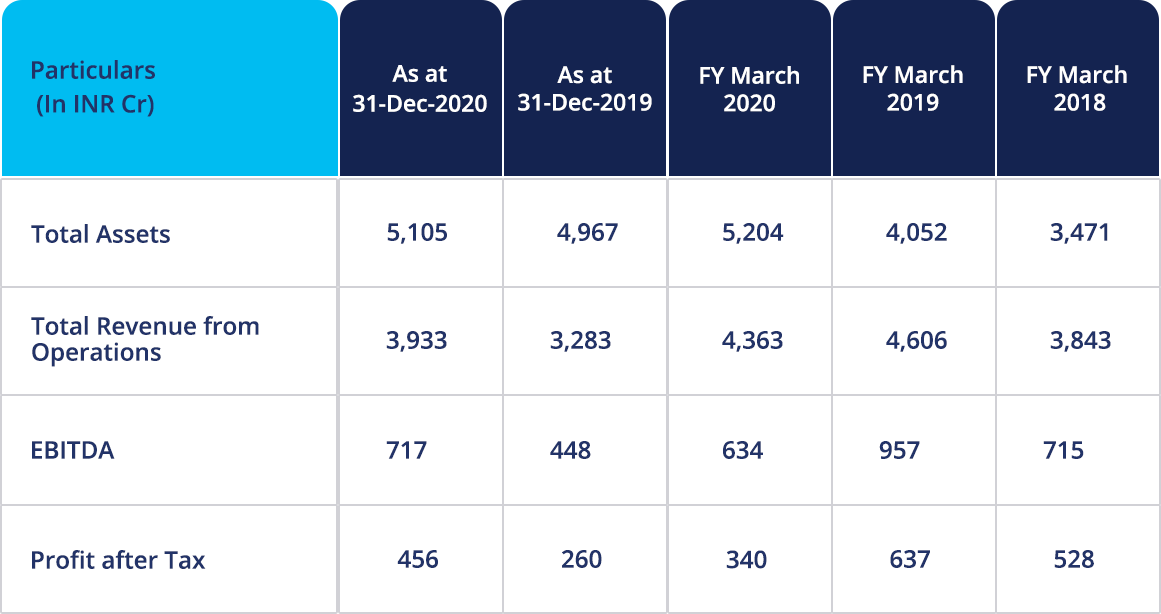

Despite the impact of the COVID-19, the company’s revenue from operations increased by 19.80% from ₹ 3,283 Cr in the nine months till December 31, 2019, to ₹ 3,933 Cr in the nine months till December 31, 2020.

Financial Performance

Let’s take a quick look into the past financial performance of the company to understand its performance of the business and evaluate the growth prospectus:

IPO Details

Shyam Metalics and Energy IPO will open for subscription on June 14 and will close on June 16. The share will be offered in a price band of Rs. 303 to Rs. 306 with a lot size of 45 shares. The company is offering up to 29,999,999 – 29,705,882 equity shares in its IPO and aims to raise an issue amount of Rs. 909 Crores.

ICICI Securities, JM Financial, Axis Capital, IIFL Securities and SBI Capital Markets are the book running lead managers to the issue. The listing will also provide a public market on NSE and BSE for equity shares in India.

IPO Timeline

The objective of the Offer

The company will use IPO proceedings for the repayment or prepayment of some loans from banks and financial institutions taken by the company and one of its subsidiaries, SSPL. The funds will also be used for meeting expenses related to general corporate operations.

Other than the aforementioned objectives, the company expects to receive the benefits of listing the equity shares on the Stock Exchanges, including other things like enhancing the visibility of its brand name and its corporate image.

Strengths & Risks

Strengths

- Integrated operations across the steel value chain.

- Strategically located manufacturing plants supported by robust infrastructure resulting in cost and time efficiencies.

- Diversified product mix with a strong focus on value-added products.

- Association with reputed customers and robust distribution network.

- Strong financial performance and credit ratings.

- Experienced promoters, board and senior management team.

Risks

- The loss of any suppliers or a failure by suppliers to deliver primary raw materials may adversely impact business.

- Dependent on stable and reliable logistics infrastructure.

- The demand and pricing in the steel industry are volatile and are sensitive to the cyclical nature of the industries it serves.

- The COVID-19 pandemic and resulting deterioration of general economic conditions have impacted business and possible future impact is difficult to predict.

- The steel industry is characterized by volatility in the prices of raw materials and energy which could adversely affect profitability.

- The Chairman and a few promoters are parties to certain criminal proceedings.

You can apply for the Shyam Metalics and Energy IPO in simple steps

- Log in to the Paytm Money app and complete your fully digital KYC for the stock, if not done already.

- Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

- You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

- Next, you must add details for bidding such as quantity, amount, and so on. Maximum 3 bids are allowed.

- After that, you have to enter your UPI id so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

- Once you accept the mandate, your application will be successfully submitted.

- Once the allotment happens, you will be notified about your allotment status.

Conclusion

Shyam Metalics and Energy is an almost a decade old company and is now coming up with an Initial Public Offering in the next few days. The IPO will open on Monday, June 14th and close on Wednesday, June 16th. The shares will be offered in a price band of Rs. 303 to Rs. 306 with a lot size of 45 shares and the company aims to raise the issue amount of Rs. 909 Crores.

Source – RHP, BRLM

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.